Report 1: Setting the Framework

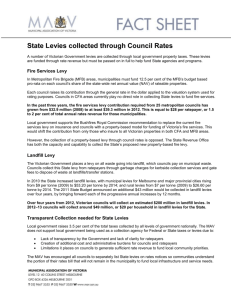

advertisement