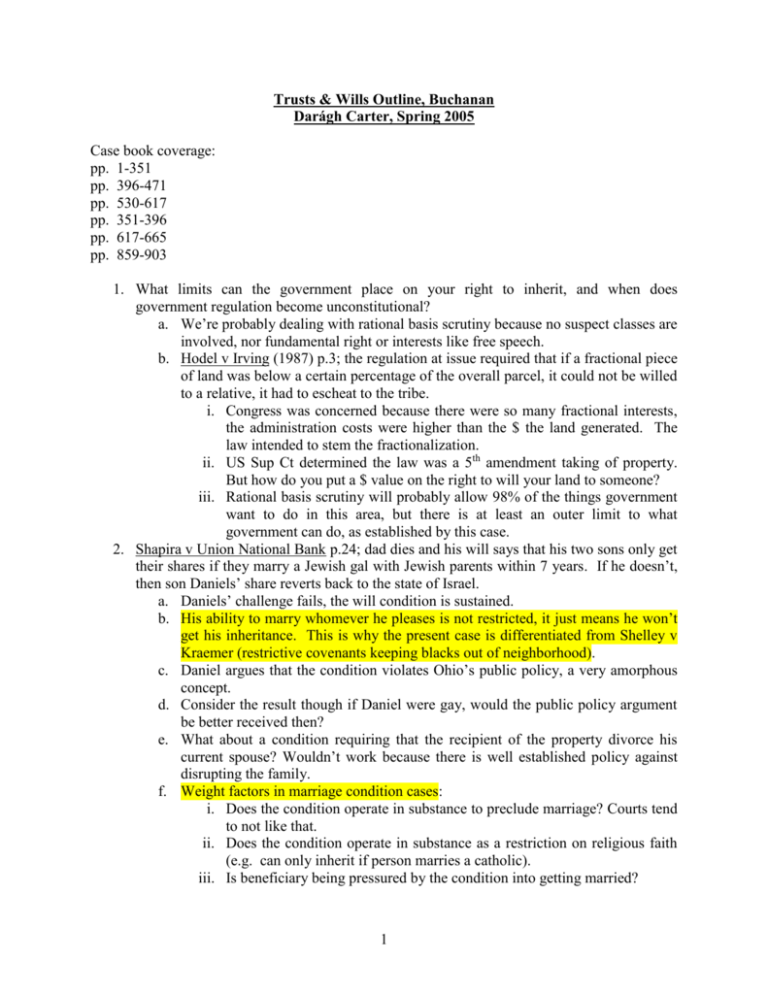

Trusts & Wills Outline, Buchanan

advertisement