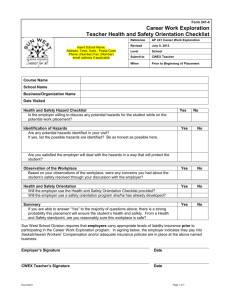

1. The Public Sector Workplace Relations policies

advertisement