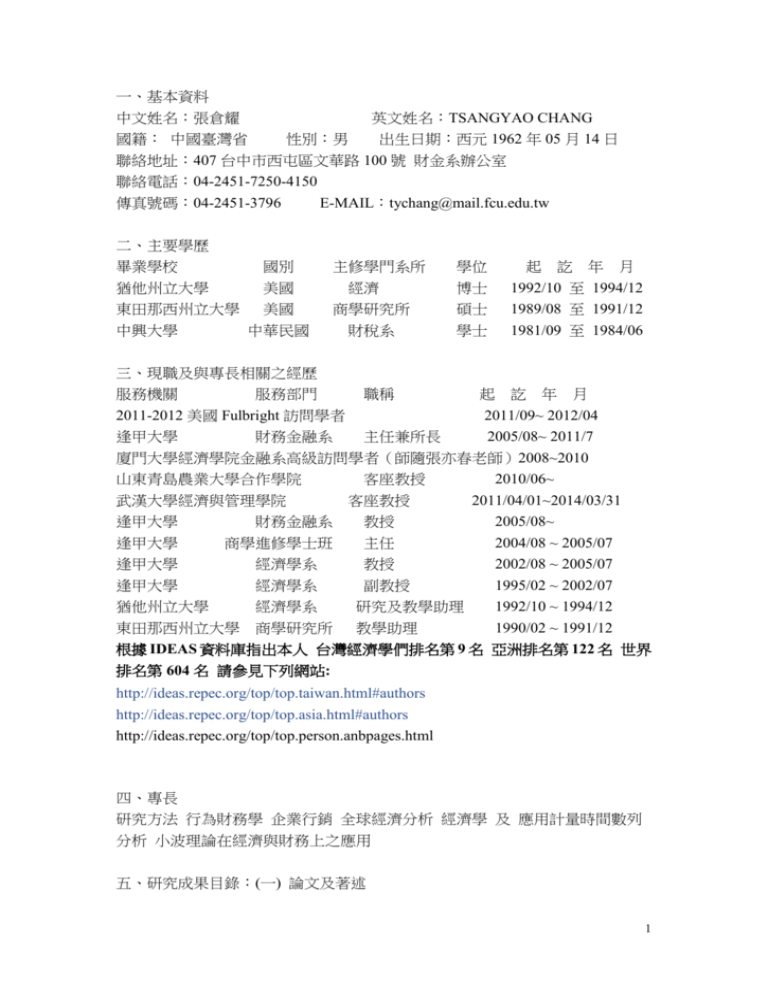

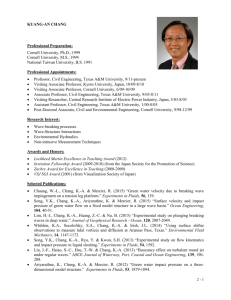

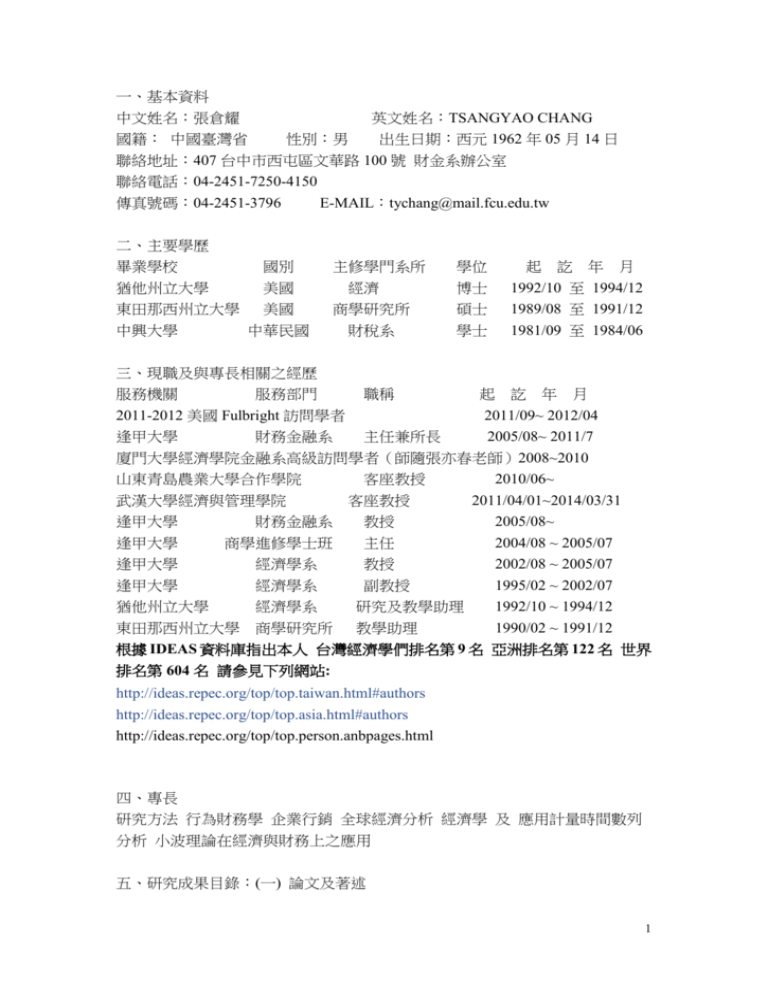

一、基本資料

中文姓名:張倉耀

英文姓名:TSANGYAO CHANG

國籍: 中國臺灣省

性別:男

出生日期:西元 1962 年 05 月 14 日

聯絡地址:407 台中市西屯區文華路 100 號 財金系辦公室

聯絡電話:04-2451-7250-4150

傳真號碼:04-2451-3796

E-MAIL:tychang@mail.fcu.edu.tw

二、主要學歷

畢業學校

猶他州立大學

東田那西州立大學

中興大學

國別

美國

美國

中華民國

主修學門系所

經濟

商學研究所

財稅系

學位

博士

碩士

起 訖 年 月

1992/10 至 1994/12

1989/08 至 1991/12

學士

1981/09 至 1984/06

三、現職及與專長相關之經歷

服務機關

服務部門

職稱

起 訖 年 月

2011-2012 美國 Fulbright 訪問學者

2011/09~ 2012/04

逢甲大學

財務金融系

主任兼所長

2005/08~ 2011/7

廈門大學經濟學院金融系高級訪問學者(師隨張亦春老師)2008~2010

山東青島農業大學合作學院

客座教授

2010/06~

武漢大學經濟與管理學院

客座教授

2011/04/01~2014/03/31

逢甲大學

財務金融系

教授

逢甲大學

商學進修學士班

主任

逢甲大學

經濟學系

教授

逢甲大學

經濟學系

副教授

猶他州立大學

經濟學系

研究及教學助理

東田那西州立大學 商學研究所

教學助理

根據 IDEAS 資料庫指出本人 台灣經濟學們排名第 9 名

排名第 604 名 請參見下列網站:

2005/08~

2004/08 ~ 2005/07

2002/08 ~ 2005/07

1995/02 ~ 2002/07

1992/10 ~ 1994/12

1990/02 ~ 1991/12

亞洲排名第 122 名 世界

http://ideas.repec.org/top/top.taiwan.html#authors

http://ideas.repec.org/top/top.asia.html#authors

http://ideas.repec.org/top/top.person.anbpages.html

四、專長

研究方法 行為財務學 企業行銷 全球經濟分析 經濟學 及 應用計量時間數列

分析 小波理論在經濟與財務上之應用

五、研究成果目錄:(一) 論文及著述

1

A. 期刊論文 (Refereed Papers)

1. Tsangyao Chang, Omid Ranjar, and Hsiao-Ping Chu (2013) Are GDP

fluctuations transitory or permanent in African countries? Sequential panel

selection method, International Review of Economics and Finance (forthcoming,

SSCI)

2. Huizhen He, Omid Ranjar, and Tsangyao Chang (2013) Revisiting Purchasing

Power parity in Transition countries: Old wine new bottle, Japan and the World

Economy (forthcoming, SSCI)

3. Bahmani-Oskooee, M., Tsangyao Chang, and Ken Hung (2013) Revisiting

Purchasing Power Parity in Latin America: Sequential Panel Selection Method,

Applied Economics, May, 45, 32, pp4548-4554. (SSCI)

4. Tsangyao Chang, Shu-Ching Cheng, Guochen Pan, Tsung-Pao Wu (2013) Does

Globalization affect Insurance Markets? Bootstrap Panel Causality Test”,

Economic Modelling, 33, July, pp254-260. (SSCI)

5. Tsangyao Chang, Hsiu-Ling Chang, and Chi-Wei Su (2013) Purchasing Power

Parity for African Countries: Further Evidence from Non-linear Panel SURKSS

Test with FlexibleFourier Function”. The Engineering Economics (forthcoming,

SSCI)

6. Tsangyao Chang, and Chi-Wei Su (2013, July). Revisiting Purchasing Power

Parity for East Asian Countries using the Rank Test for Nonlinear Cointegration”.

Applied Economics, 45, 19, 2847-2852

7. Tsangyao Chang, Hsiao-Ping Chu and Wen-Yi Chen (2013, Feb). Energy

Consumption and Economic Growth in 12 Asian countries: Panel Data Analysis.

Applied Economics Letters, 20, 3, 282-287. (SSCI).

8. Dongxiang Zhanga, Tsangyao Chang, Chia-Hao Lee and Ken Hung (2013, Jan).

Revisiting purchasing power parity for East Asian countries: sequential panel

selection metho. Applied Economics Letters, 20, 1, 62-66. (SSCI).

9. Tsangyao Chang, Omid Ranji, and D.P Tang (2013, Jan). Revisiting the mean

reversion of inflation rates for 22 OECD countries. Economic Modelling, 30, 1,

245-252. (SSCI).

10. Ming-Che Chou and Tsangyao Chang (2013) Rational Bubble in G7 countries: the

ADL test for Threshold Cointegration, The Empirical Economics Letters, March,

12, 5, pp (Econ-Lit)

11. Wen -Yi Chen, Jwo Leun Lee, Tsangyao Chang, and Yu-Hui lin (2013) Health

expenditure and economic growth nexus in 11 OECD countries: Bootstrap Panel

causality Test, The Empirical Economics Letters, April, 12, 4, pp 375-385.

(Econ-Lit)

12. Ming-Che Chou and Tsangyao Chang (2013) Revisiting Purchasing Power Parity

2

for Mainland China and Taiwan using Stationary Test with a Fourier Function: An

Empirical Note, The Empirical Economics Letters, March, 12, 3, pp 281-286.

(Econ-Lit)

13.Tsangyao Chang, Chien-Chiang Lee, and Chi-Hung Chang, (2013). Does

insurance promote economic growth? Further evidence based on bootstrap panel

Granger causality test. The European Journal of Finance, (forthcoming, SSCI).

14. Tsangyao Chang, Chien-Chiang Lee, Ken Hung, and Kuo-Hao Lee, (2013). Does

military spending real matter for G7 countries and China: The role of dependence

and heterogeneity, Defense and Peace Economics, (forthcoming, SSCI).

15.Hsiao-Ping Chu, Ming-Liang Yeh, and Tsangyao Chang, (2013) Are visitor

arrivals stationary in China? An empirical note, Asian Pacific Journal of Tourism

Research (forthcoming, SSCI),

16. Yang-Cheng Lu, Tsangyao Chang, Chi-Wei Su, and Chia-Hao Lee (2013, March).

Revisiting Purchasing Power Parity for 16 Latin American Countries: Threshold

Unit Root Test, International Journal of Finance & Economics, 18, 2, p165-174

(SSCI).

17. Tsangyao Chang, and Han-Wen Tzeng (2013, Jan). Purchasing Power Parity in

Transition Countries: Panel SURKSS test. International Journal of Finance &

Economics, 18, 1, pp74-81 (SSCI).

18. GuoChen Pan, Sen-Sung Chen and Tsangyao Chang (2012, Dec) Revisiting

Mean reversion in the stock prices of nine transition countries: Threshold Unit

Root test, 4, 565-67. Romanian Journal of Economic Forecasting (SSCI)

19. Chi-Kai Chang and Tsangyao Chang (2012, Dec). The Impact of structural change

on the calibration of interest rates models in Taiwan. Economic Computation and

Economic Cybernetics Studies and Research, 4, 1-21. (SSCI).

20. Chi-Kai Chang and Tsangyao Chang (2012, Dec) Revisiting unit root behavior in

energy futures markets with a Fourier function, International Journal of

Economics, 6, 2, 309-319. (Econ-Lit)

21. Siyue Liu, Dongxiang Zhang and Tsangyao Chang (2012, Dec) Purchasing Power

Parity- nonlinear threshold unit root test for transition countries, Applied

Economics Letters, 19, 18, 1781-1785, (SSCI).

22. Tsangyao Chang, Chia-Hao Lee and Wen-Chi Liu (2012, Dec). “Nonlinear

Adjustment to Purchasing Power Parity for ASEAN Countries. Japan and the

World Economy, 24,4, 325-331. (SSCI).

23. Chi-Kai Chang and Tsangyao Chang (2012, Nov) Mean reversion of real interest

3

rates: Further evidence based on a Unit Root test with a Fourier Function, The

Empirical Economics Letters, 11, 11, 1149-1156. (Econ-Lit)

24. Tsangyao Chang, Chia-Hao Lee, and Pei-I Chou (2012, Nov). Is Per Capita Real

GDP Stationary in Southeastern European Countries? Fourier Unit Root Test .

Empirical Economics, 43, 3, 1073-1082. (SSCI).

25. Chi-Wei Su, Hsiu-Ling, Tsangyao Chang and Chia-Hao Lee. (2012, Nov) Purchasing

Power Parity for BRICS countries: Linear and nonlinear unit root tests with stationary

covariates, Applied Economics Letters, 19, 16, 1587-1591, (SSCI)

26. Chi-Wei Su, Tsangyao Chang, and Yu-Shao Liu (2012, Sep). Revisiting

Purchasing Power Parity for African Countries: with Nonlinear Panel Unit-Root

Test. Applied Economics, 44. 25. 3263-3273. (SSCI).

27. Donxiang Zhang, Tsui-Chih Wu, Tsangyao Chang and Chia-Hao Lee, (2012,

Sep). Revisiting the Efficient Market Hypothesis for 5 African Countries: Panel

SURKSS with a Fourier Function. South African Journal of Economics, 80, 3,

287-300. (SSCI)

28. Chi-Kai Chang and Tsangyao Chang. (2012, Sept). Statistical Evidence on the

Mean Reversion of Real Interest Rates: SPSM using the Panel KSS Test with a

Fourier Function”, Applied Economics Letters, 19, 13, pp1299-1304. (SSCI,

Impact Factor = 0.241)

29. Hsiao-Ping Chu and Tsangyao Chang (2012, Aug). Nuclear Energy

Consumption, Oil Consumption and Economic Growth in G-6 Countries:

Bootstrap Panel Causality Test, Energy Policy, 48, 762-769. (SSCI)

30. Tsangyao Chang, Chia-Hao Lee, and Ken Hung (2012, Aug). Can the PPP stand

on the BRICS? The ADL test for threshold cointegration, Applied Economics

Letters, 19, 12, 1123-1127. (SSCI)

31.Tsangyao Chang, Chi-Wei Su and Chia-Hao Lee (2012, Aug) Nonlinear Adjustment to

Purchasing Power with flexible Fourier function in G7 countries, Applied Economics Letters,

19, 12, 1111-1116. (SSCI)

32.Tangyao Chang, Chia-Hao Lee, Pei-I Chou, and Shiu-Chiu Wang (2012,

July-Aug)

Purchasing Power Parity for Nine Transition Countries: Further Evidence from

Panel SURADF Test with a Fourier Function, Eastern European Economics.

Eastern European Economics, 50, 4, 42-59. (SSCI).

33. Tsangyao Chang, Chi-Wei Su and Chia-Hao Lee (2012, July) Purchasing Power Parity:

Nonlinear threshold unit root test for East Asia countries, Applied Economics Letters, 19, 10,

975-979. (SSCI)

4

34. Tsangyao Chang, Chi-Wei Su and Chia-Hao Lee (2012, June) Purchasing Power Parity

with nonlinear threshold unit root test, Applied Economics Letters, 19, 9, 839-842. (SSCI)

35. GuoChen Pan, Tsangyao Chang, Chia-Hao Lee and Wen-Chi Liu (2012, June) Revisiting

Purchasing Power Parity in 18 African countries: Sequential Panel Selection Method, Applied

Economics Letters, 19, 9, 877-881. (SSCI)

36.GuoChen Pan, Tsangyao Chang, D.P Tang and Chia-Hao Lee (2012, June) Nonlinear

adjustment to Purchasing Power Parity in Latin American countries: The ADL test for

threshold cointegration, Applied Economics Letters, 19, 9, 857-862. (SSCI).

37.Tsangyao Chang, Chia-Hao Lee, and Pei-I Chou, (2012, Jun). Perspectives on

Purchasing Power Parity for the Middle East, International Journal of Economics,

6, 1, 103-110 (Econo-Lit)

38, Tsangyao Chang (2012, June) Nonlinear adjustment to Purchasing Power Parity in China,

Applied Economics Letters, 19, 9, 843-848, (SSCI).

39. Guochen Pan, Sen-Sung Chen and Tsangyao Chang, (2012, June) Does Gibrat’s law hold in

Insurance industry of China? A Test with Sequential Panel Selection Method, Journal of

Panoeconomicus, 59, 3, 311-324.

40.Tsangyao Chang and Gengnag Chiang, (2012, Jun). Transitional Behavior of

Government Debt Ratio on Growth: The Case of OECD Countries, Romanian

Journal of Economic Forecasting,15, 2, 24-37 (SSCI, Impact factor = 0.438).

41.Yang-Cheng Ralph Lu, Tsangyao Chang, and Chia-Hao Lee (2012, May) Nonlinear

adjustment to Purchasing Power Parity in transition countries: The ADL test for threshold

cointegration, Applied Economics Letters, 19, 7, 629-633, (SSCI).

42.Syiue Liu, Tsangyao Chang, Chia-Hao Lee and Pei-I Chou (2012, May) Nonlinear

adjustment to Purchasing Power Parity: The ADL test for threshold cointegration, Applied

Economics Letters, 19, 6, 569-573. (SSCI)

43. Tsangyao Chang, Yu-Shao Liu and Chi-Wei Su (2012, Mar) Purchasing Power Parity with

nonlinear and asymmetric smooth adjustment for the Middle East countries, Applied

Economics Letters, 19,5, 487-491. (SSCI)

44. Tsangyao Chang, Hsiu-Ling Chang, Ken Hung and Chi-Wei Su (2012, Feb) Nonlinear

adjustment to Purchasing Power Parity for Germany’s real exchange rate relative to its major

trading partners, Applied Economics Letters, 19, 2, 197-202. (SSCI).

45. Tsangyao Chang, Chia-Hao Lee and Pei-I Chou (2012, Feb) Nonlinear adjustment to

Purchasing Power Parity in G7 countries, Applied Economics Letters, 19, 2, 123-128, (SSCI)

46. Chi-Kai Chang and Tsangyao Chang, 2012, Empirical Evidence of Real Interest Rate Parity

in Asian Countries: Unit Root Test by Sequential Panel Selection Method, The Empirical

Economics Letters (forthcoming, Econ-Lit)

5

47. Chi-Kai Chang and Tsangyao Chang, (2012, Feb) Revisiting the sustainability of current

account deficit: SPSM using the Panel KSS test with a Fourier function, Economic Bulletin,

32, 1, 538-550.

48. Tsangyao Chang, Chia-Hao Lee, and Guochen Pan, (2012, Jan) Purchasing power parity in

African countries: further evidence based on the ADL test for threshold cointegration,

Economic Bulletin, January, 32, 1, 2208-228.

49. Tsangyao Chang, Chia-Hao Lee, Pei-I Chou, and D. P. Tang, (2011, Dec) Revisiting

the Long-Run Purchasing Power Parity with Asymmetric Adjustments for G-7 Countries,”

Japanese and the World Economy,23, 4, pp-259-264. (SSCI, Impact Factor = 0.414)

50. Tsangyao Chang and Chia-Hao Lee, (2011, Dec) Hysteresis in Unemployment for G-7

countreis: Threshold Unit Root Test” Romanian Journal of Economic Forecasting, 14. 4,

pp-5-14 (Leading article, SSCI, Impact factor = 0.438)

51.Tsung-Hsien Chan, Tsangyao Chang, Chia-Hao Lee, and Yi-Chung Zhang,

(2011, Dec) Purchasing Power Parity in Mainland China and Taiwan: An Empirical Note

Based on Threshold Unit Root Test” Applied Economics Letters.

18, 18, pp1807-1812. (SSCI, Impact Factor = 0.241)

52.Tsangyao Chang, Yang-Cheng Lu and Kuei-Chiu Lee, Gouchen Pan, (2011, Dec)

“Revisiting Purchasing Power Parity for G-7 Countries using Nonparametric Rank

Test for Cointegration”, Applied Economics Letters. 18, 18, pp1795-1800.

(SSCI, Impact Factor = 0.241)

53.Yang-Cheng Lu, Tsangyao Chang, Kuei-Chiu Lee and Han-Wen Tzeng, (2011,

Nov) An Empirical Test of Purchasing Power Parity for Transition Countries:

Panel SURADF Test,” Applied Economics Letters. 18, 17, November,

pp1691-1696. (SSCI, Impact Factor = 0.241)

54. Tsangyao Chang and Gengnan Chiang, (2011, Nov) Regime-Switching Effects of Debt on

Real GDP per Capita: The Case of Latin American and Caribbean Countries,”

Economic Modelling, 28, 6, pp2404-2408 (SSCI, Impact factor=0.601)

55.Tsangyao Chang and Kuei-Chiu Lee , (2011, Oct) Purchasing Power Parity in East Asian

countries: Flexible Fourier Stationary Test, Asian Journal of Business and Management

Sciences 1, 5, pp38-46.

56. Yonggang Ye, Tsangyao Chang andYang-Chen Lu and Ken Hung, (2011, Oct)

“Revisiting Rational Bubbles in the G-7 Stock Markets using Fourier Unit Root Test

and Nonparametric Rank Tests for Cointegration” Mathematics and Computers

in Simulations, 82, 2,, 346-357, (SCI, Impact Factor = 0.812)

57.Yang-Cheng Lu, Tsangyao Chang, and Chin-Ping Yu. (2011, Oct) Long-rung

Purchasing Power parity with asymmetric adjustment: Evidence from Mainland

6

China and Taiwan” Romanian Journal of Economic Forecasting, 14, 3, pp59-70,

(SSCI, Impact factor = 0.438).

58. Chi-Wei Su, Tsangyao Chang and Hsiuling Chang, (2011, Oct) Purchasing Power

Parity for Latin American Countries: Fourier Stationary Test” International

Review of Economics and Finance, 20, 4, pp839-845,

(SSCI, Impact factor = 0.809)

59.Tsangyao Chang, Ding Li, Yang-Cheng Lu and Chia-Hao Lee. (2011, Sept) Purchasing

Power Parity for East –Asia Countries: Further Evidence based on Panel Stationary Test

with

Multiple Structural Breaks” Applied Economics. 43, 24, pp3289-3298,

(SSCI, Impact factor = 0.424)

60.Tsangyao Chang, (2011, Sept) Hysteresis in Unemployment for 17 OECD Countries:

Stationary Test with a Fourier Function,” Economic Modelling, 28, 5, pp2208-2214,

(SSCI, Impact factor =0.601)

61. Tsangyao Chang, Chi-Chen Chiu, and Han-Wen Tzeng, 2011, “Revisiting

Purchasing Power Parity for Nine Transition Countries Using the Rank

Test for Nonlinear Cointegration”, Romanian Journal of Economic Forecasting

14, 2, (June 30th), pp19-30. (SSCI, Impact factor = 0.438).

62.Su-Yuan Lin, Tsangyao Chang, and Horng Jinh Chang, 2011 “Purchasing power

parity for nine transition countries: Fourier Stationary Test, Post-Communist

Economies. 23. 2. June, 210-221. (SSCI, Impact Factor = 0.362)

63.Yang-Cheng Lu and Tsangyao Chang. 2011, “Long-run Purchasing Power Parity

with asymmetric adjustment: Further evidence from China” Applied Economics Letters

June, 18, 9, pp881-886 (SSCI, Impact Fatcor = 0.241)

64. Tsangyao Chang and Kuei-Chiu Lee, 2011, “Hysteresis in Unemployment for G-7

Countries: Fourier Unit Root Test,” Economic and Finance Review, 1, 2, May, pp1-12.

(ECON-LIT)

65. Tsangyao Chang and Han-Wen Tzeng, 2011,”Long-run purchasing power

parity with asymmetric adjustment: further evidence from nine transition

countries,” Economic Modelling. 28, 3, May, pp1383-1391.

(SSCI, Impact Factor = 0.601)

66. Tsangyao Chang, 2011, “Is Per Capita Real GDP Stationary? An Empirical Note for

Sixteen Transition Countries, International Journal of Business and Economics, 10,

1, April, pp81-86. (ECON-LIT)

7

67.Tsangyao Chang, Chia-Hao Lee and Pei-I Chou, 2011, “Purchasing Power

Parity in G-7 Countries: Further Evidence based on ADL Test for Threshold

Cointegration” Economics Bulletin, 31, 2, April, pp1172-1182 (ECON-LIT).

68.Yang-Cheng Lu, Tsangyao Chang, Chi-Chen Chiu and Han-Wen Tzeng, 2011,

“Revisiting Purchasing Power Parity for 16 Latin American Countries: Panel

SURADF Tests, Applied Economics Letters, 18, 3, February, pp251-255.

(SSCI, Impact Factor = 0.241)

69. Tsangyao Chang, Chia-Hao Lee, and Guochen Pan, (2011, Jan) Purchasing Power Parity

in African countries: Further Evidence based on the ADL Test for threshold Cointegration”,

Economics Bulletin, January, 32, 1, pp220-228 (Econ-Lit)

70. Tsangyao Chang, Yang-Chan Lu, D.P. Tang and Wen-Chi Liu, 2011.

“Long-RunPurchasing Power Parity with Asymmetric Adjustment: Further

evidence from African Countries” 43, 2, January, pp231-242, Applied Economics

(SSCI, Impact Factor = 0.424)

71. Feng-Li Lin and Tsnagyao Chang, 2011, “Does Debt affect firm value? A

Panel Threshold Analysis for the Taiwan Market” 43, 1, January, pp117-128,

Applied Economics (SSCI, Impact Factor = 0.424)

72.Tsangyao Chang, Yang-Cheng Lu, Wen-Chi Liu and Suchen Kang, 2011

“Revisiting Purchasing Power Parity for Major Oil-exporting Countries using

Panel SURADF Tests”, 18, 1, January, pp63-67, Applied Economics Letters

(SSCI, Impact Factor = 0.241)

73.Tsangyao Chang and Gengnan Chiang. 2010, Testing the Sustainability of

Current Account Deficits in OECD Countries: A Regime Switching Approach,

The Empirical Economics Letters, 12, 1, December, pp1207-1212 (ECON-LIT)

74.Tsangyao Chang, D.P. Tang , Wen-Chi Liu and Chia-Hao Lee, 2010,

“Purchasing Power Parity for Fifteen COMESA and SADC Countries: Evidence

based on Panel SURADF Tests” 17, 17, November, pp1721-1727, Applied

Economics Letters, (SSCI, Impact Factor = 0.241)

75.Tsangyao Chang, Wen-Chi Liu, Chin-Ping Yu nad ShuChen Kang, 2010.

“Purchasing Power Parity for ten Latin American Integration Association Countries:

Panel SURKSS Tests”, 17, 16, October, pp1576-1580, Applied Economics Letters

(SSCI, impact Factor = 0.241)

8

76.Tsangyao Chang, Yichun Zhang and Wen-Chi Liu, 2010. “Purchasing Power

Parity ASEAN-8 Countries: Panel SURKSS Tests” Applied Economics Letters 17.

14, October, pp1517-1523. (SSCI, Impact Factor = 0.241)

77.Tsangyao Chang. Wen-Chi Liu and Chin-Ping Yu, 2010. “Revisiting Purchasing

Power Parity for G-7 Countries: Further Evidence based on Panel SURKSS Tests”,

Applied Economics Letters, 17, 14, October, pp1383-1387.(SSCI, Impact Factor

= 0.241)

78. Tsangyao Chang, Yuan-Hong Ho and Steven B. Caudill, 2010. “Is Per Capita

Real GDP Stationary in China? More Powerful Nonlinear (Logistic) Unit Root

Tests” Applied Economics Letters, 17, 14, October, pp1347-1349.

(SSCI, Impact factor = 0.241)

79. Tsangyao Chang and Chia-Hao Lee. 2010. “Revisiting Purchasing Power Parity

for East-Asia Countries: Panel SURADF Tests” Applied Economics Letters, 17,

13, September, pp1329-1334 (SSCI, Impact Factor = 0.241)

80. Ling, Feng-Li and Tsangyao Chang. 2010. “Does Family Ownership affect Firm

Value in Taiwan? A Panel Threshold Regression Analysis” International Research

Journal of Finance and Economics, August, 42, pp45-53 (ECON-LIT)

81. Chien-Chiang Lee, Tsangyao Chang, Chi-Chuan Lee, and Hsin-Yi Lin, 2010.

The Non-linear Dynamic Relationship between Exchange Rates and

Macroeconomic Fundamentals in G-7 Countries, “ Journal of Economics and Management,

July, 6, 2, pp203-228 (in Chinese, ECON-LIT)

82. Tsangyao Chang, Su-Yuan Lin and Hongjih Chang, 2010, “Are Real Exchange

Rates Nonlinear with a Unit Root? Evidence on Purchasing Power Parity for China:

a note”, Economics Bulletin, July 19, 30, 3, pp1897-1905 (ECON-LIT).

83.Tsangyao Chang, Wenrong Liu and Henry Thompson, 2010, “Effectiveness in

Fiscal Stimuli” appear the Book “Curbing the Global Economic Downturn –Southeast

Asian Macroeconomic Policy” edited by Aekapol Chongvilaivan, ISEAS Publishing,

July, pp67-76. ,

84.Tsangyao Chang, Wen-Chi Liu, Han-Wen Tzeng, and Chin-Ping Yu 2010,

“Purchasing Power Parity in G-7 Countries: Panel SURADF Tests”, Applied

Economics Letters, Applied Economics Letters, July, 17, 12, p 1223-1228.(SSCI,

Impact Factor = 0.241)

85.Tsangyao Chang and Wen-Chi Liu, 2010 “Long-Run Purchasing Power Parity

with Asymmetric Adjustment: Further evidence from 9 Major Oil-Exporting

9

Countries” International Journal of Finance and Economics, 15, July, pp263-274

(SSCI in Finance, Impact Factor=0.569)

86.Yang-Cheng Lu, Tsangyao Chang, Keu Hung and Wen-Chi Liu, 2010, “Mean

Reversion in G-7 Stock Prices: Further Evidence from a Panel Stationary Test

with Multiple Structural Breaks” Mathematics and Computers in Simulation,

June, 80, 10, pp2019-2025. (SCI, Impact Factor = 0.812)

87. Tsangyao Chang, YiChung Zhang and Hanwen Tzeng, 2010, “Equity

Diversification in two Chinese Share Markets: Nonparametric Cointegration Test”,

International Journal of Economics, 4, 1, June, pp1-7 (ECON-LIT)

88.Tsangyao Chang, Hiao-Ping Chu, Hsu-Ling Chang and Chi-Wei Su, 2010, “Is per

Capita real GDP stationary in Asia countries? Evidence from a Panel Stationary test with

Structural breaks,” International Journal of Economics, 4, 1, June, pp91-98.

(ECON-LIT)

89. Tsangyao Chang and Chin-Ping Yu, 2010 “International equity diversification

between Taiwan and its major trading partners: Nonparametric

cointegration test” International Journal of Economics, 4, 1, June, pp201-211

(ECON-LIT)

90.Tsangyao Chang, Gengnan Chiang and Shuchen Kang, 2010,”Exploring an

Efficient Investment Regime: The Case of SP100,” International Review of

Financial Analysis, March, 19, 2, pp134-139 (FLI, ECON-LIT)

91. Tsangyao Chang and Han-Wen Tzeng, 2009 “International equity diversification

between the USA and its major trading partners: Nonparametric cointegration

test” International Research Journal of Finance and Economics, October, 32,

pp139-147, (ECON-LIT)

92. Tsangyao Chang, Kuei-Chiu Lee, Yao-Men Yu, and Chia-Hao Lee, 2009, “Study

on Capital Structure & Operating Performances of Credit Cooperatives in

Taiwan-Application of Panel Threshold Method” International Research Journal

of Finance and Economics, October, 32, pp-18-30 (ECON-LIT)

93.Tsangyao Chang, Chin-Wen Mo and Wen-Chi Liu, 2009 “International Equity

Diversification between Japan and Its Major Trading Partners” Applied Economics

Letters, September, 16, 14, pp1433-1437. (SSCI, Impact Factor = 0.241)

94.Tsangyao Chang and Gengnan Chiang, 2009 “Revisiting the Government

Revenue-Expenditure Nexus: Evidence from 15 OECD Countries based on the

Panel Data Approach” The Czech Journal of Finance and Economics, June, 59, 2,

pp165-172 (SSCI in Finance, Impact Factor = 0.264)

10

95.Tsangyao Chang, D-P. Tang, Chi-Tar Hsu, and Wen-Chi Liu, 2009, ‘Are African

Real Exchange Rates Stationary? An Empirical Note“ The Empirical Economics

Letters, 8, 5, May, pp423-429. (ECON-LIT)

96.Tsangyao Chang, Gengnan Chiang Yichun Zhang. 2009 “Is Volume Index of

GDP per Capita Stationary in OECD Countries? Panel Stationary Tests with

Structural Breaks” Economics Bulleitn, April 14, 29, 2, pp600-610. (ECON-LIT)

97. Tsangyao Chang. and Gengnan Chiang, 2009 “The Behavior of OECD Public

Debt: a Panel Smooth Transition Regression Approach “ The Empirical

Economics Letters, January, 8(1), pp53-59. (ECON-LIT)

98. Tsangyao Chang, Wen-Chi Liu and Chia-Hao Lee, 2008, “Rational Bubbles in

the G-7 Stock Market? Further Evidence based on Panel Cointegration Tests” The

Empirical Economics Letters, October, 7, 10, pp977-983. (ECON-LIT)

99. Tsangyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2008, “Are

Visitor Arrivals to Taiwan Stationary? An Empirical Note Based on Panel

SURADF Test” The Empirical Economics Letters, October, 7, 10, pp1001-1007.

(ECON-LIT)

100. Lin, Feng-Li and Tsangyao Chang. 2008, “Does Ownership Concentration

affect Firm Value in Taiwan? A Panel Threshold Regression Analysis” The

Empirical Economics Letters, July, 7, 7, pp673-680. ( ECON-LIT)

101. Tsangyao Chang, Chien-Chung Nieh, Mingjing Yang and Chie-Chen Chiu,

2008

“Nonlinear Short-Run Adjustments in U.S. Stock Market Returns,” Applied

Financial Economics, July, 2008, 18, 13, pp1075-1083. (ECON-LIT, FIN-LIT)

102. Lin, Feng-Li and Tsangyao Chang. 2008, “Does Managerial Ownership Reduce

Agency Cost in Taiwan? A Panel Threshold Regression” Corporate Ownership &

Control, 5, 4, Summer, 2008, pp119-127.

103. Wen-Chi Liu and Tsangyao Chang, 2008, “Rational Bubbles in the Korea

Stock Market? Further Evidence based on Nonlinear and Nonparametric

Cointegration Tests” Economics Bulletin, June 6, VOl, 3, No. 34, pp1-12.

(ECON-LIT)

11

104.Tsangyao Chang, Kuei-Chiu Lee, Shu-Chen Kang and Wen-Chi Liu, 2008, “Is

Pper Capita Real GDP Stationary in Latin American Countries? Evidence from a

Panel Stationary Test with Structural Breaks.” Economics Bulletin, May 30, Vol. 3,

No. 31. PP1-12. (ECON-LIT)

105. Tsangyao Chang and Chin-Wen Mo., 2008, “Could Intel’s Dominant Position

in the Global Semiconductor Manufacturing Industry Be at Risk?” The Empirical

Economics Letters, January, 7, 1, pp5-16. (ECON-LIT)

106. Hsiao-Ping Chu, Tsangyao Chang, Hsu-Ling Chang, Chi-Wei Su, Young Yuan, 2007.

“Mean-Reversion in the Current Account of Forty-eight African Countries:

Evidence from the Panel SURADF Test”, Physica A- Econophysics, (2005 SCI

Physics, Impact factor 1.521), October 15, 384, 2, pp485-492. (SCI)

107. Yang-Cheng Lu, Tsangyao Chang and Yu-Chen Wei, 2007. “An Empirical

Note on Testing the cointegration relationship between the real estate and stock

Markets in Taiwan” Economics Bulletin, September, 19, Vol. 3, No. 45, pp1-11.

(ECON-LIT)

108.Tsangyao Chang, Yuan-Hong Ho and Chung-Ju Juang, 2007. “Revisiting

Hysteresis in Unemployment for Ten European Countries: An Empirical Note on

a More Powerful Nonlinear (Logistic) Unit Root Test, Journal of Economic

Development, June, Vol. 32, No.1. pp49-57. (ECON-LIT).

109. Tsnaygao Chang, Ming Jing Yang, Hui-Chin Liao and Chiao-Hao Lee. 2007

“Hysteresis in Unemployment: Taiwan’s Evidence based on Panel Unit Root Tests,”

Applied Economics, 39, 10, June, pp1335-1340. (ECON-LIT, SSCI, Impact Factor =0.424)

(NSC-93-2415-H-035-001)

110. Tsangyao Chang, Chien-Chung Nieh and Chie-Chen Chiu, 2007, “Rational Bubbles

in the U.S. Stock Market? Further Evidence from a Nonparametric Cointegration

Test” Applied Economics Letters, 14, 7, June, pp517-521. (ECON-LIT,

SSCI, Impact Factor = 0.241)

111.Tsnagyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2006,

“Is Per Capita Real GDP Stationary in African Countries? Evidence from Panel

SURADF Test”, Applied Economics Letters, December 15, 13, 15, pp1003-1008.

(ECON-LIT, SSCI, Impact Factor = 0.241)

112. Tsnagyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2006

“Does PPP hold in African Countries? Further Evidence based on

a Highly-Dynamic Nonlinear (Logistic) Unit Root Test” Applied Economics,

November 10, 38, 20, pp2453-2459.(ECON-LIT, SSCI, Impact Factor = 0.424)

12

113. Tsangyao Chang, Chien-Chung Nieh and Chien-Chun Wei, 2006, “Analysis

of Long-Run benefits from International Equity Diversification between Taiwan

and Its major European Trading Partners: An Empirical Note” Applied

Economics, October 20, 38, 19, pp2277-2283. (ECON-LIT, SSCI,

Impact Factor = 0.424)

114. Tsangayo Chang, Chien-Chung Nieh, Mingjing Yang and Tse-Yu Yang.

2006, “Are Stock Market Returns Related to the Weather Effects? Empirical

Evidence from Taiwan” Physica A – Econophysics, May 15, 364, 1,

pp343-354. (2004 SCI Physics, Impact Factor = 1.521), (SCI)

115.Tsnagyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2006,

The Impact of Presidential Election on Taiwan Stock Market – Prospect Theory,

Journal of Electoral Studies (選舉與研究), May, 13, 1, pp87-118. (TSSCI)

(in Chinese)

116.Tsnagyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2006,

“Are Real Exchange Rates Stationary in African Countries?” The International

Journal of Finance, Vol 18, No, 1, p3847-3860 (FIN-LIT)

117. Tsangyao Chang and Yang-Cheng Lu, 2006, “Equity Diversification in Two Chinese

Share Markets: Old Wine and New Bottle” Economics Bulletin, April 3. 7, 4, pp1-14.

(ECON-LIT)

118. Tsangyao Chang and Steven B. Caudill, 2006, “A note on the long-run benefits from

international equity diversification for a Taiwan investor diversifying in the US

equity market” International Review of Financial Analysis, 15, 1, p57-67,

(ECON-LIT, FIN-LIT)

119. Tsangyao Chang, Kuei-Chiu Lee, Chien-Chung Nieh and Ching-Chun Wei, 2005,

“An Empirical Note on Testing Hysteresis in Unemployment for Ten European

Countries: Panel SURADF Approach,” Applied Economics Letters, October, 12, 14,

pp881-886. (ECON-LIT, SSCI, Impact Factor = 0.241)

120. Tsnagyao Chang, Hsu-Ling Chang, Hsiao-Ping Chu and Chi-Wei Su, 2005,

“Does Rational Bubbles exist in the Taiwan Stock Market? Evidence from a

Nonparametric Cointegration Test”, Economics Bulletin, August 29, 3, 41,

pp1-9 (ECON-LIT).

121. Tsangyao Chang and Steven Caudill, 2005, “Financial Development

and Economic Growth: The Case Of Taiwan,“ Applied Economics, July, 37,

pp1329-1335, (Leading article, SSCI, Impact Factor = 0.424)

13

122. Tsangyao Chang, Yuan-Hong Ho and Chiung-Ju Huang, 2005, A Reexamination of

South Korea’s Aggregate Import Demand Function:: The Bounds Test Analysis,

Journal of Economic Development, June, 30, 1, pp119-128 (ECON-LIT)

123. Tsangyao Chang, Chien-Chung Nieh and Ching-Chun Wei, 2005, “Is Per Capita Real

GDP Stationary? Evidence from Selected African Countries based on More

Powerful Nonlinear (Logistic) Unit Root Tests,” Economics Bulletin, May, 3, 4, pp1-9.

(ECON-LIT)

124. Tsangyao Chang and Chien-Chung Neih, 2004, “A Note on Testing the Causal Link

between Construction Activity and Economic Growth in Taiwan” Journal of

Asian Economics, 15(3) May-June, pp591-598. (ECON-LIT)

125. Tsangyao Chang, WenRong Liu, and Steven B. Caudill, 2004, “A re-examination of

Wagner’s Law for Ten Countries based on Cointegration and Error-Correction

Modelling Techniques,“ Applied Financial Economics, 14, 8, pp577-589.

(ECON-LIT, FIN-LIT)

126. Neih Chien-Chung and Tsangyao Chang, 2003, “Long-Run Gains from International

Equity Diversification: Taiwan’s Evidence, 1995-2001,” Journal of Economic Integration,

18(3), pp530-544, (ECON-LIT)

127. Tsangyao Chang, 2002, “Long-run Benefits from Equity Diversification:

Taiwan Stock Markets“ The International Journal of Finance, Vol 14, No 4.

pp2419-2427, (FIN-LIT) (NSC87-2415-H-035-011)

128. Tsangyao Chang, 2002, “Financial development and economic growth in Mainland

China: a note on testing demand-following or supply-leading hypothesis,“ Applied

Economics Letters, 9, 13, pp869-873. (SSCI, Imact Factor = 0.241)

(Ranked “Number One” of the Top 25 Journal Articles by Files Downloads

(Applied Economics Letters), during May- August, 2003)

129. Tsangyao Chang, WenRong Liu, and Steven B. Caudill, 2002, ‘Tax-and-Spend,

Spend-and-Tax or Fiscal Synchronization: New Evidence for Ten Countries,“

Applied Economics, 34, 10, pp1553-1561. (SSCI, Impact Factor = 0.424)

130. Tsangyao Chang, WenRong Liu, and Henry Thompson, 2002, “The Viability of Fiscal

Policy in South Korea, Taiwan and Thailand,” ASEAN Economic Bulletin, August,

19, 2, pp170-177. (ECON-LIT)

131. Tsangyao Chang and Yuan Hong Ho, 2002, “Tax or Spend, What Causes What:

Taiwan‘s Experience, “ International Journal of Business and Economics

VOL. 1, No. 2, pp 157-165. (ECON-LIT)(NSC85-2415-H-035-016)

132. Tsangyao Chang and Yuan-Hong Ho, 2002, A Note on Testing

“Tax-and-Spend, Spend-and-Tax or Fiscal Synchronization”: The case of China,“

Journal of Economic Development, 27, 1, June, pp151-160 (ECON-LIT)

133. Tsangyao Chang. 2002, “An Econometric Test of Wagner‘s Law for Six Countries based

on Cointegration and Error-Correction Modeling Techniques” Applied Economics,

14

34, 8, pp1157-1169. (ECON-LIT, SSCI, Impact Factor = 0.424) (Ranked “The 21stst

of the Top 25 Journal Articles by Files Downloads (Applied Economics),

during May-August, 2003)

134. Tsangyao Chang, 2002, “Long-run benefits from equity diversification

in two Chinese share markets: B-shares from both Shanghai and Shenzen Stock

Exchanges,“ The Indian Jouranl of Economics, VOL LXXXII, No, 326, pp303-310,

January 2002.

135. Tsangyao Chang and Chien-Chung Nieh, 2001, “International Transmission of Stock

Price Movements Between Taiwan and Its Trading Partners, Hong Kong, Japan, and

the United States, Review of Pacific Basin Financial Markets and Policies, VOL 4,

NO, 4, pp 379-401 (ECON-LIT).

136. Tsangyao Chang and Yuan-Hong Ho, 2001, “Financial Development and Economic

Growth in South Korea: a note on testing demand-following or supply-leading

hypothesis,“ The Indian Journal of Economics, VOL LXXXII, No, 325, pp153-160,

October 2001.

137. Tsangyao Chang. 2001, “Are There Any Long-run Benefits from International Equity

Diversification for Taiwan Investors Diversifying in the Equity Markets of Its Major

Trading Partners, Hong Kong, Japan, South Korea, Thailand, and the US“ Applied

Economics Letters, 8, 7, pp441-446. (SSCI, Impact Factor = 0.241)

138. Tsangyao Chang, WenShwo Fang., and Li-Fang Wen, 2001, “Energy Consumption,

Employment, Output, and Temporal Causality: Evidence from Taiwan based on

Cointegration and Error-Correction Modelling Techniques“ Applied Economics,

33, 8, pp1045-1056. (SSCI, Impact Factor = 0.424)

139. Tsangyao Chang., WenShwo Fang., Chwenchi Liu., and Li-Fang Wen, 2001, “Defense

Spending, Economic Growth, and Temporal Causality: Evidence from Taiwan and

Mainland China“ Applied Economics, 33, 10, pp1289-1300. (SSCI,Impact Factor

0.424) (Ranked “Number Five” of the Top 25 Journal of Articles by File Downloads

(Applied Economics), during August to October, 2002)

140. Tsangyao Chang, Wenshwo Fang, Wenrong Liu, and Henry Thompson, 2000,

“Exports, Imports, and Income in Taiwan: An Examination of the Export-Led

Growth Hypothesis,“ International Economic Journal, 14, summer, pp151-160.

(ECON-LIT)

141. WenShwo Fang, Tsangyao Chang, and Kung-Min Wang, 2000, “Exports, Imports, and

Economic Growth: Evidence from Taiwan and the US, 逢甲學報, 38, pp11-27,

December, 2000.

142. Tsangyao Chang, WenShwo Fang, and JerYan Lin, 1999, “多變量共整合誤差修正模

型對臺灣地區犯罪人口率之研究,“ 警學叢刊, 30卷1期 pp89-135.

143. Tsangyao Chang, Yuan Hong Ho, Chris Fawson, and Terry F. Glover, 1999, “ An

Empirical Analysis of Aggregate Consumer Demand in Taiwan: Linear Expenditure

Systems Approach,“ Indian Journal of Economics, VOL LXXIX, No, 314. pp 405-417.

15

January 1999.

144.Tsangyao Chang, and WenShwo Fang. 1997, “臺灣預算赤字與利率、匯率及資

本流入因果關係探討“ 逢甲學報, 31, pp79-92, June, 1997.

145. Chris Fawson, Terry Glover, WenShwo Fang, and Tsangyao Chang. 1996, "The

Weak-form Efficiency of the Taiwan Share Market." Applied Economics Letters,

3, pp663-667. (ECON-LIT, SSCI, Impact Factor= 0.241)

146. Chris Fawson, John Keith, and Tsangyao Chang. 1996, "Recreation as an

Economic Development Strategy: Some Evidence from Utah." Journal of Leisure

Research, 28, 2, pp96-107. (SSCI, Impact Factor = 0.784)

B. 審查中期刊論文 (Papers under Review)

1. 江春, 李小林, 張倉耀(2013)中国货币供应量变动与物价变动之间的关

系——基于 Morlet 小波时频相关性分析,数量经济技术经济研究(in Review,

CSSCI)

2. Tsangyao Chang, Chien-Chiang Lee, and Omid Ranjbar (2013) Smooth breaks,

sharp drifts, and mean reversion in inflation rates: New evidences for MENA

countries, The World Economy (in Review, SSCI)

3. Chia-I Pan, Tsangyao Chang, and Yemane Wolde-Rufael (2013) Military Spending

and Economic Growth in the Middle East Countries: Bootstrap Panel Causality

Test, Defence and Peace Economics (in Review, SSCI)

7. Tsangyao Chang, Chien-Chiang Lee and Hsiao-Ping Chu (2013) What do me

really know about the relationship between Military spending and economic

growth, Defence and Peace Economics (in Review, SSCI)

5. Hsiao-Ping Chu, Tsangyao Chang, and Tagai-Sagafi Nejad (2013) Globalization

and Economic Growth Revisited: Bootstrap Panel Causality, Journal of

Development Economics (in Review, SSCI)

6. Gengnan Chiang and Tsangyao Chang (2013) The Richer the Greener: Evidence

from G7 Countries, Praque Economic Papers (in Review, SSCI)

7. Tsangyao Chang, Shu-Chien Tseng, and ZhungPao Wu (2013) Globalization and

Inflation: Bootstrap Panel Causality, Global Economic Review (in Review, SSCI)

16

8. Tsangyao Chang, Sen-Sung Chen and Chien-Chiang Lee (2013) Does

Globalization promote Insurance Activity? Global Economic Review (in Review,

SSCI)

9. Tsangyao Chang, Beatrice D. Simo-Kengne, and Rangan Gupta (2013) The

Causal Relationship between imports and economic growth in the nine provinces

of South Africa: Evidence from Panel Granger Causality Tests, Journal of

Economic Cooperation and Development (in Review, SSCI)

10. Tsangyao Chang, Beatrice D. Simo-Kengne, and Rangan Gupta (2013) The causal

relationship between house prices and economic growth in the nine provinces of

South Africa: Evidence from Panel Granger Causality Tests, Journal of Real

Estate Literatures (in Review, SSCI)

11. Tsangyao Chang, Hsiao-Ping Chu, and Omid Ranjbar (2013) Are GDP

fluctuations transitory or permanent in African countries? Sequential panel

selection method, International Review of Economics and Finance (2nd run review, SSCI).

12.Omid Ranjbar, Chien-Chiang Lee, and Tsangyao Chang (2013) Re-examination of

the stochastic convergence hypothesis for African countries: New evidences using

stationary test with multiple structural breaks, South African Journal of

Economics (2nd run Review, SSCI)

13. Tsangyao Chang, Chien-Chiang Lee, and Omid Ranjbar (2013) Can the BRICS

catch up with the U.S.? China and the World Economy (in Review, SSCI).

14. Tsangyao Chang, Chien-Chiang Lee, and Omid Ranjbar (2013) Catch up process

in the transition countries, Scotch Journal of Political Economy (in Review, SSCI)

六. 獎勵

八十四學年度國科會 甲種獎助 ($144,000)

八十五學年度國科會 甲種獎助 ($144,000)

八十六學年度逢甲大學教師創作研究 四等獎 ($10,000)

八十九學年度逢甲大學專任教職員學術研究 優等獎及佳作獎各一 ($20,000)

八十九學年度國科會 甲種獎助 ($144,000)

九十學年度逢甲大學專任教職員學術研究 優等獎 ($15,000)

九十一學年度逢甲大學專任教職員學術研究 優等獎 ($90,000)

2003 Who is Who in the World, Marquis (世界名人錄).

九十二學年度逢甲大學專任教職員學術研究 優等獎 ($120,000)

九十三學年度逢甲大學專任教職員學術研究 優等獎 ($15,000)

17

九十四學年度逢甲大學專任教職員學術研究 優等獎 ($28,000)

九十五學年度逢甲大學專任教職員學術研究 優等獎 ($51,000)

九十六學年度逢甲大學專任教職員學術研究 優等獎 與 傑出獎 ($87,000)

2007 Who is Who in the World, Marquis (世界名人錄).

九十七學年度逢甲大學專任教職員學術研究 優等獎 與 傑出獎 ($84,000)

2009 Who is Who in the World, Marquis (世界名人錄)

九十八學年度逢甲大學專任教職員學術研究 優等獎 ($72,000)

2011 and 2012 Who is Who in the World, Marquis (世界名人錄)

九十九學年度逢甲大學專任教職員學術研究 優等獎 ($171,000)

一百學年度逢甲大學專任教職員學術研究 優等獎 與傑出獎 ($223,590)

七. 執行中及已完成之計劃

1. 經濟部在地型學界科專計畫-公開新聞量化指標資料庫-分項計畫四計畫主持

人。三年期計畫,執行期間為 2010/11-2013/10, $21,000,000

2, 財團法人證券櫃檯買賣中心建立中小企業板可行性之研究

財團法人證券櫃檯買賣中心,計劃協同主持人。2010/4-2010/9, $500,000

3. 建置 OTC 衍生性金融商品集中交易與結算制度(系統)可行性分析與設計芻議

經濟部科技研究發展專案學研聯合研究計畫,計劃協同主持人。2009/6-2010/5,

$6,000,000

4. 企業財務危機預警及投資人情緒與證券異常報酬之文辭探勘人工智慧系統

經濟部科技研究發展專案學研聯合研究計畫,計劃協同主持人。2009/6-2010/5,

$2,000,000

5. 失業率之磁滯效應:以台灣各年齡層劃分的失業率之分析

NSC98-2415-H-035-014, 行政院國科會,計劃主持人。$471,000

6. 建立我國金融服務業整體統計資料 台灣金融服務總會,協同主持人。

11/2007-04/2008。$680,000

7. 結合門檻誤差模型與模型對匯市與股市非線性關係的再審視與探討

NSC94-2415-H-035-001, 行政院國科會,計劃主持人。$532,000

8. 台灣地區失業率磁滯效應的實證檢定: Panel Unit Root Tests (追蹤資料單根

檢定), NSC93-2415-H-035-001, 行政院國科會,計劃主持人。$391,400

9. 開放證券商從事現金管理帳戶及其配套措施之研究 中華民國證券商業同業

公會 ,2004/07/01 至 2004/12/31 協同主持人。$450,000

10. 台灣與中國大陸之 Abrams 曲線的實證探 , NSC92-2415-H-035-009,

行政院國科會,計劃主持人。$120,000

11. 安全天堂假說的實證探討:ARMA--對稱或不對稱 GARCH 方法,

NSC91-2415-H-035-006,行政院國科會,計劃主持人。$120,000

12. 台灣區域性經濟犯罪率在多變量誤差修正模型的分析,

18

NSC90-2118-M-035-006,行政院國科會,協同主持人。$300,000

13. 臺中果菜運銷股份有限公司業務營運效益評估,臺中果菜運銷股份有限公

司,共同主持人。

14. 多變量 EGARCH 模型對亞洲華人股市報酬與波動傳遞之探討,NSC892415-H-035-023,行政院國科會,計劃主持人。 $320,000

15. 臺股指數期貨市場與現貨市場報酬波動與價格動態之實證探討:多變量

誤差修正 GARCH 方法,NSC89-2415-H-035-008,行政院國科會,

計劃主持人。 $486,600

16. 亞洲華人股市報酬與波動傳遞的實證研究, NSC88-2415-H-035-013,行政

院國科會,協同主持人。$,310,000

17 .多變量共整合誤差修正模型對儲蓄互助社,經濟成長與其它總體經濟變數間

動態關係的探討,NSC88-2415-H-035-016,行政院國科會,協同主持人。$245,000

18.臺灣店頭市場與集中市場股報酬與波動,NSC87-2415-H-035-011,行政院國

科會,計劃主持人。$474,200

19.ARCH-TYPE 模型對臺灣股市報酬波動的分析,NSC86-2415-H-035-009,行

政院國科會,計劃主持人。$451,400

20.政府收入與支出因果關係,NSC85-2415-H-035-016,行政院國科會,計劃主

持人。 $255,100

八 服務

1. 中華教育與人力資源管理網路學會理事長 2011/01-Present.

2. 微端科技公司獨立監察人 2004/08/01-2010/07/31。

3. 財團法人國家發展基金會財金組諮詢委員 2008-Present。

4. 台灣競爭論壇位 50 發起人之一。

5. 台灣高等教育評鑑委員 2009-Present。

6. 台灣高等教育評鑑委員 - 財金組召集人 2010-2011。

7. 台灣公共治理績效評鑑委員 2008- Present。

8. 台灣財團法人國家政策研究基金會財政金融組特約研究員 2009-Present。

9 台灣水利署專業計畫審查委員 2008-2009。

10. The Open Economics Journal, Editorial Board Member, 2008-Present Present。

11. The Open Economics Journal – Associate Editor, 2012-Present

12. Global Finance Forum, Academic Advisory Board Member, (台灣區代表,2003

Nobel Prize 經濟學 Winner, Dr. C.W.J Granger 亦為成員之一), 2005-2011。

13. International Review of Accounting, Banking and Finance, Associate Editor,

2009-Present。

14.Journal of Economics and Management, Editorial Board Member, 2006-2009。

15. Romanian Journal of Economic Forecasting, (SSCI Journal), Editorial Board

Member, 2011/12-Present.

19

16. Applied Economics, Expert System with Applications, African Journal of

Business Management, Energy Economics, Physica A, International Journal of

Business and Economics, International Economics Journal, Journal of Economics

and Finance, Journal of Empirical Finance, International Review of Financial

Analysis, International Review of Finance and Economics, Romanian Journal of

Economic Forecasting, South African Journal of Economics, International Journal

of Economics and Finance, Tourism Management, Journal of Economics and

Management, Journal of Peace Research, The Open Economics Journal,

Economics Bulletin, Economic Modelling, ……等期刊之審查委員

九 原文書本翻譯 (Book Translation)

債券市場分析與策略一書(Bond Markets, Analysis, and Strategies by Frank J.

Fabozzi, Pearson Prentice Hall, 2008)

20