Towards a Theoretical Understanding of Diabetes

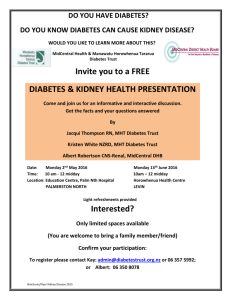

advertisement