Cal.Price Cap - The Electric Power Supply Association

advertisement

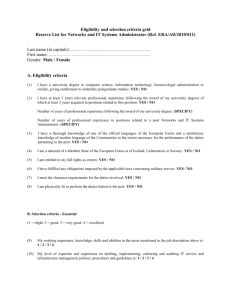

UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION ____________________________________ ) California Independent System ) Operator Corporation ) ____________________________________) Docket No. ER99-4462-000 MOTION TO INTERVENE OF ELECTRIC POWER SUPPLY ASSOCIATION AND PROTEST Pursuant to Rules 214 and 211 of the Rules of Practice and Procedure of the Federal Energy Regulatory Commission (“FERC” or “Commission”), 18 C.F.R. §§ 214 and 212, the Electric Power Supply Association (“EPSA”) hereby moves for leave to intervene in the above-captioned proceeding and protests the California Independent System Operator Corporation’s (“ISO”) proposed Amendment No. 21 to the ISO Tariff. Amendment No. 21 would extend for one year the ISO’s authority to disqualify Energy and Ancillary Service bids that exceed levels unilaterally specified by the ISO’s Board of Governors. EPSA urges the Commission to reject such proposal and allow market forces to freely determine market prices. I. MOTION TO INTERVENE EPSA is the national trade association representing competitive power suppliers active in U.S. and global power markets. EPSA’s members, which include power generators, power marketers and suppliers of goods and services to the electric power supply industry, share a commitment to bringing the benefits of competition to all electric customers. Using a broad spectrum of fossil-fuel and renewable technologies, EPSA members generate reliable, 1058919 v1; MP2F01!.DOC competitively priced electricity, steam and other forms of useful energy from environmentallyresponsible facilities.1 Many of EPSA’s members are authorized to sell energy and ancillary services at market-based rates. Given that EPSA members are engaged in numerous transactions within the California markets and, therefore, could be affected by the ISO price cap and other proposals, EPSA has a direct and substantial interest in the outcome of this proceeding that cannot be adequately represented by any other party. All pleadings, correspondence and other communications concerning this proceeding should be directed to: Lynne H. Church, Executive Director *Julie Simon, Director of Policy Electric Power Supply Association 1401 H Street, N.W., Suite 760 Washington, D.C. 20005 Tel: (202) 789-7200 Fax: (202) 789-7201 Larry F. Eisenstat *Michael J. Rustum Dickstein Shapiro Morin & Oshinsky, LLP 2101 L Street, N.W. Washington, D.C. 20037 Tel: (202) 785-9700 Fax: (202) 887-0689 *designated for receipt of service II. PROTEST In its October 28, 1998 Order, the Commission confirmed the ISO’s authority to impose purchase price caps on ancillary service prices, and directed the ISO to set out the criteria through which it would exercise that authority in the future. Subsequently, in its January 28, 1999 Order, the Commission directed the ISO to explain and justify its long-term plans for its imbalance energy price cap. In response, the ISO stated that it anticipated that the combination of several changes would make the ancillary service markets sufficiently 1 The comments contained in this filing represent the position of EPSA as an organization, but not necessarily the view of any particular member with respect to any issue. 2 1058919 v1; MP2F01!.DOC competitive so that it could raise and ultimately eliminate existing price caps on ancillary services and imbalance energy. Finally, in its May 26, 1999 Order, the Commission indicated that, while it would allow the ISO to retain its authority to impose a purchase price cap for ancillary services and imbalance energy, it would remove that authority as of November 15, 1999. Indeed, the Commission categorized its action as a necessary, but interim step in the evolution of California markets, stressing that the ISO’s purchase price cap was not an ideal approach to operating a competitive market and that it did not expect price caps to remain in place on a long-term basis. Since then, the ISO has implemented comprehensive structural solutions designed to eliminate the alleged market design flaws that necessitated the purchase price cap. Specifically, the ISO has taken actions to expand the base of potential suppliers of energy and ancillary services to include QFs, out-of-area resources, municipals within California, and other potential suppliers. In addition, the ISO has proposed market reforms (e.g., Amendment Nos. 13 and 14) which have been accepted by the Commission. In short, corrective actions have been taken to remedy any fundamental market design flaws that allegedly necessitated the imposition of price caps. While the Commission tolerated price caps in order to facilitate development of the nascent California markets, and as an interim remedy for certain software or other technological glitches, it no longer is necessary to subject sellers to administratively imposed, artificially low prices. Indeed, the Commission stressed that, “after the [1999] summer, we see no reason to leave the caps in place unless the ISO can demonstrate, based on the experience of the summer, that significant market design flaws remain.”2 The ISO presents no evidence of 2 AES Redondo Beach, et al., 87 FERC ¶ 61,208, at 61,818 (1999). 3 1058919 v1; MP2F01!.DOC significant market design flaws. Indeed, although it requests an extension of its price cap authority so as to gain the benefit of additional practical experience, it would appear that the market presently is working as designed, despite “record-high temperatures in California” and conditions causing the ISO to call a “Stage Two” emergency.3 Thus, consistent with the Commission’s May 26 Order, there is no compelling reason to extend the ISO’s authority to impose price caps. The issuance of price cap authority presumes that there is not a workably competitive market, notwithstanding the ISO’s implementation of these various market reforms. If and when the ISO concludes, based upon its examination of further information, including the forthcoming Market Surveillance Committee and the California Power Exchange Market Monitoring Committee reports, that there is, in fact, evidence of significantly flawed markets or opportunity for the abuse of market power that cannot otherwise be mitigated, then it and the Commission can revisit the role, if any, of purchase price caps. EPSA believes, however, that, in most instances, the ISO can effectively take other, less intrusive measures to remedy alleged market shortfalls. EPSA agrees with Commissioner Bailey that “temporary price caps, once placed into effect, and despite the best of intentions, have a tendency to become more permanent fixtures.”4 That appears to be the case with respect to the California ISO. The ISO should refocus its efforts on further developing market oriented solutions to any remaining market flaws, rather than continually seeking to extend its authority to cap competitively-determined prices. See Cal-ISO Sees Market ‘At Its Best’ Despite Spikes After Cap Rises, Electric Power Daily, Oct. 4, 1999, at 1. 3 4 ISO New England, 88 FERC ¶ 61,315, mimeo at 2 (1999). 4 1058919 v1; MP2F01!.DOC For competitive markets to flourish, supply and demand must interact freely to determine the price, thereby allowing market participants to make intelligent resource allocation decisions. Accurate price signals are needed to encourage suppliers to make capacity and energy available to provide ancillary services and replacement reserves or, if necessary, to finance and develop new generation projects. Allowing the ISO to manipulate the market price through enforcement of price caps will perpetuate the inaccurate price signals presently received by the market and will chill development of new generation because of the heightened uncertainty as to market prices. Price-controlled markets are inherently viewed as both riskier and less profitable to new suppliers of power. Price caps and trading limits increase risk, because there is no guarantee that, once set, the caps or limits would not be tightened in the future. 5 Moreover, price caps and trading limits would deny suppliers of electricity the opportunity to cover their fixed costs during those important, but transitory, periods when market prices substantially exceed long-run average costs. Nor is this increased risk offset by symmetric assurances of price floors. In short, the best defense against price spikes is to encourage greater numbers of suppliers to enter the market, not to restrict the payments to existing suppliers. The ISO appears too willing to resort to price caps in response to temporary (hourly) market fluctuations. Absent clear evidence of the abuse of market power or 5 Such is the case here since the ISO is requesting authority to reduce the price caps from $750/MWh to $500/MWh under certain conditions. 5 1058919 v1; MP2F01!.DOC collusion driving market prices substantially higher than otherwise expected – which appears not to exist6 – the more prudent approach would be to allow these interim prices to act as a signal for the market to develop intermediate (e.g., generation redispatch and demand-side responses) and longer-term (e.g., additional investment in generation and/or transmission) solutions during hours of scarce supply. EPSA believes that the ISO should exhaust other remedial measures, if needed, before resorting to any form of price cap. III. CONCLUSION WHEREFORE, the Commission should reject the proposed Amendment No. 21 to the ISO Tariff for extension of authority to Cap Energy and Ancillary Service Bids. October 14, 1999 Respectfully submitted, Lynne H. Church, Executive Director Julie Simon, Director of Policy Electric Power Supply Association 1401 H Street, N.W., Suite 760 Washington, D.C. 20005 _____________________________ Larry F. Eisenstat Michael J. Rustum Dickstein Shapiro Morin & Oshinsky, LLP 2101 L Street, N.W. Washington, D.C. 20037 Attorneys for the Electric Power Supply Association 6 See comments of ISO CEO Terry Winter, as reported in Electric Power Daily, See Cal-ISO Sees Market ‘At Its Best’ Despite Spikes After Cap Rises, Electric Power Daily, Oct. 4, 1999, at 1 (indicating that the market is working at its best and that there were no signs of parties exhibiting market power or manipulating the market). 6 1058919 v1; MP2F01!.DOC CERTIFICATE OF SERVICE I hereby certify that I have served a copy of the foregoing document by first class United States mail, postage prepaid, upon each person designated on the official service list compiled by the Secretary in this proceeding. Dated at Washington, D.C. this 14th day of October, 1999. _____________________________________ Michael J. Rustum 7 1058919 v1; MP2F01!.DOC