Management`s primary goal is to maximize stockholder wealth

advertisement

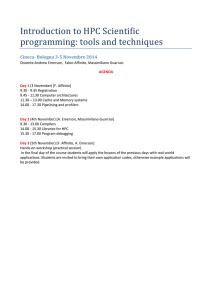

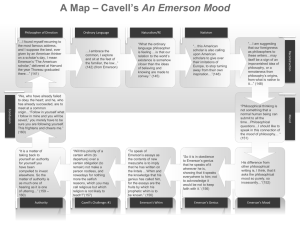

Intrinsic Stock Valuation - Emerson Electric Intrinsic Stock Valuation - Emerson Electric In this cyberproblem, you will value the stock for Emerson Electric, a scientific and technical instrument company. While stock valuation is obviously important to investors, it is also vital to companies engaging in a merger or acquisition. Here, the process of stock valuation can often be quite subjective. Frequently, the opposing sides of a merger or acquisition will have vastly different opinions of a firm's value. For example, in 1994, part of AT&T's purchase of McCaw Cellular called for AT&T to acquire McCaw's 52 percent stake in LIN Broadcasting and purchase the remaining 48 percent at its fair value. LIN's advisors valued the stock at $162 a share, while AT&T estimated its value at $100 a share. The difference resulted in a whopping $1.6 billion. As this example demonstrates, stock valuation seems to be both art and science. In this cyberproblem, use the dividend growth model's constant growth assumptions to value Emerson's stock. In addition, you will apply the concepts of risk and return by estimating the stock's required return from the CAPM model. In order to arrive at a value for Emerson Electric, you will gather and use information from Zacks Investment Research at http://www.zacks.com and Yahoo!Finance (http://finance.yahoo.com). a. First, you need to determine an estimate of Emerson’s cost of equity. Begin by using the 10-year Treasury bond rate (http://finance.yahoo.com) as a proxy for the risk-free rate, rRF. For the market risk premium, rM - rRF, just assume a premium of 6.0%. From Yahoo!Finance, the current 10-year bond rate is 3.80%, as of this writing on 2/23/08. All remaining numerical results are accurate as of February 23, 2008. b. Get a “Detailed Quote” for Emerson Electric at Zacks. Find an estimate of Emerson Electric's beta (use the stock symbol lookup function if necessary). The stock symbol for Emerson Electric is EMR, and the firm's beta is reported as 1.07 (as of 2/23/08). c. From data gathered in parts a and b, use the CAPM model to determine Emerson's required return. Using the standard CAPM equation to estimate the firm's required return, we find that: rs = rRF + bi(rM - rRF) = 3.80% + 1.07 (6.0%) = 10.22%. d. From the same web page, identify Emerson's current price and most recent quarterly dividend. The current price is $51.81 and the dividend $0.30. e. There is no direct measure of expected growth, but we can back out an estimate of Emerson’s expected 5-year growth. Identify Emerson’s PEG ratio and forward looking P/E ratio. The PEG ratio is the firm’s forward P/E divided by its expected 5-year growth rate. Therefore, an estimate of Emerson’s expected 5-year growth rate is the PEG ratio divided by the P/E ratio. The PEG ratio 1.35 and the P/E ratio is 17.51. Therefore, the expected 5-year growth rate is 12.97%. f. Using the expected five-year growth rate, calculate Emerson's next expected annual dividend, D1. (Hint: Multiply the most recent dividend by 4 to annualize it.) D0 = (Most recent)(4) = ($0.30)(4) = $1.20. D1 = D0 x (1 + g) = $1.20 x (1.1297) = $1.36. g. Assume that Emerson’s dividend will grow at a constant rate equal to the expected 5-year growth rate. Use the DCF model to determine the expected price of one share of Emerson Electric stock. Does it seem like a reasonable estimate? The DCF model suggests that the intrinsic value of the stock is: P0 = D1 / (rS - g) = $1.36/ ( 0.1022 - 0.1297) = -$49.45. This result is nonsense, because the growth rate is greater than the required return, which means you cannot use the constant growth formula. h. Using the implied 5-year growth rate as a constant growth rate may have been a problem in the valuation. The long-run constant growth rate of most stocks is expected to be between 3% and 7%. Faster growing companies often include those involved with electronics and technology and can be expected to grow as fast as 7% forever. Instead of assuming constant growth starting today, use the 5-year rate to estimate dividends for the next 5 years and then assume a long-run constant growth rate of 7%. What is Emerson's intrinsic value now? 5-year g = Long-term g = Required return = 12.97% 7% 10.22% Year Dividend Horizon price Cash flows Intrinsic price = 0 1.2 1 1.36 2 1.54 3 1.74 4 1.97 1.36 1.54 1.74 1.97 5 2.23 74.10 76.33 $52.06 Using the 5-year growth rate, the next five years’ dividends are shown above. The horizon value is based on the long-term g. The intrinsic value is the present value of the dividends and the horizon price.