natural-gas-broker-rebate-programme-agreement

advertisement

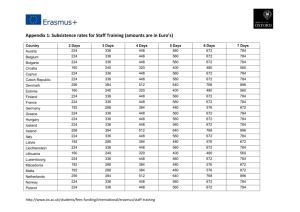

THIS INCENTIVES FRAMEWORK AGREEMENT (the Agreement) is entered into on (the Effective Date). _____ 20 BETWEEN (1) CME EUROPE LIMITED (company number 8189042), incorporated under the laws of England and Wales, whose registered office is at One New Change, London EC4M 9AF, England (the Exchange); and (2) [NAME OF PARTICIPANT] (company number []), organised and existing under the laws of [], whose registered office is at [] (the Participant), each a Party and together the Parties. WHEREAS (A) The Exchange is a recognised investment exchange under section 290 of the Financial Services and Markets Act 2000 and acts in relation to certain transactions under the terms of the Exchange Rules as amended from time to time; (B) The Exchange lists certain products and operates incentive programmes for Members and Customers in respect of these products in return for the Participant to register with the Exchange and meeting certain conditions; (C) The Participant intends to trade in the Products; and (D) The Participant wishes to participate in incentive programme(s) operated by the Exchange and agrees to be subject to the terms and conditions of this Agreement in that respect. IT IS AGREED as follows: 1 Definitions and interpretation 1.1 In this Agreement, unless defined herein or the context requires otherwise, capitalised words and phrases shall have the same meaning as set out in the Exchange Rules. 1.2 In this Agreement, unless otherwise specified: 1.2.1 the provisions of Exchange Rules 1.2.4, 1.2.5, 1.2.6, 1.2.7, 1.2.8, 1.2.9 ,1.2.10, (regarding interpretation) shall apply; 1.2.2 the recitals and the headings are inserted for convenience only and do not affect the interpretation of this Agreement; 1.2.3 references to clauses and schedules are to clauses of, and schedules to, this Agreement and references in a schedule to a paragraph are to a paragraph of that schedule; 1.2.4 the Agreement includes all schedules but, in the event of any conflict between the terms of a schedule and the main clauses of this Agreement, the main clauses of this Agreement shall take precedence; and CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) 1.2.5 references to this Agreement or any other document are to that document as from time to time amended, restated, novated or replaced, however fundamentally. 1.3 For the purposes of applying the Exchange Rules referred to in this Agreement to a Participant that is not a Member of the Exchange, such Rules shall apply to a non-Member Participant as if it were a Member. However, these Rules shall apply only insofar as is both explicitly identified herein and as is necessary to achieve the purposes of this Agreement. In no circumstances shall references to the Exchange Rules create any rights under the Exchange Rules for non-Member Participants. To this end, Exchange Rule 2.1.1 remains in full force and effect. Provisions relating to Transactions, Back-Off Transactions, or Contracts in the Exchange Rules referenced in this Agreement shall take no effect in respect of Participants that are not Members. 2 Obligations of the Participant 2.1 With effect from the Effective Date, the Participant agrees to comply with and be bound by the terms of this Agreement. 3 Incentive programmes 3.1 The parties may enter into any number of incentive programmes pursuant to this Agreement (subject to availability and subject to the criteria specified in each programme) by executing a Schedule in respect of an incentive programme. 3.2 The description and conditions of each incentive programme shall be specified in the relevant Schedule. 3.3 In the event the Participant fails to meet the conditions of an incentive programme pursuant to a Schedule, the Exchange may remove the Participant from that incentive programme. 3.4 The Exchange reserves the right to unilaterally modify incentive programmes, such changes to be communicated in a Notice published on the Exchange’s Website from time to time. 3.5 The Exchange represents and warrants that all terms of the relevant incentive programme represent the same or no less favourable terms as those applicable to all participants of that incentive programme. If the Exchange offers more favourable terms to any other person, it shall adjust the terms of the relevant incentive programme to reflect those more favourable terms for all the participants of that incentive programme, provided that the Exchange will notify the Participant in accordance with 7.2.2. 4 Confidentiality 4.1 Each Party will treat as confidential all information obtained from the other Party under or in connection with this Agreement which is designated as confidential (Confidential Information). The recipient Party will not (1) disclose Confidential Information to any person (except only to those employees, agents, sub-contractors, suppliers and other representatives who need to know it); or (2) use Confidential Information for purposes other than performing under this Agreement, without the other Party’s prior written consent (not to be unreasonably withheld or delayed). 4.2 Clause 4.1 will not extend to information which: 4.2.1 was in possession of the recipient Party (with full right to disclose) before receiving it; 4.2.2 is already or becomes public knowledge (otherwise than as a result of a breach of clause 4.1); 4.2.3 is independently developed by the recipient Party without access to or use of such information; or 4.2.4 is required to be disclosed by any Applicable Law or Regulatory Authority. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) 4.3 Each Party will ensure that all persons to whom it discloses any Confidential Information are aware, prior to disclosure, of the confidential nature of the information and that they owe a duty of confidence to the other Party. 4.4 Each Party will establish and maintain security measures to safeguard information and data of the other Party in its possession from unauthorised access use or copying. 4.5 Upon termination of this Agreement any Confidential Information received by a Party will be destroyed or returned to the disclosing Party (on the disclosing Party’s written request) and shall not thereafter be retained in any form by the receiving Party. Notwithstanding the foregoing, copies of Confidential Information that are required to be retained by Applicable Law or monitoring, compliance or audit requirements or that are created pursuant to any automated archiving or back-up procedures which cannot reasonably be deleted may be retained, however, such Confidential Information shall continue to be subject to the terms of this Agreement. 5 Term and termination 5.1 An incentive programme will operate for the period specified in the relevant Schedule or such date which will be communicated in a Notice published on the Exchange’s Website. 5.2 An incentive programme may be terminated through any of the following methods: 5.2.1 upon thirty (30) days written notice given by either Party to the other Party; or 5.2.2 in accordance with 3.3 above; or 5.2.3 upon expiry of the incentive programme; or 5.2.4 immediately, upon written notice being given by the Exchange to the Participant, if the Exchange is required (by any Regulatory Authority or under any Applicable Law) to terminate the relevant incentive programme. 5.3 Notwithstanding the above, termination of an incentive programme shall not affect the existence or validity of this Agreement. 5.4 This Agreement shall terminate: 5.4.1 upon thirty (30) days written notice given by either Party to the other Party; or 5.4.2 immediately, upon written notice being given by the Exchange to the Participant, if the Exchange is required (by any Regulatory Authority or under any Applicable Law) to terminate the Agreement. 5.5 Upon termination of the Agreement for whatever reason all incentive programmes pursuant to any Schedule(s) shall automatically terminate. 5.6 On termination under clause 5.4 above, this Agreement shall cease to have effect except for clauses 1, 4, 7 (except clauses 7.2 and 7.3) and 8. 6 Representations and warranties 6.1 The Participant represents and warrants that it: 6.1.1 is duly incorporated and validly existing under the laws of its country of incorporation; 6.1.2 has the capacity, and has taken all necessary corporate action to authorise it, to execute this Agreement and to perform the obligations it is expressed to assume under it; 6.1.3 has duly executed the Agreement and its execution does not, and the performance of its obligations under this Agreement will not, contravene or violate its constitutional documents, any Applicable Law, rights of any third parties or agreements to which it is party; and CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) 6.1.4 the obligations assumed by it under this Agreement are legal, valid, binding and enforceable obligations; and 6.1.5 is currently not subject to restrictions administered or imposed by the European Union, HM Treasury, the Office of Foreign Assets Control of the U.S. Department of the Treasury, the United Nations Security Council, any other Regulatory Authority or any other government entity or regulatory authority with jurisdiction over the Participant. 6.2 The Participant undertakes to notify the Exchange immediately in the event of its ceasing to be able to make any of the representations, warranties and undertakings set out in clause 6.1. 6.3 Each representation and warranty set out in clause 6.1 shall be deemed to be repeated on each Business Day during the term of the Agreement. 7 Miscellaneous 7.1 Notices 7.1.1 A notice or other communication given under or in connection with this Agreement (a Notice) must, unless otherwise agreed, be: (a) in writing; (b) in English; and (c) sent by a Permitted Method to the Notified Address. 7.1.2 The Permitted Method means any of the methods set out in column (1) below. Subject to any other provision in this Agreement a Notice given by the Permitted Method will be deemed to be given and received on the date set out in column (2) below. (1) Permitted Method (2) Date on which Notice deemed given Personal delivery If left at the Notified Address before 5pm on a Business Day, when left and otherwise on the next Business Day Ordinary pre-paid airmail or pre-paid Six Business Days after posting recorded or special delivery (or the nearest local equivalent in the jurisdiction of the sender), where the Notified Address is in one country and the Notice is sent from another E-mail, with the Notice attached in PDF On receipt of an automated delivery receipt or format confirmation of receipt from the relevant server if before 5pm on a Business Day and otherwise on the next Business Day 7.1.3 The Notified Address of each of the parties is set out below: Name of party Address E-mail address Marked for the attention of: CME Europe One New Change, CMEEL Incentives Framework Agreement legalnotices@cmegroup.com Legal Version: 3.2 (29 July 2015) Limited London EC4M 9AF Department United Kingdom Participant 7.2 Amendments 7.2.1 Subject to clause 7.2.2, no purported variation of this Agreement shall be effective unless it is in writing, refers specifically to this Agreement and is executed by each Party. 7.2.2 The Exchange shall be entitled to make any such amendments to the Agreement as it reasonably considers necessary or as may be required by Applicable Law or any Regulatory Authority from time to time by providing prior written notice of any such amendments to the Participant. In addition, the Exchange shall be entitled to make any such amendments to incentive programme(s) by notifying the Participant in accordance with clause 3.4 above. 7.3 Assignment 7.3.1 Subject to clause 7.3.2, neither Party may assign, delegate, sub-contract, transfer or create an Encumbrance over any or all of its rights and obligations under this Agreement without the prior written agreement of the other Party. Such agreement is not to be unreasonably withheld. 7.3.2 The Exchange shall be entitled to assign any or all of its rights or benefits under this Agreement to any Affiliate of the Exchange provided that if any such assignee shall cease to be an Affiliate of the Exchange then (unless such rights shall previously have been assigned to a continuing Affiliate of the Exchange or the parties have agreed otherwise) such rights shall terminate. 7.4 Waiver 7.4.1 Except as specifically provided in this Agreement, no waiver of any of the provisions or any part thereof shall be effective unless the same shall be in writing, and then such waiver shall be effective only in the specific instance, for the purpose for which the same is given, and such waiver shall not operate as a waiver of any future application of such provision or part thereof. 7.4.2 The waiver of any right and the failure to exercise any right or to insist on the strict performance of any of these provisions, shall not operate as a waiver of, or preclude any further or other exercise or enforcement of that or any other right. 7.5 Severability 7.5.1 Each of the clauses in this Agreement is severable and distinct from the others. It is intended that every provision shall be and remain valid and enforceable to the fullest extent permitted by law. If any clause or part of any clause is or at any time becomes to any extent invalid, illegal or unenforceable for any reason, it shall to that extent be deemed not to form part of this Agreement but the validity, legality and enforceability of the remaining provisions in the Agreement shall not be thereby affected or impaired. 7.6 Entire Agreement 7.6.1 This Agreement, the Exchange Rules where applicable (as described in clause 1.2.1), constitute the entire agreement between the Parties and supersede any prior agreement, understanding, undertaking or arrangement between the Parties relating to the subject matter of the Agreement. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) 7.6.2 The Participant acknowledges and agrees that by entering into this Agreement, it does not rely on any statement, representation, assurance or warranty of any person (whether a Party to the Agreement or not and whether made in writing or not) other than as expressly set out in the Agreement or (regarding only Participants that are Members) the Rules. 7.6.3 The Participant agrees that it shall have no right or remedy (other than for breach of contract) in respect of any statement, representation, assurance or warranty (whether made negligently or innocently) other than as expressly set out in this Agreement. 7.6.4 Nothing in this Agreement shall exclude or limit the liability of either Party which cannot by law be excluded. The Exchange shall not in any circumstances have any liability for any losses or damages which may be suffered by Participant under or in connection with this Agreement, whether the same are suffered directly or indirectly or are direct or consequential, and whether the same arise in contract, tort (including negligence) or otherwise howsoever which fall within the categories of loss of profits; loss of anticipated savings; loss of business opportunity; loss of goodwill; loss or corruption of data or information; and any special, indirect, or consequential loss or damage, whether such loss or damage was foreseeable or in the contemplation of the parties and howsoever arising. 7.7 Relationship of Parties 7.7.1 Nothing in this Agreement is intended to create a partnership or legal relationship of any kind that would impose liability on one Party for the act or failure to act of the other Party, or to authorise either Party to act as agent for, make representations, act in the name of, on behalf of or otherwise bind the other Party. 7.8 Counterparts 7.8.1 This Agreement may be entered into in any number of counterparts and by the Parties to it on separate counterparts, and each of the executed counterparts, when duly exchanged or delivered, shall be deemed to be an original, but taken together, they shall constitute one and the same instrument. 7.9 Service of process 7.9.1 If the Participant does not have an office or place of business in England or Wales, it hereby irrevocably authorises and appoints [Participant to insert name and address of process agent] (or such other person having an office or place of business in England or Wales as the Participant may at any time in the future substitute by giving prior notice in writing to the Exchange (the Process Agent)) to accept on its behalf service of all legal process arising out of or in connection with any arbitration proceedings or other related proceedings before the English courts commenced in connection with this Agreement. Further, the Participant agrees that failure by the Process Agent to notify the Participant of the process will not invalidate the proceedings concerned. 7.10 Contracting out of third party rights 7.10.1 Except as identified expressly herein, no term of this Agreement is enforceable under the Contracts (Rights of Third Parties) Act 1999 by a person who is not a party to this Agreement. 8 Governing law and arbitration 8.1 This Agreement and any non-contractual obligations connected with it and the Exchange Rules (as described in clause 1.2.1) shall be governed by and construed in accordance with the laws of England and Wales. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) 8.2 The provisions of Exchange Rules 2.8.2, 2.8.3, 2.8.4 and 2.8.5 (regarding disputes and arbitration) shall apply to this Agreement save that any reference to the Exchange Rules shall be interpreted as a reference to this Agreement. ___________ THIS AGREEMENT has been entered into on the Effective Date. Signed on behalf of CME EUROPE LIMITED acting by [NAME OF DIRECTOR], director …………………………….. Director and [NAME OF DIRECTOR], director …………………………..… Director Signed on behalf of [NAME OF PARTICIPANT] acting by [NAME OF DIRECTOR], a director …………………………….. Director CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) Schedule 1 Power and Natural Gas Broker Rebate Programme Eligibility The Power and Natural Gas Broker Rebate Programme is open to any brokers (including to brokers already Participants of the existing Natural Gas Rebate Scheme) that submit trades for clearing in the Power and/or Natural Gas products listed in the Annex 1 (“Applicable Products”) on behalf of third party clients. Description and Details of the Programme The Exchange is introducing a Broker Rebate Programme to help the development of liquidity in the Applicable Products. The Exchange will rebate back to the Participant 15% (to the nearest decimal) of fees charged by the Exchange to the Participant (as specified in Annex 1) in return for the Participant providing market data for the Applicable Products in accordance with Annex 2. Applicable Products The Broker Rebate Programme will cover eighteen (18) Natural Gas contracts and eight (8) Power contracts as listed in Annex 1. The Exchange may in its discretion amend the list to add new products. Billing and Payment of Rebates Normal billing conditions apply. Rebates will be paid out to Participants within thirty (30) working days following the end of each calendar month. Application Process Eligible brokers wishing to participate must register their interest with the Exchange by executing the relevant documentation. Details of the Broker Rebate Programme will be available on the Incentive Programmes page of the Exchange website: http://www.cmegroup.com/europe/membership/incentive-programs.html. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) Programme Compliance The Exchange will review the overall performance of the participants. The Exchange reserves the right to remove any Participant that fails to provide market data in accordance with Annex 2. Programme Conditions The Exchange will review transactions that qualify for the Broker Rebate Programme in order to check that trades have a genuine economic rationale and are exposed to market risk. Trades may be discounted from the calculation of total volume for a Participant where trading is believed to have been initiated for the primary purpose of satisfying the requirements of the Broker Rebate Programme. Programme Commencement Date and Term The Broker Rebate Programme will run for a period of twelve (12) months commencing from 1 June 2015 until 31 May 2016. The Exchange reserves the right to extend the term for an additional twelve (12) month period thereafter. Termination The Exchange reserves the right to unilaterally terminate this Broker Rebate Programme with thirty (30) days’ notice. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) Annex 1 Applicable Products and Rebates The table below sets out the Applicable Products included in the Broker Rebate Programme, Exchange Codes and applicable Rebates. Type Applicable Products Code Rebate per lot/side* PHYS UK NBP Natural Gas Daily Future NDE 0.003 GBP PHYS UK NBP Natural Gas Calendar Month Future NME 0.04 GBP PHYS Dutch TTF Natural Gas Daily Future TDE 0.01 EUR PHYS Dutch TTF Natural Gas Calendar Month Future TME 0.28 EUR CASH UK NBP Natural Gas (ICIS Heren) Calendar Month Future UKE 0.04 GBP CASH Dutch TTF Natural Gas (ICIS Heren) Calendar Month Future DUE 0.28 EUR CASH German NCG Natural Gas (ICIS Heren) Calendar Month Future GNE 0.28 EUR CASH German Gaspool Natural Gas (ICIS Heren) Calendar Month Future GRE 0.28 EUR CASH Austrian VTP Natural Gas (ICIS Heren) Calendar Month Future ASE 0.28 EUR CASH Italian PSV Natural Gas (ICIS Heren) Calendar Month Future IPE 0.28 EUR CASH German NCG Natural Gas (ICIS Heren) vs. Dutch TTF Natural Gas (ICIS Heren) Calendar Month Spread Future GME 0.28 EUR CASH German Gaspool Natural Gas (ICIS Heren) vs. Dutch TTF Natural Gas (ICIS Heren) Calendar Month Spread Future GGE 0.28 EUR CASH UK NBP Natural Gas (ICIS Heren) vs. Dutch TTF Natural Gas (ICIS Heren) (Euro per MWh) Calendar Month Spread Future NVT 0.28 EUR CASH Italian PSV Natural Gas (ICIS Heren) vs. Dutch TTF Natural Gas (ICIS Heren) Calendar Month Spread Future DPE 0.28 EUR CASH UK NBP Natural Gas (ICIS Heren) Daily Future UKD 0.003 GBP CASH Dutch TTF Natural Gas (ICIS Heren) Daily Future DNG 0.01 EUR CASH German NCG Natural Gas (ICIS Heren) Daily Future GRD 0.01 EUR CASH German Gaspool Natural Gas (ICIS Heren) Daily Future GND 0.01 EUR Type Applicable Products Code Rebate per lot/side CASH German Power Baseload Calendar Month Future GPB 0.75 EUR CASH German Power Peakload Calendar Month Future GPP 0.30 EUR CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) CASH French Power Baseload Calendar Month Future FPB 0.75 EUR CASH French Power Peakload Calendar Month Future FPP 0.30 EUR CASH Italian Power Baseload (GME) Calendar Month Future IPB 0.75 EUR CASH Italian Power Peakload (GME) Calendar Month Future IPP 0.30 EUR CASH Spanish Power Baseload (OMIP) Calendar Month Future SBP 0.75 EUR CASH Spanish Power Peakload (OMIP) Calendar Month Future SPP 0.30 EUR *Rounded to the nearest penny sterling or cent euro (as appropriate). CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015) Annex 2 Participant Obligations The Participant shall provide to the Exchange market data for the Applicable Products in accordance with the specified criteria below daily via email at NY-settlementteam@cmegroup.com. Where possible the Participant will provide the Exchange access to an FTP feed to collect this data. Market: UK NBP Spot/Prompt Months Quarters Seasons Calendar Years DA/WKND/WDNW/BOM* 1st – 6th expiry** 1st – 4th expiry 1st – 10th expiry 1st – 3rd expiry Market: Dutch TTF Spot/Prompt Months Quarters Seasons Calendar Years DA/WKND/WDNW/BOM 1st – 6th expiry 1st – 4th expiry 1st – 5th expiry 1st – 5th expiry Market: German NCG; German Gaspoool; Austrian VTP and Italian PSV Spot/Prompt Months Quarters Seasons Calendar Years DA/WKND/WDNW/BOM 1st – 4th expiry 1st – 3rd expiry 1st – 5th expiry 1st – 3rd expiry Market: German, French, Italian, Spanish Power Spot/Prompt Months Quarters Calendar Years DA/WKND/WEEK/BOM 1st – 6th expiry 1st – 8th expiry 1st – 5th expiry *DA means Day Ahead; WKND means Weekends; WDNW means Within Day Next Week; and BOM means Balance of the Month. **1st expiry period means the immediate front period. CMEEL Incentives Framework Agreement Version: 3.2 (29 July 2015)