Closure of St Regis Sudbrook Paper Mill

advertisement

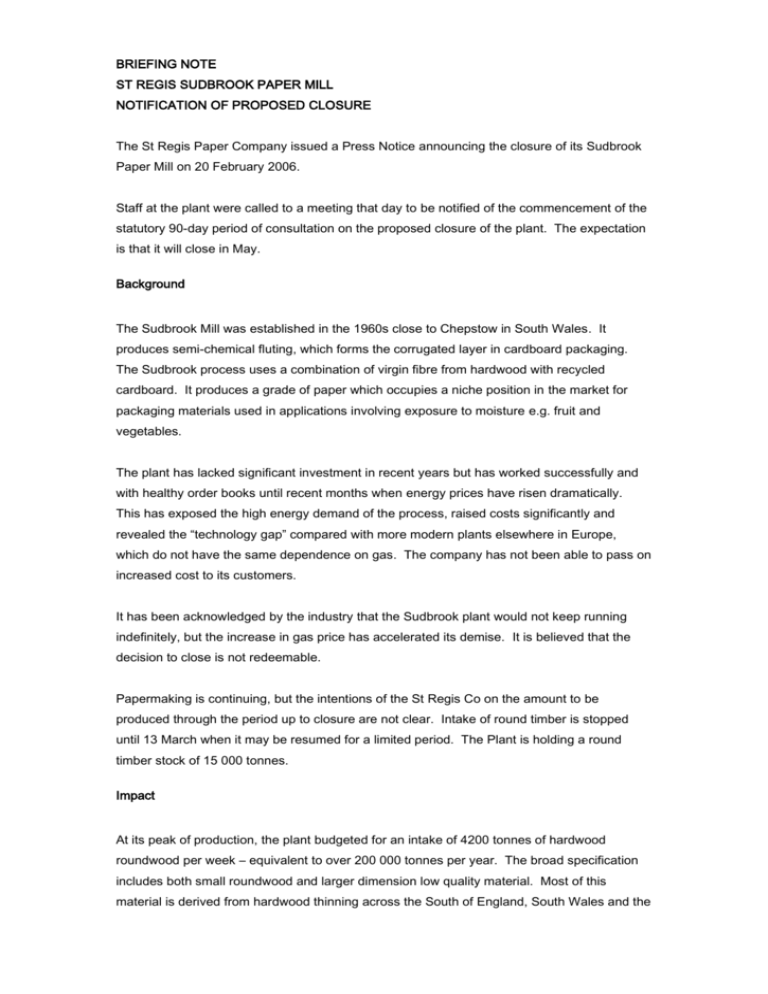

BRIEFING NOTE ST REGIS SUDBROOK PAPER MILL NOTIFICATION OF PROPOSED CLOSURE The St Regis Paper Company issued a Press Notice announcing the closure of its Sudbrook Paper Mill on 20 February 2006. Staff at the plant were called to a meeting that day to be notified of the commencement of the statutory 90-day period of consultation on the proposed closure of the plant. The expectation is that it will close in May. Background The Sudbrook Mill was established in the 1960s close to Chepstow in South Wales. It produces semi-chemical fluting, which forms the corrugated layer in cardboard packaging. The Sudbrook process uses a combination of virgin fibre from hardwood with recycled cardboard. It produces a grade of paper which occupies a niche position in the market for packaging materials used in applications involving exposure to moisture e.g. fruit and vegetables. The plant has lacked significant investment in recent years but has worked successfully and with healthy order books until recent months when energy prices have risen dramatically. This has exposed the high energy demand of the process, raised costs significantly and revealed the “technology gap” compared with more modern plants elsewhere in Europe, which do not have the same dependence on gas. The company has not been able to pass on increased cost to its customers. It has been acknowledged by the industry that the Sudbrook plant would not keep running indefinitely, but the increase in gas price has accelerated its demise. It is believed that the decision to close is not redeemable. Papermaking is continuing, but the intentions of the St Regis Co on the amount to be produced through the period up to closure are not clear. Intake of round timber is stopped until 13 March when it may be resumed for a limited period. The Plant is holding a round timber stock of 15 000 tonnes. Impact At its peak of production, the plant budgeted for an intake of 4200 tonnes of hardwood roundwood per week – equivalent to over 200 000 tonnes per year. The broad specification includes both small roundwood and larger dimension low quality material. Most of this material is derived from hardwood thinning across the South of England, South Wales and the Midlands, but also extending as far as Cumbria and County Durham. It is the only significant single user of this material in Great Britain. If we assume a thinning yield of 40 tonnes per hectare, the intake equates to the thinning of 5000 hectares of mainly broadleaved woodland per year. If we further assume a ten year thinning cycle then it could be said that the plant supports the management of 50 000 hectares of broadleaved woodland, mainly in England. As well as the area of woodland in management, the plant underpins the harvesting and haulage infrastructure for management of broadleaved woodlands across the South of England. This involves a significant number of small businesses that rely upon the plant for their livelihood. The St Regis Company has pursued a policy of working very closely with a large number of suppliers (up to 200) and has tailored its timber procurement to support them. This group of businesses is now seriously at risk. Harvesting contractors and hauliers had no warning of the closure. Many harvesting contractors are left with timber stock and significant contract commitments for purchase of timber. The past three years has been a period of significant investment in timber harvesting and haulage. There are major concerns about those businesses that have invested and are now facing the prospect of significant debt commitments with severely reduced income. Lorries and machinery have already been put up for sale. It is believed that there were no contracts between the St Regis Company and its private sector suppliers. At the plant’s peak of activity earlier last year Forest Enterprise estimate that 50% of its wood requirement was derived from the FC estate. In recent times when short-time working has been introduced and wood requirement declined to 2300 tonnes per week, as much of 70% of this may have derived from the FC estate – mainly through standing timber sales. This harvesting activity supports not only conventional thinning but also ride widening, SSSI management, creation of open space, coppicing for biodiversity purposes etc. Feedback from FTA members to date demonstrates the importance of the Sudbrook plant to private woodland owners. It supports thinning of both broadleaved and mixed woodlands and is especially valued for its practical approach to financial and management issues. It provides an assured market at a reasonable price and with certainty of regular payment. The impact will be greatest on particular woodland types. Those comprised of small or poor quality oak or chestnut, which do not have a ready market as firewood will be most affected. Sudbrook has been the only market for Poplar and this species is unlikely to find any alternative outlet at present. The St Regis Co has also been prepared to pay a premium to access timber from more difficult sites e.g. the steeper slopes on the Hampshire and Sussex Downs. Working these areas will become much less likely. The loss of the Sudbrook market has the potential to impact on other markets – either though price or availability. Firewood has been in high demand, but prices are likely to fall with an increase in available volume. Other smaller markets, such as small logs for oak posts, exist as a by-product of the larger volumes worked as pulpwood. Alternative Markets There is no immediately available alternative bulk market for the material. Chipboard manufacturers in the catchment now largely rely on recycled timber. Export opportunities are being explored but may not readily available. The firewood market consumes an estimated 175 000 tonnes of hardwood in England, and whilst this market has expanded in recent months as the price of other energy sources has increased we are now approaching the end of winter and rates of market growth will not absorb very significant quantities. A limited market for small logs is available, but is heavily dependent on a companion market for small roundwood. Wood energy represents the major opportunity, but we do not believe that there are new heat and/or power plants within the catchment ready to take up supplies now. There are plenty of proposals around in various stages of development, but these have a 1-3 year lead-time before they come to fruition. It may be possible to interest developers in stockpiling ahead of requirements. Key issues and Requirements for Action These arise on two levels – the wider strategic issues and the immediate management implications: Strategic Issues: Opportunity to Supply New Markets The closure of the St Regis Mill opens up the opportunity for the volume to be used to supply new markets – particularly wood energy. One difficulty with establishing new markets in the South of England has been to identify wood which is readily available to be harvested. St Regis has worked very hard to establish its wood supply and it has not always been easy. This means that new users have needed to look to supplies that are more difficult to access, or those outwith the immediate catchment. The St Regis supply now becomes available and the FC estate is a potential supplier to new users. Maintaining the Capacity and Skills of the Harvesting and Haulage Infrastructure This is the crucial issue. If the opportunities are to be realised, then the harvesting and haulage infrastructure needs to be supported and maintained in order to service new markets. This applies to both capacity and skills, particularly in specialist areas. For example we recognise that the forest craftsmen who represent the limited resource available for felling large, high quality hardwood trees probably rely on pulpwood production for much of their income. There is also a special concern about the limited, but very necessary availability of haulage equipped with timber cranes. This issue needs joint industry action. EFIP is the obvious vehicle for this to be pursued. Continuity of Woodland Management If we accept that the St Regis operation supports the management of approximately 50 000ha of broadleaved woodland, then the loss of the market means that this area potentially goes out of management. As a short-term temporary situation this is not a significant problem for the woodlands. However, if it were sustained for more than a year or two, or became permanent, then it would represent a major loss of the public benefits that go with the management of woodlands and impact on achievement of wider Government and internal targets. It has been suggested that a “Task Force” approach drawing from across the sector, and including FC Wales, could be appropriate to addressing the strategic issues and this will be added to the agenda of the EFIP meeting on 8 March 2006 as an item of urgent business. FTA involvement in identifying alternative work could be crucial. The Forestry Commission Programme Group has appointed Sandy Greig, the leader of its Forestry Sector Business and Skills Programme, to take the lead in this area and to ensure that the appropriate links are made on this issue between the forestry sector and wider Government and a briefing has already been provided to the Forestry Minister for England. Adapted by Mardi MacGregor EFIP from a document produced by: Brian Mahony, Head of Sustainable Forestry and Land Management, Forest Enterprise England 2 March 2006