4 th November 2011 - Ian Potter Associates

advertisement

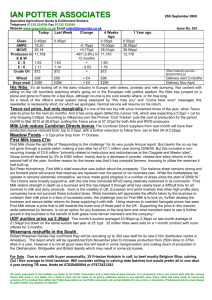

IAN POTTER ASSOCIATES 4th November 2011 Specialist Agricultural Quota & Entitlement Brokers Telephone 01335 324594 Fax 01335 324584 Website www.ipaquotas.co.uk Email sales@ipaquotas.co.uk Today Clean AMPE MCVE Producers in E&W £:$ £:€ Crude Oil Wheat Soya meal Issue No. 645 Last Week Change 4 Weeks Ago 1 Year ago 0.30ppl 32.80ppl 32.59ppl 10,791 0.30ppl 33.30ppl 33.11ppl -0.50ppl -0.52ppl 0.30ppl 33.30ppl 33.11ppl 10,779 0.30pl 29.70ppl 29.67ppl 11,137 £1.60 £1.16 £111 £156 £265 £1.60 £1.14 £111 £154 £275 +£0.02 +£2.00 -£10.00 £1.58 £1.15 £113 £167 £285 £1.61 £1.15 £85 £172 £292 (Commodity and currency prices – source BOCM Pauls) Milk Quota Available 1,275,088 litres 3.97% @ 1,019,795 litres 3.98% @ 406,569 litres 4.10% @ Should you require any information Jacquey@ipaquotas.co.uk 0.25ppl 0.30ppl 0.35ppl about the above milk quota that we have for sale then please contact 1.23ppl milk price rise from Lactalis catapults them back up the popularity league Back on the 30th September this bulletin highlighted the fact cheese processor Lactalis had some very disgruntled producers following the firms declaration that producers would not be given a milk price increase. This certainly put Lactalis under pressure but to be fair they have both listened and responded with a 1.23ppl flat rate increase from November 1st. The increase has no conditions, seasonality or hurdles making it once again one of the best milk for cheese price contracts in town. World Commodity Auction prices are a mixed bag This weeks 55th Fonterra Global Dairy Auction produced a more or less stand on result. The average auction price was $3,511/tonne down $29/tonne representing a slight drop of less than 1%. Within the results cheddar prices averaged $3,406/tonne (-$91 or -2.6%). SMP prices were identical to the previous auction at $3,292/tonne and the WMP average was virtually unchanged at $3,487/tonne. Co-ops both make half year trading statements Both First Milk and Milk Link have this week released their half year trading updates. Whilst the statements supplied, give an indication of direction of travel they are only a guide as to where both expect to be by March 31 st 2012. Credit to Milk Link for distributing a very informative full colour 10 page publication which is written in plain English and easy for all to understand and follow. A point especially important to its farmer members/owners. Sadly First Milks report contains limited information. Milk Link’s half year trading statement Group Turnover up to £311.8m (+10.2% on £283m in 2010) Net Debt reduced by £5.2m to £85.8m (-5.7% on £91m in 2010). Note Milk Link compare debt to the same six month period a year ago and not the March 2011 year end debt figure of £79.9m. Also if you add the increased member funds, now standing at £75.3m, it translates to a total debt increase year on year. In summary Milks Link’s profitability appears to be on the up with EBITDA up £1.3m or 7%. All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached First Milk’s half year trading statement Operating profit of £4.7m (+24% or £3.8m compared to 2010) Bank debt up £7m to £70m (+11% compared to the £63m in 2010) mainly due to increased cheese production as a result of increased branded sales. Group turnover down £8m to £272m (£280m in 2010) The drop in First Milk’s turnover is a bit of a mystery and surprise given that sales from the acquisition of Kingdom Dairy (May 2011) are presumably within the group turnover figure hence turnover should be up. Does this mean the value of products sold from members milk or the volume of members milk sold is down? However for all First Milk trumpet their headline press release “First Milk maintains strong progress” members will be very aware that the period this trading summary covers is by far the best market for cheese on record. How do MCVE and the average DEFRA farmgate milk price compare for the same six months. DEFRA Average Factory gate MCVE April 26.42 32.10 May 26.39 32.82 June 26.63 33.16 July 27.21 32.91 August 27.55 32.84 September 28.04 33.11 6month average 27.04 32.82 Milkprices.com’s 12 month average all processor milk price is 26.16ppl to the 1st September 2011 within which Milk Link’s cheese contract average is 25.75ppl and First Milk’s cheese contract average is 24.55ppl. The actual First Milk milk for cheese contract price is today 27.5ppl whilst Milk Link’s is 28.5ppl. First Milk claim they are making strong progress but the reality is all three of their contracts occupy the bottom 3 places in the milk price league table and there is still work to be done. Milk Link make it very clear in their trading statement that despite numerous producer price increases they realise they are 0.6ppl below the average DEFRA 12 month farmgate milk price. They comment “We remain committed to achieving a member milk price at least in line with the DEFRA rolling average”. The fact they are honest and up front is a big plus. Paynes Dairies Ltd offer 1 year fixed prices to wholesale customers Charlie Paynes sales team are currently offering 1 year fixed price milk with 6 pints @ £1.20 (35.2ppl) and 3 litres @ £1.10 (36.6ppl). Fixed prices around 35ppl leave very little if any margin especially if producers are entitled to further farmgate price increases. Dumfries Auction Mart Huntingdon Road, Dumfries, DG1 1NF Tel 01387 279495 dumfries@auctionmarts.com www.cdfarmersmart.co.uk MONDAY 14th NOVEMBER at 10.30am Part Dairy Dispersal from WG McMillan, Cumrue at 1.30pm Comprising of 30 Friesian heifers I/C to AA Bull (due June), 20 Friesian Bulling Heifers (18 mo), 12 Friesian Bulling Heifers (12mo) & 12 Friesian Heifer Stirks. Genuine reason for sale due to Mr McMillan retiring. This is an opportunity to purchase well bred Friesian type Heifers (Genus AI Bred). Also Monthly Sale of 30 Dairy Cattle consigned from noted herds from South West Scotland. All the above are From TB Free area All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached