CO2 multipliers in multi-region input-output models

advertisement

CO2 multipliers in multi-region input-output models

Manfred Lenzen1, Lise-Lotte Pade2 and Jesper Munksgaard3

1 Introduction

All societies have a responsibility for abating climate change according to, amongst other criteria,

their contribution to global greenhouse gas emissions. Through goods and services trade in a

globally interdependent world, the consumption in each region is linked to greenhouse gas

emissions in other regions. Although the ’greenhouse gas responsibility’ of the inhabitants of a

region is determined by their consumption of both domestically produced and imported

commodities (Proops et al., 1993), international negotiations on emission reductions focus solely on

territorial emissions. Greenhouse gases embodied in international trade are often neglected. It has

been argued that, in order to achieve equitable reduction targets, international trade has to be taken

into account when assessing nations’ responsibility for abating climate change (Wyckoff & Roop,

1994, Imura & Moriguchi, 1995, and Munksgaard & Pedersen, 2000).

Especially for open economies such as Denmark, taking into account the greenhouse gases

embodies in internationally traded commodities can have a considerable influence on national

balance of greenhouse gases. Increased export of commodities produced in Denmark, for example,

increase Danish energy consumption and greenhouse gas emissions, while the opposite holds for

imports into Denmark. Munksgaard and Pedersen (2000) report that a significant amount of power

and other energy-intensive commodities are traded across Danish borders, and that between 1966

and 1994 the Danish foreign trade balance in terms of CO2 developed from a 7 Mt deficit to a 7 Mt

surplus, compared to total emissions of approximately 60 Mt. In particular, (hydro-)electricity

traded between Norway, Sweden and Denmark is subject to large annual fluctuations due to varying

rainfall in Norway and Sweden, with corresponding fluctuations of CO2 embodiments. As a result,

the official Danish emissions inventory includes a correction for electricity trade (Danish

Environmental Protection Agency, 1998). Remaining emissions figures to be reported to the

Intergovernmental Panel on Climate Change (IPCC) do not reflect national ‘greenhouse gas

responsibilities’, but simply refer to territorial emissions. Consequently, reaching national emissions

targets is becoming more difficult for Denmark, since an increasing part of greenhouse gas

emissions from Danish territory is caused by foreign demand.

Similarly, Subak (1995) investigates methane (CH4) embodiments in the most CH4-intensive

agricultural goods, and the possibility of CH4 leakage. Subak points out that if greenhouse gases

embodied in trade flows were more closely monitored, leakage would be avoided and moreover,

trade could serve as a de facto abatement control, since countries with insufficient greenhouse gas

credits from emissions trading schemes would import commodities from countries with more

efficient industries.

1

School of Physics, The University of Sydney NSW 2006, Australia

e-mail m.lenzen@physics.usyd.edu.au, fax +61 / 2 / 9351-5985.

2

AKF, Institute of Local Government Studies, Nyropsgade 37, DK-1602 København V, Denmark

e-mail LPH@AKF.dk, fax +45 / 33 15 28 75.

3

AKF, Institute of Local Government Studies, Nyropsgade 37, DK-1602 København V, Denmark

e-mail JMU@AKF.dk, fax +45 / 33 15 28 75.

1

These two examples highlight the relevance of a revision of greenhouse gas accounting practices for

the Conferences Of Parties (COP). In Kyoto in 1998, differentiated emission reduction targets for

industrialised nations were negotiated for the first time. However, these targets were set without

consideration of international trade.

One way of dealing with international trade in regard to CO2 emission is applying input-output

models. Some studies dealing with environmental factors in a generalised input-output framework

assume closed economies. Most studies employ single-region models where imports are either

treated as exogenous (Schaeffer & Leal de Sá, 1996, Wyckoff & Roop, 1994, and Common &

Salma, 1992), or endogenous (Lenzen, 1998, Pedersen, 1996, and Denton, 1975). In both cases,

however, factor embodiments in imported commodities are determined by the applying domestic

production recipe and energy use structure.

Using a single-region input-output model and assuming that factor uses of foreign industries are

identical to those of domestic industries can introduce an error into the CO2 multipliers (the amount

of CO2 embodied in a value unit of commodities produced) and hence into CO2 embodiments in

internationally traded commodities. This error, which to our knowledge has not been investigated

quantitatively so far, will be estimated in this work for the example of trade into and out of

Denmark.

In order to arrive at more realistic estimates of the amount of CO2 embodied in commodities traded

internationally we further develop the methodology used by Munksgaard et al. (2000) from a

single-country model into a multi-region model including multidirectional trade flows. We

introduce a five-region input-output model including Denmark, Germany, Sweden, Norway and the

rest of the world in order to calculate CO2 multipliers for Danish, German, Swedish and Norwegian

final demand. These countries have been separated from the rest of the world because our analysis

focuses on Denmark, and Germany, Sweden and Norway are among Denmark’s most important

trading partners.4 We only consider CO2, because it represents 79% of global greenhouse gas

emissions, and because it is at the centre of COP negotiations.

This article is structured as follows: Section 2 gives a detailed literature review of earlier analyses

of the link between greenhouse gas emissions and trade, with an emphasis on input-output models.

In Section 3 the input-output methodology is introduced and the model for the empirical analyses is

explained. The data sources are described in Section 4, results are presented in Section 5, and

Section 6 concludes.

2 Literature review

Analyses of issues relating to trade and greenhouse gases have been carried out using mainly three

techniques: Process analysis, input-output models, and general equilibrium (GE) models.

2.1 Process-type studies

4

Of US$bn 44.5 of imports into Denmark in 1997, Germany accounted for 5.6%, Sweden for 18.0%, and Norway for

5.7% (Organisation for Economic Co-operation and Development (2001) ITCS International Trade

by Commodity statistics, Harmonised System 88, 1990-2000, 4 CD-ROM,.).

2

The effect of explicitly considering imports and foreign emissions on the life-cycle CO2 emissions

of German production was examined by Wenzel (1999). This author carries out a life-cycle analysis

of the CO2 requirements of passenger cars, computers and food items. His assessment involves the

identification of countries of imports origins, transport distances and modes, and foreign energy

production processes, in particular electricity. While transport emissions are modeled on the basis

of process-chain data, embodied emissions are calculated using input-output analysis. Wenzel finds

that, in spite of long distances, CO2 emissions from transport forms a relatively minor part of total

emissions (1-2% for cars and computers, and around 6% for food items). If, however, foreign

energy production was explicitly taken into account, CO2 requirements changed significantly (9%

for cars and computers; food was not examined). Wenzel concludes that within effects of trade on

CO2 emissions, and within reduction potentials, differences in production structure are more

important than increased transport requirements.

Following up a study of CO2 embodied in international trade flows of six large OECD countries by

Wyckoff and Roop (1994), Subak (1995) investigates methane (CH4) embodiments in the most

CH4-intensive agricultural goods – rice, meat and dairy products – traded from developing countries

to the USA, UK, Germany, Japan, France and Canada, and thus the possibility of CH4 leakage.

However, she considers only emissions occurring on-site in the respective agricultural industries.

Thus, she arrives at a lower limit of 1200 kt CH4 embodied in agricultural products supplied to the

above six countries, representing between 1-2% (Canada, USA) and 14-23% (Germany, Japan, UK)

of national CH4 emissions. These leakage figures are likely to increase if subsidies to agricultural

sectors in industrialised countries are removed, and exports of agricultural products by developing

countries increase. Hence, future CH4 leakage may be of a scale sufficient to undermine regional

abatement goals. Subak (1995) states that “an estimation method based on attributing all embodied

emissions to the country of import opens up a range of new technical difficulties”. These difficulties

can, however, be overcome by using (multi-regional) input-output models.

In a study by Eurostat (2001) the CO2 contents in imports to the UK have been estimated by

applying three alternative multi-regional approaches. While the first approach uses only UK energy

data, approaches two and three include foreign energy use and emissions data. The calculations are

based on sectoral trade and fuel use statistics of the exporting countries. Comparing the results of

the three approaches indicates that UK production is more CO2-intensive than that of other

countries, for example Denmark.

2.2 Single-region input-output models

An early study attempting to quantify “environmental loading” of traded products is Walter's (1973)

examination of the pollution content of American trade. Even though the author uses input-output

coefficients to allocate environmental control cost to industries, the analysis falls short of all but

first-round effects, since no matrix inversion is carried out. The first authors to use the Leontief

inverse in order to investigate embodied-factor trades was Fieleke (1975), who determined the US

trade deficit in embodied energy. Shortly after, Bourque (1981) calculated the embodied-energy

trade balances between Washington State and the rest of the United States. Due to a lack of sectoral

data in physical units, he uses “energy equivalents”, that is dollars of output and the number of

employees in energy-producing industries.

Using a single-region input-output model, Jacobsen (2000) examines the relation between trade

patterns and the energy consumption in Danish manufacturing industries. His results show that

manufacturing sectors, such as chemicals or paper production, can be affected in opposite directions

as a result of changes in trade patterns. Another interesting aspect of his analysis is the dependence

3

of the results on the aggregation level of the input-output data: impacts of trade pattern on energy

consumption obtained from a 27-sector model differ significantly from those obtained from a 117sector model. This dependence is due to the aggregation of disaggregated sectors with very different

trade developments and energy intensities.

Gale (1995) investigates the effect of Mexico’s participation in the NAFTA agreement on CO2

emissions, by estimating changes in Mexican imports, exports and import-competing goods, and

subsequently inserting adjusted figures into an augmented input-output model. Gale’s preliminary

results show that even though tariff elimination gives rise to an overall 12% increase in Mexican

CO2 emissions, half of this increase is compensated by shifts in the production structure away from

pollution-intensive sectors.

In a study of international trade flows of six large OECD countries, Wyckoff and Roop (1994)

revealed that about 13% of these countries’ total CO2 emissions was embodied in manufactured

products. They concluded that measures of greenhouse gas abatement policies, which solely rely on

domestic emissions will be less effective. The problem of ‘territorial’ or ‘attributable’ emissions

(Proops et al., 1993) is also addressed by Kondo et al. (1996) and Munksgaard and Pedersen

(2000), who demonstrate the differences between CO2 accounts assuming producer and consumer

responsibility. The latter authors highlight the significant changes that Denmark’s CO2 trade

balance underwent between 1989 and 1994. Eder and Narodoslawsky (1999) examine several

criteria for inter-regional consumer and producer responsibility in their augmented input-outputbased case study of a small Austrian region. Energy and/or CO2 emissions embodied in imports

have also been estimated by Common and Salma (1992), Schaeffer and Leal de Sá (1996), Bicknell

et al. (1998), and Frickmann Young (2000). The latter author uses results on CO2 emissions

embodied in exports to examine the ‘race-to-the-bottom’ hypothesis.

Most authors listed above carry out an input-output analysis of a closed economy, and subsequently

apply multipliers obtained from this model to exports and imports. In this approximation, the

imports structure does not enter the direct requirements matrix, and is hence not reflected in the

multipliers.

The environmental impact of Swedish trade in terms of SO2 and NOx has been investigated in a

study by Statistics Sweden (2000). Like in Eurostat's (2001) study on the CO2 contents of UK

imports, three different approaches are compared, but this time founded in single-region inputoutput models. The most sophisticated model uses foreign sectoral emission coefficients where such

data is available, while aggregate emissions coefficients are used for the remaining countries. In

addition, emissions from Swedish exports are estimated. The results show that the production in

countries exporting to Sweden is more CO2-intensive than the production in Sweden. The CO2

intensity of Swedish exports is estimated to be 0.03 kg/SEK, whereas the intensity of imports is

twice as high at about 0.06 kg/SEK. Even though in this study correct factor intensities were used

for imports, the single-region model does not capture feedback effects, which describe increases in

production in one region that result from increases in intermediate demand in another region, which

are in turn brought about by demand increases in the first region (see Miller, 1969, p. 41). The error

associated with this assumption can be overcome by employing multi-regional input-output

frameworks.

2.3 Multi-region input-output models

After Isard's (1951) introduction of input-output analysis into regional science, multi-regional

approaches were first applied to regions in Italy by Chenery (1953, as cited by Polenske, 1989) and

4

in the USA by Moses (1955, as cited by Polenske, 1989). Polenske (1976, 1980) examines the

economic interactions and repercussions between the coal mining, freight transport and electricity

generation sectors in 9 regions of the USA.

Suh and Huppes (2001) outline a multi-regional generalised input-output approach for compiling

life-cycle inventories for the industrialised world. Imura and Moriguchi (1995) employ a multiregional input-output framework in order to calculate trade balances in terms of energy. However,

their calculation only treats Japanese industries in sectoral detail, but other countries are assumed to

only produce one commodity with an average energy intensity. Using an input-output model,

Hayami et al. (1999) assess the bilateral trade in greenhouse gases between Japan and Canada. They

employ a number of matrices in order to convert between the commodity classifications of different

trade statistics, and also between free-on-board (f.o.b.) and cost-insurance-freight (c.i.f.) valuation

(see Section 3.3 in this article). An interesting finding in their study is that almost all CO2 embodied

in Japanese exports is itself induced by imports, while emissions from Canada’s exports were

generated by the respective exporting industries. In their bi-regional analysis of energy and air

pollutants in Japan and China, Hayami and Kiji (1997) examine fuel, CO2, and SOx intensities, and

also calculate indices of power and sensitivity of dispersion, in order to establish whether energyand pollution-intensive industries are also strongly interlinked within the economy. Petri (1976)

suggests extending a bilateral trade quantity model with the dual price model. Such an approach is

however quite data-intensive.

Proops et al. (1999) use regional trade flow data from the United Nations’ Statistical Yearbook in a

multiregional input-output analysis to examine a sustainability criterion. These authors

quantitatively compare the closed-economy, or single-region approach with the multiregional

approach. They demonstrate that for countries with resource-intensive imports, such as the USA

and many European nations, the sustainability index decreases when the economies are assessed in

a multiregional framework. Similarly, Battjes et al. (1998) test the assumption of identical domestic

and foreign factor intensities by examining the differences between energy intensities from a

multiregional input-output system and the corresponding single-region systems. Using the

consolidated input-output tables of a number of European-Union countries compiled by van der

Linden and Oosterhaven (1995), they show that single- and multi-region energy intensities for

Germany are equal, but that single-region energy intensities are lower/higher for the

Netherlands/Ireland than multi-region energy intensities. The latter effect results from a sectoral

over- and underestimation of energy embodiments in imports.

2.4 Feedback-loop analysis

A variety of multi-regional input-output analysis is feedback-loop input-output analysis (Round,

1985, Sonis & Hewings, 1998, Sonis et al., 1995, Sonis et al., 1993). This concept is based on a

decomposition of the Leontief inverse matrix into submatrices describing the disjoined

interdependence of two sectoral or regional subgroups in terms of internal and external multipliers,

which was introduced by Miyazawa (1966), and then further developed by Cella (1984) and

Clements (1990). Reinert and Roland-Holst (2001) utilise a social accounting matrix to examine

industrial pollution feedbacks between NAFTA member countries. Their analysis treats air

pollutants such as CO, SO2, NO2 and volatile organic compounds, but not CO2.

Miller (1969) examines the deviation of single- and multi-region models in his “experimental”

studies of Kalamazoo County and the USA, and of the USA and India. He concludes that

(monetary) feedback effects are very small, typically affecting multipliers to less than 1%. Those

results were confirmed in other studies, as summarised by Richardson (1985, p. 631). However, in

5

Greytak's (1970) results, interregional feedbacks appear to be significant. Gillen and Guccione

(1980), and later Miller (1985) show that the magnitude of feedbacks depends critically on the norm

of the A matrices (reflecting the interconnectedness of industries in the respective regional

economies), and on the proportion of interregional trade in intermediate demand (ie the selfsufficiency of the economies). There are, however, no studies examining feedback effects in a

generalised input-output framework incorporating factors such as labour, energy, or pollutants.

2.5 General equilibrium modeling

A number of general equilibrium studies attempt to quantify the amount of carbon leakage as a

result of restrictive measures in OECD countries (for example Oliveira-Martins et al., 1992, Perroni

& Rutherford, 1991, Pezzey, 1992). While Perroni and Rutherford (1991) and Oliveira-Martins et

al. (1992) determine carbon leakages of not more than 10% and 16% of the initial emission

reduction, respectively, Pezzey (1992) finds a 70% leakage offset of the carbon reduced by

unilateral OECD action, thus rendering unilateral action largely ineffective in environmental terms.

Nevertheless, Pezzey concedes that these differences “no doubt reflect the very different modelling

assumptions [...] about world energy markets, as well as different data on energy supply

elasticities”. This is confirmed by Paltsev (2001) who finds that not regional sector aggregation but

“fossil fuel supply elasticities and trade substitution elasticities are the crucial determinants” in his

static, multiregional GE model of the carbon leakage resulting from the Kyoto protocol.

Kainuma et al. (2000) calculate embodied carbon emissions using a GE model, and compare their

results with embodiments calculated via input-output analysis for an open and a closed economy

(that is, including and excluding factor inputs from foreign economies, respectively). Employing the

GTAP database and IEA/OECD energy statistics, these authors show that changing from a closedto an open-economy model increases the emissions responsibility of Japan, USA and the European

Commission, but decreases the emissions responsibility for Australia, Former Soviet Republics and

Eastern Europe, China and India. However, input-output- and CGE-based embodiments are only

comparable within limits, since they address slightly different questions (static and dynamic,

average and marginal analysis; personal communication with author).

3 Methodology

Input-output analysis deals with inter-industrial relationships. The basic model is introduced, for

example, in an article by Leontief and Ford (1972). It can be extended to describe inter-regional

trade flows by applying a multi-regional model. One particular application of generalised inputoutput models is in the field of environmental economics, where they have proven useful for

examining the embodiment of production factors in commodities.

In this work we apply a combined multi-region generalised input-output analysis in order to trace

CO2 flows through a system of trading economies. The starting point for using this technique is to

arrange economic data for different countries in a compound Social Accounting Matrix (SAM) with

the following general layout (example for Denmark, Germany and the rest of world, for a

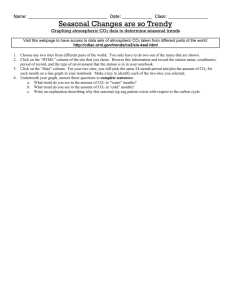

generalised formulation see Furukawa, 1986, p. 10):

The R matrices describe the national production recipes on the diagonal, while the off-diagonal

matrices describe trade flows between the countries. The vectors y represent final consumption by

households of commodities produced in different regions. g stands for government consumption,

6

while x is total output, which is equal to total input, which in turn is made up of wages w (only

domestic contributions) and taxes t. Within this part of the SAM, accounting balances hold both

vertically and horizontally. E and E’ denote matrices containing the consumption of energy carriers

by industries and households, respectively, while total CO2 emissions C are a sum of total CO2

emissions from fuel combustion by fuel (Cf), and from non-energy sources (Cr).

Denoting the bold-framed parts of the SAM in Tab. 1 with R*, and setting

y DK DK y DK D

g DK

x DK

... y* , x* ,

E' DK E' D

E' g

E

0 0

0

C

(1)

and A*ij = R*ij / x*j, we find the standard input-output equation for multi-regional systems

A* x* + y* = x* x* = ( I – A* )-1 y* ,

(2)

where I is a unity matrix. The compound Leontief inverse ( I – A* )-1 contains compound total

multipliers of intermediate demand, trade, energy consumption and CO2 emissions. x* contains

total CO2 embodiments in its last element.

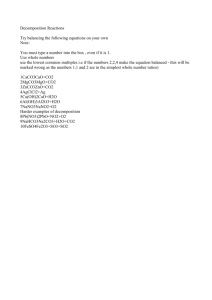

We will investigate three scenarios (see Fig. 1) that are reflected in three different A* matrices:

I.

Five autonomous regions that are completely decoupled with regard to inter-regional trade:

imports are treated as domestic production.

II.

Unidirectional trade into Denmark: the introduction of foreign production, energy and CO2

data relaxes the assumption inherent in scenario 1 that foreign industries exhibit factor

multipliers that are identical to those of Danish industries.

III.

Multidirectional trade between Denmark, Germany, Sweden and Norway, and from the rest

of the world5: inclusion of feedback loops and capture of direct, indirect, and induced effects

of trade.

3.1 Scenario I: Autonomous economies

The starting point of our analysis is a five-region input-output account incorporating Denmark,

Germany, Sweden, Norway, and the rest of the world. Danish (German, Swedish, Norwegian)

imports are assumed to be produced using the Danish (German, Swedish, Norwegian) production

recipe, energy inputs and specific CO2 emissions.

Except for the energy and CO2 intensities of a few key industries, the component of A* representing

the rest of the world was modeled on the basis of Australian input-output, energy and CO2 statistics.

This decision was mainly guided by data availability and quality, and is of course debatable.

Nevertheless, this approximation is not unreasonable, since Australia features an economy that

produces primary resources, manufactured goods and services. Australia exports significant

volumes of coal, crude oil, natural gas, gold, iron ore, wheat, beef, alumina, aluminium, nickel,

copper, iron and steel, wool, cotton, sugar, wine and woodchips. We assume that Australian energy

5

The trade from Denmark, Germany, Sweden and Norway to the rest of the world was assumed to be negligible in

terms of total imports of the rest of the world.

7

and CO2 inputs reflect world-average production conditions, except for beef cattle grazing and

forestry, where CO2 emissions from land use changes were excluded, and except for electricity

generation, aluminium, basic iron and steel manufacturing, for which energy and CO2 intensities

were derived from previous studies (Lenzen & Dey, 2000, Michaelis et al., 1998, Wenzel et al.,

1999, Worrell et al., 1997, World Bureau of Metal Statistics, 2001).

Note that absolute figures (R, y, g, x, E, C) are of course not available for the rest of the world, and

therefore this region is not explicitly, but only structurally modeled. The A* components of all

regions are represented in their make-use formulation (see Madsen & Jensen-Butler, 1999). A reclassification into a common commodity scheme was not carried out, since this would have resulted

in a considerable loss of detail. The number of industries is in general different from the number of

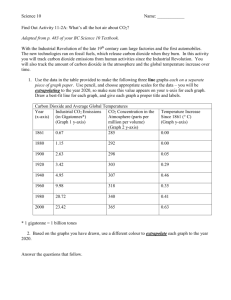

commodities, leading to rectangular components in an overall square model (Tab. 2).

The lowercase letters in Tab. 2 represent variables per unit of domestic total output xr of the

receiving economy:

uijr

U ijr

x rj

, v ijr

Vijr

x rj

, mijr

M ijr

x rj

, e rfj

E rfj

x rj

and c rj

C rj

x rj

,

(3)

where Vr, Ur, Mr, Er and Cr are make, use, imports, and energy use matrices, and CO2 emissions

vectors of regions r, covering nr industries, mr commodities, and fr fuels. In addition, ck = Ck / Ek are

specific CO2 contents of all fr energy carriers.6 While Danish, German and Swedish input-output

data were used unmodified, Australian data were augmented from 106 to 134 commodities (see

Lenzen, 2001), and Norwegian data were compressed from 1309 to 229 commodities. A* as in Tab.

2 has dimensions 1199×1199 (for further details see Tab. 3).

CO2 emissions due to Danish, German, Swedish and Norwegian final demand calculated using A*

as in Tab. 2 depend only on the structure of domestic intermediate demand, and domestic energy

and CO2 intensities. The multipliers calculated in this scenario are equivalent to those that would

result from separate single-region input-output models.

3.2 Scenario II: Unidirectional trade into Denmark

As a first improvement of scenario I, imports mDK are decomposed into contributions from

countries of imports origin. It is assumed that the imports into Denmark from Germany, Sweden,

Norway and the rest of the world are produced using German, Swedish, Norwegian, and worldaverage production technology, energy intensities, and CO2 intensities, respectively. The imports

into Germany, Sweden and Norway are still assumed to be produced using a domestic production

recipe (see Tab. 4).

CO2 emission due to Danish final demand now depend additionally on foreign production, energy

use and CO2 emission structures. For Germany, Sweden and Norway, CO2 embodiments and

multipliers are identical to those obtained from scenario I.

6

We account only for CO2 emissions from fuels with a recovery period (life cycle) of more than one year. Other fuels

(for example straw and waste) were considered as long-term zero-emitters.

8

3.3 Scenario III: Multidirectional trade

In this scenario, all trade volumes are assumed to be produced using the production, energy use and

CO2 emissions structure of the economy of origin (Tab. 5)

CO2 embodiments obtained in scenario III are all different from those obtained from previous

scenarios. We assume that

mr RW

0

xRW

(4)

and set the exports from Denmark, Germany, Sweden and Norway to the rest of the world to zero.

4 Data sources and preparation

Constructing a multi-regional input-output table involves several practical challenges, which are

treated in the following four Sections.

4.1 Re-classification

Input-output classifications differ between countries, because their different economic structures are

governed by particular commodity groups: agricultural, manufacturing and service sectors have

different importance, and some inputs and outputs (such as coffee, district heat, uranium) might

even only exist in a few countries. All off-diagonal flow matrices therefore have to be re-classified

with respect to the usage direction (industries) into the national classification of the receiving

economy, resulting in rectangular matrices. Re-classification is usually – and also in this work –

accomplished by scrutinising handbooks detailing the definition of national industry sectors.

4.2 Currency conversion

Currency conversion is necessary in models examining monetary flows in order to make the

transaction entries in the monetary matrices and vectors (A*, y*) comparable between countries.

Some authors found it convenient to either choose an important trade currency (US$, ₤, €, ¥), or the

currency of the main country appraised in the study as the common model currency. In this work,

we apply a mixed-units approach, in which we keep the national production and final demand data

including exports (rows) in national currency units (Danish Crowns, DKK; German Marks, DM;

Swedish Crowns, SEK; Norwegian Crowns, NOK). The rest of the world is modeled in units of

Australian Dollars (A$). Diagonal (domestic production) blocks Arr are then in units (DKK/DKK

etc), while off-diagonal (trade) blocks Ars are in mixed units (DM/DKK, NOK/SEK etc). Note that

units are constant across any one row of the SAM in Tab. 1, but not across any column. 7 Currency

conversion rates were obtained from OECD trade data (OECD 2001).

4.3 Valuation

7

This requirement for mixed-units models was established by Leontief and Ford (1970), after several early ecologicaleconomic models proved unoperational.

9

Input-output tables come in different formats. In the use matrix, trade can be treated in two ways:

(1) it can be incorporated into the domestic transactions matrix, treating imports as competitive, and

(2) it can be separated from domestic transactions, generating a separate non-competitive imports

matrix. The later is an essential requirement for multi-regional frameworks. If only a use matrix of

type (1) exists for a country (such as for Denmark and Norway), imports flows can only be

estimated from total imports by commodity, assuming that the usage pattern across domestic

industries is identical to that of domestically produced commodities. For many developed

economies, however, there is separate information on domestic and imported flows available.

Furthermore, entries in trade statistics or input-output tables will differ depending on whether

transactions are valued at the point of producers shipping their products, or at the point of

purchasers receiving them. The different valuations are referred to as basic prices and purchasers’

prices. While in general, domestic A matrices are provided in both valuation systems by national

statistical bureaux, exports are often only available in f.o.b. (free-on-board) valuation

(corresponding to basic prices plus domestic commodity taxes and commercial margins), and

imports only in c.i.f. (cost-insurance-freight) valuation. The latter includes insurance and transport

cost. Purchasers’ prices then consist of the c.i.f. tariffs plus domestic import duties and trade

margins (see Hayami et al., 1999). Matrices valued in basic prices show generally a higher stability

over time, because they are not subjected to potentially drastic changes in taxes and margins, and

are therefore mostly used for analytical purposes (Furukawa, 1986), and also in this work.

This work is mainly concerned with tracing physical and not monetary flows. Since all energy and

CO2 intensities in the compound A* matrices (Tabs. 3 to 5) refer to a unit of domestically produced

total output in basic prices, trade flows – as with domestic intermediate demand – have to be

expressed in basic prices. In the absence of information on margins and tax flows, and on imports

flows in both f.o.b. and c.i.f. terms, a way to estimate imports matrices valued in basic prices is to

(1) reduce entries in an existing c.i.f. matrix homogeneously using aggregated f.o.b./c.i.f. ratios, as

well as tax rate and trade margins of the exporting country, for a whole commodity group, before

applying the trade coefficients, and (2) to apply a RAS technique for balancing the resulting multiregion input-output table (Boomsma et al., 1991, pp. 22-24; see also Round, 1978a). These

procedures were applied in a compilation of an inter-country input-output table for the European

Community, and a subsequent analysis of spillover effects by van der Linden and Oosterhaven

(1995). Economy-wide basic price/f.o.b./c.i.f. ratios were used in this work in order to express

imports in scenarios I and II in basic prices.

4.4 Estimation of trade flow matrices

There is a range of international trade statistics that specify trade volumes in both f.o.b. and c.i.f.

valuation. However, these statistics only detail the amounts of commodities traded between

countries (a vector {mirs} of commodities i exported by country r and imported by country s, see

summary in Tab. 6), but not their usage by industries (a flow matrix {Aijrs}). In other words, it is in

general not possible to find information on the spatial origin of every intermediate and final import,

disaggregated according to the consuming sector in the country of destination (see also Boomsma et

al., 1991, pp. 7-8). This is mainly because of the considerable cost, time and resources that are

associated with conducting international industry surveys (Round 1978a, 1978b).

One solution to the estimation problem for off-diagonal trade flow matrices is to use trade

coefficients (a non-survey approach)

10

cirs

mirs

rs

r mi

with r cirs 1 ,

(5)

describing the percentage of imports of commodity i into country s that come from country r. These

trade coefficients can then be applied to an entire row of the national imports matrices Mijs and

imported final demand vectors yis in order to yield breakdown according to country of origin:

Aijrs cirs M ijs and yirs cirs yis .

(6)

This procedure assumes that the trade coefficients are identical for all entries along a row of the

imports matrix, that is for all using domestic industries.

Using trade coefficients as well as OECD trade data (OECD 2001), Hayami et al. (1999) give a

detailed recipe for converting exports xr from r (in r’s input-output classification) into imports ms to

s (in s’s input-output classification) in a six-step process8:

xrs = (Pr)-1 CIFrs Tr←HS THS←s Ps ĉrs ms = Zrs ĉrs ms .

(7)

The matrices in the above equations are

−

ĉrs is a diagonalised matrix of trade coefficients cirs, which converts s’s total imports into

those originating from r;

−

Ps converts imports from the classification in s’s input-output system (c.i.f. + duty) to the

classification in s’s trade statistics (c.i.f.);

−

THS←s converts imports from r to s from s’s national trade statistics into s’s trade statistics in

the Harmonised ITCS System;

−

Tr←HS converts exports from r to s from r’s trade statistics in the Harmonised ITCS System

into r’s national trade statistics;

−

CIFrs adjusts export data in r’s trade statistics from c.i.f. to f.o.b.;

−

(Pr)-1 converts exports from the classification in r’s trade statistics (f.o.b. = basic prices +

margins and commodity taxes) to the classification in r’s input-output system (basic prices).

In this work it is not necessary to convert imports from purchasers’ to basic prices, but only to

allocate exports across using foreign industries (via cirs and Mijrs) and to convert the commodity

classifications (using Pr, Tr←HS and THS←s). The result of this procedure are trade coefficients Aijrs

that represent exports of commodities i (in basic prices of country r) into country s’s industries j per

unit of country s’s industries j’s total output (in basic prices of country s). Physical flows are then

propagated in appropriate units. For example, the portion E of the energy expended in r’s industry i

that becomes embodied in the delivery of commodity i from r into s’s industry j, which in turn uses

this commodity to satisfy household consumption yjs of its own product j, is E = Eir Aijrs yjs. This

energy E is expressed in consistent units of MJ/$bpr × $bpr/$bps × $bps = MJ.

8

Hayami et al. (1999) then set up a trade interactions matrix

Qrs = Lr Zrs ĉrs Ms Ls Zsr ĉsr Mr

to describe a full loop of imports Zsr ĉsr Mr from s into r, the induced production Ls in s, the imports requirements Zrs ĉrs

Ms from r for Ls in s, and the induced production Lr in r. Qrs ys hence describe the first- and second-round requirements

in r that arise out of a final demand bundle ys is s. Lr = [I – Arr]-1 denotes the Leontief inverse of the respective

economy r. The total requirements in r are then calculated via [I – Qrs]-1, where I is the unity matrix.

11

For this work, margins and tax flow matrices using Pr were unavailable. Consequently, our

conversion matrices Zrs consist of only of Zrs = Tr←HS × THS←s, with the T matrices supplied by the

national statistical bureaux. A shortcoming of this procedure is that these Zrs convert trade data in

f.o.b. terms but not – as required – in basic prices. Trade coefficients cirs were mostly taken directly

from OECD export statistics (OECD 2001), and converted from f.o.b. valuation into basic prices.

However, the OECD data does not cover some goods and most services. Economy-wide constant

trade coefficients

mi

rs

c

rs

i

(8)

mi

rs

r ,i

were therefore applied to all remaining commodities (mostly services). Elements of the conversion

matrices Zrs for these rows were prorated from total imports shares (see Tab. 6) according to total

exports by commodity:

Z ijrs

rp

qs

mi m j

p ,q

rp

qs

mi m j

.

(9)

p ,q , j

Imports from the rest of the world were calculated residually by subtracting imports from Denmark,

Germany, Sweden and Norway from total imports as listed in the respective input-output tables.

In a multi-region input-output framework, conversions are conveniently done using matrix

formulation and operations:

0

21

A

n1

A

A12

0

A n2

A1n 0

A 2 n Z 21 ĉ 21

0 Z n1 ĉ n1

Z12 ĉ 12

0

Z n 2 ĉ n 2

Z1n ĉ 1n

Z 2 n ĉ 2 n

0

M1

0

0

M

0

0

0

.

Mn

0

2

(10)

As a consequence of using the trade coefficients ĉrs, the off-diagonal elements in the compound A

matrix have incomplete, extrapolated and therefore uncertain information, while the diagonal

elements are the original intra-country direct requirements matrices containing full, original

infomation (Boomsma et al., 1991, p.9). In addition, the trade statistics mentioned above bear a

range of uncertainties (Furukawa, 1986), which are due to (1) time lags between shipping of exports

and receipt of imports, (2) differences in commodity classification (see 2.6.1), (3) reporting errors,

(4) losses due to accidents in transits, and (5) discrepancies of origin and destination country due to

commodity re-export. The largest discrepancies found in this work were due to systematic

differences in overall import volumes as documented by national input-output tables and in the

OECD trade database. A major stumbling block was the fact that the latter source does not cover the

trade of services. Factors such as these add to inconsistencies in multi-region input-output

frameworks estimated using the prorata techniques outlined above (Boomsma et al., 1991, pp. 1017).

12

5 Results

5.1 CO2 multipliers for selected industries

Significant changes in CO2 multipliers during the transition from scenario I to scenarios II and III

are likely to be facilitated by feedbacks via a small number of industries that exhibit (1) large CO 2

intensities, (2) large differences in regional CO2 intensities, and (3) strong forward linkages to

downstream, using industries. Examples for such key industries are electricity generation, basic

chemicals, and basic metals. Industries such as commercial fishing, and manufacturing and services

are unlikely to be the origin of significant CO2 feedback loops even if they exhibit large magnitudes

differences in their CO2 intensity across countries (see Tab. 7), because of their weak forward

linkages and small CO2 emissions, respectively. Given the imports shares listed in Tab. 6, CO2intensive primary and secondary industries in the rest of the world are likely to exert the strongest

influence within the multi-regional model, and hence their appropriate representation is a crucial

requirement for obtaining realistic results.

In the following, the CO2 multipliers of a number of key industries will be presented for all

scenarios. These industries were selected either because of their CO2-intensiveness, or because of

their importance for final demand in monetary terms. As a starting point, differences in direct CO 2

intensities (Tab. 7) are most prominent in primary and some manufacturing industries, and are due

to, for example, varying penetration of non-fossil energy sources (nuclear power in Sweden’s

electricity generation, hydropower in Norway, see Wenzel et al., 1999), or to varying penetration of

scrap metal recycling and steel making routes (see Worrell et al., 1997).

5.1.1 Scenario I: Autonomous economies

The inclusion of indirect CO2 requirements leads to a general increase of multipliers (compare

Tabs. 7 and 8). This increase is minor for primary industries, because most of these do not feature

CO2-intensive upstream suppliers. For some manufacturing and service industries, however, tenfold and higher increases of multipliers are common. The associated indirect effects are facilitated

via complex supply chains, which in general link CO2 sources in primary industries, steel and

chemicals manufacturing, refining, or electricity generation to further downstream manufacturing

and service industries.

5.1.2 Scenario II: Unidirectional trade into Denmark

Once the assumption that Danish imports are produced using the Danish production structure is

relaxed, Danish CO2 multipliers undergo changes that reflect the CO2 intensity of Denmark’s

trading partners’ industries relative to that of Danish industries. Since the rest of the world as well

as one of Denmark’s important trading partners – Germany – exhibit domestic CO2 intensities that

are higher than Denmark’s, Danish CO2 multipliers increase when countries of imports origin are

modeled explicitly. Note that CO2 multipliers of countries other than Denmark are the same in

Tabs. 8 and 9, since these countries were assumed to be autonomous in both scenario I and II.

5.1.3 Scenario III: Multidirectional trade

13

Incorporating multilateral trade relationships once again refines the CO2 intensities obtained from

previous scenarios. The feedback loops captured in a truly multi-regional analysis generally work

towards evening out differences between CO2 intensity levels of different economies: those

featuring CO2-intensive industries (for example Germany) experience reductions during the

transition from scenario II to III, and vice versa (for example Denmark and Norway).9 In our

example, feedback loops induce changes in multipliers of around 20%. This confirms that, in

contrast to purely monetary flows, generalised feedback loops can be significant, because they are

often amplified by large physical factor contents (for example energy, CO2, etc).

5.2 CO2 balances

Applying the CO2 multipliers obtained from the compound Leontief inverses of scenarios I to III to

final demand categories, it is possible to determine a national CO2 balance (see C in Equation 1). In

contrast to conventional emissions accounts, this balance is expressed in terms of embodiments in

final demand, and includes CO2 embodied in imports. It thus reflects consumer rather than producer

responsibility.

In the following Sections we present a balance for each scenario, and compare these to the

‘baseline’ of territorial emissions as reported to the Intergovernmental Panel on Climate Change.

Only industrial emissions are considered, since emissions caused directly by final consumers

(households and governments) are not affected by international trade, and are therefore not subject

of this type of study.

5.2.1 Territorial emissions

In 1997, 59.2 Mt of CO2 were emitted from industries operating on Danish territory. This and the

following figures exclude emissions originating directly from households, since they are irrelevant

for trade balances.

5.2.2 Scenario I: Autonomous economies

The transition from producer to consumer responsibility reduces the CO2 emissions associated with

Danish production by about 20% or 12.0 Mt to an overall 47.2 Mt. While 18.0 Mt are embodied in

imports into Denmark (11.2 Mt into Danish industries, and 6.8 Mt directly imported by Danish

households and governments), 30.1 Mt become embodied in exports, so that Denmark exhibits a

negative trade balance of 12.0 Mt. This agrees with Munksgaard and Pedersen's (2000) finding of a

surplus of 7 Mt in 1994. Territorial emissions can be found in the lower right corner of Tab. 11.

5.2.3 Scenario II: Unidirectional trade

Considering that Danish CO2 multipliers increased during the transition from scenario I to II (see

Section 5.1.2), it is not surprising that the CO2 responsibility of Danish final demand increases as

well (from 47.2 Mt to 56.0 Mt, see Tab. 12). However, the effect on multipliers of the explicit

modeling of imports into Denmark is positive as well, because generally, foreign industries are

more CO2-intensive than Danish industries, thus increasing overall imports embodiments from 18.0

The fact that Swedish CO2 multipliers increase is in agreement with Statistics Sweden's (2000) finding that Sweden’s

imports carry more CO2 than its exports.

9

14

Mt to 34.4 Mt. As a result, the trade balance is still negative at 3.2 Mt. Most of the CO2 embodied

in imports originated in the rest of the world, followed by Germany and Sweden.

5.2.4 Scenario III: Multidirectional trade

Taking into account the multilateral trade structure of all regions changes the picture only slightly.

Once again, effects work towards the evening-out of regional differences: Relatively CO2-intensive

economies such as Germany experience a decrease in export embodiments, while the opposite holds

for Sweden and Norway (see Tab. 10). Since imports into Denmark are larger from Sweden and

Norway than from Germany (see Tab. 6), the increase of Swedish and Norwegian CO 2 intensities

outweighs the decrease of German CO2 intensities, and Danish imports embody more CO2 than in

scenario II (compare Tabs. 12 and 13). Similarly, Danish CO2 intensities increase, and with them

export embodiments. Due to the commodity and trade partner mix, imports increase more than

exports. The Danish CO2 responsibility is now 56.9 Mt, while the trade balance is –2.3 Mt.

6 Conclusions

The appropriate apportioning of national contributions to climate change entails the calculation of

greenhouse gas emissions embodied in international trade. The latter can be carried out

conveniently using a multi-region input-output model. The results from these models impact on

concepts of equity, and on producer and consumer responsibility, and therefore hold implications

for negotiations at the Conferences of Parties (COP).

This work has shown that it is important to explicitly consider the production recipe, energy use

structure and CO2 emissions of trading partners, in order to arrive at realistic figures for CO2

embodied in trade, and hence for the national contribution to emissions, based on consumer

responsibility. Considering trade in the Danish case, the CO2 trade surplus shrinks from 12.0 Mt to

about 3 Mt.

At present, generalised multi-regional frameworks covering the OECD or the entire world are

mostly restricted to a few tens of industry sectors. At this level of aggregation, initially varying

energy and CO2 multipliers average out across sub-sectors, and differences in scenarios and

feedback loops are likely to be less pronounced. Given the complex international division of

production, multi-regional input-output models that are disaggregated yet manageable will only be

possible for regional applications.

Acknowledgements

This work was carried out in the scope of the research project "Energy and Greenhouse Gases

Embodied in Trade - Implications for Future Climate Negotiations". The project was generously

supported by the Danish Energy Agency.

15

References

Australian Bureau of Agricultural and Resource Economics (2000) Australian energy consumption

and production, Table C1AUST, Historical data update, Electronic file (unpublished).

Australian Bureau of Statistics (2001) Australian National Accounts, Input-Output Tables, 1996-97,

ABS Catalogue No. 5209.0, (Canberra, Australia, Australian Bureau of Statistics).

Australian Greenhouse Office (1999) Australia's National Greenhouse Gas Inventory, Internet site.

Battjes, J. J., Noorman, K. J. & Biesiot, W. (1998) Assessing the energy intensities of imports,

Energy Economics, 20, pp. 67-83.

Bicknell, K. B., Ball, R. J., Cullen, R. & Bigsby, H. R. (1998) New methodology for the ecological

footprint with an application to the New Zealand economy, Ecological Economics, 27, pp. 149-160.

Boomsma, P., van der Linden, J. & Oosterhaven, J. (1991) Construction of intercountry and

consolidated EC input-output tables, 31th European RSA Congress, Lisboa, Portugal.

Bourque, P. J. (1981) Embodied energy trade balances among regions, International Regional

Science Review, 6, pp. 121-136.

Cella, G. (1984) The input-output measurement of interindustry linkages, Oxford Bulletin of

Economics and Statistics, 46, pp. 73-84.

Chenery, H. (1953) Regional analysis, in: H. Chenery & P. Clark (ed.)^(eds.) The Structure and

Growth of the Italian Economy (Rome, Italy, Mutual Security Agency).

Clements, B. J. (1990) On the decomposition and normalization of interindustry linkages,

Economics Letters, 33, pp. 337-340.

Common, M. S. & Salma, U. (1992) Accounting for changes in Australian carbon dioxide

emissions, Energy Economics, 14, pp. 217-225.

Danish Environmental Protection Agency (1998) Denmark's Second National Communication on

Climate Change submitted under the UN FCCC, Internet site http://www.mst.dk/homepage/,

(Copenhagen, Danish Ministry of Environment and Energy).

Danmarks Statistik (1999) Input-output tabeller, Electronic file (unpublished).

Denton, R. V. (1975) The energy cost of goods and services in the Federal Republic of Germany,

Energy Policy, 3, pp. 279-284.

Eder, P. & Narodoslawsky, M. (1999) What environmental pressures are a region's industries

responsible for? A method of analysis with descriptive indices and input-output models, Ecological

Economics, 29, pp. 359-374.

Eurostat (2001) Methods for estimating air emissions from the production of goods imported into

the UK, Working Paper 2/2001/B/5, DG Regional Policy and Eurostat).

Fieleke, N. S. (1975) The energy trade: the United States in deficit, New England Economic Review,

pp. 25-34.

Frickmann Young, E. C. (2000) International trade and industrial emissions in Brazil: an inputoutput approach, XIII International Conference on Input-Output Techniques, Macerata, Italy.

Furukawa, S. (1986) International Input-Output Analysis (Tokyo, Japan, Institute of Developing

Economies).

Gale, L. R. (1995) Trade liberalization and pollution: an input-output study of carbon dioxide

emissions in Mexico, Economic Systems Research, 7, pp. 309-320.

Gillen, W. J. & Guccione, A. (1980) Interregional feedbacks in input-output models: some formal

results, Journal of Regional Science, 20, pp. 477-482.

Greytak, D. (1970) Regional impact of interregional trade in input-output analysis, Papers of the

Regional Science Association, 25, pp. 203-217.

Hayami, H. & Kiji, T. (1997) An input-output analysis on Japan-China environmental problem:

compilation of the input-output table for the analysis of energy and air pollutants, Journal of

Applied Input-Output Analysis, 4, pp. 23-47.

16

Hayami, H., Nakamura, M., Asakura, K. & Yoshioka, K. (1999) The emission of global warming

gases: trade between Canada and Japan, Canadian Economics Association Annual Meeting,

University of Toronto, Canada.

Imura, H. & Moriguchi, Y. (1995) Economic interdependence and eco-balance: accounting for the

flow of environmental loads associated with trade, in: S. Murai (ed.)^(eds.) Toward Global

Planning of Sustainable Use of the Earth (Amsterdam, Netherlands, Elsevier).

Isard, W. (1951) Interregional and regional input-output analysis, a model of a space economy,

Review of Economics and Statistics, 33, pp. 318-328.

Jacobsen, H. K. (2000) Energy demand, structural change and trade: a decomposition analysis of

the Danish manufacturing industry, Economic Systems Research, 12, pp. 319-343.

Kainuma, M., Matsuoka, Y. & Morita, T. (2000) Estimation of embodied CO2 emissions by general

equilibrium model, European Journal of Operational Research, 122, pp. 392-404.

Kondo, Y., Moriguchi, Y. & Shimizu, H. (1996) Creating an inventory of carbon dioxide emissions

in Japan: comparison of two methods, Ambio, 25, pp. 304-308.

Lenzen, M. (1998) Primary energy and greenhouse gases embodied in Australian final

consumption: an input-output analysis, Energy Policy, 26, pp. 495-506.

Lenzen, M. (2001) A generalised input-output multiplier calculus for Australia, Economic Systems

Research, 13, pp. 65-92.

Lenzen, M. & Dey, C. J. (2000) Truncation error in embodied energy analyses of basic iron and

steel products, Energy, 25, pp. 577-585.

Leontief, W. & Ford, D. (1970) Environmental repercussions and the economic structure: an inputoutput approach, Review of Economics and Statistics, 52, pp. 262-271.

Madsen, B. & Jensen-Butler, C. (1999) Make and use approaches to regional and interregional

accounts and models, Economic Systems Research, 11, pp. 277-299.

Michaelis, P., Jackson, T. & Clift, R. (1998) Exergy analysis of the life cycle of steel, Energy, 23,

pp. 213-220.

Miller, R. E. (1969) Interregional feedbacks in input-output models: some experimental results,

Western Economic Journal, 7, pp. 57-70.

Miller, R. E. (1985) Upper bounds on the sizes of interregional feedbacks in multiregional inputoutput models, Journal of Regional Science, 26, pp. 285-306.

Miyazawa, K. (1966) Internal and external matrix multipliers in the input-output model,

Hitotsubashi Journal of Economics, 7, pp. 38-55.

Moses, L. (1955) The stability of interregional trading patterns amnd input-output analysis,

American Economic Review, 45, pp. 803-832.

Munksgaard, J. & Pedersen, K. A. (2000) CO2 accounts for open economies: producer or consumer

responsibility?, Energy Policy, 29, pp. 327-334.

Oliveira-Martins, J., Burniaux, J.-M. & Martin, J. P. (1992) Trade and the effectiveness of unilateral

CO2-abatement policies: evidence from GREEN, OECD Economic Studies, 19, pp. 123-140.

Organisation for Economic Co-operation and Development (2001) ITCS International Trade by

Commodity statistics, Harmonised System 88, 1990-2000, 4 CD-ROM,.

Paltsev, S. V. (2001) The Kyoto Protocol: regional and sectoral contributions to the carbon leakage,

Energy Journal, 22, pp. 53-80.

Pedersen, O. G. (1996) Input-output analysis and emissions of CO2, SO2, and NOx - linking physical

and monetary data, in: B. Madsen, C. Jensen-Butler, J. B. Mortensen & A. M. B. Christensen

(ed.)^(eds.) Modelling the Economy and the Environment (Berlin, Germany, Springer-Verlag).

Perroni, C. & Rutherford, T. F. (1991) International trade in cabon emission rights and basic

materials: general equilibrium calculations for 2020, (Waterloo, Ontario, Canada, Department of

Economics, Wilfrid Laurier University).

17

Petri, P. A. (1976) A multilateral model of Japanese-American trade, in: K. R. Polenske & J. V.

Skolka (ed.)^(eds.) Advances in Input-Output Analysis (Cambridge, MA, USA, Ballinger

Publishing Co).

Pezzey, J. (1992) Analysis of unilateral CO2 control in the European Community and OECD,

Energy Journal, 13, pp. 159-171.

Polenske, K. R. (1976) Multiregional interactions between energy and transportation, in: K. R.

Polenske & J. V. Skolka (ed.)^(eds.) Advances in Input-Output Analysis (Cambridge, MA, USA,

Ballinger Publishing Co).

Polenske, K. R. (1980) The U.S. Multiregional Input-Output Accounts and Model (Lexington, MA,

USA, D.C. Heath and Company).

Polenske, K. R. (1989) Historical and new international perspectives on input-output accounts, in:

R. E. Miller, K. R. Polenske & A. Z. Rose (ed.)^(eds.) Frontiers of Input-Output Analysis (New

York, USA, Oxford University Press).

Proops, J. L. R., Atkinson, G., Frhr. v. Schlotheim, B. & Simon, S. (1999) International trade and

the sustainability footprint: a practical criterion for its assessment, Ecological Economics, 28, pp.

75-97.

Proops, J. L. R., Faber, M. & Wagenhals, G. (1993) Reducing CO2 Emissions (Berlin, Germany,

Springer-Verlag).

Reinert, K. A. & Roland-Holst, D. W. (2001) Industrial pollution linkages in North America: a

linear analysis, Economic Systems Research, 13, pp. 197-208.

Richardson, H. W. (1985) Input-output and economic base multipliers: looking backwards and

forwards, Journal of Regional Science, 25, pp. 607-661.

Round, J. I. (1978a) An interregional input-output approach to the evaluation of non-survey

methods, Journal of Regional Science, 18, pp. 179-194.

Round, J. I. (1978b) On estimating trade flows in interregional input-output models, Regional

Science and Urban Economics, 8, pp. 289-302.

Round, J. I. (1985) Decomposing multipliers for economic systems involving regional and world

trade, Economic Journal, 95, pp. 383-399.

Schaeffer, R. & Leal de Sá, A. (1996) The embodiment of carbon associated with Brazilian imports

and exports, Energy Conversion and Management, 37, pp. 955-960.

Sonis, M. & Hewings, G. J. D. (1998) Economic complexity as network complication:

multiregional input-output structural path analysis, Annals of Regional Science, 32, pp. 407-436.

Sonis, M., Hewings, G. J. D. & Gazel, R. (1995) The structure of multi-regional trade flows:

hierarchy, feedbacks and spatial linkages, Annals of Regional Science, 29, pp. 409-430.

Sonis, M., Oosterhaven, J. & Hewings, G. J. D. (1993) Spatial economic structure and structural

changes in the EC: feedback loop input-output analysis, Economic Systems Research, 5, pp. 173184.

Statistics Sweden (2000) The environmental impact of Swedish trade - results from a pilot study,

Statistisches Bundesamt (2002a) Umweltökonomische Gesamtrechnung: Material- und

Energieflussrechnung 2001, Fachserie 19, Reihe 5, (Stuttgart, Germany, Metzler-Poeschel).

Statistisches Bundesamt (2002b) Volkswirtschaftliche Gesamtrechnung: Input-Output-Rechnung

1997, Fachserie 18, Reihe 2, (Stuttgart, Germany, Metzler-Poeschel).

Statistisk Sentralbyrå (2002) Input-output tables and energy statistics, Electronic files

(unpublished).

Statistiska Centralbyrån (2002) Input-output tables and energy statistics, Electronic files

(unpublished).

Subak, S. (1995) Methane embodied in the international trade of commodities, Global

Environmental Change, 5, pp. 433-446.

Suh, S. & Huppes, G. (2001) Environmental IOA of the industrialised world - a project description,

in: B. P. Weidema & A. M. Nielsen (ed.)^(eds.) Input/Output analysis - Shortcuts to life cycle data?

18

Environmental Project No. 581 (Copenhagen, Denmark, Miljøstyrelsen, Ministry for Environment

and Energy).

van der Linden, J. A. & Oosterhaven, J. (1995) European Community intercountry input-output

analysis: construction method and main results for 1965-85, Economic Systems Research, 7, pp.

249-269.

Walter, I. (1973) The pollution content of American trade, Western Economic Journal, XI, pp. 6170.

Wenzel, B. (1999) Der Einfluß internationaler Arbeitsteilung auf den Energiebedarf und die CO Emission bei der Herstellung ausgewählter Konsumgüter, VDI-Fortschrittsberichte, 16, pp.

Wenzel, P., Wenzel, B. & Wagner, H.-J. (1999) Länderspezifische Strombereitstellungs- und CO2Emissionsfaktoren, Energiewirtschaftliche Tagesfragen, 49, pp. 432-437.

World Bureau of Metal Statistics (2001) Metal statistics 1990-2000 (Ware, UK, World Bureau of

Metal Statistics,).

Worrell, E., Price, L., Martin, N., Farla, J. & Schaeffer, R. (1997) Energy intensity in the iron and

steel industry: a comparison of physical end economic indicators, Energy Policy, 25, pp. 727-744.

Wyckoff, A. W. & Roop, J. M. (1994) The embodiment of carbon in imports of manufactured

products - Implications for international agreements on greenhouse gas emissions, Energy Policy,

22, pp. 187-194.

2

19

Scenario I:

Autonomous

economies

Scenario II:

Unidirectional

trade

DK

DK

RW

D

SV

Scenario III:

Multidirectional

trade

NO

DK

RW

D

SV

NO

RW

D

SV

NO

Fig. 1: Schematic of three trade scenarios

(DK = Denmark, D = Germany, SV = Sweden, NO = Norway, RW = rest of the world).

20

Final

demand

Intermediate

demand

Intermediate demand

Government

Total

input

Fuels

CO2

Denmark

Germany

RW

Denmark

Germany

RW

Final demand

Government

Total

output

Denmark

Germany

RW

Denmark

Germany

RW

RDK DK

RDK D

RDK RW

yDK DK

yDK D

yDK RW

gDK

xDK

RD DK

RD D

RD RW

yD DK

yD D

yD RW

gD

xD

RRW DK

RRW D

RRW RW

yRW DK

yRW D

yRW RW

gRW

xRW

E’DK

E’D

E’RW

E’g

E

C

Fuels

CO2

wDK

wD

wRW

tDK

tD

tROW

xDK

xD

xRW

EDK

CDK

ED

CD

ERW

CRW

Cf

Tab.1: A multi-regional Social Accounting Matrix (SAM), extended with energy and CO2 data

(DK = Denmark, D = Germany, RW = rest of the world).

21

ind

ind

com

ind

com

ind

com

ind

com

ind

com en CO2

vDK

com uDK+mDK

ind

vD

com

uD+mD

ind

vSV

com

uSV+mSV

ind

vNO

com

uNO+mNO

ind

vRW

com

uRW+mRW

en

eDK

eD

eSV

eNO

eRW

CO2

cDK

cD

cSV

cNO

cRW

Tab. 2: A* matrix for the autonomous economies scenario

(ind = industries; com = commodities, en = energy).

22

c

Region

Denmark

Germany

Sweden

Norway

Rest of the world

nr

133

59

39

118

106

mr

128

59

39

229

134

Input-output data

Source

Danmarks Statistik, 1999

SBA 2002b

Statistiska Centralbyrån, 2002

Statistisk Sentralbyrå, 2002

ABS 2001

fr

40

37

23

23

29

Energy and CO2 data

Source

Danmarks Statistik, 1999

SBA 2002a

Statistiska Centralbyrån, 2002

Statistisk Sentralbyrå, 2002

ABARE 2000, AGO 1999

Tab. 3: Dimensions of regional components in A*, and data sources.

23

ind

ind

com

com

ind

ind

com

ind

mDDK

uD+mD

vSV

mSVDK

uSV+mSV

vNO

mNODK

uNO+mNO

ind

com

com en CO2

vD

ind

com

com

uDK

ind

com

ind

vDK

ind

com

com

vRW

mRWDK

uRW+mRW

en

eDK

eD

eSV

eNO

eRW

CO2

cDK

cD

cSV

cNO

cRW

Tab. 4: A* matrix for the unidirectional trade scenario

(ind = industries; com = commodities, en = energy).

24

c

ind

ind

com

com

ind

ind

uDK

mDKD

ind

mDKSV

mDKNO

mDDK

uD

mDSV

mDNO

ind

mSVDK

mSVD

uSV

mSVNO

vNO

mNODK

mNOD

uNO

mNOSV

ind

com

com en CO2

vSV

ind

com

com

vD

ind

com

com

vDK

ind

com

com

vRW

mRWDK

mRWD

mRWSV

mRWNO

uRW+mRW

en

eDK

eD

eSV

eNO

eRW

CO2

cDK

cD

cSV

cNO

cRW

Tab. 5: A* matrix for the multidirectional trade scenario

(ind = industries; com = commodities, en = energy).

.

25

c

DK

Trade volume

DK

D

SV

NO

RW

Total imports

Exchange rate

to 1997 US$

Share

DK

D

SV

NO

RW

D

SV

0 10,763,270

3,019,740

0

8,646,294

5,139,813

6,210,906 10,789,391

23,861,873 205,099,493

41,738,812 231,791,966

NO

6,394,554

3,817,851

0

14,463,094

39,193,576

63,869,075

3,394,513

1,544,241

2,672,364

0

36,259,020

43,870,137

0.152

0.577

0.131

0.142

7.2%

20.7%

14.9%

57.2%

4.6%

0.0%

2.2%

4.7%

88.5%

10.0%

6.0%

0.0%

22.6%

61.4%

7.7%

3.5%

6.1%

0.0%

82.7%

Tab. 6: Trade volumes (‘000 US$ f.o.b.), exchange rates and imports shares

(derived from OECD 2001).

26

Industry

DK

Commercial fishing

Electricity, gas and district heat

Basic iron and steel

Basic non-ferrous metals

Basic chemicals

Vehicle manufacturing

Electronic equipment, computers

Construction

Communication

Financial services

1.03

5.60

0.29

0.05

0.17

0.04

0.02

0.06

0.02

0.01

Direct CO2 intensity (kg/US$)

D

SV

NO

0.34

10.09

1.42

1.58

2.49

0.57

1.52

0.07

0.03

0.17

0.06

0.03

0.06

0.02

0.02

0.08

0.01

0.004

Tab. 7: Direct CO2 multipliers for important industries.

27

1.16

0.00

1.99

0.03

1.60

0.04

0.00

0.03

0.02

0.01

RW

0.53

6.04

1.97

0.63

1.50

0.03

0.02

0.06

0.04

0.001

Industry

Commercial fishing

Electricity, gas and district heat

Basic iron and steel

Basic non-ferrous metals

Basic chemicals

Vehicle manufacturing

Electronic equipment, computers

Construction

Communication

Financial services

Total CO2 multiplier (kg/US$)

D

SV

NO

1.90

1.65

1.24

11.70

1.84

0.04

2.33

6.48

1.12

0.09

4.13

0.30

2.24

1.34

0.22

0.28

0.79

0.21

0.03

1.19

0.29

0.19

0.38

0.11

0.09

1.00

0.06

0.09

DK

1.33

5.79

1.29

0.40

0.87

0.35

0.21

0.29

0.14

0.07

Tab. 8: Total CO2 multipliers calculated for autonomous economies.

28

RW

1.23

9.31

3.56

2.29

3.01

0.98

0.85

0.76

0.38

0.15

Industry

Commercial fishing

Electricity, gas and district heat

Basic iron and steel

Basic non-ferrous metals

Basic chemicals

Vehicle manufacturing

Electronic equipment, computers

Construction

Communication

Financial services

Total CO2 multiplier (kg/US$)

D

SV

NO

1.90

1.65

1.24

11.70

1.84

0.04

2.33

6.48

1.12

0.09

4.13

0.30

2.24

1.34

0.22

0.28

0.79

0.21

0.03

1.19

0.29

0.19

0.38

0.11

0.09

1.00

0.06

0.09

DK

1.40

5.88

1.74

0.72

1.25

0.62

0.34

0.38

0.17

0.08

RW

1.23

9.31

3.56

2.29

3.01

0.98

0.85

0.76

0.38

0.15

Tab. 9: Total CO2 multipliers calculated for unidirectional trade into Denmark.

29

Industry

Commercial fishing

Electricity, gas and district heat

Basic iron and steel

Basic non-ferrous metals

Basic chemicals

Vehicle manufacturing

Electronic equipment, computers

Construction

Communication

Financial services

Total CO2 multiplier (kg/US$)

D

SV

NO

1.44

1.79

1.51

11.29

2.13

0.16

2.96

5.33

1.39

0.27

3.33

0.59

2.85

1.03

0.44

0.91

0.66

0.37

0.45

0.99

0.40

0.43

0.32

0.16

0.19

0.79

0.08

0.24

DK

1.42

5.88

1.74

0.86

1.33

0.63

0.35

0.38

0.17

0.08

Tab. 10: Total CO2 multipliers calculated for multidirectional trade.

30

RW

1.23

9.31

3.56

2.29

3.01

0.98

0.85

0.76

0.38

0.15

Domestic suppliers

Foreign suppliers

Total

Trade balance

Dom.final demand + Exports - Imports = Domestic production

40.4

30.1

11.2

59.2

6.8

6.8

0.0

47.2

30.1

18.0

-12.0

59.2

Tab. 11: CO2 balance for Denmark, autonomous economies.

31

Domestic suppliers

Foreign suppliers

Total

Trade balance

Dom.final demand + Exports - Imports = Domestic production

46.3

37.6

24.7

59.2

9.7

9.7

0.0

56.0

37.6

34.4

-3.2

Tab. 12: CO2 balance for Denmark, unidirectional trade.

32

59.2

Domestic suppliers

Foreign suppliers

Total

Trade balance

Dom.final demand + Exports - Imports = Domestic production

46.8

38.4

25.9

59.2

10.1

10.1

0.0

56.9

38.4

36.0

-2.3

59.2

Tab. 13: CO2 balance for Denmark, multidirectional trade.

33