Underwriting, Sponsorship & In-Kind Donations

advertisement

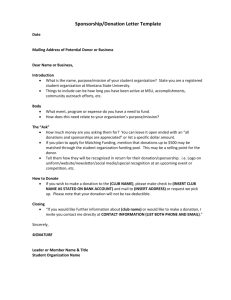

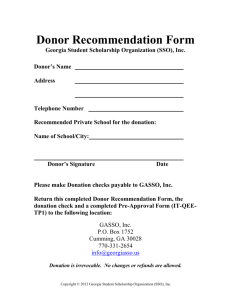

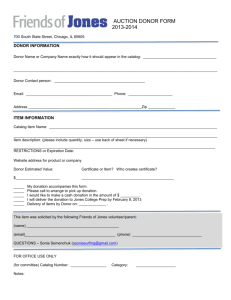

Underwriting, Sponsorship & In-Kind Donations To help offset and/or minimize the expense of conducting a special event, staff and volunteers are encouraged to seek Underwriting, Sponsorship and In-Kind gifts for the event. Sponsorship – a comparatively large cash contribution to an event that is not targeted for a specific expense (but rather to increase event revenue) and for which benefits are promised to the donor (i.e. recognition, table, etc.). For example, XYZ Corporation donates $5,000 to Anytown RFL; in doing so, the company’s logo may be included on the event t-shirts. Underwriting - includes gifts solicited and secured to pay for a specific expense of an event. When pursuing underwriting, it is advantageous to first underwrite an event’s direct expenses (versus indirect expenses). Option A -- For example, XYZ Corporation is solicited and makes a donation to Anytown RFL (payable to ACS) to pay for the event t-shirts. In doing so, the event does not incur an expense for the shirts. Staff should secure and retain documentation to confirm the donor’s intent in underwriting the event expense (documentation can consist of a donation cover letter from the underwriter, a standardized event donation form completed by the donor, or a simple notation on the underwriting check). The ACS issues a cash receipt to the donor. Option B – XYZ Corporation agrees to purchase the event t-shirts on behalf of the ACS via writing a check directly to the vendor. In doing so, the event does not incur an expense for the shirts. Subsequently, the ACS issues a in-kind donation receipt to the company. As an underwriter, the company’s logo may be included on the event t-shirts and promotional materials. In-Kind Donations – a donation to an event of product or services. For example, ABC Printing Company donates 100,000 sheets of paper and printing services to produce the event promotional flyer. In doing so, the event does not incur an expense for paper or printing services. In turn, the company’s logo may be included in event recognition materials. All three options greatly help the ACS by minimizing and/or eliminating our costs of implementing a special event – and all options are equally tax-deductible to the donor. Underwriting, Sponsorship & In-Kind Donations Guidelines for Sponsorship & Underwriting The following guidelines are recommendations for a Relay For Life event. You can adjust based on your community & your event’s needs. County with a population under 25,000 County with population between 25,000 and 50,000 County with population between 50,000 and 100,000 County with population over 100,000 Minimum for top level $1,500 $2,500 $5,000 $10,000 Rationale The top Relay For Life events in the Pennsylvania Division are achieving or surpassing these guidelines. The cost of delivering benefits requires these minimum levels to meet expense standards. The printing of logos on the back of all t-shirts is a benefit offered only to top level sponsors by including the cost of printing the logos and the time required for volunteers and staff to get the T-shirts printed, out weigh the donation. By selling the underwriting/sponsorship for a lesser amount, it will be nearly impossible to move the underwriters/sponsors to a higher level for future events. Double check your underwriting & sponsorship packets. Make sure the amenities that you give a $1,500 donor are less than what you give a $5,000 donor, no matter whether it is underwriting or sponsorship. SPONSORSHIP Description Represents a (oftentimes sizable) cash contribution to the event for which benefits are provided to the donor (i.e. recognition, table, etc.). Check is made payable to ACS. UNDERWRITING Gifts solicited to pay for a specific event expense. IN-KIND Donor contributes product or services to the event. Option A – donation is paid to ACS and targeted to underwrite a specific expense of the event. Option B – donor pays vendor directly on behalf of the ACS. Acknowledgement Format Letter to donor stating Option A – cash amount of donation donation receipt. and value received, if any, for the donation. Option B – in-kind donation receipt describing donation but less value. In-kind receipt detailing donation, less valuation. Tax Deductibility to the Donor? Yes, As a monetary Yes on both options. Gift to the ACS, donor may claim gift less FMV received. Yes. Impact on Event Income Donation recorded as event revenue. Adds to gross/net income. No impact on total expenses. Lessens event expenses as ACS does not incur cost of product or services donated. Additional benefit To the American Cancer Society Lessens event expenses as ACS does not incur cost of product or services underwritten. Option A – with donor documentation, does not appear on audit as a fund raising expense. Rather, appears as an Exchange Transaction.