Hidden Overconfidence and Advantageous Selection

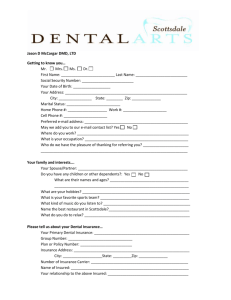

advertisement

Hidden Overconfidence and Advantageous Selection Rachel J. Huang* Assistant Professor, Finance Department Ming Chuan University, Taipei, Taiwan Yu-Jane Liu Professor, Department of Finance National Cheng Chi University, Taipei, Taiwan Larry Y. Tzeng Professor, Department of Finance National Taiwan University, Taipei, Taiwan * Corresponding Author. Finance Department, Ming Chuan University, 250 Chung Shan N. Rd. Sec. 5, Taipei, 111, Taiwan. E-mail address: rachel@mcu.edu.tw; tel: 886-2-28824564 ext 2871. Abstract Theories of asymmetric information predict the occurrence of the risk and the coverage of the insurance should be positively correlated. However, empirical researches find little support of asymmetric information. Our paper provides a theoretical model of hidden overconfidence to explain advantageous selection in the insurance market, showing that the relationship between insurance coverage and loss probability is negative or insignificantly different from zero. We demonstrate that, when the deviation in belief of the loss probability between the rational type of insured and the overconfident type of insured is relatively large, the rational type of insured takes precautions to reduce his or her loss probability, and purchases more coverage at a low premium rate. Meanwhile, the overconfident type of insured will not make any effort, and purchase less coverage at a high premium rate. In addition, when the deviation in belief of the loss probability between the rational type of insured and the overconfident type of insured is relatively small, neither the rational type of insured nor the overconfident type of insured expend any effort to reduce the loss probability, and both purchase insurance at the same premium rate. Our model confirms that the equilibrium in insurance market may settle on where individuals who are more subjectively optimistic regarding their loss probability are insured with less coverage. JEL classification: D80, G22, C30 Keywords: insurance market, advantageous selection, asymmetric information, moral hazard, adverse selection, overconfidence. 1 1. Introduction It is well known that theories of asymmetric information, both those related to adverse selection and moral hazard, predict that the occurrence of the risk and the coverage of the insurance should be positively correlated. Rothschild and Stiglitz (1976) show that, under adverse selection, insurance companies provide a product menu to screen the insured such that high risks choose high coverage with a high premium rate and low risks choose low coverage with a low premium rate. On the other hand, the theory of moral hazard (such as Shavell, 1979) indicates that individuals with higher insurance coverage have less incentive to prevent risk. However, most recent empirical papers find that the occurrence of the risk and the coverage of the insurance are insignificantly positively correlated (Chiappori and Salanie, 1997 and 2000; Richaudeau, 1999; Cardon and Hendel, 2001) or even negatively correlated. (Cawley and Philipson, 1999; Dionne, Gourieroux and Vanasse, 2001; McCarthy and Mitchell, 2003; Finkelstein and McGarry, 2006). De Meza and Webb (2001) propose an intriguing theory to explain why most empirical studies cannot find consistent results as predicted by asymmetric information theories. They assume that the insurance market contains two types of insured, the timid and the bold. The timid type of insured expends his or her efforts to reduce the loss probability, whereas the bold type does not. Thus, the timid type becomes a low risk, 2 while the bold type becomes a high risk. The insurer cannot observe the hidden risk preference of the insured and provide a product menu to screen the insured. De Meza and Webb (2001) show that the market equilibrium may settle where the timid type purchases insurance but the bold type does not. De Meza and Webb (2001) suggest that hidden risk preferences could help to explain advantageous selection, i.e. the insured with high coverage is in fact the insured with low risk. In this paper, we intend to show that the existence of advantageous selection could be explained by another rationale, namely, hidden overconfidence. The presence of overconfidence is a phenomenon that has broad applications in psychology1. Overconfidence stems from overestimation, being self serving and being overoptimistic. De Bondt and Thaler (1995) state that perhaps the most robust finding in the psychology of judgment is that people are overconfident. There is also an array of psychological evidence on managerial behavior (Langer, 1975; Weinstein, 1980; Larwood and Whittaker, 1977, Cooper, Woo and Dunkelberg, 1988).2 Recently, overconfidence has also manifested itself in a number of ways in financial markets. For example, people tend to under-diversify their portfolios and the under-diversification in their equity portfolio is hazardous to their wealth. (Barber and Odean, 2000; Goetzmann 1 Alpert and Raiffa (1982) show that people tend to overestimate the precision of their predictions of uncertain events. Miller and Ross (1975) find evidence that people tend to attribute their success to their own ability. People are overly optimistic, in that they think favorable things are more likely to occur than they actually do (Alpert and Raiffa, 1982; Weinstein, 1980). 2 For example, Langer (1975), Weinstein (1980) and Larwood and Whittaker (1977) show that CEOs tend to underestimate the failure of investment projects. Cooper, Woo and Dunkelberg (1988) domenstrate that entrepreneurs tend to overestimate the chances of survival. 3 and Kumar, 2003). Bailey, Kumar and Ng (2006) find that, due to overconfidence, many investors hold individual stocks and high expense funds and experience lower returns. Odean (1999) and Barber and Odean (2001) also find that overconfident investors often implement excessive trading, and men tend to be more overconfident than women when trading stocks. Although overconfidence theory is becoming large and influential in the finance theories and the business world, there is little discussion on how overconfidence influences insurance decision-making. In the absence of asymmetric information, researchers find that the degree of overconfidence (optimism) can shift the individual’s insurance decision. For example, Leland (1980) demonstrates that investors who are more optimistic about the expectations regarding returns will purchase portfolio insurance. Cummins and Mahul (2003) conclude that an insured will demand less insurance coverage (a high deductible) when the individual is more optimistic regarding the insurer’s insolvency risk. Constructing several experiments, Coelho and De Meza (2006) find that individuals have false positive beliefs on their own capabilities, and results in un-sufficient insurance coverage purchased. Recently, researchers have paid more attention to this point under asymmetric information. Jeleva and Villeneuve (2004) show that a pooling equilibrium may be optimal in the monopoly market when the individuals make decisions based on their 4 subjective belief, which are the private information of the insured. Sandroni and Squintani (2004) show that compulsory insurance is not a Pareto improvement in a society with a significant fraction of overconfident agents in an adverse selection model. Opp (2005) indicates that in an insurance market like that modeled by Rothschild and Stigilitz (1976), the optimism of the high risk types insured will result in underinsurance, and generate negative externalities in relation to the low risk types insured. Our paper is closely related to Jeleva and Villeneuve (2004) but differs from it in two ways. First, the different risk types in our model are driven by efforts, whereas those in their paper are determined by nature. Jeleva and Villeneuve (2004) assume that, by nature, there exist two types of insured: one is high risk and the other is low risk, and they further discuss how the market equilibrium may be affected by different degrees of deviation in belief. Our paper, as in the case of De Meza and Webb (2001), assumes that individuals have the same loss probability before they expend effort to reduce it. We further assume that an overconfident type of insured will never take precautions to decrease his/her objective loss probability, but that a rational type of insured will take precautions if doing so can increase his/her expected utility. If the rational type of insured makes efforts, the objective loss probability will decrease, and will further induce the rational type of insured to become a low risk type. Second, our paper discusses the equilibrium under a competitive market, whereas Jeleva and Villeneuve (2004) focus on a 5 monopoly.3 Following this line of the literature, we discuss the market equilibrium under hidden overconfidence by adopting the concept of overconfidence as the overly optimistic estimation regarding the probability of good future events or where people perceive their situation to be less risky than it actually is.4 It is important to notice that “hidden” overconfidence means that overconfidence is individual’s private information which the insurer can not observe. In other words, the insurer does not know who is overconfident. For example, a driver who is very confident on his own driving skill could drive much faster than the ordinary people. However, the insurer can not figure out which driver is overconfident on his or her driving ability. Our theory of hidden overconfidence is as follows. Assume that there exist two types of insured: one makes decisions on his or her subjective loss probability, which is the same as the objective loss probability, and the other is overconfident and subjectively believes that the loss probability is lower than the objective one.5 The former is called 3 Our paper is also closely related to Koufopoulos’s (2002), but differ from it, since we assume that the insurance market is under perfect competition, whereas Koufopoulos’s (2002) model is under an oligopoly market, Setting a Bertrand competition, Koufopoulos (2002) discusses the market equilibrium by adopting the assumption that individuals are heterogeneous in risk perceptions. He finds two types of separating equilibrium. The first one confirms advantageous selection: the more optimistic individuals will purchase less coverage and are less willing to invest self-protection. The second equilibrium is that all individuals will take precautions, but the less optimistic individuals will purchase more coverage than the more optimistic individuals. 4 Goel and Thakor (2002) model overconfident managers as being more willing to take risk because they perceive their situation to be less risky than it actually is. Our definition of overconfidence can be characterized as optimistic. It differs from the definition of overconfidence in the literature of finance, such as Daniel, Hirshleifer and Subrahmanyam (1998), Gervais and Odean (2001), and Gervais, Heaton, and Odean (2005), which use overconfident to describe people who think that they have higher quality information than they really do. 5 Israel (2005) uses automobile insurance data and finds that individuals are optimistic when they have just 6 the “rational type of insured” and the latter the “overconfident type of insured.” Since the overconfident type of insured make decisions upon their subjective loss probability, we implicitly assume that the overconfident type of insured truly believes that he or she has a relatively lower loss probability, and the insured does not realize that he or she is overconfident. We further assume that the overconfident type of insured chooses not to make effort.6 Thus, if the rational type of insured makes an effort to reduce the loss probability, the loss probability of the rational type of insured becomes lower than that of the overconfident type of insured. On the other hand, the insurance company cannot identify which insured is overconfident. We further assume that the insurer cannot observe the individual’s actions for reducing loss probability either. Thus, the insurer provides a product menu to screen the insured. Our findings predict that the occurrence of the loss and the coverage of the insurance could be either negatively correlated or uncorrelated. First, our paper shows that, when the difference of the subjective loss probability between the rational type of insured and the overconfident type of insured is relatively larger, hidden overconfidence could generate a market equilibrium that is consistent with advantageous selection: the overconfident type of insured would not spend efforts to reduce loss probability and joined an insurer. Bhattacharya, Goldman and Sood (2003) show that people with relatively low life expectancy tend to be optimistic and generally underestimate their mortality risks, whereas the others do not. 6 In our model, those insured who are overconfident overestimate their loss probability but are not optimistic about their efforts. 7 would purchase low coverage with a high premium rate, whereas the rational type of insured chooses to reduce loss probability and prefers high coverage with a low premium rate. In the first case, our paper predicts that the occurrence of the loss and the coverage of the insurance could be negatively correlated, and provides a theoretical support for the empirical findings of advantageous selection. Second, we further show that, when the difference of subjective loss probability between the rational type of insured and the overconfident type of insured is relatively small, the equilibrium could settle on where both rational and overconfident individuals do not make efforts to reduce loss probability and are charged by the same premium rate. In the second case, our paper predicts that the occurrence of the loss and the coverage of the insurance could be uncorrelated and is consistent to empirical research which finds no significant relationship between risk and coverage7. Moreover, our paper shows that, in the second case, both the insured with high coverage and the insured with low coverage are charged by the same premium rate. This result is consistent to Cawley and Philipson (1999) which find that the difference in the premium rate for the high coverage and low coverage is not significantly different from zero. Furthermore, for future empirical studies, our paper could provide different hypotheses to those provided by De Meza and Webb (2001). First, to test the theory of De 7 Some papers assume that the problems of adverse selection and advantageous selection co-exist in the market to explain why there is no significantly relationship between the choice of the coverage and the occurrence of the risk. 8 Meza and Webb (2001), studies such as Finkelstein and McGarry (2006) examine whether the evidences for the existence of asymmetric information can be found in the insurance market after the risk preferences of individuals are controlled. Of course, rather than the individual’s risk preference, the individual’s subjective beliefs in loss probability should be controlled to test our theory of hidden overconfidence.8 Second, notice that the market equilibrium differs in our paper because of the deviation in belief of the loss probability between the rational type of insured and the overconfident type of insured, whereas the market equilibrium varies in De Meza and Webb (2001) due to the amount of the administrative costs in relation to claims. On basis of our model, a further study could examine whether the market equilibrium may indeed alter when the deviation in belief of the loss probability between the rational type of insured and the overconfident type of insured differs. The remainder of this paper is organized as follows. Section 2 provides the model, Section 3 discusses the market equilibrium, and Section 4 concludes the paper. 2. Model Assume that the insurance market contains two types of representative insured: the rational type and the overconfident type. The objective probability of risk occurrence for these two kinds of insured is the same, except that the overconfident type exhibits a 8 In fact, both hidden risk preference and hidden overconfidence could co-exist in the market and jointly result in advantageous selection. 9 subjective belief that is lower than the objective loss probability. Let us denote this objective loss probability as . The insured can choose to expend an effort F to reduce the loss probability. Without loss of generality, let F be a binary variable that is equal to f or zero. Assume that the loss probability for the rational type of insured is (F ) and (0) ( f ) . On the other hand, the subjective belief of loss probability for the overconfident type of insured is g ( ( F )) with g ( ( F )) 0 and g ( ( F )) ( F ) . Let us further assume that g ( ) ( f ) , i.e. the overconfident type of insured thinks that he/she has better knowledge regarding the risk such that, even without any efforts, the loss probability that he/she faces is lower than that faced by the other insured type with efforts. The initial wealth of both types of insured is W and the amount of the loss is L . Let Q and pQ , respectively, denote the insurance amount and the insurance premium, where 0 Q L and p (F ) . Assume that the forms of the utility functions of both types of insured are the same and are strictly increasing and concave. The expected utility ( EU ) of the insured i is EU i [ i ( Fi )]U (W L Qi pi Qi ) [1 i ( Fi )]U (W pi Qi ) Fi , (1) where i ( Fi ) ( Fi ) for the rational type of insured (i r ) , and i ( Fi ) g ( ( Fi )) for the overconfident type of insured (i o) . For simplicity, assume that the overconfident type of insured will never choose to 10 expend effort to reduce his or her loss probability9, and that the rational type of insured will choose to take precautions if and only if r [ ( f ) ][U (W L Qr pr Qr ) U (W pr Qr )] f 0 . (2) The insurance market is competitive. The above assumptions are all common knowledge except that the risk neutral insurers cannot observe whether the insured is overconfident. The representative insurance company then provides ( po , Qo ) , ( p r , Qr ) to screen the insured. The insured can freely choose an insurance product if the insurance product increases his/her expected utility. The insurance company will never offer an insurance product that results in the expected loss being higher than the premium. It is worth noting that the insurers will price the contract with objective probabilities rather than subjective probabilities. In the following section, we use a diagram to demonstrate the equilibrium. Before we engage in any further discussion, let us explain the notation that we will use in the diagrams. In all of the figures, the x -axis represents the insured’s wealth at the no-loss state, WN , whereas the y -axis denotes his or her wealth at the loss state, WL . The insured’s endowment (W , W L) is labeled by point E . The upward-sloping curve J shows the value of (WN , WL ) such that r 0 . As shown in De Meza and Webb (2001), J is convex if the insured exhibits decreasing risk aversion. The indifference Assume that g ( ( f )) is so close to g ( ) that the benefit from reducing the loss probability cannot exceed the cost of the effort, i.e. o [ g ( ( f )) g ( )][U (W L Qo p o Qo ) U (W po Qo )] f 0 . 9 11 curve of the rational type of insured, I r , is divided into two parts by J : the upper region of J indicates that the rational type of insured takes no precautions, and the lower region shows that he/she does take precautions. Since the slope of I r is dWL dW N Ir 1 r ( Fr ) U (W N ) , r ( Fr ) U (WL ) (3) and 1 1 ( f ) , ( f ) (4) because ( f ) , I r is kinked and flatten above J . I o denotes the overconfident type of insured’s indifference curve. Under the assumption that o 0 , I o is without any kink. The slop of I o is dWL dW N Io 1 g ( ) U (W N ) . g ( ) U (WL ) (5) At any point, I o is steeper than I r since we assume that g ( ) ( f ) . Moreover, dW L d dW N Io 1 U (W N ) 0. dg ( ) g ( )2 U (WL ) (6) Therefore, if the degree of optimism of the overconfident type of insured increases, i.e. g ( ) decreases for a given , then I o will become steeper. Lines Pr and Po denote the zero profit lines of the insurer based upon loss probability ( f ) and , respectively. Thus, p (1 ) ( f ) on Line Pr and p (1 ) on Line Po , where denotes the insurance loading, 0 . Line P is 12 that under pooling equilibrium, i.e. p (1 ) ( f ) (1 ) , (7) where is the proportion of the rational type of insured in the overall population. Let I i* , i r , o , denote the optimal utility level of insured i priced by Pi . Denote point A ( B ) as the tangential point of I o* ( I r* ) on line Po ( Pr ). Iˆr* is the optimal utility level when the rational type of insured is charged Po , and B̂ is the corresponding optimal allocation. 3. Market Equilibrium Our equilibrium concept is the same as that in De Meza and Webb (2001), which is consistent with that in Rothschild and Stiglitz (1976). To discuss the market equilibrium, we start with the pooling equilibrium. The following Proposition shows that full pooling does not exist in equilibrium. Proposition 1 There is no pooling equilibrium. Proof We will demonstrate that there exists at least one profitable contract that Pareto dominates the pooling equilibrium. As shown in Figure 1, suppose Point B , which lies upon the average pricing line P , is a pooling equilibrium. To generate a profitable contract, an insurer should provide a contract located in the region above I r and below Pr . If one insurance company provides a contract C , then it will attract the rational type 13 of insured but not the overconfident type of insured. Since C is located in the lower region of J , the rational type of insured is actually low risk because he/she makes efforts. Thus, C is a profitable contract, which improves at least one type of insured’s welfare, and leaves contract B with a negative profit due to the fact that only the high risk (overconfident) type of insured stays. Q.E.D. Proposition 1 shows that the pooling equilibrium can never be an equilibrium in the insurance market when there is hidden overconfidence. This result is similar to those of Rothschild and Stiglitz (1976) and De Meza and Webb (2001), but differs from Jeleva and Villeneuve (2004). The pooling equilibrium in Jeleva and Villeneuve (2004) is a profitable contract for the insurer. Since our market is under competitive rather than being a monopoly, the pooling contract will not be in equilibrium in our model. Proposition 2 If the overconfident type of insured is highly optimistic, such that I o* cuts Line Pr on the right-hand side of B as shown in Figure 2, then there exists a unique separating equilibrium at which the rational type of insured will expend effort and choose contract B , whereas the overconfident type of insured will choose contract A . Proof Figure 2 shows that no other profitable strategy can Pareto dominate contracts 14 A and B . The only way to induce the rational type of insured to deviate from B is to provide contracts located above I r* . However, none of the insurers will provide this kind of offer, since it results in a negative profit. Q.E.D. In Proposition 2, the market equilibrium denotes the first-best allocation for both the rational and overconfident types of insured, and both types of insured satisfy the incentive compatibility: EU o ( A) EU o ( B) , and (8) EU r ( B) EU r ( A) . (9) In this case, the market separates the different types of insured automatically. The existence of the overconfident type of insured does not result in any negative externality for the rational type of insured. In equilibrium, the rational type of insured takes precautions but the overconfident type does not. Contrary to the findings in Rothschild and Stiglitz (1976), our first best separating equilibrium shows that the rational type of insured (low risk type) purchases high coverage with a low premium rate and the overconfident type of insured (high risk type) purchases low coverage with a high premium rate. Furthermore, if the overconfident type of insured is extremely optimistic, such that his/her indifference curve becomes sufficiently steep, the overconfident type of insured (high risk) may exit the market, and leave the market with only the low risk type 15 of insured. This type of equilibrium may also be found in De Meza and Webb (2001), although they do not report the result. In their model, the first best separating equilibrium exists if the first best allocation of the timid type of insured while purchasing insurance does not attract the bold type of insured, and the timid insured is better off under this allocation than if he or she were absent from the market. Proposition 3 If the overconfident type of insured is optimistic, such that I o* cuts Pr to the left-hand side of point B but still in the lower region of J , as shown in Figure 3, then there exists a unique separating equilibrium to the effect that the rational type of insured expends efforts and chooses contract B , whereas the overconfident type of insured chooses contract A . Proof To interest the rational type of insured, the potential contracts should lie in the region below Pr and above I r . Any contract located in this area will also captivate the overconfident type of insured (high risk), and result in a pooling. However, this pooling contract lies above the zero profit line P , which means that it is a negative profit strategy for the insurer. Q.E.D. In Proposition 3, the market equilibrium is again a separating equilibrium. Unlike 16 the separating equilibrium demonstrated in Proposition 2, the rational type of insured is in his/her second best allocation. This means that the existence of the overconfident type of insured causes a negative externality on the rational type of insured. In order to be separated from the overconfident type, the rational type of insured will purchase higher coverage than his/her optimal level. The mechanism of this separating equilibrium is the same as that in Rothschild and Stiglitz (1976). The “bad” insured, who is the high risk type in Rothschild and Stiglitz’s (1976) model and is the overconfidence type in ours, could settle on his or her first best allocation, but the “good” type insured, who is low risk type in theirs and is rational type in ours, could only choose the contract that the “bad” insured feels indifferent from his or her first best allocation, because of the negative externality caused by the “bad” insured. In this case, our separating equilibrium has the same implications as the equilibrium in Proposition 2 of De Meza and Webb (2001). However, they require low administration costs, whereas our condition depends on the degree of optimism of the overconfident type of insured. Proposition 4 If the overconfident type of insured has a low degree of optimism, such that I o* cuts Pr in the upper region of J , and it cuts J within curve GH , where G is the intersection of Iˆr* and J , and H is that of Pr and J , as shown in Figure 4, then 17 there exists a partial pooling equilibrium, such that the rational type of insured will choose a contract arbitrarily close to B and take precautions, and the overconfident type of insured will be indifferent between B and A . Proof As shown in Figure 4, the possible profitable offer that could increase the welfare of at least one type of insured must be located below Pr and above either I r or I o* . First, let us check the sub region below I r . Any offer in this sub region will only please the overconfident type of insured, but it will cause the insurer to lose money because the insurer is undercharging the overconfident type of insured. Second, a contract located below J and surrounded by Pr and I r will ensure that the rational type of insured will take precautions and simultaneously improve the welfare of both types of insured. However, the insurer will still lose money in this area, because the pooling pricing line is P , which is located below this area. In the last sub region, which is above J , the rational type of insured refuses to make any efforts, and leaves the market only one type of insured: the high risk type. Thus, the insurer should at least ask for Po for all individuals to avoid negative profit, which is a much higher premium rate than the insurer offers in this area. Q.E.D. Proposition 4 demonstrates that the insurers appear to have a chance to make a profit from the rational type of insured in a competitive market if the overconfident type of 18 insured is optimistic. The rational type of insured is willing to take precautions in equilibrium, and this action results in a reduction in the loss probability. In order to screen the insured, the insurers can price the rational type of insured at a premium rate that is greater than what is actuarially fair. This strategy favors the insurer. However, the market is under competitive, which means that no firms could generate a positive profit. Thus, in equilibrium, there must be some overconfident type of insured who purchases B , and consumes all the profit the insurer obtained from the rational type of insured. This partial pooling equilibrium is consistent with De Meza and Webb’s (2001) finding. Proposition 5 If (1) the overconfident type of insured has a low degree of optimism, such that I o* cuts Pr in the upper region of J , and it cuts J below point G , and (2) the rational type of insured does not make any efforts when he/she is charged a high premium rate, as shown in Figure 5, then there exists a separating equilibrium such that the rational type of insured does not expend effort but chooses a high coverage contract B̂ , whereas the overconfident type of insured chooses A . Proof The proof is similar to that in Proposition 4. Thus it is omitted here. Q.E.D. Proposition 5 provides an interesting case. When the overconfident type of insured 19 has a relatively low degree of optimism, both types of insured will be charged the same premium rate because the rational type of insured chooses not to make any efforts in equilibrium, and this leaves the market with only one risk type rather than two types. However, the overconfident type of insured will purchase less insurance than the rational type of insured since he/she is overconfident. This separating equilibrium does not really separate risk type, but separates hidden overconfidence. In other words, this equilibrium implies that the hidden overconfidence will be revealed by self-selection. Unlike adverse selection or advantageous selection, regardless of the level of coverage the insured chooses, both the rational and the overconfident types of insured have the same loss probability and are charged by the same premium rate. The empirical implications of this case differ from those of De Meza and Webb (2001) in two ways. First, our paper predicts that the conditional correlation between the probability of loss occurrence and the choice of coverage will be insignificantly different from zero, since there is only one type in the market, whereas De Meza and Webb (2001) predict a negative relationship. Second, we also predict that the premium rate and coverage could be insignificantly related, because the premium rate will be the same for all levels of coverage. The above equilibrium from Propositions 3 to 5 may be destroyed if there are too many rational types of insured in the market. The following Proposition explains the case. 20 Proposition 6 If is large enough, which means that there are too many rational types of insured in the market, such that the pooling pricing line cuts through the optimal indifference curve of the rational type of insured, then the equilibrium described above, except for the first best separating equilibrium, will be destroyed and the market will fail. Proof We use the second best separating equilibrium to illustrate the Proposition. As shown in Figure 6, if the pooling pricing line cuts through I r , then a pooling contract located above I r will indeed make both types of insured better off. However, Proposition 1 concludes that the pooling equilibrium cannot exist. Thus, the market will fail in this case. Q.E.D. As discussed in Rothschild and Stiglitz (1976), the separating equilibrium could be demolished when the number of low risk type insured is large in the population. Although the rational type of insured is not necessarily being low risk in our model, except that he/she decides to take precautions, the number of them could also consume the separating equilibrium. A relatively huge number of the rational type of insured will make the negative externality caused by the overconfident type of insured become insignificant, and thus a pooling equilibrium could dominate the separating equilibrium. But, as shown 21 in Proposition 1, a pooling equilibrium cannot exist. Thus, the market fails. In addition, hidden overconfidence could also predict adverse selection. In the previous section, we already mentioned that the assumption of g ( ) ( f ) is critical in our analysis. If the assumption is modified to ( f ) g ( ) , which means that the overconfident individual believes that his/her loss probability is smaller than others but is still greater than those with efforts, than the single cross property will not hold. In this case, the equilibrium could convert to either Rothschild and Stiglitz’s (1976) adverse selection or advantageous selection with a linear premium rate. If I o* cuts Pr above the intersection of Iˆr* and Pr , as shown in Figure 7, then the equilibrium exhibits adverse selection: the rational type of insured (low risk) purchases low coverage at a low premium rate, B , whereas the overconfident type of insured (high risk) settles for high coverage at a high premium rate, A . As shown in Figure 8, if I o* cuts Pr below the intersection of Iˆr* and Pr , then the rational type of insured will agree on a contract with high indemnity, B̂ , and the overconfident type of insured will prefer that with a low indemnity, A , and both of them will be charged by the same premium rate. The appearance of these two equilibriums depends on the overconfident type of insured’s degree of optimism. If the overconfident type of insured has a high degree of optimism, then this will give rise to a large negative externality in relation to the rational type of insured. Therefore, the rational type of insured will deny taking any precautions. The 22 equilibrium will be a separating equilibrium under a linear premium rate. Otherwise, the equilibrium will be consistent with adverse selection. The above Propositions conclude that the different degrees of optimism of the overconfident type of insured give rise to different types of equilibrium. In our analysis, we do not assume any transaction cost. It should be noted that the findings in our paper are robust with or without the expense loading of the insurance, but the market equilibrium in De Meza and Webb (2001) varies with respect to the amounts of the fixed administration cost. 4. Conclusion Our paper has demonstrated that hidden overconfidence can lead the market toward advantageous selection. When the degree of optimism of the overconfident type of insured is large, the rational type of insured will purchase high coverage with a low premium rate, and at the same time take precautions to reduce his or her loss probability. Meanwhile, the overconfident type of insured will choose an insurance contract with low coverage and a high premium rate, and refuse to make efforts. In addition, our paper also indicates that, when the overconfident type of insured exhibits a low degree of optimism, the market could settle on another separating equilibrium where the rational type of insured would rather give up taking action to reduce his or her loss probability because of 23 the huge negative externality that the overconfident type of insured causes. Researchers have documented that both risk preference and risk type could influence individuals’ decision making in full information. De Meza and Webb (2001) and our paper contribute to the literature by confirming that these two factors could also alter the type of equilibrium in a world with hidden information, only that the former focus on hidden preferences and the latter focus on hidden belief. It is worth recognizing that both papers assume that the loss probability of the insured before the loss prevention effort is the same for every agent. The “low risk type” insured refers to an individual who takes precautions. Thus, it is very important to recognize that both papers cannot rule out the case where both advantageous selection and adverse selection co-exist in the market. Although both De Meza and Webb (2001) and our paper could explain the existence of advantageous selection, we focus on different empirical implications. Our paper can provide a theoretical background for the papers that find that individuals who are more subjectively optimistic regarding their loss probability are less likely to purchase insurance. Moreover, our paper can also provide explanations for several empirical papers that neither found evidence of adverse selection nor of advantageous selection. 24 References Alpert, M., & Raiffa, H. 1982. A progress report on the training of probability assessors. in Daniel Kahneman, Paul Slovic, and Amos Tversky, ed.: Judgement under Uncertainty: Heuristics and Biases (Cambridge University Press: Cambridge). Bailey, W., Kumar, A., & Ng, D. 2006. Picking stocks for fun or buying stock funds? The portfolio choices of U.S. individual investors. Working paper, Cornell University. Barber, B.M., & Odean, T. 2000. Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance. 55(2): 773-806. Barber, B.M., & Odean, T. 2001. Boys will be boys: gender, overconfidence, and common stock investment. Quarterly Journal of Economics. 116: 261-292. Bhattacharya, J., Goldman, D., & Sood, N. 2003. Market evidence of misperceived prices and mistaken mortality risks. NBER Working Paper Series. Browne, M. J. 1992. Evidence of adverse selection in the individual health insurance market. Journal of Risk and Insurance. 59: 13-33. Browne, M. J., & Doerpinghaus, H. I. 1993. Information asymmetries and adverse selection in the market for individual medical expense insurance. Journal of Risk and Insurance. 60: 300-312. Cardon, J.H., & Hendel, I. 2001. Asymmetric information in health insurance: Evidence from the national medical expenditure survey. Rand Journal of Economics. 32(3): 408-427. Cawley, J., & Philipson, T.J. 1999. An empirical examination of information barriers to trade in insurance. American Economic Review. 89(4): 827-846. Chiappori, P.A., & Salanie, B. 1997. Empirical contract theory: The case of insurance data. European Economic Review. 41(3): 943-950. Chiappori, P.A., & Salanie, B. 2000. Testing for asymmetric information in insurance markets. Journal of Political Economy. 108(1): 56-78. Coelho, M., & De Meza, D. 2006. Self deception, self selection, self destruction: an experimental investigation of adverse selection. Mimeo London School of Economics, UK. Cummins, J.D., & Mahul, O. 2003. Optimal insurance with divergent beliefs about insurer total default risk. Journal of Risk and Uncertainty. 27(2): 121-138. D’Arcy, S. P., & Doherty, N.A. 1990. Adverse selection, private information, and lowballing in insurance markets. Journal of Business. 63: 145-164. Daniel, K., Hirshleifer, D. & Subrahmanyam, A. 1998. A theory of overconfidence, self-attribution, and security market under- and over-reactions. Journal of Finance, 53(6): 1839-1885. 25 De Bondt, W. F. M., & Thaler, R. H. 1995. Financial decision-making in market sand firms: A behavioral perspective. Robert A. Jarrow, V. Maksimovic, and W. Z.Ziemba, ed.: Finance, Handbooks in Operations Research and Management Science 9, 385-410 (Amsterdam: North Holland). De Meza, D., & Webb, D. C. 2001. Advantageous selection in insurance markets. Rand Journal of Economics. 32(2): 249-262. Dionne, G., & Gagne, R. 2002. Replacement cost endorsement and opportunistic fraud in automobile insurance. Journal of Risk and Uncertainty. 24: 213-230. Dionne, G., Gourieroux, C., & Vanasse, C. 2001. Testing for evidence of adverse selection in the automobile insurance market: A comment. Journal of Political Economy. 109(2): 444-455. Finkelstein, A., & McGarry, K. 2006. Multiple dimensions of private information: evidence from long-term care insurance market. American Economic Review. 96(4): 938-958. Finkelstein, A., & Poterba, J.M. 2004. Adverse selection in insurance markets: Policyholder evidence from the UK annuity market. Journal of Political Economy. 112: 183-208. Gervais, S., Heaton, J.B., & Odean, T. 2005. Overconfidence, investment policy, and manager welfare. Working paper. Gervais, S. & Odean, T. 2001. Learning to be overconfident. The Review of Financial Studies. 14(1): 1-27. Goel, A.M., & Thakor, A. 2002. Do overconfident managers make better leaders? Working Paper, University of Michigan Goetzmann, W., & Kumar, A. 2003. Why do individual investors hold under-diversified portfolios. Working paper, Yale School of Management Israel, M. 2005. Services as experience goods: An empirical examination of consumer learning in automobile insurance. Working paper. Jeleva, M., & Villeneuve, B. 2004. Insurance contracts with imprecise probabilities and adverse selection. Economic Theory. 23(4): 777-794. Koufopoulos, K. 2002. Asymmetric information, heterogeneity in risk perceptions and insurance: an explanation to a puzzle. Mimeo University of Warwic, UK. Lehman, D.R., & Nisbett, R.E. 1985. Effects of higher education on inductive reasoning, working paper, University of Michigan. Leland, H.E. 1980. Who should buy portfolio insurance? Journal of Finance. 35(2): 581-595. Makki, S.S., & Somwaru, A. 2001. Evidence of adverse selection in crop insurance markets. Journal of Risk and Insurance. 68: 685-708. McCarthy, D., & Mitchell, O.S. 2003. International adverse selection in life insurance 26 and annuities. NBER Working Paper Series. Miller, D. T., & Ross, M. 1975. Self-serving bias in attribution of causality: Fact or fiction? Psychological Bulletin. 82: 213–225. Odean, T. 1999. Do investors trade too much? American Economic Review, 89: 1279-1298. Opp, M. 2005. Optimism and self-select models: A theoretical investigation of the Rothschild-Stiglitz insurance model. University of Chicago, working paper. Puelz, R., & Snow, A. 1994. Evidence on adverse selection: Equilibrium signaling and cross-subsidization in the insurance market. Journal of Political Economy. 102: 236-257. Richaudeau, D. 1999. Automobile insurance contracts and risk of accident: An empirical test using French individual data. The Geneva Risk and Insurance Theory. 24: 97-114. Rothschild, M., & Stiglitz, J.E. 1976. Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. Quarterly Journal of Economics. 90(4): 629-649. Sandroni, A., & Squintani, F. 2004. The overconfidence problem in insurance markets. ELSE working papers. No. 2005-2. Shavell, S. 1979. On moral hazard and insurance. Quarterly Journal of Economics. 93(4): 541-562. Svenson, O. 1981. Are we all less risky and more skillful than our fellow drivers? Acta Psychologica. 47: 143-148. Ulrike, M. & Geoffrey, T. 2005. CEO overconfidence and corporate investment. Journal of Finance. 60(6): 2661-2700. Weistein, R.M. 1980. The favorableness of patients’ attitudes toward mental hospitalization. Journal of Health and Social Behavior. 21(4): 397-401. 27 Pr WL P J Po B C I r* B I r I o* A W L E 45 0 WN 0 W Figure 1 Pooling equilibrium 28 Pr WL P J Po B I r* A W L I o* E 45 0 WN 0 W Figure 2 First best separating equilibrium 29 Pr WL P J Po B B I r* I r A I o* W L E 45 0 WN 0 W Figure 3 Second best separating equilibrium 30 Pr WL P J Po Iˆr* H B B G I r* I r B̂ A I o* W L E 45 0 WN 0 W Figure 4 Partial pooling equilibrium 31 Pr WL P J Po Iˆr* G B̂ Iˆr* A I o* W L E 45 0 WN 0 W Figure 5 Separating equilibrium for a linear premium rate 32 P Pr WL J Po B B I r* I r A I o* W L E 45 0 WN 0 W Figure 6 No equilibrium 33 Pr WL P J Po G B̂ A B I o* I r Iˆr* W L E 45 0 WN 0 W Figure 7 Adverse selection 34 Pr WL P J Po G B̂ A Iˆr* I o* W L E 45 0 WN 0 W Figure 8 Separating equilibrium for a linear premium rate 35