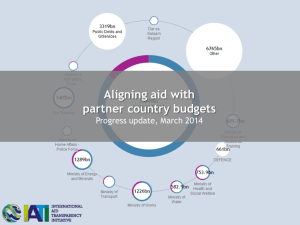

Discussion Paper for Budget Alignment

advertisement