FOI Guidelines - Exemptions sections in the FOI Act

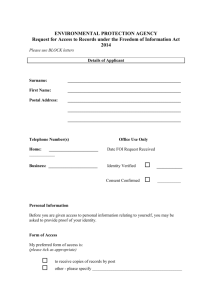

advertisement