the 1st quarter trading statement in Microsoft

advertisement

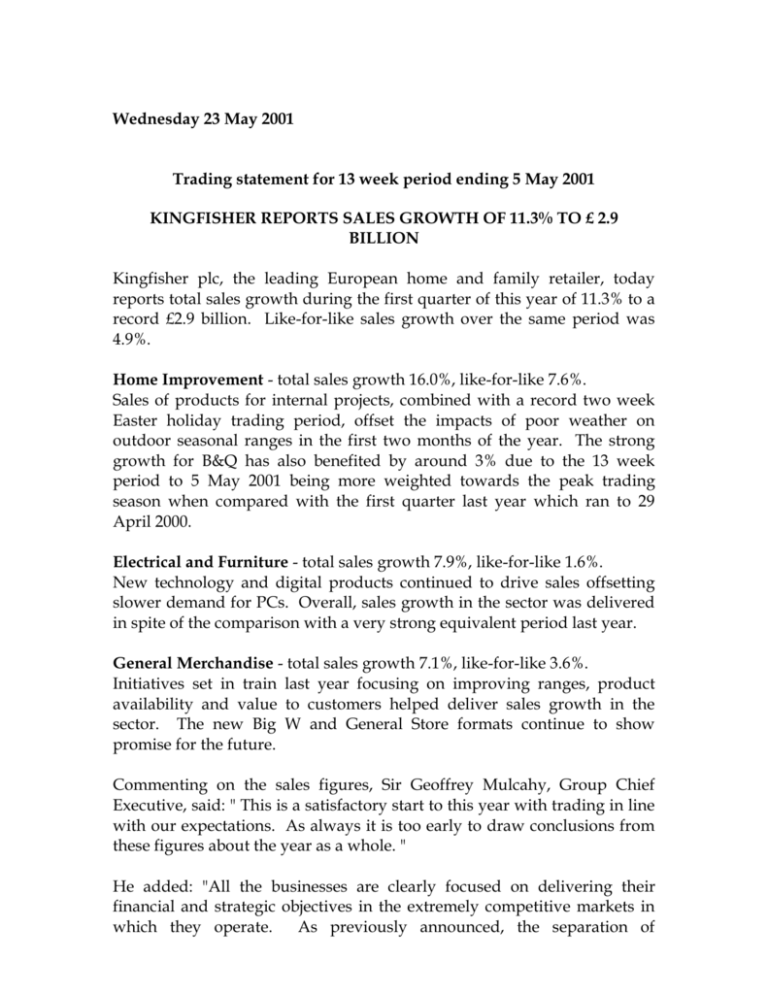

Wednesday 23 May 2001 Trading statement for 13 week period ending 5 May 2001 KINGFISHER REPORTS SALES GROWTH OF 11.3% TO £ 2.9 BILLION Kingfisher plc, the leading European home and family retailer, today reports total sales growth during the first quarter of this year of 11.3% to a record £2.9 billion. Like-for-like sales growth over the same period was 4.9%. Home Improvement - total sales growth 16.0%, like-for-like 7.6%. Sales of products for internal projects, combined with a record two week Easter holiday trading period, offset the impacts of poor weather on outdoor seasonal ranges in the first two months of the year. The strong growth for B&Q has also benefited by around 3% due to the 13 week period to 5 May 2001 being more weighted towards the peak trading season when compared with the first quarter last year which ran to 29 April 2000. Electrical and Furniture - total sales growth 7.9%, like-for-like 1.6%. New technology and digital products continued to drive sales offsetting slower demand for PCs. Overall, sales growth in the sector was delivered in spite of the comparison with a very strong equivalent period last year. General Merchandise - total sales growth 7.1%, like-for-like 3.6%. Initiatives set in train last year focusing on improving ranges, product availability and value to customers helped deliver sales growth in the sector. The new Big W and General Store formats continue to show promise for the future. Commenting on the sales figures, Sir Geoffrey Mulcahy, Group Chief Executive, said: " This is a satisfactory start to this year with trading in line with our expectations. As always it is too early to draw conclusions from these figures about the year as a whole. " He added: "All the businesses are clearly focused on delivering their financial and strategic objectives in the extremely competitive markets in which they operate. As previously announced, the separation of Kingfisher's General Merchandise businesses is well underway and is on schedule to be delivered by the end of July. Work on the demerger option has progressed well. At the same time we are well advanced with negotiations with the prospective buyers of both the main businesses. Our final decision will be based on which route ensures best value for shareholders. Having leading brands in fast growth markets combined with a track record of successful innovation and investment leave us well placed to deliver our medium term growth targets." -endNotes to editors: Kingfisher plc is one of Europe’s leading retailers. It operates principally through its two international businesses, Home Improvement and Electrical & Furniture, and its UK-focused General Merchandise business. The company employs more than 130,000 people in over 2,900 stores across 16 countries and has some of the best known retail brands in Europe, including B&Q, Castorama, Comet, Darty, BUT, Woolworths and Superdrug among others. For further information Media Enquiries Andrew Mills, Director of Corporate Affairs Gail Lavielle, Director of Corporate Communications + 44 (0) 20 7725 5776 + 33 (0) 1 43 18 52 68 Tom Wyatt - Financial Dynamics + 44 (0) 20 7269 7204 Broker and Institutional Enquiries Ian Harding, Director of Investor Relations Graham Fairbank, Head of Corporate Communications + 44 (0) 20 7725 5776 + 33 (0) 1 43 18 52 26 Kingfisher plc + 44 (0) 20 7724 7749 Kingfisher Website www.kingfisher.com QUARTER 1 TRADING STATEMENT First Quarter 2001/02 Sales for 13 week period ending 5 May 2001 2001/02 2000/01 £m £m 795.0 438.6 149.8 677.9 390.7 124.2 17.3%* 12.3% 20.6% 11.8%* 4.2% (3.8%) 1,383.4 1,192.8 16.0% 7.6% Darty (7) Comet ProMarkt (4,7) BUT (7) Other (5) 282.9 272.8 139.2 82.2 41.4 266.2 235.8 134.9 75.5 46.3 6.3% 15.7% 3.2% 8.9% (10.6%) 0.3% 7.2% (2.3%) 3.8% (11.7%) Electrical and Furniture sector 818.5 758.7 7.9% 1.6% Woolworths Superdrug Other (6) 394.2 211.0 118.4 387.5 192.8 95.6 1.7% 9.4% 23.8% 1.2% 6.9% 12.2% General Merchandise sector 723.6 675.9 7.1% 3.6% 2,925.5 2,627.4 11.3% 4.9% 698.9 450.7 221.9 130.9 643.3 438.4 222.1 124.3 8.6% 2.8% (0.1%) 5.3% UK (1) France (2,7) International (3) Home Improvement sector Total Group % increase/(decrease) Total sales Like-for-like % % Euro (2001/02: £1 = EUR 1.59; 2000/01: £1 = EUR 1.65) Home Improvement France (EURm) Darty (EURm) ProMarkt (EURm) BUT (EURm) The like-for-like increases are shown at constant exchange rates * The growth has benefited by around 3% due to the 13 week period to 5 May 2001 being more weighted towards the peak trading season when compared with the first quarter last year which ran to 29 April 2000. Notes (1) Home Improvement UK includes B&Q Warehouse, Supercentre and Screwfix. (2) Home Improvement France relates to domestic French operations only (Castorama France, Brico Dépôt France, Dubois Matériaux and Amiland). (3) Home Improvement International includes all Home Improvement activities outside of France and the UK. B&Q China included for the 3 months to 31 March 2001 (last year 3 months to 31 March 2000). (4) ProMarkt included for the 3 months February to April 2001 and February to April 2000 respectively (previously reported as the 3 months to 31 March 2000). (5) Electrical and Furniture Other comprises BCC, New Vanden Borre and Datart. Datart included for the 3 months to 31 March 2001. Last year includes sales of £8.5m from Electric City. (6) General Merchandise Other includes Big W, General Store, Entertainment UK, MVC, VCI and StreetsOnline. VCI included for the 3 months February to April 2001 and February to April 2000 respectively (previously reported as the 3 months to 31 March 2000). StreetsOnline included for the 3 months to 31 March 2001. Entertainment UK and VCI are not included in the like-for-like sales. (7) Castorama, Darty, ProMarkt and BUT sales are reported on a calendar month basis.