The employer and employee shall each pay the contribution as

advertisement

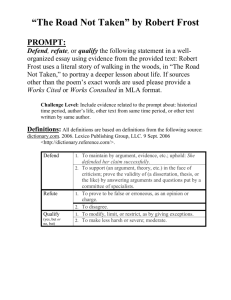

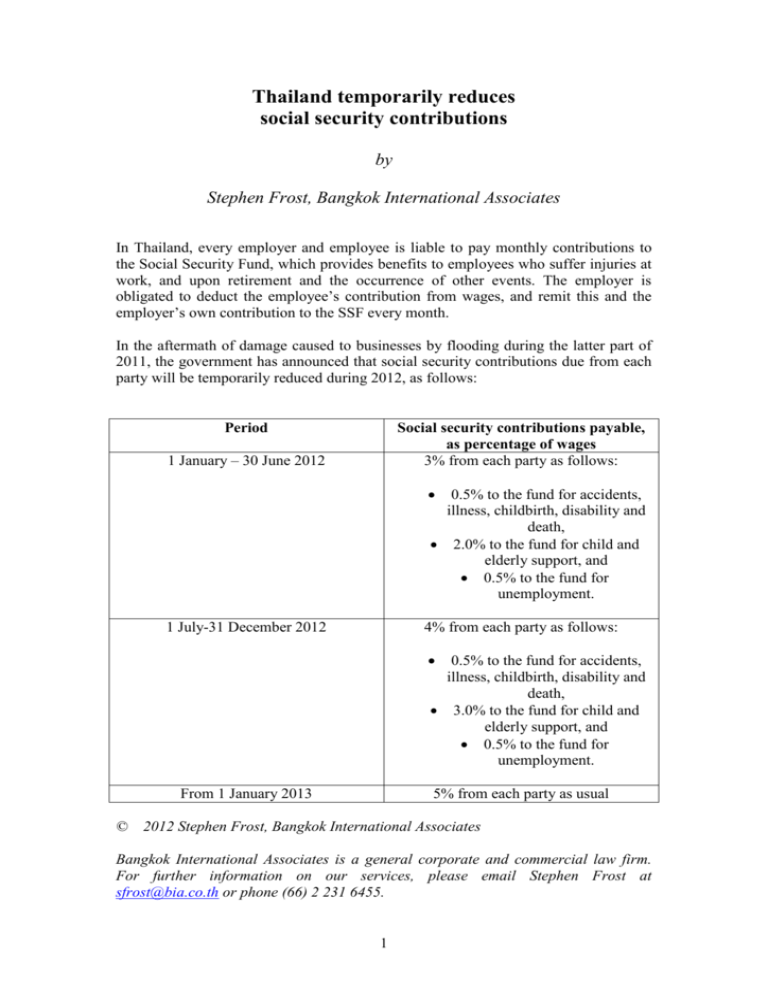

Thailand temporarily reduces social security contributions by Stephen Frost, Bangkok International Associates In Thailand, every employer and employee is liable to pay monthly contributions to the Social Security Fund, which provides benefits to employees who suffer injuries at work, and upon retirement and the occurrence of other events. The employer is obligated to deduct the employee’s contribution from wages, and remit this and the employer’s own contribution to the SSF every month. In the aftermath of damage caused to businesses by flooding during the latter part of 2011, the government has announced that social security contributions due from each party will be temporarily reduced during 2012, as follows: Period Social security contributions payable, as percentage of wages 3% from each party as follows: 1 January – 30 June 2012 0.5% to the fund for accidents, illness, childbirth, disability and death, 2.0% to the fund for child and elderly support, and 0.5% to the fund for unemployment. 1 July-31 December 2012 4% from each party as follows: 0.5% to the fund for accidents, illness, childbirth, disability and death, 3.0% to the fund for child and elderly support, and 0.5% to the fund for unemployment. From 1 January 2013 © 5% from each party as usual 2012 Stephen Frost, Bangkok International Associates Bangkok International Associates is a general corporate and commercial law firm. For further information on our services, please email Stephen Frost at sfrost@bia.co.th or phone (66) 2 231 6455. 1 © 2012 Stephen Frost, Bangkok International Associates Bangkok International Associates is a general corporate and commercial law firm. For further information on our services, please email Stephen Frost at sfrost@bia.co.th or phone (66) 2 231 6201/6455. 2