Project governance - Department of Treasury and Finance

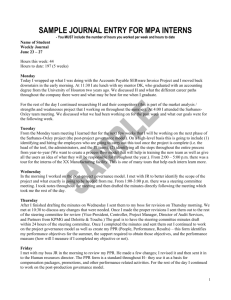

advertisement