Standards - Le Bonheur Children`s Hospital

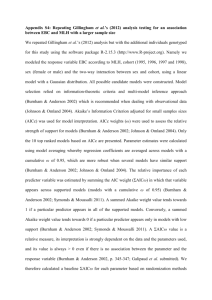

advertisement