Alkali Manufacturers Association of India

advertisement

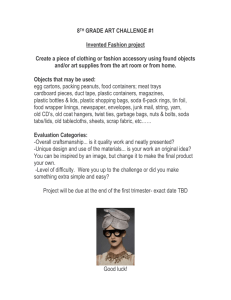

ALKALI MANUFACTURERS' ASSOCIATION OF INDIA PRE-BUDGET MEMORANDUM 2012-2013 The Industry Profile The Chlor-Alkali Industry in the country produces mainly Caustic Soda, Chlorine and Soda Ash. The products of the industry are of vital importance and their uses are:a) Caustic Soda Soaps and Detergent Industry Pulp and Paper Industry Textile Processing Industry Aluminium Smelting Dyes and Dyestuff Industry Plastic Polymers Rayon Grade Pulp Pharmaceuticals Electroplating Adhesives/Additives. b) Chlorine, By-product of Caustic Soda Industry is very important for manufacturing of PVC, one of the five major Thermoplastic Commodity Plastics. Besides this, it is used in disinfection of drinking water, pharmaceutical industry and various other chemical industries. Because of the strong oxidizing properties of Chlorine, it is effectively used to control bacteria and viruses in drinking water that can cause devastating illness such as Cholera. Use of Chlorine is very important for the Countries like India especially in case of floods. 85% of the pharmaceuticals rely on Chlorine Chemistry including medicines that treat heart disease, cancer, AIDS and many other life threatening diseases. Chlorine tablets are also used by public health workers in rural areas. c) Soda Ash is used in Glass Industry, Soaps & Detergents, Silicates and various other Chemical Industries. As stated above the growth of Caustic Soda and Soda Ash Industry is very important for the Nation and if competitiveness of this Industry is maintained, it can certainly grow at a much faster rate. At present the world production of Caustic Soda is 80 million MTPA while Indian capacity is only 3.2 million tonnes i.e. 4% of the World capacity, while China has a capacity of 28 million tonnes i.e. 35% of the World capacity. It is due to unattractive government policies. Similarly Soda Ash capacity of the world is 55 million tonnes. China & US are the biggest producing countries accounting for 40% & 20.5% of total global Soda Ash capacity, while Indian capacity is only 3 million tonnes. Due to high cost of inputs & finally cost of production, lot of ALKALI MANUFACTURERS' ASSOCIATION OF INDIA Soda Ash is imported into India at lower cost, which affects the capacity utilization of the industry. The Government of India have not paid so far adequate attention to these two basic industries. AMAI may like to request the Government to consider the following factors:1. Power Cost The major input in Chlor-Alkali Industry is Power. In case of Caustic Soda, power constitutes more than 60% of the cost of production. It is strongly felt that this major input should be made available to the industry at internationally competitive prices. A chart showing comparative rates of power in India & other countries is given at Annexure-I. Today, the cost of power in India is quite high. In some States, it is ranging from Rs.5.35 to 6.00 per unit. With such high power cost, the industry cannot compete in the International market. If we compare the power cost internationally India is at a disadvantage and the reason for this are:I. State Electricity Boards are not in good health. II. In order to meet the challenges of the higher cost of power various industries have installed captive power plants, these are again taxed by the Governments in various ways like:(i) Higher cost of coal for captive power plants which have been recently increased and the coal pricing policy of 2007 have been violated for captive power plants only. (ii) The coal which is the main source of power generation have been burdened in the Union Budget 2010-11 by imposition of Clean Energy Cess of Rs. 50/- per ton which is not vatable, Inspite of coal prices having been increased, the availability is poor. Government should scrap the Coal Nationalization, in order to increase the availability of Coal at reasonable prices. Coal blocks need to be allocated on priority basis to power intensive industries like Chlor-Alkali. (iii) The import of power equipments for captive power plants is subject to import duty at 7.5% inspite of the fact that coal based power plants (most of the captive power plants) are quite expensive and per MW cost of installation is around Rs. 6 crores. Since customs duty is not brought at ‘0’ level the capital cost have increased. (iv) Some of the captive power plants use the fuel oils for power generation. Government of India charges 5% customs duty on the fuel oils which makes the power more expensive as compared to other countries. The Government have recently reduced customs duty on FO from 10% to ALKALI MANUFACTURERS' ASSOCIATION OF INDIA 5% vide Notification No.52/2011 dated 25/6/2011 to provide little relief to the power intensive industries like caustic soda. However, it is necessary to abolish customs duty on FO to make power intensive Chlor Alkali industry competitive. (v) Besides above, the State Government are also very keen to realize more and more money from the captive power plants in which they have no contribution at all, by imposing cess, electricity duty and various other taxes. Industry have been requesting that in order to avoid the cascading effect of taxes the Government should take steps to make these taxes mod- vatable, but so far these issues have not been considered by the Government at all. (vi) Natural Gas for Captive Power Units is in last priority. The allocation of NG and pricing for NG used for Captive Power Units feeding power to Caustic Soda and Soda Ash should be at Administrative Price Mechanism and KG basin gas to be allocated. 2. Import of Membrane Cell Plants 95% of the Caustic Soda Industry today is operating on Membrane Cell technology. While duty on new plants including membrane & parts is 2.5% (Amended Notification No.21/2002 S.No.285 in Union Budget 2011-12), the spare parts of the existing plants are subject to customs duty of 10% + CVD + ACVD. This makes the maintenance of the plants more expensive. AMAI requested the Government to allow duty free import of the spare parts but so far it remains unheard. 3. Equal status in various free trade agreement is not accorded to India. Exports of Caustic Soda and Soda Ash to Pakistan are still in banned list whereas Pakistan is exporting these products to India. Additional Points a) Levy of 4% Additional Duty of Customs under Sec 3(5) and accumulation of cenvat: The Special additional duty under Section 3(5) of Customs Tariff Act was initially levied in 2005 budget on items bound for information Technology agreement and items used for manufacture of electronics / IT goods. This levy was allowed cenvat facility. This Special additional duty was extended to all imported goods in the 2006 budget. For traders who import and sell the goods, this levy was granted as refund from September 2007 by notification 102/2007. By allowing cenvat and granting refund there is no much revenue contribution to the exchequer, but only the fund of industries and traders are blocked for few months till utilization of the cenvat or grant of refund. ALKALI MANUFACTURERS' ASSOCIATION OF INDIA The government is to be represented for abolishing the levy as no real contribution accrues to the government from it. b) Reduction of Central Sales Tax (CST) from 2% to 1% as announced during the road map for implementation of GST is to be adhered. c) Section 11 of the Electricity Act 2003 to be amended to curtail the powers of the State Governments to restrict open access for inter-state sale of power. d) Levy of 5% Excise duty on Coal under Chapter 27 of the Excise Tariff: The Government has levied 5% excise duty on coal. The same is levied on imported coal as counter vailing duty of customs (CVD). In India, the power cost is exorbitantly high and the manufacturing industries had put up power plants to obtain reliable quality power at affordable cost as the same could not be expected from the State Electricity Board. The cost of power is in the region of Rs.1/- to 2/in the neighbouring countries like China, while in India, it is in the region of Rs.5/to 6/-. In spite of such high power cost, our industries are competing in the global market. The Finance Minister in his 2010 budget had also stated the thrust is put on the manufacturing sector to contribute to the GDP. To achieve the above objective, the basic ingredient viz., power for industries should be available at affordable cost. Hence, the excise duty / CVD on coal should be withdrawn and failure would make our products uncompetitive in the global market, besides, having inflationary effect. e) Disposal of flyash from the coal based power plants is a major problem and small scale brick manufacturers are the only consumers for the flyash. The transportation is a major cost. To have effective use of the fly ash at the generation stage itself, Cement should be exempted from excise duty and sales tax, for manufacture of flyash bricks by the coal based power plant itself at its site. This would reduce the transportation cost and would be an effective means to utilize the flyash. f) Technology upgradation fund to be established for the chlor-alkali industries similar to the TUF scheme of Textile industry. Our country’s minerals exports earn major revenue in the foreign exchange, but the value addition attained from the above mineral wealth is very nominal. The Government should set up an infrastructure fund for the minerals like Ilmenite ore to make it into value added products. Such fund is already implemented by the government for the textile sector and if it is provided for ilmenite ore and other minerals the existing industries can upgrade the technology and be competitive globally, earning more foreign exchange to the country and providing employment in the rural areas. Rural employment would also help the government in containing urban population growth and its resources would not be under strain. ALKALI MANUFACTURERS' ASSOCIATION OF INDIA The Government should also make available funds through the Technology Upgradation Fund similar to that of textiles, for Chloro Alkali Industry which are power intensive, to make investments in wind power and technologies reducing the power consumption. Such a measure would help the industry to reduce the power cost and survive the competition from global players. g) Chlorination of drinking water: The Government should further promote the chlorination of drinking water as a precautionary measure to check water-borne diseases. The Government’s local bodies should be insisted to chlorinate the water effectively. Such a measure would help the chlor-alkali industries for effective use of chlorine. h) Cenvat credit to be allowed on steel and cement used in industry for construction of plant and machineries. Cenvat should be allowed on diesel and vehicles used inside the plant operations for movement of goods within the factory premises. Cenvat should be on all goods used in the factory either directly or indirectly. i) Abolishtion of restriction of 50% Cenvat availment on capital goods: At present the Cenvat credit rules restricts manufacturer to avail only 50% of the credit in a financial year and the balance 50% is to be availed in the subsequent financial year. The above restriction only increases the cost and there is no direct benefit or indirect benefit to the Government by the above restriction which is any way availed in the subsequent years. The Government should abolish the above restriction. Conclusion To conclude it is important to note that :i) On one hand the Government of India is entering into various Free Trade Agreement with various countries, but they are not trying to reduce the production cost of Indian industries which is quite discouraging. ii) Today the capacity of Caustic Soda & Soda Ash all over the world is increasing and these countries are exporting Caustic Soda & Soda Ash to India. In India, the industry has to take the shelter of Anti Dumping & Safeguard duty which again is not helpful sometimes. iii) The industry like Caustic Soda & Soda Ash consumes salt to the extent of 50% of the national production. This provides lot of employment to the salt workers and the transporters. iv) Quality salt supply at reasonable cost to be ensured through Government providing incentives & subsidies for R&D work for mechanization of salt production. ALKALI MANUFACTURERS' ASSOCIATION OF INDIA v) The industry adds to the kitty of the Government a sum of Rs. 2000 crores by way of taxes but, this milching cow is not properly looked after so that it could grow properly and face the international competition. vi) To reduce the cost of inputs, it is also important that interest rates are reduced and brought at international level. vii) To promote Cl2 usage, Government support is required to develop domestic ethylene capacity by providing incentives. Also, import duty on ethylene to be abolished so that ethylene instead of EDC & VCM is imported & more of domestic Cl2 is utilized for Vinyls. viii) Also to secure raw materials like Ethylene & Cl2 for producing Vinyls, investments in PCPIRs may be encouraged. Indirect import of Chlorine through EDC/VCM/PVC to be avoided by retaining appropriate duty structure. ix) Customs duty on Coal & fuel oils should be brought down to zero – to reduce the input cost. At present, duty on Coal is 2.5% and Fuel oil is 5%. x) Indian ports need to be improved on PPP model to facilitate better coastal movements to transport raw materials & feed stocks to ensure reasonable transport cost & free inter state movements. xi) GST to be implemented at the earliest. xii) Government support is required in enhanced allocation of raiway rakes to Soda Ash Industry on priority basis as all the Soda Ash plants are located in the coastal belt of Gujarat & consumer destinations are in north, east & south regions. xiii) Incentives to chemical industry units for pursuing green initiatives like providing star ratings which could facilitate fast clearances of New Projects. xiv) Facilitate Open Access & inter state wheeling of Power, especially for power intensive industries. xv) R&D for effective use of Hydrogen as green energy like in fuel cells to be encouraged. xvi) Allocation of Natural Gas for captive generation of Power for use in Caustic Soda and Soda Ash at Administered Price Mechanism. xvii) To ban import of chemicals like Caustic Soda, Soda Ash, Hydrogen Peroxide from Pakistan till Pakistan removes it from banned list. ALKALI MANUFACTURERS' ASSOCIATION OF INDIA Annexure-I AMAI Issues and Challenges of Indian Alkali Industry Power Rates for Industry in India & other Countries 0.16 0.15 USD/ KWH 0.14 0.13 0.12 0.11 0.1 0.09 0.08 0.07 0.06 or ea K Ta i pe i ic o es e C hi n M ex ia In d or w ay N en w ed S er la n d d w itz S Fi nl an ce Fr an U S 0.05 EUROPE INDIA AMONGST THE COUNTRIES WITH HIGHEST POWER COST Source:- 2010 Key World Energy Statistics by International Energy Agency