index - Azerweb.com

advertisement

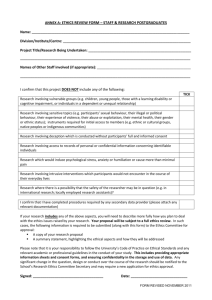

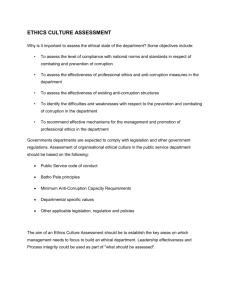

Statement of Work Material Development and Delivery of Training Workshop at the Azerbaijan Bank Training Centre (ABTC) in Baku, Azerbaijan Proposed Time: April 1, 2008 – June 15, 2008 Language: Azerbaijani Target Audience: EFCB target audience: bank employees with at least secondary (vocational) education and who are starting their careers in a bank, and bank employees already working in a bank but without any formal professional banking education. Assignment Components: 1) Preparation of EFCB course materials for Section C – Ethics Module (as specified in attached Appendix 1), including 24 text pages of self-study materials, Powerpoint presentations and exercises (for workshops). A first draft of the materials would need to be delivered to ACDI/VOCA and ABTC by April 30, 2008 for review and comment. The final version of the text materials would be due no later than May 30, 2008. 2) Delivery of 1 – 4 hour EFCB workshop: (see description in Appendix 2) a. Management & Business Aspects Notes: ABTC is waiting for accreditation confirmation from the EBTN Network on their EFCB course. Dates for the workshops are subject to clarification relating to the accreditation procedures. Send your CV’s to Khayal Guliyev by March 16 2008 E-mail: khguliyev@acdivoca.org.az Appendix 1 Text Descriptions: EFCB (minimum) Requirements – Section C – Ethics: ABTC No. C.2 C.2.1 C.2.1.0 C.2.1.1 C.2.1.2 C.2.1.3 C.2.2 C.2.2.0 C.2.2.1 C.2.2.2 C.2.2.3 C.2.2.4 C.2.3 C.2.3.0 C.2.3.1 C.2.3.2 C.2.3.3 C.2.3.3-1 C.2.3.3-2 C.2.3.3-3 C.2.3.4 C.2.3.5 ABTC TOPICS ETHICS ETHICAL THINKING The student is able to describe in a broad way what is meant by ethical thinking. He/she can describe the notion ethics. He/she can define what factors influence ethical thinking He/she can relate mission statements with ethical behaviour. BUSINESS ETHICS The student is able to interpret how business ethics can be viewed. He/she can define the notion of business ethics. He/she can describe the notion of normative ethics and the factors on which it is based. He/she can contrast the notions of normative and analytical ethics. He/she can show how and why notions as duty, rights and interests influence ethical thinking. BANKING AND ETHICS The student is able to describe why ethical behaviour is important in the banking sector. He/she can describe the bank-customer relationship in other terms than contractual and place codes of conduct/ethics in this context. He/she can define the notions of trust and confidentiality in banking and describe the tension between these notions and commercial banking activities. He/she can define terms like: Money laundering: can define terms like Insider trading: can define terms like Chinese walls: can define terms like He/she can describe the notion of compliance. He/she can interpret the impact of change on corporate culture and its possible effects on ethical behaviour. Appendix 2 EFCB Workshop Descriptions: Topic (WS6) Management & Business Aspects Date Half-day, [TBD] Managerial Products, Tools and Strategies 1. Bank Financial Statements and Balance Sheets 2. Costs and Pricing 3. Product Differentiation i. Interest Margin Products ii. Fee-based Service Products iii. Off-Balance Products 4. E-banking and electronic intermediation Ethics 1. Ethical Thinking 2. Business Ethics 3. Banking and Ethics 4. Corporate Governance Management 1. Organization Structure and Corporate Culture 2. Planning and Control 3. Management vs. Leadership i. Motivation ii. Communication iii. Conflict Resolution 4. Human Resource Management i. Hiring (roles and functions w/i Banks?) ii. Career Planning iii. Training iv. Performance Assessment iv. HRM Practices Modules Sessions - Introduction Open Discussion Session Questions – Answers