chapter 6: inventory analysis - Kellogg School of Management

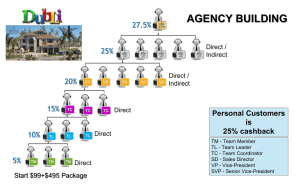

advertisement

CHAPTER 6: INVENTORY ANALYSIS 6.3 Solutions to the Problem Set Problem 6.1 The data in the question is: flow rate R = 50,000 parts/yr, fixed setup cost S = $800, purchasing cost C = $4/part, and cost of capital r = 20%/yr. Thus, the annual unit holding cost is H = rC = $0.8/yr. The economic order quantity tells us to purchase each time 2RS 2 50,000 800 = 10,000 units. H 0.8 a) Q = b) Order R/Q = 5 times per year. Problem 6.2 BIM Computers: Assume 8 working hours per day. We know Q = 4 wks supply = 1,600 units, R = 400units/wk = 20,000 units/yr, purchase cost per unit C = $1250-20% = $1,000. Thus, holding cost H = rC = 20%/year * $1,000 = $200/yr. Switch over or setup cost S = $2,000 + 1/2hr*$1,500/day*1day/8hr = $2,093.75. Thus, # of setups per year = R/Q = 20,000 units/yr / 1600 units/setup = 12.5 setups/yr. Thus, Annual setup cost = (R/Q) S = 12.5setups/yr * $2,093.75/setup = $26,172/yr. Annual Purchasing Cost = RC = 20,000 units/yr * $1,000/unit = $ 20 M/yr. Annual Holding Cost = (Q/2)*H = 800*$200/yr = $160,000/yr. Thus, total annual production and inventory cost = $20,186,172. 2 RS 2 20000 2093.75 = 647 units. H 200 EOQ = #setups = R/Q = 20,000 /647 = 30.91. Thus, annual setup cost = 30.91setups/yr * $2,093.75/setup = $64,711/yr. annual holding cost = (Q/2) * H = 323.5 * $200/yr = $64,711/yr (notice that at optimal EOQ annual holding cost equal setup costs) annual purchasing cost remains $20M/yr the resulting annual savings equals $186,172 - $129,422 = $56,750. Problem 6.3 Victor's data: flow unit = one dress, flow rate R = 30 units/wk, purchase cost C = $150/unit, order lead time L = 2 weeks, fixed order cost S = $225, cost of capital r = 20%/yr. Victor currently orders ten weeks supply at a time, hence Q = 10wks * 30 units/wk = 300 units. a. Costs for Victor's current inventory management: Annual variable ordering (purchasing) cost = RC = $150/unit * 30 units/wk * 52 wks/yr = $234,000/yr. Annual fixed ordering (setups) cost = (# of orders/yr) S = (R/Q) S = (30*52/yr/300) $225 = $1,170/yr. 49 Chapter 6 Annual holding cost = H (Q/2) = (rC) (Q/2) = $30/yr * 150 = $4,500/yr. Total annual costs = $239,670. b. To minimize costs, Victor should order in batches of Q* = EOQ = 2RS 2 30 52 225 = 153 units. H 30 Thus, he should place an order for 153 units two weeks before he expects to run out. That is, whenever current inventory drops to RL = 30 units/wk * 2 wks = 60 units, which is the reorder point. His annual cost will be RC + 2RSH 2 30 52 225 30 + $234,000 = $4,589 + $234,000 = $238,589. c. Inventory turns = R/I, where average inventory I = Q/2 with cycle stock only. Current policy: turns = R/(Q/2)=2*R/Q = 2*30units/wk / 300units = 2/10week = 52*2/10 per year = 10.4 times per year. Proposed policy: Q is roughly halved, so turns roughly double to 20.4 times per year. Problem 6.4 The retailer: Current Fixed Costs S1 = $1000. Current optimal lot size Q1 = 400. New, desired lot size Q2 = 50. We must find the fixed cost S2 at which Q2 is optimal. Since Q1 is optimal for S1, we have Q1 = 400 = 2RS1 2 R 1000 . So, R/H = 160000/2000 = 80. H H Now, Q2 = 50 = 2 RS 2 , H or S2 = 502 /(2*80) = 15.625. So ABC should try to reduce the fixed costs to $15.625. Problem 6.5 Major Airlines: This question illustrates the basic tradeoff between fixed and variable costs in a service industry; thus the concepts of EOQ discussed in class in the context of inventory management are much more generic. The process view here is illuminating and it goes as follows: flow unit = one flight attendant (FA). The process transforms an input (= "un-trained" FA) into an output (= "quitted" FA). The sequence of activities is: undergo training for 6 weeks, go on vacation for one week, wait in a buffer of "trained, but not assigned FA" until being assigned, serve as a FA on flights, and finally quit the job. Untrained FA R Training T = 6 wks Vacation 1 wks Pool of trained FAs ? wks Serve on flights 2 years Quitted FA Chapter 6 The question asks for the tradeoff between training costs (higher class size is preferred) versus 'holding costs' in the buffer (smaller class size -> fewer attendants waiting in buffer is preferred). (a) Flow rate R = 1000 every two years = 500 attendants per year = 10 per week. Fixed costs of training involves hiring ten instructors and support personnel for 6 weeks. Thus, fixed costs of training S = 10 * ($220+$80) * 6 weeks = $18,000 per training session. Annual holding cost is the cost incurred to hold one flow unit (FA) in the buffer for one year: H = $500 per month * 12 = $6,000 / person / year. Thus, Economic Class Size (EOQ) = 54.77 or 55 per class. Thus, we should run R/Q = 500 / 55 = 9.09 classes per year Per person variable cost of training is the stipend paid for 6 weeks of training + stipend for a week of vacation = $500/mo,person * 7 wk * 12 mo/yr / 50 wk/yr = $840 per person. Notice that the annual variable cost is constant $840/person * 500 person/yr = $420,000/yr regardless of the class size. Total Annual Cost = Fixed Costs of Training + Variable Costs of Training + Holding Costs = ($18,000 * 9.09) + ($840 * 500) + (55/2)($6000) = $748,636.36 per year. Time Between starting consecutive classes (say, T) = Q/R = 5.5 weeks. Thus, we will have two classes overlap for a 1/2 week (and thus we need two sets of trainers and training class rooms). The inventory-time diagram looks as follows (assuming for simplicity that we start the training process at time 0): I (in training) 110 55 Class 1 0 Class 2 Class 3 6 t (weeks) 5.5 I (on vacation) Class 1 Class 2 Class 3 55 0 6 7 I (in buffer) Class 1 t (weeks) Class 2 Class 3 55 0 6 7 t (weeks) Chapter 6 (b): This part of the question illustrates the following: Often, in reality, people wish to adopt policies that are simple (e.g., starting training every 6 weeks is simpler than trying to track the exact days to start training when subsequent trainings start every 5.5 weeks. But what is the implication of deviation from the optimal? In this case, quite small. This is because the optimal cost structure near the (optimal) EOQ is quite flat. Thus any solution close to optimality will suffice. If time between classes (T = Q/R ) has to be 6 weeks, then Q = T R = 6 wks * 10 attendants/wk = 60 attendants. Total Cost of this policy = ($18,000)(500/60) + ($840)(500) + (60/2)($6000) = $750,000 per year. Problem 6.6 Fixed cost of filling an ATM m/c, S = $100. To estimate demand, observe that the average size of each transaction = $80. With 150 transactions per week, annual demand R is estimated to be = 150*52*80 = 624,000. With cost of money of 10%, unit holding cost, H = $0.10 / year Then, the economic quantity to place in the ATM machine is given by the EOQ formula: Q 2RS 2 624000 100 $35,327 H 0.1 The number of times the ATM needs to be filled = R/Q = 624000/35327 = 17.66 per year. Problem 6.7 The annual demand, R = 150,000 lbs/yr. The purchase price per lb is $1.50. However the shipping cost exhibits a quantity discount model. The holding cost per year is then 15% of the sum of the purchase and shipping cost. The administrative costs of placing an order = $50/order. (a) In addition, rental cost of the forklift truck adds to the fixed cost giving a total fixed cost, S = 50+350 = $400/order. We can use a spreadsheet model as shown in Table TN 6.1. The optimal order quantity = 22,000 lbs with an annual cost of $249,916.77. (b) If GC buys a forklift and builds a new ramp, then the per-transaction fixed cost will simply be the administrative cost of $50 per order. The economic order quantity and annual operating costs of this option is shown in Table TN 6.2. The economic order quantity is 15000 lbs. with an annual operating cost = $246,833.75. The annual savings = 249,916.77 - 246,833.75 = $3,083.02. The net present value of cost savings (over 5 years) with cost of capital of 15% = $10,334.76. Assuming a useful life of 5 years for the forklift and ramp, an investment of less than $10,334 generates a positive NPV. Problem 6.8 Changeover time = 4hrs giving a fixed cost, S = 4 * 250 = $1,000. Annual demand, R = 1000/mo * 12 = 12,000 units / yr. Chapter 6 Unit cost, C = 100 Holding cost = $25 / unit / yr. a) The optimal production batch size is Q 2 RS 2 12000 1000 $980 H 25 b) To reduce batch size by a factor of 4, the setup cost needs o be reduced by a factor of (4)2 = 16. That is, S should reduce to 1000/16 = $62.5. This reduction can be achieved by reducing the changeover time or the cost per unit time during changeovers. Problem 6.9 a) From the EOQ formula, observe that the order quantity is proportional to the square root of annual demand (R). Since cycle inventory is half of the order quantity, it too is proportional to R. Since HP motors has a higher R, the cycle inventory for HP motors is also higher. b) Average time spent by a motor T = Icycle / R. Since Icycle is proportional to R , T is proportional to 1/ R . Therefore time spent by a HP motor is less than the time spent by an LP motor. Problem 6.10 Each retail outlet faces an annual demand, R = 4000/wk * 50 = 200,000 per year. The unit cost of the item, C = $200 / unit. The fixed order cost, S = $900. The unit holding cost per year, H = 20 % * 200 = $40 / unit / year. a) The optimal order quantity for each outlet Q 2 RS 2 200000 900 $3000 H 40 with a cycle inventory of 1500 units. The total cycle inventory across all four outlets equals 6000 units. b) With centralization of purchasing the fixed order cost, S = $1800. The centralized order quantity is then, Q 2RS 2 800000 1800 $8485 H 40 and a cycle inventory of 4242.5 units. Chapter 6 Table TN 6.1: Problem 6.7 (with use of rental forklift) S R (h+r) purchase price 50 per order 150000 lbs / yr 15.00% % per year 1.5 per lb. Order Shipping Total size (Q) cost per variable pound 6000 6500 7000 7500 8000 8500 9000 9500 10000 10500 11000 11500 12000 12500 13000 13500 14000 14500 15000 15500 16000 16500 17000 17500 0.17 0.17 0.17 0.17 0.17 0.17 0.17 0.17 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.13 0.13 0.13 0.13 0.13 0.13 holding Number Annual Average Annual Annual Total cost of orders order cost Cycle holding procurement Annual costs cost = pound (R/Q) (SxR/Q) Inventory cost cost (CxR) TC purchase per year (Q/2) (HxQ/2) cost + (H) shipping (C) 1.67 0.2505 25.00 1250.00 3000 751.5 250500 252,501.50 1.67 0.2505 23.08 1153.85 3250 814.125 250500 252,467.97 1.67 0.2505 21.43 1071.43 3500 876.75 250500 252,448.18 1.67 0.2505 20.00 1000.00 3750 939.375 250500 252,439.38 1.67 0.2505 18.75 937.50 4000 1002 250500 252,439.50 1.67 0.2505 17.65 882.35 4250 1064.625 250500 252,446.98 1.67 0.2505 16.67 833.33 4500 1127.25 250500 252,460.58 1.67 0.2505 15.79 789.47 4750 1189.875 250500 252,479.35 1.65 0.2475 15.00 750.00 5000 1237.5 247500 249,487.50 1.65 0.2475 14.29 714.29 5250 1299.375 247500 249,513.66 1.65 0.2475 13.64 681.82 5500 1361.25 247500 249,543.07 1.65 0.2475 13.04 652.17 5750 1423.125 247500 249,575.30 1.65 0.2475 12.50 625.00 6000 1485 247500 249,610.00 1.65 0.2475 12.00 600.00 6250 1546.875 247500 249,646.88 1.65 0.2475 11.54 576.92 6500 1608.75 247500 249,685.67 1.65 0.2475 11.11 555.56 6750 1670.625 247500 249,726.18 1.65 0.2475 10.71 535.71 7000 1732.5 247500 249,768.21 1.65 0.2475 10.34 517.24 7250 1794.375 247500 249,811.62 1.63 0.2445 10.00 500.00 7500 1833.75 244500 246,833.75 1.63 0.2445 9.68 483.87 7750 1894.875 244500 246,878.75 1.63 0.2445 9.38 468.75 8000 1956 244500 246,924.75 1.63 0.2445 9.09 454.55 8250 2017.125 244500 246,971.67 1.63 0.2445 8.82 441.18 8500 2078.25 244500 247,019.43 1.63 0.2445 8.57 428.57 8750 2139.375 244500 247,067.95 Chapter 6 Table TN 6.2: Problem 6.7 (without use of rental forklift) S R (h+r) purchase price 50 per order 150000 lbs / yr 15.00% % per year 1.5 per lb. Order Shipping Total size (Q) cost per variable pound 6000 6500 7000 7500 8000 8500 9000 9500 10000 10500 11000 11500 12000 12500 13000 13500 14000 14500 15000 15500 16000 16500 17000 17500 0.17 0.17 0.17 0.17 0.17 0.17 0.17 0.17 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.13 0.13 0.13 0.13 0.13 0.13 holding Number Annual Average Annual Annual Total cost of orders order cost Cycle holding procurement Annual costs cost = pound (R/Q) (SxR/Q) Inventory cost cost (CxR) TC purchase per year (Q/2) (HxQ/2) cost + (H) shipping (C) 1.67 0.2505 25.00 1250.00 3000 751.5 250500 252,501.50 1.67 0.2505 23.08 1153.85 3250 814.125 250500 252,467.97 1.67 0.2505 21.43 1071.43 3500 876.75 250500 252,448.18 1.67 0.2505 20.00 1000.00 3750 939.375 250500 252,439.38 1.67 0.2505 18.75 937.50 4000 1002 250500 252,439.50 1.67 0.2505 17.65 882.35 4250 1064.625 250500 252,446.98 1.67 0.2505 16.67 833.33 4500 1127.25 250500 252,460.58 1.67 0.2505 15.79 789.47 4750 1189.875 250500 252,479.35 1.65 0.2475 15.00 750.00 5000 1237.5 247500 249,487.50 1.65 0.2475 14.29 714.29 5250 1299.375 247500 249,513.66 1.65 0.2475 13.64 681.82 5500 1361.25 247500 249,543.07 1.65 0.2475 13.04 652.17 5750 1423.125 247500 249,575.30 1.65 0.2475 12.50 625.00 6000 1485 247500 249,610.00 1.65 0.2475 12.00 600.00 6250 1546.875 247500 249,646.88 1.65 0.2475 11.54 576.92 6500 1608.75 247500 249,685.67 1.65 0.2475 11.11 555.56 6750 1670.625 247500 249,726.18 1.65 0.2475 10.71 535.71 7000 1732.5 247500 249,768.21 1.65 0.2475 10.34 517.24 7250 1794.375 247500 249,811.62 1.63 0.2445 10.00 500.00 7500 1833.75 244500 246,833.75 1.63 0.2445 9.68 483.87 7750 1894.875 244500 246,878.75 1.63 0.2445 9.38 468.75 8000 1956 244500 246,924.75 1.63 0.2445 9.09 454.55 8250 2017.125 244500 246,971.67 1.63 0.2445 8.82 441.18 8500 2078.25 244500 247,019.43 1.63 0.2445 8.57 428.57 8750 2139.375 244500 247,067.95