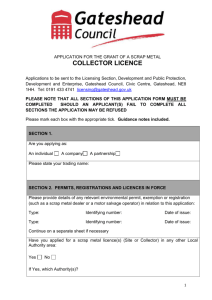

collector`s licence (pdf, 41kb) (opens in a new

advertisement

Scrap Metal Dealers Act 2013 Scrap Metal Dealer Collectors-Statutory Requirements A. Display of Licence 1. The enclosed licence must be displayed on the vehicle being used for scrap metal business. It must be displayed so it can be clearly read by a person outside the vehicle so we have provided a holder for its display. 2. If you have more than one vehicle you may wish to take a photocopy for any other vehicle. 3. If you have more than one collectors licence you must ensure the correct licence is displayed when collecting in the relevant licensing area. It is an offence to not clearly display the appropriate licence. B. Records to be kept 1. Records of receipt; your records must include the following informationa. Description of the metal, including it’s type (or types if mixed), form, condition, weight and marks identifying previous owners or other distinguishing features; b. The date and time of receipt; c. If metal is received from a person, the full name and address of that person: d. If metal is received from a person, you must keep copies of any documents used to verify the name and address of that person; e. If you make payment for the metal by cheque, you must keep a copy of the cheque; f. If you make payment for the metal by electronic transfer, you must keep the receipt identifying the transfer or if no receipt was obtained, record the details of the transfer. 2. Records of disposal; your records must include the following informationa. The date and time of disposal; b. If disposal is to another person, the full name and address of that person. 3. The above records must be marked so as to identify the scrap metal to which they relate. 4. Records and other information mentioned above must be kept for a period of three years. 5. It is an offence to not keep the required records. C. Verifying of supplier’s name and address 1. You must not receive scrap metal from a person without verifying the person’s name and address. 2. The best acceptable proof of name and address is a valid GB or Northern Ireland photo-card driving licence; 3. Alternatively a valid passport (UK or EEA State) and one of the following a bank/building society statement, credit/debit card statement, council tax letter or utility bill. 4. Copies of identification must be taken where possible. Scrap Metal Dealers Act 2013 5. Members of the public may be reluctant to show these documents; all possible steps must be taken to see and copy such documents and all information must be recorded to the best of the collector’s ability. D. Payment methods 1. Cash, or cash alternatives, cannot be used for payment of scrap metal, there are no exemptions. 2. The only acceptable methods of payment are: a. By cheque (as long as they are ‘non-transferable/crossed’ made payable to an individual or business, not made out to cash) or, b. Electronic transfer of funds (authorised by credit or debit card or BACS etc) E. Employees 1. If you have employees who collect metal on your behalf you may wish to give them some identification of such employment, or they may wish to carry a pay slip to confirm such employment in case the Police stop the vehicle and question if the scrap collection is licensed. F. Other Permissions 1. Collectors need to ensure they comply with all other relevant environmental and planning legislation. G. Variations 1. The licence holder must inform the Council of any changes in the name of licence holder within 28 days of the change taking place. 2. Transfers of licences from one person to another cannot take place, including when one person business buys another business. 3. A licence holder who ceases to trade as a scrap metal dealer in an authority’s area, must notify the Council who issued the licence of that fact within 28 days. Failure to comply with the requirements of the Scrap Metal Act 2013 may lead to ??? The above information is based on current legislation may be subject to change – November 2013.