COSTING BABEL: THE CONTRIBUTION OF LANGUAGE SKILLS

advertisement

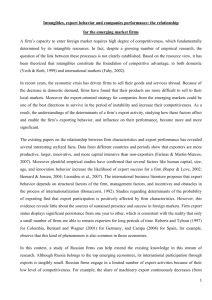

COSTING BABEL: THE CONTRIBUTION OF LANGUAGE SKILLS TO EXPORTING AND PRODUCTIVITY James Foreman-Peck ‘…they have all one language; and this [the city and the tower] they begin to do: and now nothing will be restrained from them, which they have imagined to do. Go to, let us go down, and there confound their language’…. Genesis II 11 pertinent. This ‘network externality’ can give rise to underinvestment in languages.1 Another realistic modification to the model for business purposes is suggested by an incident in David Lodge’s novel Nice Work.2 There a bilingual academic shadowing a monolingual businessman is able to achieve an advantage by overhearing and translating a discussion among the foreign language negotiators with whom a deal is to be struck. The commercial benefits to each negotiating, or potentially negotiating, party depend on whether they can both understand each other’s language or not. Languages are not always perfect substitutes in transactions. To be dependent on the other party communicating in your language when you require is a handicap that it is worth investing to overcome. T he tower of Babel story illustrates the contribution a common language makes to trade. Also the drama shows that different languages are barriers reducing productivity — unless language skills are widespread. Yet as early as the 1890s, a keen observer bemoaned the unwillingness of British businessmen to make any linguistic concessions in overseas markets, thereby losing customers to the more accommodating foreign competitors (Gaskell 1897). The English-speaking nations’ lack of language skills might be explained by the fact that at present they belong to the largest economic group measured by spending power (not by population). A simple model explains (Church and King 1993). Consider two languages that are merely communications technologies and perfect substitutes for each other. The (positive) cost of learning each language is the same. Assuming these costs are not too high, then the efficient language learning solution is for the smaller language group to learn the language of the larger group. This maximises the excess of communication benefits over learning costs. The communication benefits are the same whichever group becomes bilingual, and the costs are lowest if the fewest possible acquire the extra language skills. Despite these theoretical possibilities, studies of the private return to individual acquisition of language skills in Britain show few signs of underinvestment. The following section therefore suggests why such results nonetheless may be consistent with inadequate resources devoted to languages. Section 2 examines more fundamental reasons for underinvestment, an excess of social over private returns, and outlines some possible evidence for the impact on international trade. The third section analyses evidence from a survey of SMEs. Larger firms and those with language skills are more likely to export, while the proportions of enterprises claiming language skills, language plans and using translators in the rest of Europe are at least three times higher than in the UK sample. Section 4 explains why exporting tends to be particularly socially beneficial, the wider market allowing a spreading of fixed costs and giving a once and for all boost to productivity. The fifth section shows that the language effect for British bilateral trade is stronger than for the world average. It offers some illustrations of the size of the social gain from more investment in language expertise, in particular from raising British linguistic skills to those of the world average. European language investment is then probably covered by this model. To explain the English-speaking economies’ language investment stance on say Mandarin or Hindi, it is necessary to note that the value of time spent acquiring language skills is less the lower the earning power that constitutes the opportunity cost. The opportunity cost to a member of a rich nation of learning say Mandarin is much higher than that for a Chinese citizen learning English — leaving aside intrinsic difficulty. Asian economic growth may well change this opportunity cost in a couple of decades though. Even in this simple model, language learning costs can be so high that the socially ideal arrangement of the minority learning the majority language does not come about. When deciding whether to invest in language skills, individual learners do not take into account the benefit conferred upon those they will be able to communicate with. Only their own payoff enters the private calculation. But for the world as a whole the gains to both parties relative to the investment costs are 1 In a different framework Konya (2006) develops this idea further, concluding that in some circumstances it may be optimal for small countries to subsidise language learning in actual or potential trading partners. 2 1 Pages 276–281 of the Penguin 1989 edition. into account implies a 6–13% ‘social’ return, probably within the range obtainable on other investments, and therefore consistent with Swiss optimum investment in language skills. But this does not include network externalities, nor explain persistence, because private investment decisions will not take into consideration state funding. So perhaps there is a language ability constraint that keeps private returns high, for those possessing it. 1. What Do We Earn from Knowing More Languages? Gross and Net Private Returns to Language Investment A market approach to language skills investment suggests we should ask whether the earnings of those with specific skills or qualifications are higher than others (and if so, what does it mean?). For this is how the market encourages investment in skills. What about native English-speakers? English is a world language so there is no perceived need for the US, the UK, Ireland and other native English-speakers to invest in language skills? Certainly there is no evidence for a significant UK wage premium for language degrees (Dolton and Vignoles 2002 Table 1 p123). But this is not the same as a premium to skill (occupation-dependent). ‘A’ levels are grouped in this study so that it is apparently impossible to separate languages from humanities to estimate a skill effect. The research was concerned primarily to show the excess returns to mathematics, which might give a clue to the interpretation of the findings. If mathematics teaching in English schools was particularly poor or painful or simply adequate teaching scarce, compared with other subjects, then the wage premium identified would be necessary to induce students to pursue the subject. Such scarce students would attract a scarcity premium. By a similar argument it follows that the absence of a wage premium for languages could indicate that A-level language teaching is about right. Language teaching is sufficiently effective that students do not require financial compensation for the pain of learning. One of the most widely studied relationships in human capital investment is the Mincer equation (Rosen 1992). In this model individuals’ earnings are explained by their years of schooling and subsequent work experience. The idea is that individuals undertake schooling until the expected foregone earnings, and additional costs of school and from not working, equal expected future increased pay. An additional assumption is that on average their earnings expectations are correct. Individuals make different schooling choices (and achieve different earnings) because of their varied abilities, dispositions, financial constraints and time preferences. Private costs (such as the pain or pleasure of studying) are included in the Mincer model. Gross and net returns therefore diverge only if the public sector pays the costs of education, and/or if there are spillover effects — such as the network externality discussed above for language acquisition. Other human capital measures, (such as language skills) have been added to this model subsequently. But if there are ‘excess returns’, why are they not eliminated by more, profit-seeking, investment in human capital? One answer could be in the time necessary for supply to adjust to the change in demand for skills — a plausible explanation for the Welsh language premium in Wales in 1999 (Henley and Eleri Jones 2005). In the case of years of schooling financial constraints might be compelling and keep up returns for those less constrained. But the same would not apply to the choice of subjects — maths or French say — while being schooled (assuming a choice was available). A US high school curriculum study found that ‘two years of foreign language would raise wages by 4%.’ (Altonji 1995). The language effect was apparently stronger than those for maths and science. The interpretation offered of the result is that ‘languages may play a role in the development of general cognitive and communication skills.’3 This is an alternative explanation for the maths result above as well. Conversely the language finding might reflect on the position of language teaching in the US. Analysis of a representative sample of U.S. college graduates, with controls for cognitive ability, suggests a 2–3% wage premium for college graduates who can speak a second language (Saiz and Zoido, 2005). Note that the premium compares poorly to returns to an extra year of education, 8–14%. If private returns to languages were higher, then a fault would be signalled in either the US labour market or education industry. In the case of an extra year at college the explanation could well be a financial constraint or time preference but this does not apply to choice of subject. In short the absence of a wage premium or excess return to language skills is no Turning to language acquisition by non-English speakers, investment in English as a second language in Switzerland yields a 25% earnings differential for fluent skills, controlling for education and experience (Grin 2003). But returns depend on whether employment is in a trade-orientated sector. In French-speaking Switzerland German skills are rewarded more highly than English. Why do these differentials persist? Possibly there are barriers to employment in Swiss trade-orientated sectors. Alternatively it could be because the focus is on gross returns whereas the individual is concerned with the net payoff. The direct financial investment in Swiss human capital pattern is largely a state decision. Around 10% of Swiss total education spending is devoted to second language teaching, according to Grin (2003). Taking this 3 2 A bigger effect was found for the ‘non-academic’ sample. indication of whether there is or is not adequate investment. interpreted, on international trade have often turned to the 49th parallel (for instance McCallum 1995). Analysis of the role of language differences in these border effects has estimated the impact of common language variables on trade and immigration between Quebec and foreign countries on the one hand, and other Canadian provinces and foreign countries on the other (for example Wagner, Head and Ries 2002). 2. Why Might the Market Under-Invest in Languages? Social Returns Earnings returns to languages depend upon the demand for these skills by firms.4 If firms incorrectly do not perceive profit opportunities from exploiting language skills then they will not demand them, and private returns — primarily wages — will be lower in the short run. In the longer term, when people have time to adjust to these price signals, the proportion of national resources devoted to language skills will be lower than ideal. Commonly, language effects on trade have been identified simply with a binary variable, but more sensitive approaches have been adopted. For example Melitz (2002) distinguishes between an open circuit language and direct communication. An open circuit language is widely spoken (20% or more) or official in both bilateral trading countries (maximum of two per country). He finds 15 languages in this category. Direct communication depends on the percentage of speakers in each country; in this category he identifies 29 languages. The measure is found by summing the products of the respective percentages of speakers over all the relevant languages (at least four percent) in the two trading countries. The impact of the sum of these two is about the same as the Frankel-Rose (2002) binary measure (doubles trade or trade/GDP) (Table 3. Melitz 2002).5 What then might prevent businesses from identifying such opportunities, triggering this divergence between private and social returns? A plausible possibility is complementarity between general (language) and specific (e.g. marketing) training. Returns to general training are likely to be higher when combined with specific training and, conversely, returns to specific training are probably greater in conjunction with general. Employers will not invest enough in specific training if workers do not have the right general educational background. Equally workers will invest insufficiently in general training if they think that inadequate specific training will follow. Without labour turnover workers and employers could negotiate contracts whereby employers paid a part of the general training costs. But if workers may leave before employers recoup the cost of their training then employers will be loath to pay for the investment. Labour turnover then encourages under-investment in both general and specific training when the one enhances the productivity of the other. In a recent survey, the language effects on the trade of industrialised countries was suggested to be equivalent to about a 7% tax (Anderson and van Wincoop 2004), This nation-based analysis could breakdown when large multinational companies choose to communicate across borders in the language of their headquarters country, as Siemens insists on German. But even for large businesses there will be pressures to use the language native to the majority of participants in transactions (Loos 2007). The greater the proportion of the population that speaks English, as either a first or second language, the higher the volume of trade, both exports and imports, between the US and that country (Hutchinson 2002). Moreover the difficulty of learning a language has an impact. Linguistic difference from English reduces trade with the US, controlling for migrants and networks (Hutchinson 2005). The significance of these types of results is brought out forcefully by the second stage of Frankel and Rose’s (2002) analysis; not only does a common language cause trade, but trade causes economic growth, and therefore so does the lack of a language barrier. That there also may be an information-based market failure in language investment is suggested by a study of export managers of British SMEs (Williams and Chaston 2004). The research found that linguistic ability was a major stimulus for the positive use of export information. Experience of living and/or working overseas significantly affected both information-gathering and decision-making. Without this experience it would be difficult to judge what was being missed. Identifying the social rate of return to investment in language skills has been facilitated by two strands of recent research; on the trade impact of common currencies and borders and on the productivity boost derived from international trade. Those seeking to understand the impact of national borders, broadly 5 Melitz (2002) builds on the same data base as constructed by Frankel and Rose (2002). Results from this data are not used in the present report although experiments show large British and whole world language effects. This is because the trade data appear to have been deflated twice so that the values tend to decline in successive periods when real trade volumes rose substantially. 4 Usually by firms, but in the case of Welsh, by government through regulation. Hence the findings of an 8-10 percent Welsh language premium (Henley and Eleri Jones 2005). 3 Table 1. Proportions of SMEs with Language Investments and Planning (Elan Sample) UK Rest of Europe Skills 0.131 0.487 Plan 0.020 0.474 National 0.160 0.209 Translator 0.150 0.440 Agent 0.280 0.292 3. How do Language Skills Affect Smaller Firms’ Exports? Information failure about possibilities in foreign language markets is likely to be greatest for smaller businesses, with fewer resources to invest in search. The matter is here probed with the European Commission’s Elan survey of European SMEs (Hagen et al 2006).6 This is the most ambitious survey of language use by business, in that all European countries were included, and up to 100 SMEs (up to 250 employees) were sampled in each country. The sample was stratified for each country to match the national export profile as closely as possible. The export profile was identified as the pattern of trade destinations and sectors by country for exports of goods and services based on official trade figures. A crosssection of company sizes was selected that also reflected national rather than regional patterns. the Managing Agency system in India, and was often accused of contributing to Britain’s export shortcomings in the face of foreign competition. In most other respects British firms do not compare at all. The proportions of enterprises claiming language skills, language plans and using translators in the rest of Europe are at least three times higher than in the UK sample. British SMEs are likely to rely on everyone else using English. This ‘common language network’ logic might suggest greater UK employment of foreign nationals than continental Europe. European members of this network can more easily migrate to Britain for jobs than the British can migrate to Europe. Moreover to the extent that Britain is a more open economy than most of the rest of Europe, British SME’s will be more likely to employ foreign nationals than the rest of Europe. These will be self-selected by their language skills, and British businesses will be saved from investing in language acquisition. Yet Table 1 shows the proportion of SMEs employing foreign nationals is lower in Britain than in the rest of Europe. The language investment questions employed in the analysis below are; ‘Plan’. In order to deal with customers abroad does your company have a formal language strategy? ‘Skills’. Have you acquired staff with specific language skills due to export needs? ‘Nationals’. Have you ever employed native speakers full time in your company who support your foreign trade? ‘Agents’. Have you ever used local agents and/or distributors who speak your own native language in your foreign markets? ‘Translator’. Have you ever employed external translators/interpreters for foreign trade? This lower UK demand for language services might simply reflect a lower need relative to the continent; the British can export without language skills. But, in this sample, UK SMEs export a lower proportion (37%) than the rest of Europe (45%),8 consistent with underinvestment in the language skills that are associated with exports. The small firms survey shows that the larger the turnover, the higher the proportion of sales abroad 7. Regardless of whether turnover is included in the statistical model though, language skills are a good predictor of a higher proportion of export sales for the whole sample. To examine whether these descriptive statistics reflect a genuine and significant pattern, multivariate analysis is used. British businesses are expected to demand fewer language skills than the rest of Europe. But there is no reason why this should be associated with lower British exports, if other nationals have adequately acquired English. So a test of a UK language shortfall in export model (1) is whether the UK ‘country effect’ is positive, to offset the lower language skills input. If this country effect is zero or negative, then being English-speaking is not sufficient to counterbalance the impact on exports of lower language resources.9 Consistent with English as a world or ‘open circuit’ language, British SMEs in the ELAN sample in general behave very differently from the European average. They only broadly compare with the rest of Europe in the employment of agents (Table 1), which has been a long standing feature of British export organisation. It spilled over to the 19th century Comprador system in China and 6 We are grateful to the Commission for permission to use the survey results. 8 Although there is a wide dispersion around these averages. 9 Ireland is not included in the present sample. 7 The UK sample was unusually unwilling or unable to provide turnover figures and the UK seems to have larger firms. 4 Exportsi = f(language skillsi, countryi, sectori, national trade opennessi, turnoveri) impact is equivalent to increasing the number of customers. In turn this lowers fixed costs per capita, and raises profit, which may encourage entry to the market by other firms. If so, more competing firms lower the markup of price on costs, so that output is higher and wellbeing increases. Even without such entry, fixed costs per capita still decrease and well-being rises. (1) ….UK effect>0 for no language failure Exports of the ith SME are normalised by turnover,10 so the dependent variable can range only from zero to unity. This restriction also requires logit type estimation or transformation of the variable. The drawback is that a firm must be large to make the shift from the home market to exporting and here there may be a market failure. The benefits of exporting are rather like agglomeration economies in this model; a larger market brings down costs for everybody. Language skills are the way in which the market is extended. Cooperation or collaboration between firms to share a fixed cost, such as an Arabic-speaking switchboard operator, could in principle go some way to address the problem. But the difficulty of finding a group of firms with the same needs that is willing to cooperate in this respect, while presumably competing in others, is likely to be very considerable. The findings of this section are consistent with this obstacle indeed being substantial for the UK, and with significant associated underinvestment in language skills. A number of other controls are needed in the model to ensure that other peculiarities of the British economy, such as industrial structure, do not give rise to SME’s lower export propensities. The British sample does indeed have different sector characteristics from the European average.11 Individual country effects are included as well as a measure of national trade openness. The logic of the last control is that a typical SME of an economy that trades 160% of its output is likely to be more export-intensive than that of a country that trades only 60%. But openness probably stems primarily from the size and prosperity of the economy, rather than from investment in language human assets. Whatever the specification it is not possible to obtain a positive and significant UK country effect. If native English language-speaker conferred an export advantage, then the data would show a stronger tendency of UK firms to export, controlling for other influences. They do not. Equally robust is the result that firms with language skills and a language plan are likely to export a higher proportion of their output. 4. How Does Exporting Boost Productivity? SME language skills influence their trade performance, on the basis of the foregoing analysis. Investment in languages improves access to foreign markets. Exporting firms tend to be more productive than those that only supply the home market (Greenaway and Kneller 2004, Greenaway and Yu 2004, Girma, Kneller and Pisu 2005). The principle of comparative advantage — that specialisation is the basis of the gains from trade — is consistent with this association. Countries and economies that specialise in what they do better, exporting these goods and services, while importing products which they cannot make so cheaply, will have higher living standards than those that restrict trade. Exporters will be more productive because of this specialisation. It is apparent from these results that British SME’s lower investment in language skills is not compensated by the advantages of being native English-speakers, as far as export intensity is concerned. Indeed the best estimate is that there is a substantial negative effect on exports that must be attributed to language complacency. This model cannot calculate, but only suggest, the extent of exports forgone by those SMEs that do not export at all, because these are not included in the sample. The model underlying these findings is that foreign language skills boosts the firm’s sales opportunities, permitting either or both of a higher price for the same volume of sales and higher sales at the same price, because of the wider market permitted by exports. The downside is that the firm must invest in the fixed costs of acquiring these skills. If the investment pays off, the For good empirical reasons, analysis now more commonly focuses on the fixed and sunk costs associated with exporting. These include establishing distribution and service networks in foreign markets, which can be barriers for less productive firms (Helpman, Meltiz and Yeaple, 2004). Exporting, on one interpretation then, identifies those firms with sufficiently good products, or which are productive enough, to overcome the sunk costs. The expansion of these more efficient and effective firms must improve the productivity of the economy as a whole. The variable is the answer to the question ‘What is the percentage of your sales abroad of goods or services as a proportion of your total sales?’ 10 More importantly, the higher productivity of exporters is, in part, caused by exporting. Through international buyers and competitors, exporters may learn about new processes, products or management practices. Export 11 In particular, 17 percent of the UK sample was classified as ‘manufacture of machinery and equipment nes’ compared with a European sample average of 8 percent, and 11 percent ‘land transport’ compared with one percent. 5 markets allow firms to exploit economies of scale, thereby enhancing productivity. By gaining access to bigger markets, they may simply be in a better position to spread their overheads over more sales, increasing their productivity in this way. There is a good deal of evidence that unit costs fall with the scale of production for many enterprises, and exporting often allows access to greater scale. Exporters may also face greater competitive pressures in international markets, which could more strongly encourage efficiency.12 Consequently inadequate investment in language skills could lose SMEs profitable opportunities. A second, not mutually exclusive, possibility is that SME management are averse to risk. Their limited resources and reserves must often encourage such an attitude, with the consequence that they are likely to invest less in the acquisition of information of uncertain value (before they have acquired it) than would a risk-neutral organisation. Yet there is a strong case that society as a whole, and public authorities representing society, should be riskneutral, because they can diversify away project-specific risk, and take the long view of economic affairs. If this premise is accepted, there is, in principle, scope for productive public intervention to offset this underinvestment in information. Are exporters in fact more productive because productivity causes exports, or because exporting boosts their productivity. Both effects are likely to be at work. Only the second is pertinent for the present study however. Selling more abroad does not necessarily improve economic performance — if for instance there is no difference from the consequences of selling more at home. For example switching more resources into foreign languages for a firm could require a reduction of investment in domestic marketing. In such a case, only if the additional linguistic resources generated more sales than were lost from the diversion away from marketing at home would there be a gain to the firm and to the economy. This is where the contribution of scale economies or learning in the wider export market is critical. The net productivity effect of exporting greatly enhances the returns to language investment by SMEs, primarily for those not yet engaged in exporting. 5. What Are the Trade Effects of Language Skills for the United Kingdom? To complement the evidence at the individual firm level, another approach to testing for British underinvestment in languages is through national aggregate trade effects. Here the principal challenge is to model international trade flows so that the impact of language knowledge or ignorance can be isolated from other influences. Industry groups do gain from ‘learning-by-exporting’ (Harris and Li 2007 Table 3.6). But experiences differ for entrants, exiting firms, and those that enter and exit overseas markets. Harris and Li (2007) show that firms new to exporting experienced substantial productivity effects; a 34% long-run increase in Total Factor Productivity in the year these firms began exporting. This was a once and for all boost for, in the year after beginning exporting, a productivity increase of only about 5% was found. Because the ‘follow on’ effect is small compared with the initial stimulus, the fixed cost explanation for exporting permitting greater productivity is of greater significance than learning by exporting. Isaac Newton proposed that the attractive force between two objects depended on the product of their masses divided by the square of the distance between them. Some centuries later it was found that the gravity model also provided a good explanation for international trade flows.13 The attractive force is replaced by trade between two countries and the ‘mass’ of the countries is their GDP, or GDP per capita, or both. Distance and other barriers such as language also have been found to influence trade flows in this type of model. Gravity models are by far the most widely used means of empirically studying trade because they fit the data so well. Is this an unexploited gain? Or does it entirely represent the unmeasured fixed costs of exporting? If not, how could such an unexploited potential for gain persist in a competitive market? Why should firms not undertake more profitable investment and ignore less profitable ones? The researchers claim to have measured costs completely. If this is accepted, one strong possibility to explain persistence of the effect is inadequate information. Information can be costly to acquire and the value may be unknown until it is obtained. So the optimum investment in information is hard to establish. Language skills are often essential for acquiring information about opportunities in other economies. Human behaviour requires more explanation than expressed by a gravity equation and so various attempts have been made to model what underlies the trade versions. A recent attempt (Andrews and van Wincoop 2003) adopts the following assumptions. Each region or country engaging in bilateral trade produces a fixed quantity of a distinctive good. Because these goods are distinctive they are less than perfect substitutes for each other. The income of a region is determined by the exports of the good to all other regions (including itself). 12 On the other hand, firms in countries already very open to trade may already be exposed to these competitive pressures and benefits form learning, whether or not they export. 13 Ravenstein (1885) appears to have been the first to make an economic application of the gravity model. 6 Consumers with identical constant elasticity of substitution preferences, in each region, demand these exports. How much they demand depends upon (to us) unobservable prices, which include trade costs, such as language barriers and transport costs. Trade costs or barriers are symmetrical between country pairs. much larger than the average for the whole world, in the period 1990–97. Whereas a common language boosts trade (using 1990–1997) by 57% for the whole world, for the UK the advantage is 103%. Given that the gravity model (with country random effects) controls for other influences on the determinants of bilateral trade, this language impact is consistent with British underinvestment in language, both relative to the world as a whole and absolutely, reducing trade. Although there is a warrant for Britain investing less in languages than non-English-speaking countries, no distinctive trade effect should be apparent, for lower British commitment should be offset by the investment of other economies. Trade between a pair of regions or countries depends on their bilateral trade barrier relative to average trade barriers with all partners. This last insight is an important feature of the model and survives relaxation of many of the assumptions. For present purposes, trade between Britain and any one partner depends not only on language barriers, distance, and so on, but on language barriers and other costs between all other partners as well. By ‘taxing’ trade with some partners but not with others, language underinvestment lowers trade with some, in part to the benefit of others (trade diversion) and in part reducing trade in total (trade destruction). At the national level, different languages may be thought of as a tax on trade. Inadequate language skills reduce the chances of identifying profitable trading opportunities. The ‘tax’ is lower the more widespread are language skills in potential trading partners. The common language effect captures some of the trade diversion of language barriers. A greater trade diversion effect of the British common language implies greater trade destruction as well. The burden of the ‘tax’ imposed by language barriers depends in this model on the extent to which national goods are substitutes. The more substitutable are the products of different trading nations the less the ‘tax equivalent’ of a given foreign language effect. The principal interest here is in the price mark up for trade costs, a portion of which depends upon national language differences, but that also is determined by distance between trading partners, trade agreements and so on. The empirical gravity model is estimated from bilateral trade time series collected for most countries in the world in a data set generously made available on Andrew K Rose’s web pages.14 Common languages are broadly interpreted so that for example Britain is defined as sharing a common language with India and with Pakistan. Comparable with the other Rose data set (such as Frankel and Rose 2002), 69.11% of British bilateral trades are with different language economies. On reasonable assumptions about the range of substitutability, raising British standards of language competence to the rest of the world average is equivalent to between a 3 and a 7 percentage point tax reduction on British trade. These numbers (7% and 3% of exports) may be interpreted as the maximum sum worth spending on raising British language skills if the investment was effective, assuming other economies spend the optimum on language investment. Optimum investment in language skills depends upon how effective the investment is in reducing language barriers to trade. It is beyond the scope of the present paper to assess such efficacy directly, but it is the next step for public policy. In this data set, the average level of British trade is higher with common language countries by one third. But then common language countries’ GDPs per head are also higher (by almost 20%), which should in itself generate more trade, according to the gravity model. On the other hand the effect will be attenuated by the greater GDPs and relative closeness of different language trade partners; the gravity model implies that the tradeboosting effects of a common language are partly offset by the greater average distance of these countries from the UK. The strongest associations of common language are to be found with colonies (current and former) and currency unions. Colonies are defined over several recent centuries, so the US is identified as having colonial ties with Britain (but Italy is not). 77.5% of bilateral trades with sometime colonies in the data set were with those with whom Britain shared a common language. The boost to well being from the reduction of even a one percent tax on British exports, that amount to one quarter of GDP, can be substantial, for it is equivalent to a similar rise in productivity. One percent of 25% of GDP is 0.25%, more than £3 billion, from the 2005 GDP figure. It would be worth spending almost up to this sum on improving language skills, if the outlay brought British proficiency closer to world levels equivalent, by reducing language trade cost by one percent. On top of the direct effects of reducing the ‘tax effects’ of language on exports are the productivity impacts of accessing a wider market. As indicated in section 4, these gains seem to be substantial; perhaps as much as a one third increase in output, controlling for all inputs. Turning to the gravity model estimates, controlling for country effects as proxies for multilateral trade costs, the principal result is that the UK common language effect is 14 http://faculty.haas.berkeley.edu/arose/RecRes.htm 7 Language is a barrier to trade, which can be represented as equivalent to a tax. There is evidence that Britain’s language investment is so low that it imposes a heavier tax on British trade than the average for the rest of the world. Britain’s greater estimated ‘common language effect’ is consistent with British underinvestment in languages. The mirror image of the common language advantage is the handicap imposed upon international trade by language differences. Even a one percent reduction in the language tax — much less than the difference between Britain’s ‘tax’ and the world average — would be equivalent to a more than £3 billion increase in productivity. The likely range of the language ‘tax’ (assuming the rest of the world invests the ideal amount) is three to seven percent, so the minimum possible gains from optimal investment in languages for Britain in 2005 was £9 billion. 6. Conclusion Lack of a common language is a barrier to trade. Overcoming the barrier is costly but there are widespread benefits from doing so that may warrant public intervention. Information shortcomings, network effects, problems arising from the indivisibility of substantial investments in language skills, complementarities between firm-specific skills and languages, and uncertainty, all suggest that underinvestment in overcoming the language barrier to exporting may be particularly marked for smaller firms. The payoff from effective intervention in language investment could be large. These payoffs normally cannot be measured by market returns to individuals’ investment in language skills. In the absence of barriers, higher than ‘normal’ returns will encourage more investment that will, in due course, eliminate excess payoffs. There are extra boosts from encouraging greater exports; greater productivity stemming from larger markets in which overheads can be spread, and expansion of more productive firms at the expense of less. These spillover effects add to both gross and net returns. Gains from exporting persist most likely, in part because of information failures and, in part because of the costs of beginning exporting. Language investment contributes to overcoming these hurdles. The observation that English is a world language does not imply that native English-speaking economies need not invest in language skills; indeed there is evidence that it promotes complacency and under-investment. If being based in an English-speaking country alone conferred an uncompensated advantage, the SME analysis would show a positive UK effect on SME exports. After controlling for investment in language skills, where the UK might justifiably put in less than the continental European average, there is no such positive effect. The net gain from a ‘language tax’ reduction depends on the effectiveness of the language investment that brings it about. However, assessing the effectiveness of alternative investment strategies is beyond the scope of the present study. References Altonji, J G (1995) ‘The Effects of High School Curriculum on Education and Labor Market Outcomes’, Journal of Human Resources, 30, 3, 409–38 Gaskell, W S H (1897) Our Trade in the World in Relation to Foreign Competition 1883-1893 cited in R J S Hoffman (1983) Great Britain and the German Trade Rivalry 1875– 1914 New York Garland Anderson, J E and van Wincoop, E (2003) ‘Gravity with Gravitas: A Solution to the Border Puzzle’, American Economic Review 93 1 170–192 Girma, S., Greenaway, D. and Kneller, R. (2002) 'Does Exporting Lead to Better Performance: A Microeconometric Analysis of Matched Firms’, GEP discussion paper 2002/09 Nottingham University Anderson, J E and van Wincoop, E (2004) ‘Trade Costs’, Journal of Economic Literature; 42, 3 . 691–751 Girma, S., Kneller, R. and Pisu, M (2005) ‘Exports versus FDI: An Empirical Test’, Review of World Economics/Weltwirtschaftliches Archiv, 141, 2, pp. 193– 218 Church, J and King, I (1993) ‘Bilingualism and Network Externalities’, Canadian Journal of Economics 26 2 337– 345 Dolton, P. J. and Vignoles, A. (2002) ‘The Return on Postcompulsory School Mathematics Study’, Economica, 69, 273 113–41 Glick, R and Rose, A K, (2002) ‘Does a Currency Union Affect Trade? The Time Series Evidence’, European Economic Review 46 1125–1151 Frankel, J and Rose, A K (2002). ‘An Estimate of the Effect of Common Currencies on Trade and Income’, Quarterly Journal of Economics, 117, 437–466. Greenaway, D and Kneller, R (2004) ‘Industry Differences in the Effect of Export Market Entry: Learning by Exporting?’, GEP discussion paper 2004/33 Nottingham University 8 Greenaway, D and Yu, Z (2004) ’Firm Level Interactions Between Exporting and Productivity: Industry Specific Evidence’, GEP discussion paper 2004/01 Nottingham University Loos, E (2007) ‘Language Policy in an Enacted World: The Organization of Linguistic Diversity’ Language Problems and Language Planning 31, 1, 37–60. McCallum, J (1995) ‘National Borders Matter: Canada-US Regional Trade Patterns’, American Economic Review 85 3 615–23 Grin, F (2003) ‘Language Planning and Economics’, Current Issues in Language Planning, 4, 1, 1–66 Melitz, J (2002) ‘Language and Foreign Trade’, University of Strathclyde, CREST-INSEE, and CEPR Hagen, S., Foreman-Peck, J, and. Davila-Philippon S (2006) ELAN: Effects on the European Economy of Shortages of Foreign Language Skills in Enterprise. Brussels: European Commission. A report commissioned from CILT, the National Centre for Languages by the Directorate for Education and Culture of the European Commission and prepared by CILT in association with InterAct International Ltd. Ravenstein, E G. (1885) ‘The Laws of Migration’ Journal of the Royal Statistical Society, 48 2 167–235. Rose, A K and Wincoop, E van (2001) ‘National Money as a Barrier to International Trade: The Real Case for Currency Union’, American Economic Review 91, 2, 386– 390 Harris, R and Li, Q Cher (2007) Firm level empirical study of the contribution of exporting to UK productivity growth , Final Report to UKTI Rosen, S (1992) ‘Distinguished Fellow: Mincering Labor Economics’ Journal of Economic Perspectives 6, 2, 157– 170 Helpman, E., Melitz, M J and Yeaple, S R (2004) ‘Export versus FDI with Heterogeneous Firms’, American Economic Review, 94, 1, pp. 300–316 Saiz, A and Zoido, E (2005) ‘Listening to What the World Says: Bilingualism and Earnings in the United States’, Review of Economics and Statistics, August 87(3): 523–538 Henley, A and Eleri Jones, R (2005) ‘Earnings and Linguistic Proficiency in a Bilingual Economy’, Manchester School 73, 3, pp. 300–320 Wagner, D, Head, K and Ries, J (2002) ‘Immigration and the Trade of Provinces’, Scottish Journal of Political Economy 49, 5, 507–525 Hutchinson, W K (2005) ‘Linguistic Distance as a Determinant of Bilateral Trade’, Southern Economic Journal 73(1) 1–15 Williams, J E M and Chaston, I (2004) ‘Links between the Linguistic Ability and International Experience of Export Managers and their Export Marketing Intelligence Behaviour’, International Small Business Journal 22, 5, 463–486 Hutchinson, W K (2002). “Does Ease of Communication Increase Trade? Commonality of Language and Bilateral Trade,” Scottish Journal of Political Economy, 49, 544–556 Konya, I (2006) ‘Modeling Cultural Barriers in International Trade’ Review of International Economics, 14, 3, 494–507 2