West Coast Profile Part 2

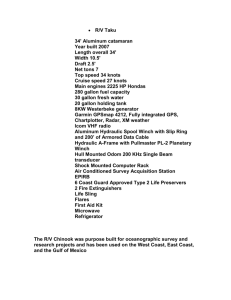

advertisement