Measuring Business Income: Adjusting Process

advertisement

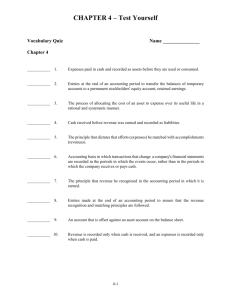

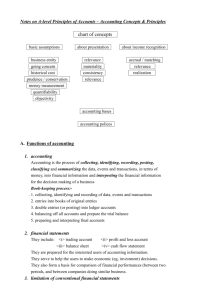

CHAPTER 3 … Measuring Business Income: Adjusting Process Objective 1: Distinguish accrual accounting from cash-basis accounting A. To measure income, businesses must apply accounting principles and concepts, such as accrual accounting, the accounting period, the revenue principle, and the matching principle. 1. 2. B. In accrual accounting, the accountant enters the transactions when the business performs a service or incurs an expense. a. The effect of every transaction is recorded when the transaction occurs, not just when cash is received or paid. (Exhibit 3-1 compares the accrualbasis and cash-basis of accounting.) b. Accrual accounting is the more correct and common method used. In some cases, accountants use cash-basis accounting. In cash-basis accounting, cash receipts are treated as revenues, and cash payments are treated as expenses. The accounting period for most businesses is one year. At this time, a business measures its income. 1. The only way to know for certain how successfully a business has operated is to liquidate, which means to go out of business. However, a business needs to have information on a regular basis. Most businesses divide their life into smaller segments, usually a year. 2. Some businesses use the calendar year—January 1- December 31. 3. Other businesses use a fiscal year usually corresponding with a low point in business activity. 4. Companies also prepare interim financial statements covering months or quarters. Objective 2: Apply the revenue and matching principles A. Three accounting principles and concepts underlie the use of accrual accounting. 1. The revenue principle states that revenues are recorded when earned, and the amount of revenue recorded equals the cash value of the goods or services transferred to the customer. (Exhibit 3-2 illustrates the revenue principle.) 3-1 B. 2. The matching principle states that expenses should be deducted from (matched against) the revenues earned in the same period. (Exhibit 3-3 illustrates the matching principle.) 3. The time-period concept requires that accounting information be reported at regular intervals and that income be measured accurately each period. To measure income accurately, companies update their accounts at the end of each period. This process also helps to properly match revenues and expenses. In order to completely measure income, journal entries called adjusting entries must be prepared at period end to ensure that all revenues and expenses have been recorded properly. Objective 3: Make adjusting entries A. B. Adjusting entries assign revenues and expenses not previously recorded to the proper accounting period as well as bringing related asset and liability accounts to correct balances for the balance sheet. 1. The trial balance or the unadjusted trial balance lists the accounts and their balances after the period’s transactions have been recorded. These trial balance amounts are incomplete because they do not reflect certain revenue and expense transactions that affect more than one accounting period. (The information provided in the unadjusted trial balance in Exhibit 3-4 is used to illustrate the adjusting entries.) 2. Adjusting entries assign revenues to the period when they are earned and expenses to the period when they are incurred. 3. Adjusting entries also bring related asset and liability accounts to correct balances for the balance sheet. 4. Adjusting entries are always required when using accrual accounting but never required when using the cash-basis. Adjusting entries can be divided into prepaids and accruals. Exhibit 3-7 illustrates the prepaid and accrual adjustments. 1. Prepaid adjustments are needed when the cash transaction occurs before the related expense or revenue is recorded. Prepaid expenses, depreciation, and unearned revenue are prepaid-type adjustments. 3-2 2. C. Accrual adjustments are needed when the cash transaction occurs after the related expense or revenue is recorded. Accrued revenue and accrued expenses require accrual-type adjustments. Adjusting entries can be further divided into five categories: prepaid expenses, depreciation, accrued expenses, accrued revenues, and unearned revenues. 1. Prepaid expenses require adjustment because the cash is paid in one period, but the resource is not completely used until a later period. a. The entry to record the payment for the prepaid expense increases the asset and decreases cash. Prepaid Insurance (or Supplies) Cash b. XX XX The adjusting entry records an expense and a decrease in the asset; the entry reflects the amount expired or used up. Insurance (Supplies) Expense XX Prepaid Insurance (Supplies) XX 2. (↑ asset; debit) (↓ asset; credit) (↑ expense; debit) (↓ asset; credit) Long-lived assets, such as buildings and equipment, are used up over several years. Depreciation is the allocation of the cost of a plant asset to expense over its useful life. (Exhibits 3-5 and 3-6 show two different financial statement presentations of plant assets.) a. Depreciation is similar to prepaid expenses in that an asset is recorded when the plant asset is acquired. The asset is expensed as it is used. Depreciation Expense XX Accumulated Depreciation b. XX (↑ expense; debit) (↓ asset; credit) As the asset depreciates, the asset value declines. Instead of reducing the asset account, another account, Accumulated Depreciation, is used. 1) Accumulated depreciation is a contra asset account; that is, an asset account with a credit balance. A contra account always appears following its companion account on the financial statements. 2) The balance of the Accumulated Depreciation account is the sum of all depreciation recorded to date for the asset. 3-3 2) The book value of the asset is determined by the following formula: Book value = Cost of asset – Accumulated depreciation 3. Accrued expenses are expenses that are incurred (because a good or service has been used) by the end of the period but will not be paid until a later period. The adjusting entry records an expense for the amount used and a liability for the amount not yet paid. Salaries, interest, and taxes are examples of accrued expenses. Salary Expense Salary Payable 4. Accrued revenues are revenues that have been earned (because the good or service has been delivered) but not yet received. The adjusting entry records revenue (because the revenue has been earned) and a receivable (because the cash is not yet collected). Interest and service revenue are examples of accrued revenues. Interest Receivable Interest Revenue 5. (↑ asset; debit) (↑ revenue; credit) XX XX Unearned revenues arise when a business receives cash in one period but does not earn all of it until a later period. a. An unearned revenue is a liability because the business owes the customer a good or service. The receipt of the cash increased cash and increased a liability. Cash XX Unearned Revenue b. XX (↑ asset; debit) (↑ liability; credit) The adjusting entry records the part of the unearned revenue that has been earned. Unearned Revenue Service Revenue D. (↑ expense; debit) (↑ liability; credit) XX XX XX XX (↓ liability; debit) (↑ revenue; credit) In summary, each adjusting entry adjusts an income statement account—either a revenue or an expense. Each adjusting entry also adjusts a balance sheet account—either an asset or a liability. No adjusting entry ever adjusts the balance of Cash. (Exhibit 3-8 3-4 summarizes the adjusting entries and Exhibit 3-9 illustrates all of the adjusting entries and T-accounts for Cookie Lapp Travel Design) Objective 4: Prepare an adjusted trial balance A. The adjusted trial balance is prepared after the adjusting entries. (Exhibit 3-10 shows the trial balance, adjustments, and the adjusted trial balance in work sheet form for. Cookie Lapp Travel Design) B. The adjusted trial balance serves as the basis for the preparation of the financial statements. Objective 5: Prepare the financial statements from the adjusted trial balance A. The financial statements are prepared using the account balances found on the adjusted trial balance. (Exhibits 3-11, 3-12, and 3-13 are the income statement, statement of owner’s equity, and the balance sheet, respectively, of Gay Gillen eTravel.) B. The income statement is prepared first, followed by the statement of owner’s equity, and then the balance sheet. C. The following information should be considered in the preparation of the financial statements: 1. 2. The heading of the statement should include: a. the name of the entity, b. the title of the statement, and c. the date or period covered by the statement. On the income statement, expenses are listed in descending order by amount, except for Miscellaneous Expense, which is usually listed last. D. Exhibits 3-11, 3-12, and 3-13 also show the relationships among the three financial statements. E. Accrual accounting provides some ethical challenges that cash accounting avoids. 1. Since expenses are not necessarily expensed when paid in accrual accounting, management can exercise some discretion when recording expenses. 3-5 F. 2. Accrual accounting provides opportunities for unethical accounting. Failure to prepare adjusting entries can cause an error in net income. 3. It is important for accountants to prepare accurate and complete financial statements because people rely on the data for their decisions. Decision Guidelines ask important questions about accrual accounting, the adjusting process, and the adjusted trial balance. Appendix A. Prepaid expenses are advance payments of expenses. B. Prepaid expenses require adjustment because the cash is paid in one period, but the resource is not completely used until a later period. 1. The entry to record the payment for the prepaid expense can increase the asset and decrease cash, or, alternatively, increase an expense and decrease cash. Record as Asset Prepaid Rent expense) Cash (↓ asset) 2. Record as Expense (↑ asset) Rent Expense XX (↓ asset) Cash XX The adjusting entry for each method is: Record as Asset Rent Expense XX asset) Prepaid Rent expense) Record supplies used. C. (↑ XX XX Record as Expense (↑ expense) XX (↓ asset) Prepaid Rent (↑ XX Rent Expense XX (↓ Record supplies not used. The balance sheet and income statement will report the same amounts regardless of the method used to originally record the payment. 3-6 D. Unearned (deferred) revenues arise when a business receives cash in one period but does not earn all of it until the next period. 1. The entry to record the receipt of the unearned revenue can increase the liability and increase cash, or, alternatively, can increase revenue and increase cash. Record as Liability 2. Record as Revenue Cash XX (↑ asset) Unearned Revenue revenue) XX (↑ asset) (↑ liability) Cash Service Revenue XX XX (↑ The adjusting entry for each method is: Record as Liability Unearned Revenue XX Service Revenue liability) Record revenue earned. Record as Revenue (↓ liability) Service Revenue XX XX (↑ revenue) Unearned Revenue (↓ revenue) XX (↑ Record revenue not earned. 3-7