WILLS & ESTATES - Mississippi Law Journal

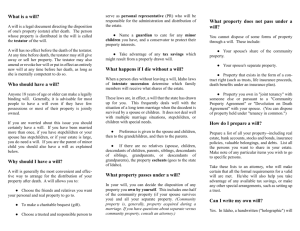

advertisement

WILLS & ESTATES

Weems / Fall 2005

USE THIS AND Cross Ref with 4 to make outline

Chapter 1: Intestate Succession

§ 1.1 Property subject to law of intestate succession

All property (real and personal) in which deceased person owned an inheritable interest in at

time of death and which was not included in a will is controlled by intestate succession

Life insurance proceeds are distributed by intestate succession when

o Decedent dies with life insurance proceeds payable at death,

o Decedent dies without a will, and

o “Estate of Insured” is the beneficiary

Joint tenancy with right of survivorship property is not affected by intestate succession

because the decedent does not own an inheritable interest in the property but rather the

surviving joint tenant owns 100% inheritable interest

o Joint tenancy is presumed for bank accounts and certificates of deposit

made in the name of two or more persons and

payable to any one of such persons or the survivor

o Joint tenancy for the contents of a safety deposit box requires clear and unambiguous

agreement to that affect (owner must purposely contract rights to those items)

Weaver v Mason: The law (in MS and other places as well) is clear that joint tenancy of an

asset cannot be part of a single joint tenant’s estate --- the money goes to the surviving joint

tenant with right of survivorship; thus, bank accounts held in joint tenancy cannot be touched by

creditors seeking debt from only one of the joint tenants who died.

Cooper v Crabb: When property is clearly owned in a joint tenancy with right of survivorship,

parol evidence will not be allowed to supplement the documents which make that clear.

§ 1.2 Governing law

CL Rule:

o intestate succession of real property was governed by the law of the state or nation

where the land was located

o intestate succession of personal property was governed by the law of the decedent’s

domicile

MS Rule:

o Intestate succession of real and personal property located in the state is governed by

the law of Mississippi (91-1-1: personal ppty located in MS will be governed by law

1

of MS) (did away with ancillary administrations = where ppty would have to be taken

back to other state)

Change in law has extinguished ancillary administrations in MS

o An out of state resident has to open up an original administration in MS to get

property that is covered by MS law

Apply MS law (even though owner/creditor is out of state resident) to

o Inheritance of money on deposit with a bank in MS

o Inheritance of stock in a MS corporation

o Recovery of debts owed by MS residents

§ 1.3 Heirs at law – Time of determination

MS Rule: Whoever is the inheritable class at the moment of death will inherit as long as they

are “in being”

ADD INFO ABOUT SIMULTATNEOUS DEATH STAUTE (SEE POCKET PART OF

WEEM’S BOOK)

§ 1.4 Heirs at law “in being” – Posthumous heirs

Harper v Archer: a person is “in being” i.e. “alive” from the moment of conception (for the

purposes of inheritance).

For a child heir merely conceived at death of decedent, “in being” requires

o Fetus to be born alive and

o After such period a of fetal existence that its continuance in life might be reasonably

expected

Uniform Simultaneous Death Act

o If a husband and wife both die in a car accident and it can be proved by

preponderance of the evidence that she lived one minute longer than he did, she will

inherit everything he owned

o However, if it is not proved by preponderance of the evidence that she lived any

amount of time longer than he did, then neither one inherits the other’s property and it

will be inherited by survivors of both spouses as if the other spouse had died before

the accident took place

§ 1.5 Heirs at law – Right of representation

Whenever a person’s parent would have taken an inheritance by intestate succession from a

decedent’s estate had the parent been alive at the time of the decedent’s death, but the parent

was in fact not alive at that time, the person and his or her brothers and sisters, if any, who

2

are in being at the time of decedent’s death, will take in equal parts the inheritance their

parent would have taken (had the parent been alive)

o MS law gives right of representation to:

Descendents of the person who died and

Descendents of the dead person’s siblings

So, where parent dies and has four children (A B C D), and C and D had predeceased the

parent, E and F (C’s two children) will each get ½ of ¼ (the portion their parent C was

entitled to) = therefore, each would get 1/8 (see Rodgers below for another example)

Dunaway v McEachern: right of representation does not go to a spouse of a deceased-intended

beneficiary, only descendants of decedent. (did not cover)

Rodgers v Rodgers: unlike most jurisdictions where inheritors in the same class receive per

capita inheritance, MS law uses per stirpes to distribute inheritance to heirs at law

Case Facts: Parent dies, A and B, two children, predeceased parent; A had two

children (C and D) and B left four children (E F G H)

o Majority Rule (Per Capita)

Each child would share equally in 1/6 portion

o MS Rule (Per Stirpes)

C and D: would share equally in A’s ½ share (so each would get ¼)

E F G H: would share in B’s ½ share (so each would get 1/8) (1/2

multiplied by ¼ = 1/8)

Hypo

o A had two brothers named B and C who died earlier

o A now dies intestate

Majority Rule (Per Capita)

o B’s two children and C’s three children each get 1/5 of A’s estate

Mississippi Rule (Per Stirpes)

o B’s two children get 1/4 each

o C’s three children get 1/6 each

§ 1.6 Heirs at law – Relatives by Consanguinity

If a person is related to someone else by blood, somewhere up the line, they had common

ancestors

Two groups

o Lineals

Ancestors = relatives on whose prior existence the decedent’s birth depended

Parents, grandparents, great-grandparents, etc.

Descendants = relatives who would not have been born but for decedent

Children, grandchildren, great-grandchildren, etc.

o Collaterals = relatives whose existence did not depend on the existence of decedent

Brothers, sisters, uncles, aunts, cousins, etc.

91-1-3 : only deals with land

o 91-1-11 : says that personal ppty will inherited like land

o Benficiary trust ppty is also inherited like land

3

So, really all three are inherited the same

Four Inheritance Groups in MS (91-1-3)

o Group I = decedent’s children and the descendents of decedent’s children who died

before the decedent died (i.e. predeceased decedent)

One share to surviving spouse (91-1-7 : surviving spouse will inherit just like

they would if they were a child; they are given a child’s share)

One share to each surviving child

One share to each child of a previously deceased child (per stirpes)

Nothing goes to surviving spouses of deceased children; only to

children of deceased children

If child D had two children E and F (each would be entitled to 1/8) but

E predeceased and left two children G and H (then G and H would

share equally in their parent’s 1/8 portion = 1/16)

If anyone is in Group I, don’t worry about other groups (everything

will go to anyone who may be in Group I)

If there is no one in Group I, go to group II and so on and so forth….

o Group II = decedent’s father, mother, brothers, sisters, and descendants of previously

deceased brother or sister (i.e. nieces and nephews of deceased siblings)

One share to each parent and sibling

One share to each child of a previously deceased sibling (per stripes)

o Group III = decedent’s grandparents, uncles, and aunts (only blood relatives =

nothing to aunts and uncles by marriage)

One share to each grandparent, uncle, and aunt

No share to a previously deceased uncle or aunt

Right of representation does not extend to cousins

o Group IV = decedent’s relatives of the highest degree as computed by the rule of

civil law

Example: Child of your first cousin = a first cousin once removed; your child

and your cousin’s child are second cousins

o If no person exist in any of the four groups, the property of the deceased’s estate goes

to the state of MS

§ 1.7 Half-bloods (91-1-5)

o Half-blood relationships can exist only among collaterals

o MS § 91-1-3

o Half-bloods are given same group status as full bloods

o However, if a full blood heir exists in the same group as the half-blood heir, then the

full blood heir inherits to the total exclusion of the half-blood

o Also, full blood children of full blood predeceased heirs inherit to the total exclusion

of the half-blood in same position (reason is right of representation)

4

o Hume: So, whole blood brothers and sisters will inherit all if there are both whole and half

blood siblings.

o Scott v. Terry: H1 and W have three children (A B C); W remarries H2 and have one child

(D); Before A died, B and C died (B and C left children behind); A leaves no children or

wife; so, A leaves a half blood sister and E F G and H (full-blood nieces and nephews)

o E F G H (full blood nieces and nephews) inherit to exclusion of D (half-blood sister)

(through right of representation)

o Acock: where A is survived by father and two half-blood siblings = the father inherits to the

exclusion to the half-blood siblings

o First cousin (half-blood) will take to exclusion of first cousin once removed (full-blood)

MS WRONGFUL DEATH STATUTE

Wrongful death benefits will go to Group 1 (surviving spouses, children, and children of

dead children)

If none, it will go to siblings (with no distinction b/t half and whole-blood)

o This is the only place where the wrongful death statute does not mirror the law of

intestate succession

§ 1.8 Decedent’s Surviving Spouse

MS Intestate Law

o Spouse must survive the decedent to be considered in distribution of decedent’s estate

o Surviving spouse shares equally with surviving children of decedent

o If decedent was not survived by any children or descendents of children, then

surviving spouse inherits the entire estate

o Surviving spouse may be entitled to homestead rights and a living allowance which

does not count as part of his or her inheritance

o Common law marriages were invalidated in MS in 1956

§ 1.9 Adoptions

Majority Rule: adoption is like divorce as far as the natural parents’ ability to inherit from the

child given up for adoption.

MS Rule § 91-17-13

o Adopted child has right to inherit

o From and through right of representation the of adoptive parents

o From the other children of the adoptive parents [just like full bloods]

However, half bloods cannot inherit from any other relatives

o From and through natural family just like before adoption took place

o Adoptive family (parents and siblings) has right to inherit

o From and through adopted child just like child was their natural child

o Natural family’s right to inherit from child given up for adoption is totally

extinguished

5

o Note: If adoptive father and adoptive mother only adopt one child; both parents die

and the child dies intestate = then no one will be able to inherit from the adoptive

child

Half-adoptions

o Occurs when a child is adopted by the new spouse of one of the natural parents

following divorce from the other natural parent

o No reason why this should cause any change at all in the rights of inheritance

between the child and the natural parent now remarried to new adopting parent

Issue (decided by SCrt): what right does an adoptive child have to adopt from natural family

o Full right to adoption (so where boys were adopted by grandparents; father marries

another woman and has child = when father dies boys get to inherit from father in

addition to half-sister)

o Statutes in Derogation of common law are strictly construed = so SCrt could not add

to statute to say something that it does not say (and the statue did not say anything

about taking away an adoptive child’s right to inherit from natural family)

§ 1.10 Illegitimates

NEED TO CROSS CHECK THIS SECTION (DIDN’T PAY ATTENTION THIS

DAY IN CLASS)

o Common Law

o illegitimate children could not inherit from anyone other than their spouses or

children

o purpose for the rule was the hope that it would discourage sexual intercourse

outside the bonds of marriage

o MS Law

o 1857: MS law was changed to permit an illegitimate to inherit from his mother

and her kindred apparently recognizing that the rule was not going to achieve its

goal

o 1981: MS law was amended to also permit an illegitimate to inherit from his

father and his father’s kindred provided

(1) there had to been an adjudication of paternity or legitimacy before the

death of the intestate or

(2) there has been an adjudication of paternity after the death of the

intestate (suit to determine heirship)

91-1-15

o Section 2: illegitimate has right to inherit from mother(?)

6

If illegitimate child dies, not married, and predeceased his natural

father, the mother cannot inherit from natural father through the

illegitimate child

THE legislature probably meant to say survived and not

predeceased b/c the way it is does not make sense (B/c if he

predeceased his natural father he WOULD NOT inherit

anything from his father anyways - so there would be no

way for the mother to inherit through the child)

If child inherits from father, he cannot even pass to mother through

will the ppty inherited from his natural father

o Subsection 3: the right of illegitimate to inherit from his natural father and

his kindred (this changed the law) (SEE STATUTE - I Think this info is

found below - just check statute to make sure)

Subsection C (he went over this) - lawsuit adjudication

Estate of Taylor

o man died intestate; after estate opened, adult woman appeared and

contended decedent was her natural father; her mother was married to

another man at the time claimant was born; strong presumption in law that

husband was father; before DNA; chancellor held against her (in favor of

presumption); put on a lot of evidence that decedent was her father; SCrt

reversed saying that she did prove he was her natural father; court said in

order for this to happen, evidence has to be almost to criminal burden

(beyond reasonable doubt)

Whit v. Mitchell

o Wealthy woman died intestate

o Never married and no children

o Had one sister

o Brother had died 40 years earlier

o Man filed petition claiming he was illegitimate son of deceased brother

If he could prove = he was entitled to inherit (does not have to be

for estate of the illegitimate parent)

Larson

o Man died intestate

o Survived by wife

o No children

o Claimant claims to be daughter of illegitimate child (born b/f decedent

was married)

o Could inherit if could prove her mother was natural/illegitimate child

11-7-13: illegitimate child can share in wrongful death benefits BUT first must

bring suit to establish hiership to prove relation

Illegitimate can bring suit to challenge will BUT only after bring suit to establish

heirship which shows they would be entitled to inherit had the will be valid

o Suits to determine heirship [MS 91-1-27 and 91-7-29]

7

Timing

Must be instituted within 90 days of publication of notice to the

creditors OR

Within one year of the date of death of the intestate

o Whichever is less

(?? Check to make sure this is true: this shall run notwithstanding the

minority of the claimant)

Standard

Illegitimate must prove his or her alleged relationship with decedent

by clear and convincing evidence

o BOP becomes beyond reasonable doubt when claimant alleges

he or she is natural, illegitimate child of a deceased man and

the claimant’s mother was at the time of his or her birth

married to another man --- in this situation, there is a very

strong presumption that the mother’s husband at claimant’s

birth was the natural father

Either the plaintiff or the defendant may make a motion for a DNA

blood test pursuant to MS § 93-9-21

o Court has power to compel a party to submit a blood test

o Court can only request a nonparty witness to submit a blood

test

o Illegitimate child may inherit as a legitimate child IF

Natural father marries natural mother and acknowledges the child as his OR

Natural parents participate in a marriage ceremony before child’s birth

Even if the subsequent marriage was declared null and void by court

o Natural parents and their kindred may inherit from the illegitimate

BUT one natural parent and its kindred may not inherit through the

illegitimate any property the illegitimate inherited from the other natural

parent

o The illegitimate child who dies unmarried and without issue cannot transfer, even by

will, property inherited from his father or mother

o Natural father and his kindred cannot inherit from or through the illegitimate child

UNLESS the father has

openly treated the child as his and

neither refused nor neglected to support the child

BOP is on the father’s kindred to prove by preponderance of the

evidence

o If no evidence on either of the two prongs, then claim of

father’s kindred must fail

o Administrator: files petition to be appointed administrator of state

Must publish notice to creditors

8

Creditor must respond w/in 90 days

o Law treats illegitimate as creditor

o Administrator’s obligation concerning illegitimates

as trustee, must exercise reasonable diligence to determine illegitimates’

identity and location

should disclose to court any actual knowledge of persons claiming to be

illegitimate heirs

If administrator, with knowledge of an illegitimate heir claim,

represents to the court that another person is the sole heir of an estate,

such representation may represent fraud on the court

required to provide actual notice to known or reasonably ascertainable

illegitimate children who are potential heirs and whose claims will be barred

by the running of the 90 day limitation

as protector of the assets of the estate, duty to contest claims of people who

profess to be illegitimate heirs if such claims may be contested properly and in

good faith

o Where there has been an adjudication of paternity prior to the death of the intestate

that a certain child is the natural child of a certain man, the adjudication is FINAL

and the issue of paternity may not be adjudicated again

Even if adjudication was by default, no blood or DNA tests were submitted,

and the person seeking readjudication was not a party to original adjudication

§ 1.11 In-laws

In laws cannot inherit by intestate succession

§ 1.12 Nonresident Aliens

Generally, nonresident aliens may not acquire and hold MS land by intestate succession

or by will, subject to several exceptions

o MS 89-1-23

Nonresident aliens shall not inherit land located in MS; BUT following

may:

Residents of Syria or Lebanon

Persons who were or are US citizens and became an alien by

reason of marriage

Where a treaty between two countries permits the alien to own

land in MS under certain circumstances (treaties of US and

nonresident alien’s country supercedes MS law)

Nonresident spouse of person who owns ppty in MS and dies = not allowed to inherit

JUST KNOW THIS STATUTE SAYS NONRESIDENT ALIENS CANNOT HOLD

LAND = IF YOU HAVE THIS COME UP, THEN GO LOOK TO SEE EXCEPTIONS

(DON’T THINK HE IS WORRIED ABOUT US KNOWING THE EXCEPTIONS)

9

§ 1.13 Escheat

If there is no one to inherit the property, the property goes to the state. This rarely

happens.

§ 1.14 Advancements

Parent dies intestate = law says each child shall get equal share, BUT:

o In situation where there have been inter vivos gifts

o A child can file a petition and contend that inter vivos gifts were advancements

Advancements = gift parent intended it to be advancement of inheritance

Must prove it by preponderance of evidence that parent intended it to be

part of child’s inheritance

Children who have not received an advancement on their intestate inheritance may tell

the chancellor that during the lifetime of the parent, he or she made inter vivos

advancements to other kids and that the parent had intended for these to be advancements

on their inheritance

If the court believes the child, the court will tell the kid who got the advancement to bring

the value of the gifts into court (into hotchpot), or they will not get any of the remaining

inheritance --- then the estate can be split evenly based on its true value

o If the parent already gave the kid way more than they could ever get from

intestate succession, then the kid will just not bring the estate into court

Advancement = must be GIFT

Hypo: Man dies intestate

o Survived by spouse and children A B C

o Gave A land worth 40K

o Gave B cash to open business

o Gave wife ring worth 10K

o Net estate at time of death = 360K

o How is estate divided assuming gifts to A and B were advancements?

First, surviving spouse takes ¼ share of net estate (90K)

Advancements have nothing to do with surviving spouses

No gifts to spouses can be advancements = only applies to children

40K and 20K is brought back into hotchpot = increases 270K to 330K

Each child takes 1/3 of 330K

A = gets 110 minus 40K = for additional 70K

B = gets 110 minus 20K = additional 90K

C = gets the rest????

§ 1.15 Loss of Right to Inherit – Willfully Causing Death of Decedent

91-1-25

A person who willfully causes or procures the death of another will not inherit from the

decedent

o Same applies to insurance policies

10

o MS Sup Court has indicated that it would hold the same in joint tenancy with

right of survivorship

The property will be inherited as if the killer had predeceased the course of action

o So, the children of the killer may have the right of representation

Remember it must be willfully: some manslaughter killings are not willful according to

statute

Remember the simultaneous death statute applies = if can’t decide who died first =

presumed they both survived each other (what he owned will go to his heirs, what she

owned would go to her heirs)

Same principle applies to wills???? (CHECK TO MAKE SURE THIS IS CORRECT)

§ 1.16 Loss of Right to Inherit – Spousal and Parental Misconduct

A spouse can, if there is misconduct which manifests a total abandonment of the

marriage, forfeit the right to inherit

o Repeated acts of adultery are not sufficient

o A bigamous “common law” marriage (even though common law marriage is no

longer recognized in MS) would constitute an act of abandonment

What constitutes common law marriage?

Intent to be married

Cohabitation

Holding themselves out to community as being husband and wife

o So, today if a man leaves his wife and meets common law standard for marriage

with another woman -- he is prohibited from inheritance by intestate succession

from either woman

Estopped from wife

Prevented from new woman b/c never married

Gastin v. Gastin: (NOT SURE HOW IMPORTANT THIS IS)

Man died intestate

Had child in 1925; living at woman at time; split

Woman went away and married another man

There was C/L marriage but no C/L divorce

o If they were married, they stayed married

Trial

court = they were not married and son was illegitimate

Supreme Court = reversed and said they were married (C/L)

§ 1.17 Loss of Right to Inherit by Contract – Release of Expectancy

o A person can contract away his right to inheritance he has under this area of the law

if:

o The parties are competent

(21 years old and of sound mind)

o It is clear that the right of inheritance is being contracted away

11

(most important)

o The compensation is adequate for the contract

(adequate consideration)

o Marital contracts (pre-nuptial and post nuptial agreements)

o Courts look especially hard at the contracts between husbands and wives

o If it appears to be terribly one-sided, the court will label it unconscionable

Kirby v. Kent:

Married in may 1934; split in July 1934

He filed for divorce

Executed agreement where she agreed to accept 195 dollars as full release of

any and all liability in so far as alimony and ppty distribution b/c the two

He died b/f it was finalized intestate

She claimed to be heir at law

She was technically is wife and stood to inherit his entire state

Other heirs and laws went to court and said she contracted away her right to

inherit

The terms were not clear (court concluded it was an alimony settlement that

had nothing to do with right to inherit by intestate succession)

o Children (and parents)

o A child (adult) may contract away his right to inherit from his parent

o Such releases of expectancy, if valid, bind the releaser and his descendants

who could have claimed through him

§ 1.18 Loss of Right to Inherit – Assignment of Expectancy (this is the other type of K; the

Ks above involve K b/t heir and decedent)

o Bayless v Alexander

o Brother agreed to assume responsibility of taking care of Mother (out of her

mind) full time IF the sisters would assign their right to inherit from the

mother when she died

The sisters agreed

One of sister died BEFORE mother died (sister was survived by four

children)

o An assignment is only good if the person who makes the assignment survives

the source (assignor must live longer than the source)

Where dealing with assigning the right of a person of unsound mind,

always have a guardian appointed

o Perhaps the guardian could have then made sure the ppty went

to the brother

o In an assignment of expectancy, the people who would inherit through the assignor

are not bound by the assignor’s contract signing away his expectancy

12

o If the decedent is competent to make a will, it supercedes any assignment, making an

assignment worthless

§ 1.19 Disclaimer of Inheritance

o Common Law: In order for a gift to be valid, it must be accepted. At common law, the

law of intestate succession would not allow someone to refuse the gift.

o Person could not refuse to accept inheritance from intestate succession

o The desire to refuse a gift comes up in two situations

o A person does not want to pay the estate tax

o The person is hopelessly in debt and the creditors will get the inheritance the

moment the property comes in

o Uniform Disclaimer of Property Interest Act ( § 89-21-1 )

o A person who has inherited by way of intestate succession may disclaim that

interest, in whole or in part, by filing a disclaimer to that effect with the chancery

clerk

Must also deliver a copy of disclaimer to the personal representative of the

decedent’s estate

o The disclaimed interest devolves as if the disclaimant had predeceased the

decedent

o Time limit: must be done w/in 90 days

§ 1.20 Intestate Succession – Exempt Property

o There is some property which the law cannot seize by process of execution (or

attachment) in order to pay debts

o Some ppty the sheriff simply cannot take (85-3 in Code)

o Homestead exemption

o MS law poses three questions in regard to exempt property

o Who inherits it?

Exempt property is inherited as all other property of a decedent except in

one situation

EXCEPT: When the surviving spouse owns a place of residence

equal in value to the homestead of the decedent, and the decedent

has no surviving children of the last marriage, but decedent does

have children or grandchildren of a former marriage

o In this situation, surviving spouse shall not inherit interest

in the homestead – it goes to decedent’s children and

grandchildren

o What limitations are there upon the size and value of the homestead?

13

Homestead cannot exceed 160 acres

If unpaid creditors are present, the value of the homestead is limited to

$75K

o Who has the right to use and possession of the homestead?

Where homestead is inherited by surviving spouse and their children

and/or grandchildren, the surviving spouse has the right to exclusive use

and possession of the homestead, as long as surviving spouse remains

unmarried and occupies or uses it

A surviving spouse is also entitled to all rents and profits from the

homestead property

Excess of 160 acres for homestead may be partitioned accordingly among

surviving spouse and children

A married person may not validly convey or mortgage the homestead

property unless the other spouse signs the conveyance or mortgage

If they both sign a mortgage and waive the homestead exemption,

the homestead is subject to those creditors

If decedent is not survived by a spouse and/or descendants, the homestead

property is subject to the claims of creditors just like the rest of decedent’s

property

§ 1.21 Suits to Determine Heirship

o Anyone with a legitimate interest in needing to know who the heirs to an estate are by

name may obtain that information

o People almost never institute suits to determine heirship because the family almost

always believes they know who the heirs are

Chapter 2: Administration of Intestate Estate

Three Purposes of an Administration

o Provides a process whereby the property of the deceased person can be

accumulated

o Provides a procedure whereby the net estate will be distributed to those who

deserve it

o Provides a method whereby creditors will be identified and paid (most

important)

§ 2.1 Appointment of Administrator – Jurisdiction and Venue

This is the process by which the property of the intestate decedent actually gets into

the hands and becomes the property of the heirs at law

Jurisdiction

o In MS, the chancery courts have jurisdiction over administration of estates

14

o Statute which provides clerk of court can perform acts of Chancellor

Subject to later approval of chancellor

i.e. sign orders admitting wills and appointing administrator, etc…

Rationale: Chancellor serves several counties and would be

inconvenient to require lawyer to find Chancellor

Venue

o Proper venue is in the county of the decedent’s residence

o If the decedent does not reside in MS, venue is proper

In the county where he died or

In the county where some or all of his personal property is located

§ 2.2 Person Appointed Administrator

He said he will not try to hit every point in this sections (but he is hitting the high points)

The Process

o Petition

Person goes to appropriate chancery court and files a petition asking

for a letter of administration to issue

Letter of administration is a document which sets out that the

person to whom this document is issued by the court has the

authority to deal with all personal property having to do with

the decedent

Who is entitled to the letter of administration?

o First, the surviving spouse

If another comes forward and request letter of

administration, spouse may remove such person

within 30 days from death of decedent

o Next, the heirs (people who would inherit the property

or part of it)

Court will choose the heir at law who is best

calculated to manage the estate

o Otherwise, a bank or trust company can do it

If no one comes forward within 30 days, the

court can grant letters of administration to any

suitable person

Often this occurs if the family doesn’t want to

do it themselves

A

creditor

can

have

someone appointed

o Rationale: b/c you can’t sue dead person; you have to

open estate and sue the estate

Otherwise: no one would open the estate and a

creditor would never be able to bring a lawsuit

against the estate

It will not be the creditor himself = often will

appoint the sheriff

15

§ 2.3 Administrator’s Oath, Bond, and Duty

Oath

o Prior to be granted letters of administration, administrator must take oath that

Decedent died without a will

As administrator he or she will truly administer the goods, chattels,

and credits of the decedent

He or she will pay debts as far as the assets allow and

He or she will make perfect inventory and a just account of goods and

so on

Posting bond

o Before the letters issue by the clerk, the person has to take an oath and post a

bond promising to faithfully discharge all duties required by law

Purpose is to give anyone who suffers financial loss as a result of the

wrongdoing of the administrator in the management of the estate a

source of recovery other than the administrator’s resources

Bond may be waived or reduced by chancellor if

o the administrator is the sole heir or

o if all heirs are competent and ask by sworn petition that

the bond be reduced and waived

Paying Debts

o The only property that the personal representative is concerned with is

personal property – which is used to pay debts and expenses of the

administration

The PR will have to deal with real property of the deceased person

only when the personal property is not enough to pay all creditors

Duty

o Administrator’s acts must be of that which a reasonable, prudent, and

intelligent administrator would take

Must act in good faith and employ such vigilance . . . as prudent

persons of discretion and intelligence employ in their own affairs

Holds a fiduciary duty to all parties having an interest in the

estate

§ 2.4 Administrator’s Attorney

If the personal representative is not an attorney, he must get one.

o The attorney is the attorney for the personal representative, not the estate

o Although the PR may agree to pay a certain amount to the attorney, the court

ultimately decides what a reasonable fee is after considering the totality of the

circumstances surrounding his service

16

It is preferable to have the court fix a reasonable fee first and then pay the

fee allowed

Such fee is the personal obligation of the PR unless the fee is fixed

by the chancellor

o If fixed by the chancellor, the administrator’s attorney fee

is an administration expense and may be paid out of the

assets of the estate

§ 2.5 Temporary Administrator

When it is necessary, someone may be needed to manage the estate until a regular

administrator can be appointed

Temporary administrators do everything the same as a normal administrator and just turn

the estate over when the actual administrator is appointed

Temporary administrators are entitled to fair compensation for their efforts

§ 2.6 Administrator Ad Litem

Administrator appointed usually for the sole purpose of pursuing a cause of action which

had not been filed or was pending when decedent died

§ 2.7 County Administrator

Duty to administer the estates of decedents who died owning property in MS and for

whom no administrator is appointed within 60 days of the decedent’s death

o Myth: this simply does not happen

o Statute says there is one in every county appointed by chancellor

o Don’t confuse this with the County Administrator by the Board of Supervisors

§ 2.8 Sheriff as Administrator

The administrator of last resort

o Court must be shown

There are assets to administer and

Creditors claims are valid, if they exist

§ 2.9 Removal of Administrator – Misconduct

Once properly appointed, an administrator may generally not be removed without proof

of misconduct in the management of the estate

o However, before the administrator is removed, he must first be given notice

17

o Failure to return inventory, payment of unprobated claims, failure to render

annual accounts misappropriation of estate funds

§ 2.10 Removal of Administrator – Other Causes

If a person applies who has a claim to the office superior to that of the person who has

been appointed, then the court may replace the administrator in that case

Also, if a will is found, the probate of the will and the granting of letters testamentary

effectuate the removal of the administrator

§ 2.11 Resignation of Administrator

Administrator may resign, but he or she must make final settlement and satisfaction of

the trust

§ 2.12 Administrator De Bonis Non

The successor which must be appointed when an administrator dies, resigns, or is

removed for misconduct prior to the completion of the administration of the estate

Simply a substitute administrator

§ 2.13 The Estate to Be Administered

Personal property is to go into the possession of the administrator to be used to pay debts

and expenses, with the remainder to be distributed to the heirs at law

Real property descends directly to, and title vests in, the heirs at law to enjoy until the

contingency arises when it may be needed to pay debts

There is no deed from dead person to heir at law (so you will go to the courthouse and

see a deed to John Jones in 1923 and then 50 years later you will see a deed from Sara

Jones to X)

The administrator has nothing to do with real property

o Exception: if personalty is not sufficient to pay creditors, the representative will

then have to take as much non-exempt as necessary and sell to pay creditors

§ 2.14 Inventory and Appraisement – When Appraiser Appointed

Upon the granting of letters of administration, unless otherwise ordered, at least three

disinterested people shall be appointed appraisers (by Chancellor) and ordered to

o inventory and appraise the goods, chattels, and personal estate of the decedent

(except for money and choses in action) and

o return written report to the court within 30 days

o Then, their duties end

Rationale: fear of family member that is appointed appraiser will hide assets to keep them

away from creditors

18

Problem: this is troublesome and expensive

o Solution: Chancellor has authority to waive these three appraisers (statute passed)

This is done in almost all cases today

o If it is not done, then the personal rep has to make the inventory and appraisal

o SEE INFO BELOW 2.15 & 2.16

The value placed by the appraisers on the various items is deemed to be prima facie

correct, but the presumption may be shown to be incorrect

o If it is shown to be incorrect, the administrator is chargeable with the proven

actual value rather than the appraised value

The administrator is charged with making an inventory of the decedent’s money which

comes into his or her hands and of debts due the decedent that the administrator knows

about

§ 2.15 Inventory and Appraisement – When Appraisers Not Appointed

Appraisers are usually NOT appointed

o So, the administrator must include in his or her inventory of the money and debts

due the decedent a list of the rest of the decedent’s property which has come into

the administrator’s hands

The administrator is also supposed to give the value of this property

The administrator’s complete inventory must be returned in 90 days

If, after the making of the original inventory, additional property comes into the hands of

the administrator, an amended or additional inventory must be made within 30 days

There is not authority which says the chancellor may waive the actual inventory

§ 2.16 Inventory and Appraisement – Waiver Of

Due to the high costs, a chancellor may waive appointment of appraisers

o However, a chancellor does not have the right to waive all inventories and

appraisals (personal representative must become appraiser) regarding intestate

estates

§ 2.17 Setting Aside Exempt Personal Property

Some kinds of personal property are exempt from seizure under execution of attachment

o This property is simply not part of the estate

Exempt items include

Tangible personal property worth less than $10K

A part of wages earned

19

$50K life insurance policy on the life of a decedent payable to the

administrator of the estate

The homestead in MS up to a value of $75K

o Where there are no unpaid creditors, the dollar limitation

on the homestead exemption is immaterial

§ 2.18 Support for One Year

Aka Widow’s allowance

The personal representative must pay to the surviving spouse and dependent kids enough

money to enable them to live for one full year

Very important historically when man owned everything and it took up to year to

administer the estate (the widow and children had to have something to live on for a year)

b/c the exempt ppty might not be enough to live on

Statute amended to include right to husband (widow replaced by spouse in statute)

Unresolved issue of whether husband is entitled even if he was not being supported by

wife

This is NOT included as part of inheritance (it simply comes off top before inheritance is

calculated)

§ 2.19 Notice to Creditors

The executor or administrator must

o 1. make reasonably diligent efforts to identify persons having claims against the

estate and

o 2. mail to the persons identified a notice informing them that the failure to have

their claim probated and registered by the clerk of the court within 90 days from

the first publication of the notice to creditors will bar their claim

3. Then, administrator must file an affidavit saying he or she has complied with the

diligent efforts requirement

4. Then, the administrator must publish notice once a week for three consecutive weeks

in “some newspaper in the county”(this used to be the ONLY requirement; SCrt said due

process requires diligent efforts requirement above; MS provided 3rd step by statute)

o The creditor has 90 days from the first publication to respond

However, if proper procedure is not done, the 90-day period will not run

against the creditor

On the other hand, if proper procedure is followed and the 90-day period

runs, the creditor may not probate a claim against the estate

o Newspaper will provide affidavit and copy of publication and then this is filed w/

the court as proof of publication

If creditor is r’bly ascertainable, they must be sent letter EVEN if they do receive notice

through publication.

§ 2.20 Claims Requiring Probate

20

The claims which are required to be probated and registered by the clerk are contractual

claims (i.e. sum certain claims)

o Specific money demands which are then due or will mature at some time in the

future

Sums due on promissory notes

Open accounts

Alimony payments in default at decedent’s death

Claims for services rendered

General indebtedness

Judgments or decrees

Tort claims do not have to be probated (indeed cannot be probated b/c jury has to tell

how much is owed)

Also, no claim has to be probated unless it is a claim against the decedent

o Ex: Funeral expense is a claim against the estate, not the decedent

Alimony

o An obligation on an estate’s behalf to pay alimony is terminated upon death

unless the party has expressly agreed to continue payments until the death or

remarriage of the surviving spouse

§ 2.21 Probating Claim

A claim is probated by the creditor who goes down to the chancery clerk’s office and

presents two things

o Written evidence of the debt (ex: note, judgment, or itemized account or written

statement)

o An affidavit that says that the statement of the claim is correct and the money is

due from the deceased person

Claimant’s affidavit should (what’s required in affidavit is found in

statute)

Conform to the statute

Contain written evidence

Contain an itemized account

Attach statement in writing

The clerk will mark them registered, probated, and allowed if they appear to be in order

Substantial compliance with statute (with regard to affidavit)

§ 2.22 Amendment of Claim

After the 90-day period has expired, the creditor may amend his probate claim as long as

he has the prior approval of the court

Must have substantially complied with statutory requirements of probating b/f

amendment is allowed

21

§ 2.23 Failure to Probate

If the creditor gets a letter and doesn’t probate the claim within 90 days, the claim is

barred

o However, if a claimant’s identity is known or is reasonably ascertainable, and the

claimant is not mailed a notice by administrator informing the necessity to probate

the claim, the 90-day limitation does not bar the claim

§ 2.24 Payment of Claims

The administrator has no authority to pay a claim until it has been properly probated

o The administrator should not pay a claim unless he is certain that it truly is due

and owing

The fact that a claim has been probated is not an adjudication of that fact

o If there appears to be even a remote chance of insolvency, the administrator

should not pay any claims until the end of the 90-day period

o The personal representative is not supposed to pay claims unless they have been

probated properly in “substantial compliance with the statute”

Townsend: If the personal representative probates a claim pursuant to the wishes of

some, but not all of the heirs, only the heirs who were present will be bound by the

agreement

o One remedy if there is some uncertainty about certain claims, the personal rep can

get permission from heirs at law to pay the claim

Then, the personal rep will not be liable for improperly paid claims to the

heirs that gave permission

o In Townsend, personal rep and atty went over 3 probated claims with 4 of 7 heirs

at law

The three probated claims had not been properly probated and should not

have been paid

The four heirs who agreed to payment of claim could not recover anything

from personal rep for improperly paid claims

o Ex: If the personal representative paid improperly probated claims, the personal

representative will only be liable to the absent heirs

Personal rep must post bond in intestate estate

o May be waived if personal rep is sole rep OR if all heir are competent and they

agree

o Must be in the amount of the entire estate

o Purpose: have somebody else the heirs can look to beside the personal rep

This is not for the personal rep to be liable (they will be liable anyways)

o Surety writes the bond: insurance company

o If the bonding company ends up paying, they have the right to be indemnified by

personal rep who caused the loss

22

§ 2.25 Payment of Claims Not Due

Claims of the kind that must be probated must be probated whether or not they are due

and payable

o After 90 days from the grant of the letters of administration, the creditor must

accept as payment in full of the debt an amount equal to what the debt would have

been had it been payable on the day tender is made

Ex: decedent’s obligation to pay $750 per month to former wife is

calculated for a commuted value of future and unmatured sums and all of

it is paid from the estate

§ 2.26 Contest of Claims

A probated claim may be contested by the administrator, an heir, or a creditor

o However, a creditor may only contest a probated claim if the claim would render

the estate insolvent

If the personal representative does not believe that the payment is due on a probated

claim, he must not pay it and should contest the probated claim

Regardless of who institutes the claim, the burden is on the claimant to prove the claim is

valid

o Be aware that just because a creditor probated and registered the claim with the

clerk does not constitute prima facie evidence that the claim is valid

§ 2.27 Secured Claims

If a bank loans a party money and takes a security interest in the property and the party

dies, the bank does not have to probate the claim (but it probably should)

o The secured creditor can simply go get the property that the decedent used the

bank’s money to buy

o If bank probates claim, sells the property and there is a deficiency, then the

deficiency is a valid claim against the estate

If the bank, without probating the claim in the 90-day period, goes and gets the property

and sells it and that doesn’t cover the amount that has not been paid back to the bank by

the decedent, the bank will lose the money that has not been paid

§ 2.28 Claims for Services Rendered – Quantum Meruit

A party may probate a claim for quantum meruit if the court concludes that a reasonable

person would not have expected that the person would have done work without payment

The claim must be probated within 90 days, proving that the agreement had been made,

that the claimant was to be paid, and that he had not been paid

If there was an agreement for specific amount that a person was to be paid: that would be

an oral contract and not a QM claim

23

Quantum Meruit = no agreement on amount that was to be paid

First, party should probate the claim

P must prove that there was either express or implied agreement or contract that services

would be paid for

o Number of cases where close relative rendered services = SCrt usually holds there

is simply no understanding services would be paid for (gratuitous services)

o Given all circumstances, would the deceased person expect that person providing

services expected to be paid for them

If there is agreement to pay, P must prove what services were actually performed (what

you did, how much you did, when you did)

Then, claimant must present evidence as to what r’ble value of those services were: bring

someone to stand w/ knowledge of value and what payment would be

If all this done, claimant can recover

o SOL can imply, if there is evidence that services would be paid for by a specific

time, and they were not, and the SOL has run, then they will not be paid

o IF on the other hand, there was an agreement that they would be paid for after the

death, then they would be payable at that time

EXAMPLE: Often occurs when older person realizes they need help, has

no family to help, but has property

Young person has no particular career

Agreement that young person will come and help and if they do,

they will leave everything to the young person in will

o Often times, the will is never made = so young person will

have to file QM

SCrt: nothing against law for a person to contract to make a will in a

person’s favor

Parties must be competent

Terms must be clear

Must be consideration AND

Has to be in writing (for this particular contract) (B/c in SOF)

o IF NOT IN WRITING = CAN MAKE CLAIM

THROUGH THIS DOCTRINE OF QM

§ 2.29 Oral Contract to Pay for Services Rendered by Will

Williams v Mason: Allowed to file a claim for services rendered even if you cannot

bring a claim for oral contract to make a will because there was no written contract and

SOF principles bar evidence of the contract

24

§2.30 Claims Against Estate – Statutes of Limitations

If the limitations period pertaining to a creditor’s claim expired prior to the decedent’s

death, then it may not be recovered against the estate, regardless of any act or promise of

the administrator

The death of the decedent (the one the claim is against) does not interrupt the running of

the SOL

o Exception: If the decedent dies in the last year of the SOL, it is extended so as to

expire one year from the date of the decedent’s death

Rationale: death upsets process (with appointment of estate, etc…)

The appointment of an administrator tolls the SOL for an extra 90 days

Upon publication of notice to creditors, all probatable claims must be probated within 90

days of the date of first publication no matter what the SOL remaining may be

§ 2.31 Creditor’s Action to Compel Payment of Probated Claim

Even though a claim may have been properly probated by a creditor, it does not legally

entitle him to the money

If the administrator fails to pay an alleged debt, the creditor will have to take judicial

action to compel payment

Actions to compel payments of claims must be brought within four years (and 90 days) of

the qualification of the administrator, even though the claim has been duly probated

o Reason is that administrators may not be sued for 90 days after taking office, and

there is a four-year SOL for actions against administrators

§ 2.32 Taxes

Previous Tax Rule: MS treated taxes like any other debt (except the government did not

have to probate it) --- therefore, taxes had to be paid out of the estate before the money

was distributed to the heirs

Uniform Estate Tax Apportionment Act: provides that federal and state estate taxes

must be apportioned among all persons interested in the estate in the proportion that the

value of the interest of each person bears to the total value of the estate (unless the

decedent has a will and it provides otherwise)

o Application: If you inherit ¼ of the value of the estate, you are going to have to

pay ¼ of the estate taxes

§ 2.33 Tort Claims Against Estate

Old Rule: At common law, tort actions permanently abated upon the death of either the

injured person or the injuring person

Today’s Rule: Personal actions survive the decedent (with the exception of libel and

slander and actions to recover punitive damages)

25

o MS Court has defined a personal action as

Suit to recover personal property

Action for contractual damages (Powell)

Injury to person or property

Reviving or bringing a claim

o Tort claims cannot be probated and are not affected by the 90-day period --- they

are governed by the 4 year SOL

Claim can be brought after the person dies???? (CHECK TO MAKE

SURE THIS IS CORRECT)

If administration has already been closed, and THEN a person brings

claim and wins lawsuit, he, as a creditor, has a right to make the people

who have received the money to bring it back b/c as a creditor he has first

claim to it

o Other statutes of limitations applicable to claims against estates in general apply

to tort claims as well (see § 2.30)

§ 2.34 Management of Estate

The administrator is a type of junior co-manager of the estate with the chancellor

o Anything administrator does must be approved by chancellor

o So Personal rep decides what needs to be done, but has to go to chancellor to get

the authority to do it

The administrator must get authority from the chancellor before doing anything with the

estate

o However, the administrator may invest or deposit funds in interest-bearing

accounts in federally insured banks and S & L associations whose main offices

are located in MS

Administrator must do what a r’bly prudent person would do under those circumstances:

o Put in interest bearing account

o Get ppty insured

§ 2.35 Management of Estate – Growing Crops, Farms, and Businesses

Didn’t discuss next three sections in class

A growing agricultural crop is a personal asset that goes to the administrator for the

payment of the decedent’s debts and expenses

The court may allow the administrator to operate the decedent’s farm or lease it to

someone else for a period of no more than 15 months

If necessary to pay debts, the court may allow the administrator to cultivate or lease the

farm from year to year

When a decedent dies while engaged in operating a business, the court may authorize the

administrator to continue the business as a going concern for a time no more than 3 years

§ 2.36 Management of Estate – Sale of Personal Property

Perishable property and livestock may be sold for cash for any purpose without an order

Ant item of personal property may be sold for cash without an order if:

26

o The reason for the sale is to pay debts of the estate, and

o The appraised value has been obtained

If the reason is not to pay debts and where the sale is to be public, five days notice to

interested parties is required

When the purpose of the sale is to reduce to cash property which cannot be equally

divided in kind, the heirs must be made aware by summons or publication unless the

value of the property does not exceed $500

§ 2.37 Management of Estate – Sale of Land

Nonexempt real property must be sold when a decedent’s nonexempt personal property is

not sufficient to pay his or her debts and the expenses of administration

o A petition to sell such land must be filed with the court that granted the letters of

administration

§ 2.38 Management of Estate – Mortgage or Lease of the Land

When a decedent’s personal property isn’t enough to pay his debts and the expenses of

administration, the court may order that the decedent’s land be mortgaged to secure a

loan to pay the debts or expenses

§ 2.39 Management of Estate – Cause of Action of Decedent

The personal representative may “revive” a COA or initiate a new COA (see § 2.30)

All recovery for wrongful death goes to the beneficiaries of the estate, not subject to the

claims of creditors (except for the items listed in the wrongful death statute)

o Ex: the part of the recovery allotted for medical expenses goes to pay off the

medical expenses; the funeral expenses go to pay the funeral expenses; car

damage goes to the car

Need to Distinguish b/t Two Types of Tort Actions:

o Tort Action for Injury - Where Wrongful Act Did Not Cause Death of Decedent

(i.e. survival action)

Can only be brought by the personal rep (NOT by an heir at law)

Whatever is recovered = asset of estate

o Wrongful Death Action

i.e. wrongful acts Do cause the death (died from lung cancer caused by

cig)

May be brought by personal rep OR heirs at law

Only one may be brought (first one to file = the lawsuit; others

may join)

If recovery = only monies that will go to estate are ones that are for:

medical expenses, funeral expenses, and ppty damage (to pay for those

claims

Everything else = goes to the wrongful death beneficiaries

o If not perfectly clear which type of action = proper route is to bring action with

two counts (for survival AND wrongful death)

27

§ 2.40 Management of Estate – Compromise and Settlement of Claims

The chancellor may authorize an administrator to settle and compromise any claim

belonging to an estate which cannot be readily collected

o Must have Chancellor approval to settle claim (whether estate is P or D)

Chancery Rule 610: must put on proof at hearing before chancellor (to

prove settlement is fair)

A new chancery rule was written to abate the problem of chancellors approving

settlements that were not fair to the beneficiaries

o In petitions for authority to compromise claims for wrongful death or injury,

witnesses must be called to testify as to liability and injuries (basically, it is no

longer a perfunctory matter)

§ 2.41 Suits By or Against Administrators (didn’t discuss in class)

An administrator may bring suit on matters that accrue to the decedent during the

administration and may be sued as to such matters as well (after the 90-day period)

FOREIGN ADMINISTRATORS:

o He just said they are allowed to come in and get ppty, etc… (see book for details;

pg. 74)

§ 2.42 Management of Estate – Prohibited Acts

Even if the chancellor approves it, an administrator is expressly prohibited from (Some

acts that are just prohibited):

o Borrowing or using for his benefit any of the funds or property of the estate

o Taking a position contrary to the heirs

o Purchasing or acquiring funds or ppty of estate adverse to any creditor or

beneficiary (think this is what the second element is trying to say) (CHECK

BOOK PG. 75)

o Loaning funds or property to the administrator’s family, attorney, or agent OR

o Moving any of the estate property outside of the state of MS

Executor de son tort

o A person who intermeddles with, alienates, or embezzles any of the money of

personal property of a deceased person before taking out letters of administration

or letters testamentary

Such person is liable to creditors and others aggrieved by his actions and

will be held to the same standard of trust as an administrator

§ 2.43 Insolvent Estates

Not necessarily where there are NO assets (insolvent just means when there are more debts

than assets (so there might be substantial assets))

28

When it becomes apparent that there is not enough money to pay all debts and expenses,

everyone who has a claim is given notice to come to court and the chancellor will take up

each claim, examining the claims that either (everything is sold for cash)

o Were probated within 90 days OR

o If not probatable, were filed with the clerk prior to the hearing

Thus, the chancellor compiles a list of claims found to be due and owing

Preference claims are paid first (expenses of last illness, funeral, administration, and

attorney fees)

o If there is not enough money to pay all these full amount, then they will be paid

on a pro rata basis

o If there is any money left over after all preferred are paid in full, then the left over

money goes to any other creditors

Only thing inherited = exempt ppty (and widow’s allowance that is paid even b/f

preferred claims)

§ 2.44 Annual Accounts

If a year goes by after the administrator is appointed and he is not ready to close the

estate, he must file an annual report (i.e. any estate not closed w/in yaer)

o Otherwise, he will be held liable to creditors and others aggrieved by his actions

and will be held to the same standard of trust as an administrator

Simply an asset/liability account: what is left to be paid out, what is left, and stubs of

checks that have been paid out)

o No notice of it is required, but anyone can go look at it

Purpose of this is to let the court know that the matter is proceeding as it ought to proceed

(and the administrator isn’t plundering the estate of its money)

Statutory Amendment = BOP is on the clerk to give an accounting of every estate that has

been opened up, not closed, and for which there has not been an accounting

o Administrator has duty to do the accounting

o Attorney has duty to see that administrator does accounting

o Clerk has duty to notify the chancellor that accounting has been done

§ 2.45 Compelling Distribution or Final Settlement

If an heir is anxious to receive his inheritance, he has two possible remedies

o First, six months after letters of administration have been distributed, an heir can

petition the court to order the administrator to make the heir’s distribution (i.e.

make part of the administration)

If the heir requests this before the final settlement, the heir must put up a

refund bond with sufficient sureties, communicating that if it should turn

out that the estate must have the money back for some unforeseeable

reason (ex: debt), the early heir will pay it back

Chancellor can order administrator to make Partial settlement

HE DESCRIBED THIS SECTION SORT OF DIFFERENTLY IN

CLASS = CHECK BOOK TO MAKE SURE EVERYTHING IS

CORRECT)

29

o Second, the heir may petition the court to order the administrator to make the final

settlement and close the estate (i.e. make final payment)

Court should order the estate closed unless the administrator can show

cause why it should not be

§ 2.46 Final Accounts

The petition on the final account is required to include the name and addresses of the

people who the personal representative believes to be the heirs at law of the deceased

person

o The SOL on reopening the estate only applies to those who were made parties to

the closing of the estate

o A suit to determine heirship can help clear up any potential problems

o When an heir shows up later, the court will ask if a reasonably prudent

administrator would have found the heir

Service of process is given to all of the people named in the petition

o In lieu of serving process, most sign a waiver and answer which shows that the

heirs agree to the way the estate is being closed

o Heirs can sign (in front of notary publicy) that waives service and agrees with

accounting of estate

o If there are any objections = a day in court will be set aside so the chancellor can

take them up

After it is approved, the administrator writes himself and the attorney a check for the

approved amount

§ 2.47 Administrator’s Attorneys Fees – General Services

At end of process, chancellor will be asked to set r’ble atty fee based on what all the

lawyer had done and the time that it has taken (tell the client that you will accept that fee

OR alternative method = you don’t have to do it this way = i.e. you can tell client that

you will charge a specific fee, try to get chancellor to authorize that fee, but if Chancellor

doesn’t authorize that much = still going to get that much and have to pay out of own

pocket)

Administrator’s attorney’s reasonable fees for necessary services rendered in good faith

are a legitimate expense of administration and may be paid out of the funds of the estate

The court decides on a reasonable fee in the exercise of its sound discretion, considering

the time the attorney expended as well as the difficulty of the work, the skill required to

do it, the responsibility involved, the amount involved, the promptness of services, and

the size of the estate

The chancellor should not authorize any payment out of estate funds for attorney fees

rendered either

o Before the appointment of the administrator OR

o For the sole benefit of the administrator’s personal interest in the estate as against

the interest of other heirs

Chancery Rule 612

30

§ 2.48 Administrator’s Attorney Fees – Special Services

Occasionally it will be necessary for an administrator to pursue a claim which is

customarily handled by the claimant’s attorney on a contingent fee basis

o Any such agreements between the administrator and his or her attorney should not

be made without a prior detailed petition to the court and approval of the

chancellor

§ 2.49 Administrator’s Commission and Expense

Those services which the person performed as a lawyer should be compensated as a

lawyer would be compensated

The non-legal services should not be compensated at a lawyer’s rate of compensation

§ 2.50 Reopening the Estate

Interested people can reopen the estate for two years after it is closed as long as the issue

on which the reopening is based was not brought up at the hearing of the final account

§ 2.51 Suits for Devastavit (Waste) Against Administrator and Surety

Any heir, creditor, or beneficiary may institute proceedings for a devastavit against the

administrator and the surety on his bond when it is believed that the administrator has

neglected his duty and caused a loss to the decedent’s estate

§ 2.52 Recovery of Decedent’s Personal Property Without Administration

Administration of estate is not required

o The most important thing an administration does is put to rest claims against a

creditor

SOL will keep running on a creditor’s claim after the death (even if there is no

administration): ppty decedent owned (except exempt ppty) remains liable for those

claims as long as the SOL has not run

To protect property holders and to permit the decedent’s heirs at law to take possession of

the property without the necessity of a formal administration, the legislature has enacted

legislation which authorizes

o A bank to pay the decedent’s nearest relative any sum to the credit of the decedent

not to exceed $12,500

o A savings association to do the same upon receipt of an affidavit and bond

o Any person indebted to the decedent or having property of the decedent may pay

the successor (subject to some exceptions) and

o Any person owing wages to a decedent may pay them to the decedent’s Group I

or Group II relatives

31

§ 2.53 Gifts Inter Vivos

The person who claims to own property by inter vivos gift has the BOP by clear and

convincing evidence that there was a delivery of the property and the donor surrendered

all dominion over it

o Burden on Claimant to prove elements

§ 2.54 Gifts Causa Mortis

(did not cover; Don’t need to know this)

Gifts made in contemplation of death

o Ambulatory and can be revoked at any time in the donor’s life

o Such a gift is subject to claims of creditors if the other property of the decedent is

not sufficient to pay them

Land cannot be conveyed by a GCM

§ 2.55 Ancillary Administration

MS does not allow ancillary administration for property in the state

However, the administrator of the estate of a MS decedent should concern himself with

the recovery of personal property of the decedent located in other states

o This must be done pursuant to the law of the other states and may necessitate an

ancillary administration

§ 2.56 Joint Bank Accounts and Certificates of Deposit

Funds in bank accounts held by two or more people will become the property of the

survivor(s) upon the death of a joint tenant

o Same rule generally applies to certificates of deposit

Intent is the crucial question regarding CDs

If intent is clear that CD was jointly held with right of survivorship, that

intent will be given effect

Where terms of account are clear that it is a joint account with right of

survivorship is conclusive (and evidence to the contrary is not admissible)

These accounts can still be challenged (Cannot be challenged on Intent)

but can be challenged on these grounds:

Decedent did not have mental capacity to create account (i.e. they

were incompetent)

Person who created account was unduly influenced

Fraud

32

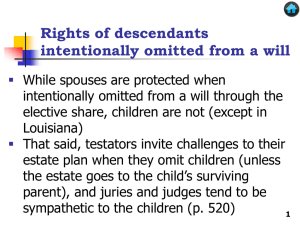

Chapter 3: Wills

§ 3.1 Introduction

A person can, with a valid will, make moot the law of intestate succession

This is the only chance for some people to have a shot at the big house, and they will try

to find some way to attack the will when they are left out of a will

When a person says that someone died with a will, they mean that:

o There was a writing

o And it was legally valid (which is not always the case)

Usually Titled “Last Will and Testament”

o Last: not necessarily the last, b/c person can always make another will

o Could be just titled: “will” and it would still be legally sufficient

§ 3.2 Wills – Nature and Purpose of Writing

The first step in the process of interpreting a will is determining whether the writing

attempts to do what a will does

The purpose is to make a testamentary disposition (gift/transfer (i.e. disposition) that will

only take place upon death (i.e. testamentary))

o If it does not do this, it is not a will regardless of what it is called

o If it does do this, it is a will whatever it may be called

§ 3.3 Wills – Animus Testandi – Intent of Testator

The document must communicate that it is the intent of the testator that the instrument

make testamentary dispositions (only has legal validity upon the death of the testator)

o So the words of the writing PLUS the intent must be illustrated in order to prove it

is a will

o If the writing clearly makes a testamentary disposition (i.e. I hearby bequeath,

give, etc…) = intent is usually presumed

Except: if you can prove fraud

o On one extreme: you will have a writing that clearly indicates intent

o On the other extreme: you will have a writing that clearly does not have

testamentary disposition

o The hard cases: fall in between = ambiguous writing

Intent is key in these cases and ALL RELEVEANT EVIDENCE IS

ADMISSIBLE IN THESE CASES, including declarations of testator

(exempt from exclusion under hearsay rule (803(3))

§ 3.4 Ambulatory Nature of Will

The will must be ambulatory, which means that the person who made the will is free to

modify or revoke it at any time

33

o If a will is not ambulatory, it is not a will, because that is what sets a will apart

from other documents

§ 3.5 Form or Title of Writing

A writing does not have to be in any particular form to be a will

o Ex: a personal letter, a scrap of paper, or the back of a certificate of deposit may

be a will if the words written there are sufficient and were executed with the

necessary intent

The writing does not have to be designated or entitled a will in order to be one

o However, as with the form, the title given to it by the maker may provide

evidence as to intent

§ 3.6 Will or Deed with Reservation of Life Estate (did not pay attention to the next

several sections in class; cross check these with someone else’s notes OR the book)

o Many cases in MS have regarded whether a document was a will or a reservation of a

deed with a life estate

o This occurs when it is not clear whether the intent of the maker was to make

A deed by conveying a future interest in the land which vest in the grantee

upon delivery of the deed, though reserving in the grantor a life estate, the

effect of which is to postpone only the grantee’s right of possession

A will by making no present conveyance of any interest in the land and to

have the interest vest or the instrument be effective only upon the death of

the testator

o Regardless of what it is called, if a document makes a testamentary disposition, it is a will

o However, if the parties did not consider it to be a will and it was not executed like

a will (because the parties did not realize the need to execute it like a will), it is

not a will and the property will go by intestate succession

o MS Rule = If it’s in the form of a deed and is called a deed, the court must construe it as a

deed unless the terms of the writing make it totally clear that no interest is passing until

the death of the donor

§3.7 Conditional Wills

If the testator of the will wants the will to have permanence, he should be very wary

about putting any language in the will which could be construed as conditional

Intention is to be collected from the language of the will

o Declarations by the testator to the contrary of the condition in the will are not

admissible

§ 3.8 Nuncupative Wills (Oral Wills)

34

An oral will may be a valid conveyance of personal property provided many conditions

are satisfied, but an oral will cannot convey land

o The conditions (which can pretty much only be met by a Hollywood-type

deathbed scene) are