proposals for changes to the nice classification

advertisement

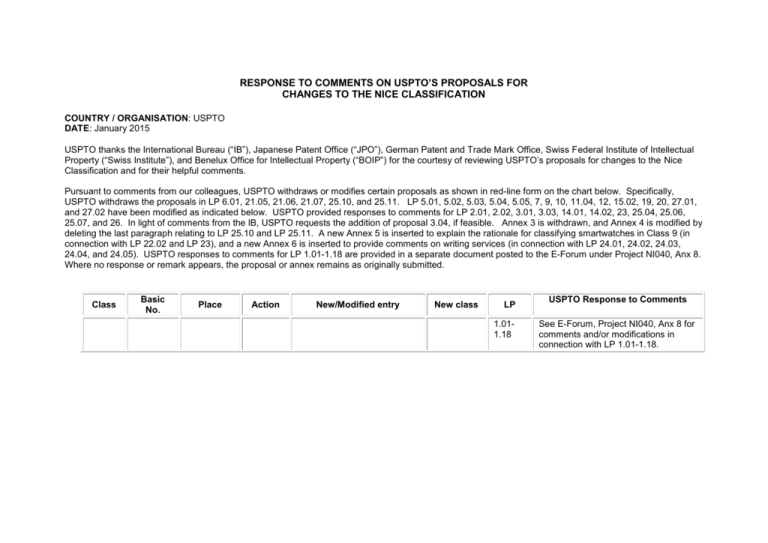

RESPONSE TO COMMENTS ON USPTO’S PROPOSALS FOR CHANGES TO THE NICE CLASSIFICATION COUNTRY / ORGANISATION: USPTO DATE: January 2015 USPTO thanks the International Bureau (“IB”), Japanese Patent Office (“JPO”), German Patent and Trade Mark Office, Swiss Federal Institute of Intellectual Property (“Swiss Institute”), and Benelux Office for Intellectual Property (“BOIP”) for the courtesy of reviewing USPTO’s proposals for changes to the Nice Classification and for their helpful comments. Pursuant to comments from our colleagues, USPTO withdraws or modifies certain proposals as shown in red-line form on the chart below. Specifically, USPTO withdraws the proposals in LP 6.01, 21.05, 21.06, 21.07, 25.10, and 25.11. LP 5.01, 5.02, 5.03, 5.04, 5.05, 7, 9, 10, 11.04, 12, 15.02, 19, 20, 27.01, and 27.02 have been modified as indicated below. USPTO provided responses to comments for LP 2.01, 2.02, 3.01, 3.03, 14.01, 14.02, 23, 25.04, 25.06, 25.07, and 26. In light of comments from the IB, USPTO requests the addition of proposal 3.04, if feasible. Annex 3 is withdrawn, and Annex 4 is modified by deleting the last paragraph relating to LP 25.10 and LP 25.11. A new Annex 5 is inserted to explain the rationale for classifying smartwatches in Class 9 (in connection with LP 22.02 and LP 23), and a new Annex 6 is inserted to provide comments on writing services (in connection with LP 24.01, 24.02, 24.03, 24.04, and 24.05). USPTO responses to comments for LP 1.01-1.18 are provided in a separate document posted to the E-Forum under Project NI040, Anx 8. Where no response or remark appears, the proposal or annex remains as originally submitted. Class Basic No. Place Action New/Modified entry New class LP 1.011.18 USPTO Response to Comments See E-Forum, Project NI040, Anx 8 for comments and/or modifications in connection with LP 1.01-1.18. 2 Class Basic No. Place Action New/Modified entry New class LP 2.01 18 Add USPTO Response to Comments The IB inquired as to whether luggage tags of paper or cardboard would be classified in Class 16 or 18. BOIP indicated their preference for the material content of the tags to form part of the indication. USPTO seeks to simplify the classification of luggage tags so as to classify all luggage tags in Class 18 regardless of material content. Per the Class 18 Explanatory Note, Class 18 includes “mainly … travel goods not included in other classes.” Luggage tags Does the IB view luggage tags as analogous to labels? MGS includes labels of plastic in Class 16 and luggage tags of plastic in Class 18. Wouldn’t OHIM’s proposals to delete “goods made from these materials …” from the Class 16 and 18 headings preclude classification of the goods based on material content? 3 Class Basic No. Place Action New/Modified entry Class 18 includes mainly leather, leather imitations, travel goods not included in other classes and saddlery. This Class includes, in particular: 18 Explanatory Note Change – luggage tags. This Class does not include, in particular: – clothing, footwear, headgear (consult the Alphabetical List of Goods). New class LP 2.02 USPTO Response to Comments BOIP and JPO responded that this proposal could be redundant of LP 2.01. USPTO included this proposal to make clear that all luggage tags are in Class 18 regardless of content. See comments above. 4 Class Basic No. Place Action New/Modified entry New class LP 3.01 28 Add Mouth guards [sporting articles] USPTO Response to Comments The IB inquired as to whether there are other types of teeth protectors or mouth guards than those used for sporting or dental purposes. Research indicates that mouth guards (also called “protectors”) are mainly used for athletic or dental purposes. BOIP, the IB, and the Swiss Institute indicated that they would classify the goods in Class 9. USPTO submits that these goods should be appropriately divided between Class 10 and Class 28 according to their respective purposes as dental apparatus or sporting articles. See comments to LP 3.03 and 3.04 below. 28 Add Head guards [sporting articles] 3.02 5 Class Basic No. Place Action New/Modified entry New class LP 3.03 9 090414 Change Teeth protectors for protection against accidents USPTO Response to Comments BOIP and the Swiss Institute remarked that the current proposal is not necessary. USPTO proposed to change “Teeth protectors” (Basic No. 090414) to “Teeth protectors for protection against accidents” to distinguish teeth protectors in Class 9 from those used for sporting purposes or for dental use. For example, see http://www.walgreens.com/store/c/thedoctor's-advanced-comfortnightguard/ID=prod3908900-product (“Dental protector for nighttime teeth grinding (bruxism).”). As worded, the current indication “Teeth protectors” is broad enough to encompass, for example, dental apparatus appropriate to Class 10. The IB inquired whether “teeth protectors/mouth guards for use against teeth grinding (or for dental purposes)” should be added in Class 10. Accordingly, USPTO is requesting the addition of “Teeth protectors for dental purposes,” in Class 10 as LP 3.04 which further demonstrates the need for clarification of Basic No. 090414. See comments in LP 3.01 and 3.04. 6 Class Basic No. Place Action New/Modified entry New class LP 3.04 36 2 2 360011 020090 020092 Add Teeth protectors for dental purposes Change Financial calculation and payment of taxes, duties and excise by customs brokers Change Change See comments to LP 3.01 and 3.03 above. Alternatively, USPTO proposes “Mouth guards for dental purposes” in Class 10. “Guards” or “protectors” are used interchangeably in the industry. See, e.g., http://www.webmd.com/oralhealth/guide/mouth-guards. 10 4 5.01 Pursuant to comments by the IB and BOIP, USPTO modifies its original proposal from” Metals in powder form for painting, decorating, printing, and art*” to “Metals in powder form for painting, decorating, printing, and artists’ use,” in Class 2. This modification addresses the Swiss Institute’s concerns that “art” is broader than the original term “artists” and the IB’s comments regarding appropriate use of the asterisk in the Alphabetical List. 5.02 Pursuant to comments by the IB and BOIP, USPTO modifies its original proposal from “Metal foil for painting, decorating, printing, and art*” to “Metal foil for painting, decorating, printing, and artists’ use,” in Class 2. Metals in powder form for painting, decorating, printing, and artists’ use Metal foil for painting, decorating, printing, and artists’ use USPTO Response to Comments 7 Class 2 Basic No. Place Class Heading Action New/Modified entry Change Paints, varnishes, lacquers; preservatives against rust and against deterioration of wood; colorants; mordants; raw natural resins; metals in foil and powder form for painting, decorating, printing, and artists’ use Class 6 includes mainly unwrought and partly wrought common metals as well as simple products made of them. New class LP 5.03 Pursuant to comments by the IB and BOIP, USPTO modifies its original proposal to suggest replacing the wording “metals in foil and powder form for painters, decorators, printers and artists” in the Class 2 Heading with “metals in foil and powder form for painting, decorating, printing, and artists’ use.” 5.04 Pursuant to comments by the IB and BOIP, USPTO modifies its original proposal to suggest replacing the wording “metals in foil and powder form for painters, decorators, printers and artists (Cl. 2)” in the Class 6 Explanatory Note with “metals in foil and powder form for painting, decorating, printing, and artists’ use (Cl. 2).” 5.05 Pursuant to suggestions from JPO, USPTO modifies its original proposal from “Metals in foil or powder form for 3D printing” to “Metals in foil or powder form for 3D printers” for clarity. 6.01 Pursuant to the comments from the Swiss Institute, the USPTO withdraws this proposal. This Class does not include, in particular: 6 6 Explanatory Note Change Add USPTO Response to Comments – bauxite (Cl. 1); – mercury, antimony, alkaline and alkaline-earth metals (Cl. 1); – metals in foil and powder form for painting, decorating, printing, and artists’ use (Cl. 2). Metals in foil or powder form for 3D printers 8 Class Basic No. Place Action New/Modified entry 37 Laying of cable 39 Rental of tractors 45 Personal wardrobe styling services New class LP 6.02 7 9 Pursuant to comments received from the Swiss Institute, the USPTO modifies this proposal to Silicon carbine [raw material]. 10 Pursuant to comments received from the IB, JPO, and the Swiss Institute, USPTO modifies the classification of the original proposal to Class 8. Emery boards 8 Add Joysticks for use with computers [not for computer games] 11.01 9 12 Add Vehicle joysticks 11.02 28 Add Joysticks for games 11.03 11.04 7 Add Joysticks, being parts of machines, for controlling machines, motors or engines [not for game machines] 12 41 Add Organization of in-person educational forums Pursuant to comments from BOIP, USPTO modifies the classification of the original proposal to Class 39. 8 Silicon carbide [raw material] 1 USPTO Response to Comments Pursuant to comments from BOIP, USPTO modifies its original proposal from “Joysticks for controlling machines, motors or engines [not for game machines]” to “Joysticks, being parts of machines, for controlling machines, motors or engines [not for game machines].” Pursuant to comments from the IB and BOIP, USPTO modifies its original proposal from “Providing in-person educational forums” to “Organization of in-person educational forums.” 9 Class Basic No. 16 160361 Place Action Change New/Modified entry Document holders for stationery purposes New class LP 13 14.01 35 Add Providing ratings and reviews of restaurants for commercial purposes USPTO Response to Comments Opinions on the proper classification of these services (i.e., LP 14.01 and 14.02) are mixed. The IB has indicated that these services should be classified as information services in Class 43, pursuant to item (c) of the General Remarks (which states that “[s]ervices that provide advice, information or consultation are in principle classified in the same classes as the services that correspond to the subject matter of the advice, information or consultation…”), unless, according to the IB, these services imply rate comparison information, in which case the proper class would be Class 35 by analogy to Basic No. 350091 for “price comparison services” in Class 35. BOIP has indicated that it is not sure whether classification of these services should be split into different classes, based on commercial purposes and other purposes, and has also indicated that these services could be classified in Class 42 as a type of quality appreciation/quality control services. JPO has stated that these services should be classified in Class 43, pursuant to the TM5 ID list entry for “Providing reviews of restaurants and bars” in Class 43. However, the USPTO respectfully advises JPO that 10 Class Basic No. Place Action New/Modified entry New class LP USPTO Response to Comments “Providing reviews of restaurants and bars” in Class 43 was removed from the TM5 ID list on November 19, 2014. As indicated in the USPTO’s original explanation of these proposals, “Providing ratings and reviews of restaurants for commercial purposes” refers to ratings provided by companies such as http://www.zagat.com/ and http://www.angieslist.com/, said ratings being in the nature of commercial information provided to consumers about the goods or services of others for a business purpose. (Such services may or may not include price comparison information.) *Comment continued below in 14.02.* 14.02 41 Add Providing ratings and reviews of restaurants for entertainment or educational purposes Providing ratings and reviews of restaurants for entertainment or educational purposes” refers to ratings and reviews provided on websites such as http://www.yelp.com/, said ratings and reviews being in the nature of information provided to the public for entertainment or educational purposes concerning the goods or services of others. In response to the IB and JPO’s comments, the USPTO respectfully inquires as to the proper classification of services such as the following, if the provision of reviews (and ratings) is 11 Class Basic No. Place Action New/Modified entry New class LP USPTO Response to Comments treated as provision of information services, regardless of particular purpose: “Providing reviews of wine.” “Providing reviews of sports cars.” The USPTO believes that, if treated as information services, providing reviews of certain goods, such as the foregoing goods, could encompass services that are classified in more than international class. For example, providing reviews of wine could include Class 35 pricing information, Class 36 financial evaluation information, Class 43 food and beverage preparation information, Class 42 quality control information, etc. Reviews of sports cars could include Class 35 pricing information, Class 36 financial evaluation information, Class 37 repair and maintenance information, Class 39 transportation information, Class 45 safety information, etc. 9 090121 Transfer 11 15.01 12 Class Basic No. Place Action New/Modified entry This Class does not include, in particular: Explanatory Note 11 New class LP 15.02 – steam producing apparatus (parts of machines) (Cl. 7); Change This Class includes, in particular: – electrically heated clothing 29 Add 29 Add Candied nuts 16.01 Sugared nuts 16.02 45 450202 Delete 17.01 45 450196 Change Baggage screening for security purposes 17.02 42 Add Motor vehicle inspections 17.03 42 Add Mechanical inspections 17.04 42 Add Building inspections 17.05 35 Add Appointment scheduling services [office functions] 18.01 Add Appointment reminding [confirming] services [office functions] 18.02 35 USPTO Response to Comments Pursuant to comments from BOIP, USPTO modifies its original proposal that the wording “This Class does not include, in particular: - electrically heated clothing (Cl. 9)” be deleted from the Class 11 Explanatory Note to, in addition, add the following language to the Class 11 Explanatory Note: “This Class includes, in particular: electrically heated clothing.” 13 Class Basic No. 35 Action Add 39 28 Place Add 280108 New/Modified entry New class LP 19 Pursuant to comments from JPO, USPTO modifies its original proposal from “Administration of incentive reward programs [for commercial or advertising purposes]” OR “Administration of consumer loyalty programs [for promotional purposes]” to “Administration of consumer loyalty programs [for advertising or promotional purposes].” 20 Pursuant to comments from BOIP, USPTO modifies its original proposal from “Collecting of recyclable items for others” to “Collecting of recyclable goods for others [transportation].” Administration of consumer loyalty programs [for advertising or promotional purposes] Collecting of recyclable goods for others [transportation] Transfer 8 USPTO Response to Comments 21.01 7 Add Power-operated ski edge sharpening tools 21.02 8 Add Hand-operated ski edge sharpening tools 21.03 21 Add Ski wax brushes 21.04 14 Class Basic No. Place Action New/Modified entry 9 Add Smartglasses 9 Add Smartwatches New class LP USPTO Response to Comments 21.05 BOIP agreed with this proposal, but did not indicate its rationale for classifying the dart point sharpeners in Class 28 (and distinguishing between the dart point sharpeners and the umpire brushes and chess timers). JPO did not support this proposal. The Swiss Institute indicated that the proposal was overbroad and included goods in Classes 7 and 8 (depending on whether they are power-operated or hand-operated). Considering the comments on this proposal and the related proposals, LP 21.06 and 21.07, USPTO withdraws Annex 3 and this proposal. 21.06 BOIP, JPO, and the Swiss Institute classify these goods in Class 21 based on their function as “Brushes” (Basic No. 210014). As noted above, USPTO withdraws this proposal. 21.07 BOIP and the Swiss Institute classify these goods in Class 9. JPO classifies these goods in Class 14. As noted above, USPTO withdraws this proposal. 22.01 22.02 See Annex 5 15 Class Basic No. Place Action New/Modified entry New class LP 23 12 Add Driverless cars [autonomous cars] USPTO Response to Comments BOIP suggests the wording “Automatically guided cars.” USPTO disagrees with BOIP’s suggested alternative because, based on an internet search, the term does not appear to be generic or commonly used in the automobile industry. See Annex 5 24.01 See Annex 6 24.02 See Annex 6 24.03 See Annex 6 24.04 See Annex 6 24.05 See Annex 6 42 Add Technical writing services 45 Add Personal letter writing services 41 Delete 41 Add Song writing services 41 Add Screenplay writing services 29 Add Milk substitutes 25.01 Change Almond-based beverage 25.02 Change Almond milk for culinary purposes 25.03 32 29 320032 290188 25.04 29 32 320046 Add Almond milk [milk substitute] Change Peanut-based beverage 25.05 The Swiss Institute notes that this proposal is covered by LP 25.01. However, USPTO maintains the proposal to make clear the classification of the goods. 16 Class 29 Basic No. Place Action Add New/Modified entry New class LP USPTO Response to Comments 25.06 The Swiss Institute notes that this proposal is covered by LP 25.01. However, USPTO maintains the proposal to make clear the classification of the goods. 25.07 The Swiss Institute notes that this proposal is covered by LP 25.01. However, USPTO maintains the proposal to make clear the classification of the goods. Peanut milk [milk substitute] 29 Add Coconut milk [milk substitute] 29 Add Coconut milk for culinary purposes 25.08 32 Add Coconut-based beverage 25.09 BOIP and JPO objected to the proposed transfer. The Swiss Institute did not object. Considering the comments, USPTO withdraws the proposal. BOIP and JPO objected to the proposed transfer. The Swiss Institute did not object. Considering the comments, USPTO withdraws the proposal. 17 Class Basic No. Place Action New/Modified entry New class LP 26 20 Add Birdhouses USPTO Response to Comments BOIP indicated that this proposal is covered by the existing indication “Nesting boxes,” nichoirs, (Basic No. 200109). The Swiss and JPO supported this proposal. The Swiss indicated that the French version of the new indication should be nichoirs pour oiseaux. USPTO acknowledges that the Alphabetical List already includes “Birdcages” (Basic No. 210059) in Class 21. The co-existence of “Nesting boxes” in Class 20 and “Birdcages” in Class 21 creates confusion as to the proper classification of birdhouses. This proposal is intended to resolve the confusion and promote consistent classification of birdhouses among national offices. 18 Class Basic No. Place Action New/Modified entry New class LP 27.01 14 Add USPTO Response to Comments USPTO amends this proposal to correspond with the IB’s proposals to amend Basic Nos. 060221 and 200294. This proposal was originally made as a modification to Basic No. 140162 in LP 27.02, but the IB noted that it represented a change of concept from that basic number. Split rings are rings having two helical turns used to hold keys and are appropriate to Class 14 based on the material content of the goods. Split rings of precious metal for keys JPO indicated that they would support “Rings of precious metal for keys” as an addition but suggested the proposed amendment to LP 27.02 rendered the classification of “key rings [trinkets or fobs]” unclear. See Comments to LP 27.02. 27.02 18 140162 Transfer and Change Key rings / Key chains USPTO initially proposed changing “Key rings [trinkets or fobs]” to “Rings of precious metal for keys” in Class 14 (LP 27.02) and adding “Key rings / Key chains” to Class 18 (LP 27.01). See comments to LP 27.01. USPTO now proposes changing “Key rings [trinkets or fobs]” to “Key rings / Key chains” and transferring the goods to Class 18. Classification in a single class would simplify classification for the relevant manufacturers. BOIP and the Swiss Institute indicated that key rings and chains are classified 19 Class Basic No. Place Action New/Modified entry New class LP USPTO Response to Comments by material content. The Swiss Institute and BOIP suggested that Basic No. 140162 be amended to the following, respectively: “key trinkets and fobs” and “Rings and chains of precious metal for keys.” The bracketed wording creates ambiguity as to the precise nature of the goods. Are the goods key rings sold together with trinkets or fobs or are they merely fobs or trinkets for use on key rings? The Class 26 Explanatory Note was amended at the last Committee of Experts meeting to include “charms, other than for jewellery” in Class 26 as a transfer. Thus, key fobs and trinkets in the nature of charms for key chains would be appropriate to Class 26 as a transfer. Keychain fobs may also be in the nature of “a small electronic device that fits in a pocket and locks or opens a lock on a door, especially a car door.” http://www.macmillandictionary.com/di ctionary/american/fob_2; see, e.g., http://www.gatehousesupplies.com/Pro ductDetails.asp?ProductCode=1346LN SSN&click=2&gclid=CNqr8_rHtcMCFe Xm7AodGwUAfA, http://www.plumbersurplus.com/Prod/K wikset-926-KEVO-FOB-Kevo-KeyFOBAccessory/312076/Cat/1568?gclid=CK _K0ZXItcMCFY82gQod3xQAvw. Key 20 Class Basic No. Place Action New/Modified entry New class LP USPTO Response to Comments fobs in the nature of remote controls are not appropriate to Class 14. Annex 1 - Transfer Only of Table Cutlery [knives, forks and spoons] also known as Tableware [knives, forks and spoons] from Class 8 to Class 21 Based on discussions held during the 24th session of the Committee of Experts in Geneva from April 28 to May 2, 2014, on Project CE 242, Annex 3, the USPTO submits proposed changes to the Class 8 and Class 21 Headings and Explanatory Notes, Class 14 Explanatory Note and related additions, modifications, transfers and deletions of indications involving only the transfer of table cutlery [knives, forks and spoons], also known as tableware [knives, forks and spoons], from Class 8 to Class 21. Annex 2 – Resubmission of proposal to transfer “socks, electrically heated” based on prior study These proposals seek to provide a solution that resolves the outstanding issue of the proper classification of electrically heated clothing; specifically, by classifying all electrically heated clothing, whether or not for life-saving purposes, in Class 11, pursuant to the Class 11 Class Heading, “Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes.” ALPHABETICAL LIST ENTRIES AT ISSUE: Current Alphabetical List Entry Socks, electrically heated Footmuffs, electrically heated Footmuffs, not electrically Current Alphabetical List Classification Class 9 Class 11 Class 25 21 heated Electrically-heated socks are clothing socks that are worn for the purpose of relieving cold feet by electrically providing a continuous direct heat source that warms the feet. Footmuffs, not electrically heated, are muffs used to keep the feet warm. (See: http://www.collinsdictionary.com/dictionary/english/footmuff) Footmuffs, electrically heated are muffs for the feet that are used for relieving cold feet by electrically providing a continuous direct heat source that warms the feet. Because “footmuffs, not electrically heated” and “footmuffs, electrically heated” are muffs that envelope both feet in a pouch, footmuffs cannot be worn with shoes or while walking/participating in activities that require walking. It is also noted that, in the UK and other European countries, the term “footmuffs” is often construed as referring to the following particular goods for infants: 22 footmuff (plural footmuffs) 1. (UK) A cover for a baby's feet or legs which attaches through the harness of a pushchair, stroller, or travel system. http://en.wiktionary.org/wiki/footmuff The current Alphabetical List classification inconsistencies can be rectified by classifying all electrically-heated clothing, whether or not for life-saving purposes, in Class 11, pursuant to the Class 11 Class Heading, which includes “Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes.” However, it is noted that the 10th Edition Class Heading for International Class 11 includes “Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes,” with the following exception: “Electrically heated clothing (Cl. 9).” Accordingly, this solution requires (1) that the Class 11 Class Heading be amended to delete the wording “This Class does not include, in particular: - electrically heated clothing (Cl. 9)” and (2) that “socks, electrically heated” be transferred to Class 11. It should be noted that, while this solution does not take into account the practice of classifying goods that have a particular life-saving purpose in Class 9, the USPTO’s research does not evidence the common existence of any electrically heated clothing that serves a Class 9 life-saving purpose. The most commonly-found item of protective clothing that prevents or protects the wearer from a life-threatening condition (such as hypothermia) that is related to exposure to cold temperatures is the “immersion suit,” which is designed to prevent or protect the wearer from exposure to cold water temperatures. Immersion suits are not electrically heated because they are designed for use in water: 23 http://www.landfallnavigation.com/immersionsuits.html Further, it is noted that “Electrically heated carpets” appear in the Nice Alphabetical List (Basic No. 110310) in Class 11, and “Blankets, electric, not for medical purposes” appear in the Nice Alphabetical List (Basic No. 110305) in Class 11. The classification of both electrically heated carpets and electrically heated blankets in Class 11 supports the principle that goods that have a heating or warming purpose are properly classified in International Class 11, and this principle upholds the proposed USPTO solution of classifying clothing that is electrically heated in Class 11. Annex 4 This group of proposals establishes a framework for classifying milk substitutes. The U.S. proposes classifying any food/beverage-type goods described as “milks” in Class 29 as milk substitutes. Additionally, all milk substitutes should be classified in Class 29 notwithstanding the ultimate purpose of the goods. This proposal is consistent with the existing Nice Alphabetical List indications “Milk,” “Soya milk [milk substitute],” and “Condensed milk” in Class 29 (Basic Nos. 290039, 290163, and 290180, respectively). Beverages that are not intended for use as milk substitutes should not be described as “milks.” Instead, those goods should be characterized based on their primary components, e.g., Almondbased beverages and Peanut-based beverages in Class 32. (This principle does not apply to cosmetic or pharmaceutical-type “milks,” e.g., “Almond milk for cosmetic purpose” (Basic No. 030169), “Milk of almonds for pharmaceutical purposes” (Basic No. 050300). This principle is limited to food/beverage-type goods characterized as “milks.”) Milk is defined as “a white liquid that comes from cows, goats, and sheep, which people drink and use in cooking,” or “a white liquid that some plants such as the coconut produce.”i Milk may be consumed as a beverage from a cup or glass, as a component of a meal, such as breakfast cereal and milk, or it may be consumed as an ingredient in a prepared entrée, such as potato soup.ii See illustrations below. 24 Soya milk is defined as “a white liquid from soy beans, used as a drink and in cooking”iii and “[t]he liquid obtained by suspending soybean flour in water, used as a fat-free substitute for milk”.iv NCL 10-2014 includes “Soya milk [milk substitute]” in Class 29. This milk substitute may also be consumed as a beverage from a cup or glass, as a component of a meal, such as breakfast cereal and soy milk, or it may be consumed as an ingredient in a prepared entrée, such as creamy tomato soup.v See illustrations below. While “Milk” and “Soya milk [milk substitute]” are classified in Class 29, “Milk of almonds [beverage]” and “Peanut milk [non-alcoholic beverage]” are classified in Class 32 (Basic Nos. 320032 and 320046, respectively). Additionally, effective January 1, 2015, “Rice milk [milk substitute],” “Milk of almonds for culinary purposes,” and “Peanut milk for culinary purposes,” will be added to the Alphabetical List in Class 29. The existing indications cause confusion, and the addition of the new indications will cause further confusion, because soya milk, almond milk, peanut milk, and rice milk all function as milk substitutes. Yet, two of the milk substitutes are classified in Class 29, and two of the milk substitutes are classified in Class 32. Soya milk, almond milk, peanut milk, rice milk, and others (such as coconut milk, oat milk, and hemp milk) are packaged and marketed in the same manner, travel in the same channels of trade, and would be encountered by the same consumers. See illustrations of packaged milk substitutes below. 25 There are no qualitative differences between “Milk of almonds for culinary purposes” in Class 29 and “Milk of almonds [beverage]” in Class 32. (Unlike “Condensed milk” in Class 29, which is a sweet, thick version of cow’s milk typically used as an ingredient in cooking desserts,vi “Milk of almonds for culinary purposes” is not a concentrated version of almond milk.). In other words, the almond milk that consumers purchase at the supermarket for use as a beverage is the same almond milk that consumers purchase as the supermarket for use in baking muffins, cake, and cookies, for example. vii Therefore, milk of almonds and/or almond milks should be classified in Class 29 as milk substitutes. The same principles apply to the other various types of milks, including soya milks, peanut milks, rice milks, etc. USPTO proposes the following changes to the NCL10-2014 (and pending additions) and new additions to make clear that any food/beverage-type goods described as “milks” are classified in Class 29 as milk substitutes, and all milk substitutes are classified in Class 29 notwithstanding the ultimate purpose of the goods, and. USPTO also proposes changing the wording “Milk of almonds” to “Almond milk” consistent with the existing indication for “Soya milk [milk substitute],” and others. 029 Add Milk substitutes See Annex 4 032 320032 Change Milk of almonds [beverage] Almond-based beverage See Annex 4 029 290188 Change Milk of almonds for culinary purposes Almond milk for culinary purposes See Annex 4 Almond milk [milk substitute] See Annex 4 Peanut-based beverage See Annex 4 029 032 Add 320046 Change Peanut milk [non-alcoholic beverage] 26 029 Add Peanut milk [milk substitute] See Annex 4 029 Add Coconut milk [milk substitute] See Annex 4 029 Add Coconut milk for culinary purposes See Annex 4 032 Add Coconut-based beverage See Annex 4 Annex 5 JPO, BOIP, and the Swiss Institute described different approaches to classifying smartwatches. Specifically, JPO supported the USPTO’s proposal to classify smartwatches as wearable computers in Class 9. BOIP suggested that the term smartwatches is overbroad, and indicated that these goods may be classified in either Class 9 or Class 14 depending on the primary function of the goods. The Swiss Institute classifies smartwatches in Class 14. The diverse classification practices among national trademark offices highlight the need to amend the Alphabetical List to provide definitive guidance. The IB asked whether any goods having computer functionality or internet connectivity would be classified in Class 9. Under the current guidance, the answer is no, and USPTO proposed both “Smartwatches” in Class 9 and “Driverless cars [autonomous cars]” in Class 12 to illustrate precisely this point. Although the Nice Classification requires classification of computers in Class 9, see Basic No. 090372, goods having automatic or computerized features must be classified according to their primary function consistent with the General Remarks even if their primary function is initiated, guided, or driven by a computer. Smartwatches are wearable computers (capable of indicating the time of day) and should be classified in Class 9. “Driverless cars [autonomous cars],” on the other hand, function as apparatus for locomotion by land, and those goods are classified in Class 12 based on their primary function even though their function is initiated and guided by a computer. Smartwatches are not merely “chronometric instruments” (Basic No. 140030) for measuring time in Class 14. Smartwatches do not travel in the same channels of trade as clocks and watches and other chronometric instruments, and they are not commonly sold by jewelers or watchmakers. Smartwatches are wearable computers sold by retailers offering computers, smartphones, smartglasses, and other technology. See, e.g., http://www.apple.com/watch/overview/ (the Apple® smartwatch is not yet available, but an overview appears on the Apple® website), http://www.bestbuy.com/site/smart-watches-accessories/smart-watches/pcmcat321000050004.c?id=pcmcat321000050004. Moreover, smartwatches function in connection with smartphones or other wireless devices and, in most cases, maintain a connection with and receive data from those devices. http://www.consumerreports.org/cro/2014/02/smart-watch-review-is-this-a-must-have-gadget/index.htm. Desktop computers, tablet computers, and smartphones measure and indicate the time of day, but consumers do not consider those goods to be chronometric instruments in Class 14 because the clock or time-telling feature of the computer or smartphone is ancillary to the primary function of the goods. Similarly, smartwatches primarily function as wearable computers, the clock or time-telling featuring of the computer is ancillary, and the smartwatches should be classified in Class 9. 27 Annex 6 USPTO proposes a framework for classification of writing services based on the nature of the writing activity. The Alphabetical List currently includes “writing of publicity texts” (Basic No. 350099) and “writing of text, other than publicity texts” (Basic No. 410184). The current classification guidance appears to limit the classification of writing services to Classes 35 and 41. In other words, a broad interpretation of the existing Alphabetical List entries requires classification of any writing service in either Class 35 or Class 41. However, OHIM’s TM Class, the USPTO ID Manual, and the MGS Manager include “Personal letter writing services” (or similar wording) in Class 45. Additionally, TM Class and the USPTO ID Manual include “Technical writing for others” (or similar wording) in Class 42. The widespread practice of classifying certain writing services in classes other than Class 35 and Class 41 indicate that the national offices are narrowly interpreting the wording “writing of text, other than publicity texts” in Class 41. USPTO’s proposals to delete “writing of text, other than publicity texts” from Class 41 and add “Song writing services” and “Screenplay writing services” in Class 41 are intended to replace vague wording with more specific wording. Additionally, USPTO’s proposals to add “Technical writing services” in Class 42 and “Personal letter writing services” in Class 45 are intended to memorialize common classification practice and promote uniform classification practices among national offices. Although BOIP and the Swiss Institute indicated a preference to maintain the current classification scheme, which requires classification of writing services in either Class 35 or Class 41, the USPTO is maintaining its proposals to provide a clear framework for classification of writing services. USPTO looks forward to the discussion at the upcoming Committee of Experts meeting. i http://www.macmillandictionary.com/dictionary/american/milk http://allrecipes.com/recipe/old-fashioned-potato-soup/ iii http://www.macmillandictionary.com/dictionary/american/soy-milk iv http://www.oxforddictionaries.com/us/definition/american_english/soy-milk v http://silk.com/recipes/creamy-tomato-soup vi Condensed milk is cow’s milk from which the water has been removed (resulting in a thick consistency) and to which sugar has been added. https://www.ahdictionary.com/word/search.html?q=condensed%20milk. Condensed milk is typically used as an ingredient in cooking desserts. http://www.eaglebrand.com/products/sweetened-condensed-milk vii http://www.yummly.com/recipes/baking-almond-milk ii