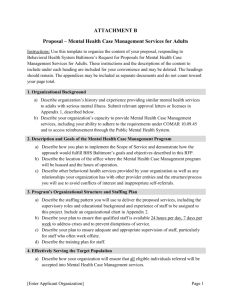

Director General Directive 4.17

advertisement

Programs for the Provision of Aid for the Placement of New Employees in Businesses in Israel (Director General Directive 4.17) Index 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Background Definitions The Relationship between the Aid Programs of this Scheme and Aid in other programs Implementation of the Director General Directive – the Roles of the Director and the Committee Submission of the Application Threshold Conditions Consideration of the Applications and Selection of the Winner Handling Fees Performance Guarantee The Various Aid Programs – Persons Who may Submit Applications for Aid Employees' Wages The Number of Employees and their Place of Residence Actions to be Performed by the Receiver of the Aid following the Winning The Amount of the Aid and the Payment Structure Cancellation of the Aid The Criteria for Choosing the Winner in the Sderot and Gaza Envelope Region, Outlying Regions and Class "A" Development Area Programs and inn the Populations Characterized by a Low Rate of Participation in the Work Force Program. The Criteria for Choosing the Winner in the People with Disabilities Program Miscellaneous Budget and date for Submission of Applications Application Appendices Ministry of Industry, Trade and Labor Director General Directives 1. Background In accordance with Israeli government decisions No. 4423 (SE/174) dated 22/1/2009, and No. 4545 dated 12/3/2009, the Ministry of Industry, Trade and Labor (hereinafter: "the Ministry") has formulated several different aid programs, in order to encourage investments in Israel's economy, and the integration of new employees into the circle of employment. In the current scheme, an emphasis has been placed on the placement of employees in national priority regions in general and in the outlying regions in particular, on the placement of additional employees in the Sderot and Gaza envelope region, in view of the continuing serious security situation in this region, and on the placement of employees from populations characterized by a low rate of participation in the work force. The aid shall be granted by way of competitive allocation. This Director General directive sets out an outline for the implementation of the aforesaid aid Programs. 2. Definitions In this Director General Directive, the following terms shall have the definition ascribed to them in this section, unless otherwise expressly stated in this directive: 2.1. 2.2. 2.3. 2.4. 2.5. 2.6. 2.7. "A Person with Disabilities" – a person for whom one of the following holds true: 2.1.1. His level of disability is no less than 20%, according to the valid determination of an authorized body. 2.1.2. He suffered a hearing loss of at least 50 Db, according to the valid determination of an authorized body. 2.1.3. The Office for Integration of the Handicapped into the Work Force in the Ministry determined, after he had provided a medical certificate from the relevant specialist physician, that he is a person with disabilities under the Equal Rights for People with Disabilities Law, 5758-1998, whose disability is no less severe than the disabilities of a handicapped person as said in section 2.8.1 or 2.8.2. "Populations Characterized by a Low Rate of Participation in the Work Force" Ultra-orthodox people, minorities, people with disabilities, single parents. Development Area "A" Within the meaning thereof in the Encouragement of Capital Investments Order, (Determination of the Extent of Development Areas) 5763-2002. "Minorities" Arabs, Druzes or Circassians. "Controlling Shareholder" A person who holds, whether directly or indirectly, either alone or together with another person, at least 50 percent of the holding rights in the corporation. "Together with another person" – together with his relative, and also together with a person who is not his relative, if they jointly are controlling shareholders of another body of persons, or if - under an agreement, directly or indirectly - there is cooperation between them, on a permanent basis, on substantive matters of the company. "The Committee" The Committee as defined in section 4 below. "Relocation" 2.8. 2.9. 2.10. 2.11. 2.12. 2.13. The relocation of the business's activity, either in whole or in part, from the Tel Aviv, central and Haifa regions, as defined by the Ministry of Interior, to Development Area "A". "Ultra-Orthodox People" Mitzva-observing Jews, who are unique in the religious strictness they maintain in education, in the character of their community and in their way of life, all of which distinguish them from other Mitazva-observing Jews, and for whom at least one of the following holds true, to the satisfaction of the allocation committee (as defined below): 2.8.1. Their place of residence is in one of the localities or one of the urban neighborhoods the level of homogeneity of which is 1-9, that are listed in the first part of Appendix A. 2.8.2. Their place of study is an ultra religious study institution recognized by the Ministry of Education. 2.8.3. The places of study of their children who are under the age of 18 are non-official but recognized, or "exempt" ultra-orthodox study institutions, the licenses of which are regulated by the Department for Non-Official Recognized Education. "Authorized Body" A person who is authorized by law to determine a percentage of invalidity for the purpose of the payment of a disability benefit that is paid under any law, or for the purpose of granting an exemption or credit granted under any law. “Single Parent” A single parent recognized by the National Insurance Institute, who receives income support/an income supplement and/or maintenance payments from the National Insurance. “Judea and Samaria” The settlements in which citizens of the State of Israel reside, in the Judea and Samaria area, which include the following sub-districts, according to the Ministry of Interior: The Jenin sub-district (71), the Nablus sub-district (72), the Tulkarm sub-district (73), the Ramallah sub-district (74), the Jordan sub-district (75), the Bethlehem sub-district (75) and the Hebron sub-district (76). "Director" Deputy Director of the Investment Center in the Ministry and Director of the Employment Program. “The Number of Employees” The average monthly number of employees in the business – as defined in section 2.15 below – in the year preceding the date that shall be published according to the provisions of section 19, or 80% of the number of employees in the business according to a monthly average in the final quarter preceding the date published as aforesaid, whichever is higher. The higher number of the two, that shall be determined, shall be retained throughout the aid period, hereinafter “the Base Positions”. Employees who were employed by the applicant but do not meet the definition of “Employees” as said in section 2.15 below, shall be taken into account for the purposes of base positions. 2.14. "A Full Time Position" A position in which the employee was employed for at least 186 monthly hours, and where a collective agreement, individual employment contract or any other agreement that applies to the employee exists, in which a full time position is defined otherwise – in accordance with such definition. 2.15. "Employees" Israeli citizens or residents who are directly employed in the business. For the purpose of determining the number of employees, only the fulltime positions in the business shall be taken into account, in accordance with the above definition of "full-time position". However, a full-time position may be manned by a number of employees who are employed part-time, provided that the total positions accumulate to the working hours of a full-time position. "New Employee" An employee who was placed in the applicant starting from the date that shall be published in accordance with the provisions of section 19 below, and was not employed by the applicant for aid or by its associated business and did not himself or through another person provide services to the applicant for aid. "Services Industries" The industries set out in Appendix B of this Director General directive. "Business" A corporation engaged in one of the manufacturing industries defined by the Central Bureau of Statistics or that provides a business service in one of the services industries defined in Appendix B of this directive. 2.16. 2.17. 2.18. 2.19. 2.20. 2.21. "Medium Sized Businesses" Businesses in which the number of employees is over 50 and under 100, or the sales turnover of which, as of the date of the submission of the application, is over 25 million NIS and under 100 million NIS. "Large Businesses" Businesses in which the number of employees is over 100 or the sales turnover of which, as of the date of the submission of the application, is over 100 million NIS. "Small Businesses" Businesses in which the number of employees is under 50 or the sales turnover of which, as of the date of the submission of the application, is under 25 million NIS. 2.22. "Associated Business" Any one of the following: 2.22.1. 2.22.2. 2.22.3. A subsidiary of the business, an affiliated company and an associated company, as defined in The Securities Law, 57281968; A controlling shareholder in the business. A business controlled – directly or indirectly – by the controlling shareholder of a business applying for aid under this Director General directive. 2.23. "Outlying Regions" Local authorities that are included in clusters 1 through 4 of the periphery index published by the Central Bureau of Statistics, or local authorities included in cluster 5 of the periphery index and which were included in government decision No. 4415 dated 20.11.05, on the national strategic plan for the development of the Negev. 2.24. The Sderot and Gaza Envelope Region As defined in the Encouragement of Capital Investments Order, (Determination of the Extent of Development. Areas) 5763-2002. 2.25. "Corporation" A body of persons that was incorporated in Israel, and in the case of a body of persons that was incorporated outside of Israel – a subsidiary fully owned by it or a sister corporation with identical ownership, that was established by it within 3 months from the date of the issuance of the instrument of approval. 2.26. "The Establishment Period" A period starting from the date of receipt of the notice of winning the competitive allocation process, and ending at the date of the recruitment of the number of employees undertaken by the applicant for aid, provided that this period does not exceed a year. "The Employment Period" The period during which the applicant for aid undertakes to operate the business with the entire number of employees undertaken by it, at the wage undertaken by it. This period, starting from the recruitment of the first employee, shall be not less that four years per employee. 2.27. 3. The Relationship between the Aid Programs of this Scheme and Aid in other Tracks 3.1. A business that receives aid under this directive shall also be entitled to receive benefits of the "benefits track" the Law for Encouragement of Capital Investments, 5719-1959 (hereinafter: "the Law") subject to its meeting the conditions prescribed therein. A business that holds an instrument of approval under the grants track or under the alternative track prescribed in the Encouragement of the Law for Encouragement of Capital Investments, 5719-1959 (as worded prior to 1.4.05) or an instrument of approval under a different aid track prescribed in the Capital Investments Law or under the employment program, in accordance with the relevant government decisions, shall receive the aid for the placement of additional employees, in excess of the obligation of the business set out in the instrument of approval, as stipulated in the Law. Clarification: an approved enterprise that does not meet its obligations shall not be entitled to receive the aid under this directive, and a business that holds and instrument of approval that was granted by virtue of any allocation under the employment program shall not receive aid while it hasn't completed all of its obligations in accordance with the instrument of approval that was granted to it. 3.2. A business that submitted an application for aid under the grants track, and as of the date of the publication of the Director General directive the application has not yet been considered and no instrument of approval has been issued in respect of it, shall not be able to receive aid under this process, unless it gave notice of withdrawal of the application under the grants track. 4. Implementation of the Director General Directive – the Roles of the Director and the Committee 4.1. 4.2. 4.3. The Director shall be responsible for the implementation of all of the provisions of this Director General directive, including the opening of the envelopes, the assembling of the applications, the preparation of all the material required by the committee for taking its decisions, and after the winning – inspections regarding the fulfillment of the conditions for the grant of aid, and of all the processes involved in its payment. For the purpose of carrying out the aforesaid, the Director shall appoint a team of employees that shall operate in accordance with his instructions. The choosing of the businesses who shall be granted aid under the programs set out in this directive shall be made by a committee the composition of which shall be as follows: 4.3.1. The Director of the Investment Center – Chairperson of the committee. The Deputy Director of the Investment Center – a member and the substitute Chairperson of the committee. 4.3.3. The representative of the Director General. 4.3.4. The representative of the Accountant General of the Ministry of Finance. 4.3.5. The representative of the Budget Department of the Ministry of Finance. The legal quorum for decision taking by the committee is at least 3 members of the committee, including the chairperson of the committee or his substitute. In legal matters, the position of the legal council accompanying the committee shall be decisive. The position of the Accountant General shall be decisive in budget matters. In case of ties, the chairperson of the committee shall hold a double vote. The committee shall have the authority to take any decision required for the carrying out of this directive, including – 4.5.1. Examining the various applications; 4.5.2. Requesting the companies to clarify their applications, as needed; 4.5.3. To carry out any act for the purpose of examining the offerors' representations; 4.5.4. To determine the winners of the competitive allocation, in accordance with the threshold conditions and the criteria prescribed in this directive. 4.5.5. To prescribe conditions in the approval granted to the winners. 4.5.6. To take a decision on the cancellation of the aid and the forfeiture of the guarantee, as set out in section 15. 4.5.7. To lay down procedures concerning the carrying out of this directive. The procedures shall be posted on the website of the Ministry, from time to time. 4.5.8. To take any decision for the purpose of carrying out this directive. The committee may choose more than one winner or to decide not to choose any winner. The committee may also accept any application, in whole or in part. The committee shall keep minutes of its meetings. The minutes shall be signed by the Chairperson of the committee or by his substitute. The decisions of the committee shall be taken by a majority vote. In the event that the committee reaches an impasse on voting, the vote of the chairperson shall be decisive. The decisions of the committee shall be signed by the chairperson of the committee or by his substitute. 4.3.2. 4.4. 4.5. 4.6. 4.7. 4.8. 5. Submission of the Application The applicant for aid shall submit its application on the form appended as Appendix A of this directive, shall indicate the program under which it is applying and whether it belongs to the Sderot and Gaza envelope region - and shall also indicate its preferred framework of aid – the general framework or the one described in section 12.4 below. The applicant for aid shall attach to its application the following documents, duly made and signed: 5.1. A detailed business plan for the establishment, relocation or expansion of the business, and for its operation for no less than thirty months. The plan shall include at least the following: 5.1.1. An undertaking to meet milestones for the establishment and operation of the business. 5.1.2. 5.1.3. 5.1.4. 5.1.5. 5.1.6. 5.2. 5.3. The number of employees (in terms of a full-time position) that the applicant undertakes to employ for no less than 30 months from the date of the operation of the business. The offerer must indicate a defined and fixed number of employees, and not a varying number of employees. The number of employees, and in the case of an expansion - the number of additional employees in excess of the base positions, shall be no less than the number of employees stipulated section 12 below. The average monthly wage cost in the business, undertaken by the applicant for aid, during each of the years of operation of the business. The average monthly wage shall be no less than the wage said in section 11 below. The period of establishment and the period of operation undertaken by the applicant for aid. The rate of the proposed reduction from the maximum amount of aid. Details on the proposed project and its feasibility, and details on the applicant for aid, its experience and its financial stability. A Certificate of incorporation. In the case of a body of persons that was incorporated outside of Israel an undertaking must be attached, according to which the applicant shall establish a subsidiary fully owned by it or a sister corporation with identical ownership, within 3 months from the date of the issuance of the instrument of approval, in accordance with the text attached as Appendix C. An approval of book-keeping and of registration at the value added tax and income tax authorities, as well as all of the approvals required under the Public Bodies Transactions (Enforcement of Account Administration and Payment of Tax Debts) Law, 1976. In the case of a body of persons that was incorporated outside of Israel, an undertaking must be attached, according to which these approvals shall be submitted by the subsidiary or sister corporation, as the case may be, after its establishment, in accordance with the text attached as Appendix C. 5.4. 5.5. 5.6. 5.7. 5.8. 5.9. 6. Audited financial statements of the past year. A receipt for the payment of handling fees as set out in section 8 below. An undertaking to meet the requirements of this provision, according to the text attached as Appendix D. A body of persons that was incorporated outside of Israel shall undertake that the subsidiary or sister corporation, as the case may be, shall provide an undertaking as aforesaid, after its establishment, according to the text attached as Appendix C. An undertaking to observe intellectual property laws, according to the text attached as Appendix E. A body of persons that was incorporated outside of Israel shall undertake that the subsidiary or sister corporation, as the case may be, shall provide an undertaking as aforesaid, after its establishment, according to the text attached as Appendix C. An undertaking not to request benefits under the grants track, according to the text attached as Appendix F.A body of persons that was incorporated outside of Israel shall undertake that the subsidiary or sister corporation, as the case may be, shall provide an undertaking as aforesaid, after its establishment, according to the text attached as Appendix C. 5.10. If separate applications shall be submitted under the programs set out in section 7.1 above (to each of which all of the required documents must be attached), in respect of the same employees, the submitter must indicate, in a letter that shall be attached to each application, which of the application it shall request to exercise if all of its offers are announced as winners. It should be clarified and emphasized that an applicant for aid under one of the programs may submit an application under another program as well provided that it meets its threshold conditions. However, there shall be no duplication of aid granted in respect to the same employees. 5.11. A beneficiary particulars opening/updating form - Appendix G. 5.12. An affidavit on social responsibility – according to the text of Appendix H of this directive. A body of persons that was incorporated outside of Israel shall attach an affidavit according to the text attached as Appendix H1. 5.13. Any additional document required for the consideration of the application. Threshold Conditions 6.1. The applicant for aid is a business. 6.2. The applicant is among those eligible to submit and application for aid under this Director General directive. 6.3. 6.4. 7. The business undertook to pay the employ the minimal wage stipulated in section 11 and to employ the minimum number of employees stipulated in section 12. The applicant for aid meets the conditions set out in the Ministry of Industry, Trade and Labor's Director General Directive 0.4, on "Conditioning Aid on the Observation of Social Responsibility" (hereinafter – "the Social Responsibility Directive") and attached to its application a declaration and a request as required under this provision, according to the text attached as appendix H. Consideration of the Applications and Selection of the Winner 7.1. 7.2. After the end of the period for submitting the applications, that was determined for the various programs, the team shall open the envelopes and divide them into groups, according to the programs to which the publication applies: 7.1.1. The Sderot and Gaza envelope region, outlying regions and class "A" development area program. 7.1.2. The populations characterized by a low rate of participation in the work force program. 7.1.3. The people with disabilities program. The consideration of the applications and the selection of the winner shall be carried out in the following manner – 7.2.1. Each application shall be considered in accordance with the threshold conditions of the program under which it was categorized and according to the area to which it belongs. Offers form the Sderot and Gaza envelope region applying for aid in the framework described in section 12.4 below – shall be categorized under a separate group. 7.2.2. An opinion shall be prepared on behalf of the Investment Center in respect of each application that meets the threshold conditions, on the financial feasibility of the business plan that was submitted and the applicant's ability to meet its targets. Applications in respect of which negative opinions were given by the Investment Center, regarding their financial feasibility, shall also be brought before the committee. The committee shall decide whether or not the offers shall participate in the scoring process. 7.2.3. The applications which met the threshold conditions and which the committee decided shall participate in the scoring process, shall be scored in accordance with the criteria set out in section 16 below, except applications under the people with disabilities program, which shall be scored in accordance with the criteria set out in section 17 below. 7.2.4. All of the applications that were scored, shall be ranked, each in its own program. Offerors whose offers shall receive the highest score in their program shall be selected as winners of the aid, up to the amount of the budget that has been allocated in advance for each program. The winners shall be granted instruments of approval by the Investment Center. 8. Handling Fees The applicant for aid shall attach to his application a receipt for depositing the sum of 1,500 NIS to account No. 0000107 at the Postal Bank, on a regular payment voucher to the order of: the Ministry of Industry, Trade and Labor, the Investment Center, for (the name of the business). An application in respect of which no such payment was made shall be disqualified. Payment made after the prescribed final date of submission of applications shall not be accepted. 9. Performance Guarantee 9.1. As a condition for the receipt of an instrument of approval, the receive of the aid shall deposit an autonomous bank guarantee or a guarantee from an Israeli insurance company that holds a license to engage in insurance under the Control of Financial Services (Insurance) Law, 5741-1981, to the order of the Ministry, in the amount of 5% of the sum of the aid stated in the offer, according to the text attached as Appendix I, for a period of forty four months, starting from the date of the instrument of approval The amount of the guarantee shall be annually reduced to a rate of 5% of the balance of the aid to which the receiver of aid is entitled. 9.2. The guarantee shall be linked to the consumer price index published by the Central Bureau of Statistics. The base index and the base date are the date of the instrument of approval. The guarantee shall be submitted only according to the attached text (Appendix I). 9.3. The Ministry may forfeit the guarantee if the winner fails to begin the establishment/expansion/relocation of the business within the period undertaken by it in its offer, or fails to fulfill its other obligations under the instrument of approval, these Director General directives or its offer, or if it did not correct the noncompliance in accordance with the requirements of the committee. Only the winner shall be liable for the costs of the issuing of the guarantee. It is hereby clarified that in case of failure to deposit the guarantee within the aforesaid period, the Ministry may cancel the winning of the applicant for aid. 9.4. 9.5. 10. The Various Aid Programs – Persons who May Submit Applications for Aid 10.1. 10.2. 10.3. Under the Sderot and Gaza envelope region, outlying regions and class "A" development area program, any person who intends to establish a business in one of these area, to expand a business in them, or to relocate a business to them, may submit and application for aid. Under the populations characterized by a low rate of participation in the work force program, where there is no restriction in respect of the entitled areas, as aforesaid in section 10.1, any person who intends to establish or expand a business in any area may submit an application, provided that at least 90% of the employees in the business, and in the case of an expansion – at least 90% of the additional employees in excess of the base position, shall be from the same population. Under the people with disabilities program, where there is no restriction in respect of the entitled areas, as aforesaid in section 10.1, any person who intends to establish or expand a business in any area may submit an application, provided that at least 90% of the employees in the business, and in the case of an expansion – at least 90% of the additional employees in excess of the base position, shall be from the same population. Under the people with disabilities program, only a business that is not a protected undertaking within its meaning in section 17(a) of the Minimum Wage Law, 5747-1987 may submit an application. 11. The Wage of the Employees 11.1. Throughout the operation period, the average monthly wage cost per employee shall be according to the undertaking of the owner of the business set out in his application, and no less than the following minimum rates: 11.1.1. Under the Sderot and Gaza envelope region, outlying regions and class "A" development area program - at least 5,500 NIS, according to the cost reported in form 106. The wage cost includes national insurance and employer tax. 11.1.2. In telephone call centers, under Appendix B "services industries" (2, I), in "outlying regions", the wage cost shall be at least 5,000 NIS per employee. The wage cost includes national insurance and employer tax. 11.1.3. Under the populations characterized by a low rate of participation in the work force program – at least the minimum wage, and in respect of the placement of people with disabilities – at least the minimum wage or the adjusted minimum wage under the Minimum Wage Law, 5747-1987, and the regulations promulgated pursuant thereto. 11.1.4. 11.2. 12. Under the people with disabilities program, at least the minimum wage or the adjusted minimum wage under the Minimum Wage Law, 5747-1987, and the regulations promulgated pursuant thereto. The calculation of the average monthly wage cost: 11.2.1. In the case of the establishment of a business or its relocation – the average monthly wage cost shall be calculated in respect of all of the employees in the business. 11.2.2. In the case of the expansion of a business - the average monthly wage cost shall be calculated only in respect of new positions that shall be added in excess of the base positions. 11.2.3. For the purpose of calculating the average monthly wage cost, a wage of up to four times the average wage in the economy shall be taken into account. The Number of Employees and their Place of Residence 12.1. 12.2. 12.3. 12.4. 12.5. In the case of an establishment of a business – the business must employ at least 5 new employees. Under the people with disabilities program, the business must employ at least one new employee. In the case of a relocation of a business – the business must employ at least the number of employees that was employed by it prior to the relocation, or 5 employees, whichever is higher. In the case of an expansion of a business – the business must employ at least 5 new employees, in addition to those who are already employed in the business. Under the people with disabilities program, the business must employ at least one new employee. In a business located in localities in Sderot and the Gaza envelope region – as an alternative to the framework of the aid aforesaid in sections 12.112.3 above, aid may be receive starting from the placement of 2 new employees. However, in that case, no aid shall be granted in respect of employees exceeding four. The aid under this section shall be granted exclusively to 50 businesses, from among the businesses who shall choose this framework of aid. The places of residence of the employees employed in the business and entitling it to receive aid, except populations characterized by a low rate of participation in the work force, shall only be in localities in development areas, as defined in the Capital Investments Order, (Determination of the Extent of Development Areas) 5763-2002. It should be clarified that the business may employ additional employees, who do not reside in these areas, but they shall not be included in the business plan, neither with regard to the total number of employees for the purpose of its fulfillment of the threshold conditions, nor to the payment of the aid. Notwithstanding the aforesaid, businesses located in Judea and Samaria shall be entitled to receive aid in respect of employees who shall be placed in them, even of such employees do not reside in development areas, as defined in the Capital Investments Order, (Determination of the Extent of Development Areas) 5763-2002, provided that against the placement of the number of employees who do not reside in development areas as aforesaid, the business shall discontinue the employment of at least an identical number of employees who are not Israeli citizens or residents. 13. Actions to be Performed by the Receiver of Aid following the Approval of the Aid 13.1. 13.2. 13.3. 14. Where a body of persons that incorporated outside of Israel received an instrument of approval and established a subsidiary or a sister corporation in accordance with its obligations under this directive, the instrument of approval shall be assigned to the subsidiary or to the sister corporation. The winner must recruit at least the number of employees undertaken by it within the establishment period, and continue to employ them, at no less than the wage undertaken by it, for no less than 30 consecutive months. In addition to the aforesaid, on the programss concerning populations characterized by a low rate of participation in the work force, the winner shall employ employees as set out in sections 10.2 and 10.3. The Amount of the Aid and the Payment Structure 14.1. The amount of aid in respect of each employee shall be according to the following rates out of the wage cost of the employee, but shall not exceed a wage cost ceiling of 15,000 NIS: 14.1.1. Businesses located in Sderot and the Gaza envelope region, and in the outlying regions: In large businesses a. During the first ten months of the employment of the employee – up to 15%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 10%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 5%. In medium sized businesses a. During the first ten months of the employment of the employee – up to 25%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 15%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 5%. In small businesses 14.1.2. 14.1.3. a. During the first ten months of the employment of the employee – up to 30%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 20%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 10%. Businesses located in a class "A" development area In large businesses a. During the first fifteen months of the employment of the employee – up to 10%. b. Starting from the sixteenth month of the employment until the end of the thirtieth month – up to 5%. In medium sized businesses a. During the first ten months of the employment of the employee – up to 15%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 10%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 5%. In small businesses a. During the first ten months of the employment of the employee – up to 25%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 15%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 5%. Notwithstanding the aforesaid in sections 14.11 and 14.1.2 above, in businesses that shall employ employees from populations characterized by a low rate of participation in the work force the amount of aid in respect of such employees wil be as follows: a. During the first ten months of the employment of the employee – up to 35%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 25%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 15%. These aid rates shall also apply to businesses located Judea and Samaria, in respect of employees against the placement of which the business discontinued the employment of at least an identical number of employees who are not Israeli citizens or residents (and only in respect of such employees). 14.1.4. 14.2. Under the populations characterized by a low rate of participation in the work force and the people with disabilities program a. During the first ten months of the employment of the employee – up to 35%. b. Starting from the eleventh month of the employment until the end of the twentieth month – up to 25%. c. Starting from the twenty first month of the employment until the end of the thirtieth month – up to 15%. The payment of the aid shall be carried out in the following manner, and subject to the receiver of aid's compliance with the rest of the terms of this Director General directive (see an illustrative example below): 14.2.1. Starting from the placement of the minimum number of employees, and for a period of 30 months, the winner shall receive the aid requested in the application in respect of each of the employees it has placed. That is, during the operation period (which begins on the date on which the receiver of aid recruited all of the employees it had undertook to recruit) and for a period of 30 months, the receiver of aid shall receive the aid requested by it in its application (provided that it employed all of the employed stated in its application). At the end of 30 months from the beginning of the receipt of the aid, and for a period identical to the one during which it received aid during the establishment period (the period starting from the recruitment of the minimum number of additional employees and ending upon the completion of the recruitment of the number of employees undertaken by the applicant for aid), the receiver of aid shall receive the balance of the aid available to it. "The balance of the aid" means – the full aid in respect of the entire number of employees undertaken by the applicant for aid, with a deduction of the aid it had received during the establishment period (starting from the date on which it fulfilled the condition concerning the minimum number of additional employees) and during the 30 months following it - all of which is conditional upon it employing the entire number of employees undertaken in its offer, and until no balance remains in the aid available to the winner. Example: For example – the receiver of aid undertook that the establishment period shall not exceed 5 months, and to employ 20 employees. The receiver of aid recruited 5 employees within 3 months. 3 months have passed. The receiver of aid completed the recruitment of 5 employees (or one employee under the people with disabilities program). It begins to receive aid. Two more months have passed (the end of the establishment period undertaken by the receiver of aid). The receiver of aid completed the recruitment of 20 employees. It continued to receive aid in respect of each additional employee. 28 more months have passed, which are 30 months with a deduction of the two months during which it received aid, in the course of the establishment period. The receiver of aid employs 20 employees, and receives all of the aid in respect of them. Two more months have passed. The receiver of aid employed 20 employees. It receives the balance of the aid available to it. 14.2.2. At the end of each quarter of the establishment and operation years, during which the applicant for aid fulfilled the terms of the instrument of approval, the applicant for aid shall be entitled to submit to the Investment Center an application for aid. The application shall be supported by a report, signed by the CEO of the applicant for aid, and shall specify the average number of employees for that quarter, their wages, their places of residence and all of the data relevant to the fulfillment, by the applicant for aid, of the terms of the instrument of approval, and any other information required. An opinion prepared by the business's accountant shall be attached to the report, as well as references as per the requirements of the Investment Center or the Ministry comptrollership. The receiver of aid shall be entitled to the entire aid amount requested in its application, provided that it fulfilled all of the terms of this directive and those of the instrument of approval, and subject to the stipulations of section 14.2.3 above. It should be clarified that the number of employees entitling the receipt of the grant shall not exceed the number of employees declared by the offerer in its application. 14.2.3. Where the applicant for aid employed a number of employees lower than the number of employees undertaken by it in its offer, but no less than the minimum number of additional employees, or where the wage cost in the business was lower than the cost undertaken by the offerer in its offer, but no less than the minimal wage, the committee may make deductions, in accordance with the provisions of Appendix J, from the payments payable to the business. In cases in regard to which 14.2.4. 14.2.5. 15. 16. reasons shall be given, the committee may, instead, decide to amend the instrument of approval. Any sum received by the winner for supporting the training of the employees or for their employment from any public body shall be reduced from the aid amount. In this matter, "training" – internal plant training. The aid shall be paid within 60 days from the date of the submission of the application for aid. Notwithstanding the aforesaid, in the event that the Ministry of Finance's Comptroller General shall not transfer the entire monthly funding in accordance to the Ministry's approved budget, the Ministry may defer parts of the payment of the aid, for a reasonable period of time, until the completion of the funding by the Ministry of Finance, and the business shall not be entitled to linkage differentials, interest or any compensation for such deferment. Cancellation of the Aid 15.1. The committee shall consider the events listed below to constitute fundamental breaches of the terms of this directive, and may decide to cancel the aid, in whole or in part, both the aid that had already been paid and the aid not yet paid, and to demand the repayment of the portion which had been paid with the addition of interest and linkage differentials, within their meaning in the Adjudication of Interest and Linkage Law, from the date of its payment to the date on which it was actually repaid. In addition, the committee may in such cases forfeit the performance guarantee. 15.2. The following are the events for the purposes of section 15.1 – 15.2.1. Any reduction below the respective required wage of the employees under section 11 above. 15.2.2. Any reduction below the respective required minimum number of employees under section 12 above. 15.2.3. Any relocation of the business without the prior approval of the committee. It is to be noted that a business may relocate the business, provided that the general weighted grade of its offer (in accordance with the criteria set out in section 16 below) has not fallen lower than the general weighted grade as such stood in its offer. 15.2.4. The provision of false data, at the submission of the application or thereafter. 15.2.5. A breach of section 18.11. 15.2.6. Where the business failed, in the opinion of the committee, to comply with any of the provisions of this directive, or with the provisions on social responsibility. The Criteria for Choosing the Winner in the Sderot and Gaza Envelope Region, Outlying Regions and Development Area "A" program and of the Populations Characterized by a Low Rate of Participation in the Work Force Program The winner shall be determined in accordance with the following criteria: 16.1. The location of the business (30%). Higher points shall be awarded the further the business is located from the center of Israel, according to the following: 16.1.1. For the purpose of the Sderot and Gaza envelope region, outlying regions and the Development Area "A" program a. Where a business is located in the northern district, according to the Ministry of Interior, the distance of the business from the city of Haifa shall be taken into account. The 120 km point of distance from the city of Haifa is a point that receives a maximum score under this criterion. For the purpose of the scoring, the distance of the business from Haifa - relative to the 120 km point of distance, shall be taken into account. b. Where a business is located in the southern district, according to the Ministry of Interior, the distance of the business from the city of Ashdod shall be taken into account. The 150 km point of distance from the city of Ashdod is a point that receives a maximum score under this criterion. For the purpose of the scoring, the distance of the business from Ashdod - relative to the 150 km point of distance, shall be taken into account. c. A business located in Judea and Samaria or in Jerusalem shall be scored as follows: 1) A business located in a locality that is on longitude 165 or westward of it – shall receive 5.5 points. 2) A business located in a locality that is east of longitude 165 and until longitude 180 inclusive – shall receive 11 points. 3) A business located east of longitude 180 – shall receive 16.5 points. 16.1.2. 16.2. For the purpose of the populations characterized by a low rate of participation in the work force program: the distance of the business from the city of Herzliya shall be taken into account. The 135 km point of distance from the city of Herzliya is a point that receives a maximum score under this criterion. For the purpose of the scoring, the distance of the business from Herzliya in every direction (north, south or east) - relative to the 135 km point of distance, shall be taken into account. The average wage cost per employee, under the stipulations of section 11 above; (25%). 16.3. 16.4. 16.5. 16.6. 16.7. 16.8. 17. Higher points shall be awarded the higher the wage undertaken by the applicant. The minimum score shall be assigned to the required wage under the relevant program, and the maximum score shall be assigned to the ceiling of wage entitling to receive the grant (15,000 NIS). The classification of the locality in which the business is located under the socio-economic cluster (under the publications of the Central Bureau of Statistics; (5%), up to socio-economic class 5. Higher points shall be awarded the lower the socio-economic classification of the locality in which the business is located. The maximum score (5 points) shall be assigned to a business located in a locality listed under class 1, the minimum points (one point) shall be assigned to a business located in a locality listed under class 5, and any additional point under the socioeconomic classification (above 1) shall reduce one point under this criterion. A business located in a locality the socio-economic classification of which is higher than 5 shall receive 0 points. The length of the establishment period (5%) Lower points shall be awarded the longer the establishment period. The maximum period (one year) shall be assigned a score of 0 points, and the minimum period (0 months) shall be assigned 5 points. The length of the operation period (10%) Higher points shall be awarded the longer the operation period. For each quarter in excess of the required 30 months a two point score shall be awarded, up to the maximum of 10 points (for 5 quarters and above). The requested rate of reduction from the maximum aid rate (10%) Higher points shall be awarded the higher the rate of reduction from the maximum aid rate. A business that requested to reduce 10% from the maximum aid rate shall be awarded the maximum score (10 points), and any lower percentage of reduction (9%, 8% and so on) shall reduce one point from the score, accordingly. An applicant who shall not offer any reduction shall receive 0 points under this criterion. The scope of investment in the business; (5%) Higher points shall be awarded the higher the investment per employee. An investment exceeding 15,000 NIS per employee shall be awarded the minimum score (10 points), and any investment of 50,000 NIS per employee shall be awarded the maximum score. The business being located in the Sderot and Gaza envelope region, or in the outlying regions – (10%). The Criteria for Choosing the Winner in the People with Disabilities Program 17.1. A business the distance of which from the city of Herzliya (in every direction) shall be awarded 30 points. For any other business, the distance of the business from the city of Herzliya in relation to a distance of 135 km shall be taken into account. The score shall be relative to the 18. maximum score – 30 points (that is, the distance of the business from the city of Herzliya shall be determined, the relation between that distance and a distance of 135 km shall be measured, and the result shall be multiplied by 30). 17.2. A business located in the Sderot and Gaza envelope region, or in the outlying regions shall receive 10 points, in addition to the aforesaid in section 17.1. 17.3. The classification of the locality in which the business is located under the socio-economic cluster (under the publications of the Central Bureau of Statistics may entitle to receive up to 5 points. Higher points shall be awarded the lower the socio-economic classification of the locality in which the business is located. The maximum score (5 points) shall be assigned to a business located in a locality listed under class 1, the minimum points (one point) shall be assigned to a business located in a locality listed under class 5, and any additional point under the socio-economic classification (above 1) shall reduce one point under this criterion. A business located in a locality the socio-economic classification of which is higher than 5 shall receive 0 points. Miscellaneous 18.1. No aid shall be granted within the framework of a competitive allocation for activities for which government support was granted within another framework. 18.2. The committee does not undertake to grant any application, including due to non-compliance with the terms of a prior instrument of approval, and it may cancel the selection process or make another new allocation, at its decision. 18.3. Unsuccessful applicants may apply to view the winning applications within 30 days from the date of the committee's decision. The offerors are asked to indicate in advance which sections of their applications are privileged against presentation before other competitors. Nevertheless, the Committee may, at its discretion, present the unsuccessful offerors with any document which, in its professional evaluation, does not constitute a trade or commercial secret and the presentation of which is required in law. 18.4. It is hereby clarified that the policy is to oppose any assignment of rights and obligations. However, after it receives the instrument of approval, the winner may submit a request to assign rights and obligations under this Director General directive, at the committee’s discretion. In those circumstances where such approval is given, the winner shall remain responsible towards the committee in matters concerning the carrying out of the provisions of the instrument of approval. 18.5. The Committee does not undertake to terminate the selection process of the winner and to determine a winner within a certain period, however if the winning approval process does not end within 120 days from the last date for the submitting of offers, the offerer may cancel its offer. 18.6. 18.7. 18.8. 18.9. 18.10. 18.11. 18.12. 18.13. 19. 20. The committee may disregard an offer the conditions of which are unreasonable or due to the lack of detailed reference to any of the allocation sections which, in the opinion of the Ministry, prevents the proper evaluation of the offer. The committee may cancel the allocation if only one application is submitted The Committee reserves the right, during the course of the examination and evaluation, to turn to all the applicants, in order to receive clarifications on their applications or in order to remove any lack of clarity which may arise during the course of examining the applications. The grant of aid is subject to the approval of the budget, each year, to budget limitations and to the Ministry's approved budget. The winner shall not be entitled to receive aid if it has unsettled debts towards the Ministry. The applicant for aid undertakes to enable the Ministry or any person acting on its behalf, including external parties on its behalf, at any time, to audit its activities, to supervise the execution of the operating plan of the business, on the dates and under the conditions as prescribed by them, and to act in accordance with the Ministry's instructions, as given from time to time. Any change in the approval given to the winner shall require the prior approval of the Committee. The outlying regions, Development Area "A" and Sderot and Gaza envelope region program, shall be given up to 40% of the total approved budget. Notwithstanding the aforesaid, if the budget of the special populations programs is not fully exhausted, the balance of the budget shall be transferred to the Sderot and Gaza envelope region, outlying regions and Development Area "A" program. Budget and Date for Submission of Applications Applications to participate in the scheme shall be submitted to the Investment Center. The manner of submission of the applications, the programs to which the publication applies, the determining date for the definition of "New Employee" and the definition of "Number of Employees" and the final date for their submission shall be published on the Ministry's internet website and in the press. In the notification, the budget available to the scheme shall be specified. If this date or the scope of the budget shall be changed, a notice of this shall be published in the Ministry's internet website and in the press, and, when necessary, the relevant new dates for the definition of "New Employee" and "Number of Employees" shall be published on the Ministry's internet website and in the press. Applications submitted after the final date determined for the relevant program shall not be considered. Application This directive shall come into force on the date of its signing, and it replaces Director General Directive No. 4.17 dated 27.10.10. 21. Director General Directive No. 4.17 dated 12.3.09 shall continue to apply to the allocation that was made pursuant to it. Director General Directive No. 4.17 dated 30.12.09 shall continue to apply to the allocation that was made pursuant to it. Appendices Appendix A – Application form Appendix B - Services industries Appendix C – Undertaking of a Body of Persons that was Incorporated Outside of Israel to Complete its Obligations through a Subsidiary or Sister Corporation Appendix D – Undertaking to Fulfill the Terms of Director General Directives Appendix E – Undertaking to Observe Intellectual Property Laws Appendix F – Undertaking not to Receive Benefits under the Grants Program Appendix G - Beneficiary Particulars Opening/Updating Form Appendix H – Social Responsibility Appendix H1 – Affidavit by a Body of Persons that Incorporated Outside of Israel, Concerning Compliance with Labor Laws Appendix I – Performance Guarantee Appendix J – Calculations of Deductions Sharon Kedmi Director General Jerusalem, 4 Kislev, 5771 11 November, 2010