ENGR 140

advertisement

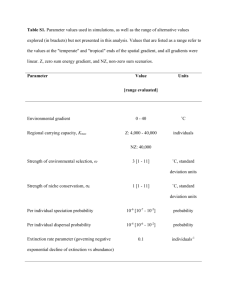

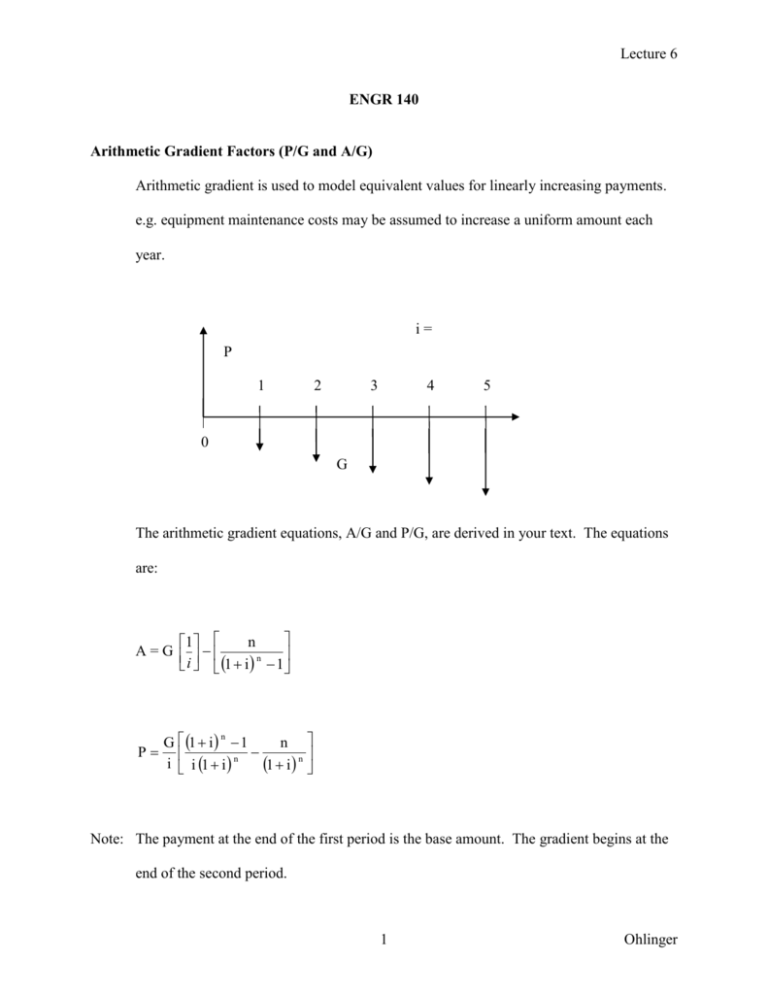

Lecture 6 ENGR 140 Arithmetic Gradient Factors (P/G and A/G) Arithmetic gradient is used to model equivalent values for linearly increasing payments. e.g. equipment maintenance costs may be assumed to increase a uniform amount each year. i= P 1 2 3 4 5 0 G The arithmetic gradient equations, A/G and P/G, are derived in your text. The equations are: n 1 A=G n i 1 i 1 P n G 1 i 1 n n i i 1 i 1 i n Note: The payment at the end of the first period is the base amount. The gradient begins at the end of the second period. 1 Ohlinger Lecture 6 To model and solve problems involving arithmetically changing gradients, break the payment into two components, the base amount and the arithmetically changing gradient. Model the base amount as a uniform series, A. Model the arithmetically changing gradient as a gradient, G. This technique is illustrated in the cash flow diagram below. i= P 1 2 3 4 0 5 A G To determine the present worth equivalent of the series, determine the present worth equivalent of each component and sum them. The most direct solution method is to use the interest rate tables. The present worth equivalent for the series is: P = A(P/A, i, n) + G(P/G, i, n) To determine the uniform series equivalent of the series, sum the base amount, A, and the uniform series equivalent of the gradient (A/G). The uniform series equivalent for the series is: Aeq = A + G(A/G, i, n) Using Compound Interest Factor Tables to Solve Engineering Economic Problems Notation Name Find/Given Equation (P/G, i, n) Arithmetic gradient present worth factor P/G P = G(P/G, i, n) (A/G, i, n) Arithmetic gradient uniform series factor A/G A = G(A/G, i, n) 2 Ohlinger Lecture 6 Example problem: 1. Maintenance cost for a new piece of manufacturing equipment is expected to be $5,000 in the first year and increase $250 per year for every year thereafter. If the cost of funds is 10%, what is the present worth cost of maintenance for the next 5 years? Given: A = $5,000; G = $250; i = 10%; n = 5; P = ? P=? i = 10% 1 2 3 4 0 5 A = $5,000 G = $250 Solution using compound interest tables: P = A(P/A, i ,n) + G(P/G, i, n) P = $5,000(P/A, 10%, 5) + $250(P/G, 10%, 5) P = $5,000(3.7908) + $250(6.8618) = $20, 669 Solution using equations: 1 i n 1 G 1 i n 1 n P A n n 1 i n i 1 i i i 1 i 3 Ohlinger Lecture 6 1 0.105 1 $250 1 0.10 5 1 5 P $5,000 = $20,669 5 5 5 0.10 0.10 1 0.10 0.10 1 0 . 10 1 0 . 10 Comment: The interest table method is easier by far! 2. A construction company plans to accelerate the payments on an equipment loan as production increases. The initial payment is $10,000 per year and the plan is to increase the payment, beginning in year 2, by an additional $1,000 each year through year 10. Determine the equivalent annual payment if the loan interest rate is 12%. Given: A = $10,000; G = $1,000; i = 12%; n = 10; Aeq = ? i = 12% 1 2 3 4 5 6 7 8 9 10 A = $10,000 0 G = $1,000 Solution using compound interest tables Aeq = A + G(A/G, i, n) Aeq = $10,000 + $1,000(A/G, 12%, 10) Aeq = $10,000 + $1,000(3.5847) = $13,585 4 Ohlinger Lecture 6 3. Production from a gas well is expected to decline over the next five years until production revenues equal operating costs, at which point the well will be shut down. Net income for year 1 is projected to be $1.2 Million. Determine the gradient and the present worth equivalent value of the five-year production from the well. The company uses a 10% rate of return for its planning purposes. i = 10% P=? $1.2 M A G=? 0 G= 1 $1,200,000 $0 1 5 2 3 = $300,000 4 5 yr P = A(P/A, i, n) – G(P/G, i, n) P = $1,200,000(P/A, 10%, 5) – $300,000(P/G, 10%, 5) P = $1,200,000(3.7908) – $300,000(6.8618) = $2.49 Million Reading: Chapter 2, pp 65 – 71 Homework: Problems 2.27, 2.30, 2.33 Due Monday, October 3 Quiz 4, Monday October 3 5 Ohlinger