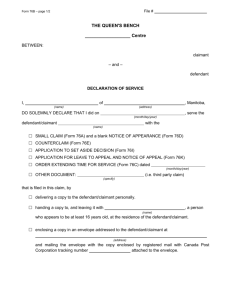

QUEEN`S BENCH DIVISION

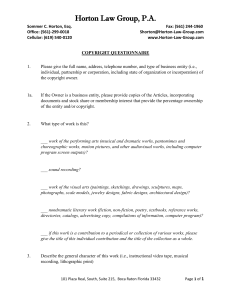

advertisement