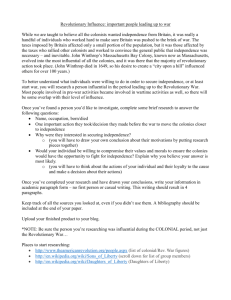

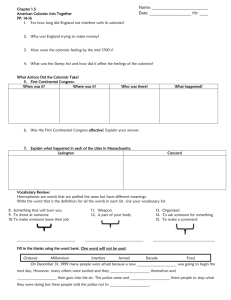

Who pays for Protecting the Colonies

advertisement

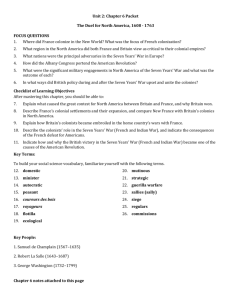

Who pays for Protecting the Colonies The struggle between France and Britain continued for seven years, from 1756 to 1763. Finally France was defeated. Britain became the master of North America and of India, where France had had colonies. The British Navy controlled the seas. The British colonists in America were happy with the results of the war. Now they no longer had to worry about French and Indian attacks. But the war had been costly, and the British treasury was empty. British leaders thought the colonists should pay their “fair” share for their own defense. Parliament, the British lawmaking body, had passed tax laws in the past. For instance it set duties (taxes) on goods brought into the American colonies. However, little money had been collected from such taxes, which could be evaded by smuggling (secretly bringing goods into the colonies). The British had not tried very hard to collect taxes or to end smuggling. Now all this was to be changed. Britain needed money, and the colonies would have to pay. There were new taxes, and they would be collected. In our story about an imaginary dinner party, several individuals from different sections of the colonies and Frenchman talk about Great Britain and the new taxes. Ask yourself what a country should expect of its colonies. What should a colony expect of the country controlling it? Williamsburg, Virginia, 1765 The scene is a wealthy planter’s house. The planter, his wife, and their guests have just finished dinner. Roger LaTourette: What a marvelous dinner! And how kind you were, Mr. Sampson, to ask me to your house. Even though I fought on the French side in the French and Indian War, you treat me as a friend. 1 Rebecca Sampson: The war is over. We are all friends in this house. Besides, you are going to stay in the colonies. Soon you will be an American just like the rest of us. LaTourette: Yes, I will stay in America. People here live so much better than they do in Europe. I don’t see the great differences between the rich and the poor that I see there. The poor are not so poor and the rich are not so rich. Though you are certainly rich enough! James Sampson: We are well off, but we have our problems. It hasn’t been easy—and now those taxes! LaTourette: Everyone should pay taxes. Do you have any idea what taxes are like in France or in Great Britain? William Blaine: I don’t think you understand our position in the colonies, Mr. LaTourette. My grandparents came to Virginia to escape the harsh life in England. They worked very hard in those early days. Life in the colonies was brutal. They were lucky to survive. LaTourette: I understand that, but you are not suffering. Matthew Wilson: You still do not understand! We built these colonies in the wilderness, fought the Indians, and suffered through sickness and starvation. We’ve earned what we have. And we’re going to keep it! Rebecca Sampson: Don’t forget that we did all this on our own, cut off from our friends and relatives in Britain. We have made new lives for ourselves. John Smithson: Aren’t you forgetting something? Yes, we struggled. Yes, we are far from our families. But we cannot turn our backs on Britain. It needs money now. We should pay our fair share. LaTourette: Ah, Mr. Smithson, you are saying that the colonists should be grateful for all that Britain has done. Smithson: Right! These colonial lands belonged to the British king. He permitted the colonists to come here, to own their land, and to work at whatever they wanted. You all admit that you live far better than you would in Britain. Don’t you think that you owe your home country something for your lives here? Blaine: Owe Britain? You don’t know what you are talking about! Without our work, these colonies would be a dangerous wilderness. 2 Agricultural Products Tobacco Sea Products Forest Products Furs Minerals All others Each symbol represents £100,000 worth of visible export product. (£ is the symbol for pounds, the British unit of money.) Major Exports from the American Colonies to Great Britain in 1770 We provide the things Britain wants. I grow tobacco. Can I sell to the highest bidder? No sir! I can sell only to those places the British government says I can. James Sampson: Why should I pay taxes to Britain? I pay my colonial taxes. That’s enough! Smithson: Look, William, I’m a newspaper owner and I pay taxes. It isn’t easy, but it must be done. Besides, taxes in America are less than half of those in Britain. And why are you complaining, Mr. Wilson? Parliament lowered taxes on molasses for the rum you make up there in Massachusetts. Wilson: The difference now is not between higher and lower taxes. It is between taxes and no taxes. Before the French and Indian War, Britain left us alone. We enjoyed being neglected. We were happy to be forgotten. Let the British government forget about our taxes once again—and we’ll all be happy. 3 Smithson: The French and Indian War changed all that. Britain spent a lot of money fighting for us. Now we have to pay for the war and the 10,000 soldiers who protect us. Rebecca Sampson: Who decided how much we should be taxed? Are there any colonial representatives in Parliament? Not one! Those who seek to tax the colonies are the very people who want to use and wring us dry! Smithson: Wrong again! We colonists are represented in Parliament. Each member of Parliament represents every citizen of the British Empire. Blaine: It’s not enough, and it’s too much! LaTourette: That I do not understand. Blaine: We do not have real representation, and we pay too much in taxes. Wilson: We alone should decide whether we want to pay to support the British Empire. LaTourette: The British think the colonies should help the colonial power, the homeland. You Americans, except for Mr. Smithson, feel that the colonies exist for you alone. Blaine: No, it is not that simple. There is a middle ground. We want to be part of the British Empire. But we will not let ourselves be pushed around. We want to be treated fairly. We will trade. We will provide things that the British can use. Then, as we profit, so will the people in Britain. James Sampson: We are British subjects and proud to admit it, but we are colonists first. After that we will think of the Empire. Smithson: This is our first point of agreement. We will always be British. I just think we should pay our import taxes. Mr. Blaine, Mr. Wilson, and Mr. and Mrs. Sampson have other ideas. LaTourette: Mr. Smithson, you said that you own a newspaper. You do not object to any of the taxes that Mr. Blaine and Mr. Sampson must pay. That is very decent of you. But what do you think of the Stamp Act passed earlier this year? Smithson: Young man, you are talking now of a very nasty tax. This is something that everyone in the colonies is against. LaTourette: Yes, I have heard a lot of talk against the Stamp Act. Smithson: It would force me to print my news on special paper. I would have to get these sheets of paper from the tax office and pay for them. I can’t afford to print a newspaper or a book if I have to do it that way. LaTourette: Aha, this sounds like self-interest to me. You publish a newspaper; you pay a tax. James Sampson: Oh, he wouldn’t really pay those taxes. He’d pass them on to his readers. 4 Wilson: Even so, it would be a nuisance. And don’t forget all the little taxes on every single document written in the colonies. Rebecca Sampson: And playing cards and diplomas and wills. LaTourette: Mrs. Sampson and gentlemen, you complain and complain. Yet you know that you are going to have to pay these taxes, or are you revolutionists? James Sampson: Careful, LaTourette. There is a limit to our hospitality! Wilson: Don’t be so sure about Britain’s ability to collect these taxes. We are planning some interesting times for His Majesty’s tax collectors. The colonies will not stand for these taxes! Postscript The colonists disliked the new taxes and the stepped-up efforts of the British government to collect them. Many looked upon these actions of the British government as unnecessary meddling in colonial affairs. Another law passed by parliament that troubled the colonists was the Proclamation of 1763. It forbade American colonists to settle west of the Appalachian Mountains. By the rule, the British hoped to keep peace with the Indians. The colonists felt that good farmland was being set out of their reach. The Quartering Act of 1765 and 1766 also angered the colonists. These laws required the towns in which British troops were located to provide housing and supplies for the troops. Now that the French and the Indian tribes in the East had been defeated, the colonists wondered why Britain needed to keep troops in the colonies. 5 Homework Questions 1. How were France and Britain affected by the French and Indian War? 2. Why did Roger LaTourette choose to stay in America? 3. How were the colonists affected by the change in Britain’s colonial tax policy? 4. Why did James Sampson object to the colonial taxes passed by the British Parliament? 5. Why did the colonists object to the Stamp Act? Understanding the story A. Write T for each statement that is true, F for each statement that is false, and N for each statement that is not mentioned in the story 1. Great Britain defeated France in North America. _______ 2. France lost no territory in Europe after the French and Indian War. _______ 3. The French navy controlled the seas in 1763. _______ 4. The colonies taxed Britain heavily to pay for the war. _______ 5. LaTourette was the son of a French nobleman. _______ 6. Taxes in America were much lower than those in Britain. _____ 7. The French and Indian War cost the British a great deal of money. _______ 8. No one objected to paying the stamp tax. _______ B. Match each name in Column A with the description in Column B. Column A 1. Roger LaTourette _______ 2. Rebecca Sampson _______ 3. James Sampson _______ 4. William Blaine _______ 5. Matthew Wilson _______ 6. John Smithson _______ a. b. c. d. e. f. Column B wealthy planter tobacco grower newspaper owner visitor from France wife of a planter maker of rum 6 Activities and Inquiries 1. Study the graph on page 3. Then choose the term or phrase that best completes each statement. a. The export that had the greatest value was (1) tobacco (2) minerals (3) agriculture (farm) products b. The total value of sea products and forest products is (1) Less than that of tobacco (2) more than that of tobacco (3)the same as that of tobacco c. The British imported mostly (1) Manufactured goods (2) Raw materials (unfinished products) (3) precious jewels and metals d. The value of agricultural products was (1) almost half of the total of the other exports (2) twice the total of the other exports (3)equal to the value of the other exports e. From the graph you can find out (1)that the British liked American tobacco better than any other kind (2) that the American colonies imported more British manufactured goods in 1770 than in 1750 (3) the value of the furs and minerals exported from America to Great Britain in 1770 7