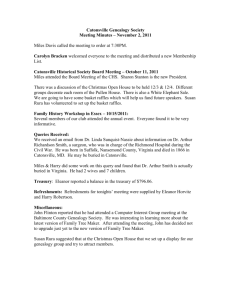

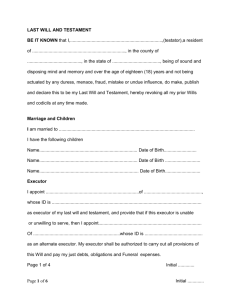

Estates (Black) - NA (11)

advertisement