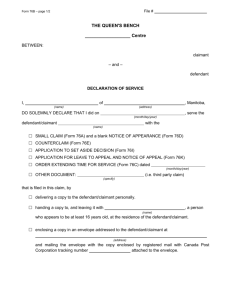

QUEEN`S BENCH DIVISION

advertisement