BBA in Accounting Learning Goal 1

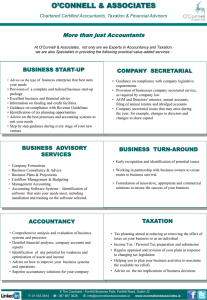

advertisement