tax system for the arts

advertisement

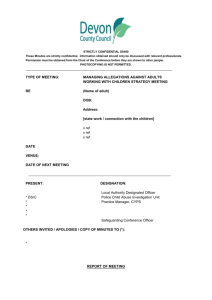

(6) Taxation Systems Related to Cultural Activities Tax Systems Applicable to the Promotion of Arts and Culture and the Protection of Cultural Properties Category Description Non-profit corporations set up for the purpose of planning and/or staging artistic performances and/or exhibitions or of implementing projects to preserve or use cultural property may be authorized as Designated Public Benefit Corporations by the Minister of Education, , Sports, Science and Technology. Apr 1976~ Institutions officially recognized as contributing to the public welfare purposes Non-profit corporations that provide subsidies for dissemination of the arts or that are set up for the purpose of providing grants for the protection of cultural property or of conducting international exchange or cooperation may be authorized as Designated Public Benefit Corporations by the Minister of Education, Culture, Sports, Science and Technology. The Japan Arts Council, and National Language Research Institute, national art museums, national museums, and national research institutes of cultural properties. are authorized as Designated Nonprofit Corporations by the Minister of Education, Culture, Sports, Science and Technology. Among registered museums stipulated within the Museums Law, those Non-profit corporations that mainly aim at establishment and operation that satisfy certain requirements may be authorized as Designated Non-profit Corporations by the Minister of Education, Culture, Sports, Science and Technology. Inheritance Tax Exemptions Registered art works Inheritance Tax Exemptions Inheritance tax is not imposed on donations of inherited properties or the like to corporations that mainly aim to disseminate the arts or to protect cultural properties and that are so authorized by the Minister of Education, Culture, Sports, Science and Technology. This also applies to donations made to the Japan Arts Council, National Language Research Institute, national art museums, national museums, and national research institutes of cultural properties. Inheritance tax: exempt Apr 1977~ Years enforced Apr 1976~ Corporation tax: A contribution made by a corporation is generally calculated as a charitable donation, with an amount of equivalent value also being calculated as a loss Apr 1989~ Apr 2001~ Income tax: the value of the contribution is deducted from the individual's income Apr 1997~ Inheritance tax: exempt When a person who has inherited an estate wishes to make payment in kind using an enrolled art work, the priority level for payment in Exception to payment in kind is Level 1 (similar that of government bonds, real estate, and kind similar property), making payment in kind easier with an enrolled art work than with an art work that is not enrolled. Apr 1977~ Dec 1998~ Donations to Designated Organizations Donations solicited by public benefit corporations as funds to restore important cultural properties or to construct disaster prevention facilities for the same may be individually designated as Designated Donations by the Minister of Finance. Designated Charitable Trusts Charitable trusts set up for the purpose of work (limited to the provision of subsidies) related either to the dissemination and advancement of the arts or to the preservation and/or use of cultural property may become Authorized Designated Charitable Trusts with the certification and authorization of the Minister of Education, Culture, Sports, Science and Technology. Exemtion from : Income tax Pensions awarded to Persons of Cultural Merit, money awarded by the Japan Art Academy as its Imperial Prize or Japan Art Academy Prize, or money awarded in recognition of an outstanding contribution to the arts shall be exempt from income tax of the individual concerned. Corporation tax: the full value of the donation made by a corporation is calculated as a loss Income tax: the value of the donation is deducted from the individual's income Apr 1965~ Income and corporation taxes: Incurred losses are treated in the same way as for Designated Public Benefit Corporations. Inheritance tax: if losses are incurred using money acquired via an inheritance or a bequest, the basic taxable threshold for inheritance tax does not apply. Oct 1987~ Oct. 1988~ Income tax: exempt Tax Incentives Applicable to the Protection of Cultural Property Category Exemption from tax on capital gains income Description If an individual transfers a movable asset or building designated as an important cultural property to the national or local government by December 31 of 2002, the associated capital gains shall not be subject to income tax. Income tax: exempt Apr 1972 to Dec 2002 (from 1975 for local governments) If an individual transfers a non-designated tangible cultural property, which has a value judged equal to that of an important tangible cultural property or is an important tangible folk property, by December 31 of 2002 to the either the national government or to specific IAIs (a national museum, a national art museum, or national science museum), half of the capital gains shall be deducted. Income tax: levied on 50% of the capital gains (100% exempt from Apr 1972 to Dec 1992) Jan 1993~ Dec 2002 Income tax: special deduction of 20 million Corporation tax: loss of 20 million Apr 1970~ Corporation tax: the Apr 2001 An individual or corporation that transfers land designated as an important cultural property together with its building(s) or transfers land designated as a historical site, place of scenic Special deductions beauty, or a natural monument to the national or local government from capital gains tax or to specific IAIs (a national museum or national science museum), either a special deduction or a loss of 20 million shall be sanctioned. Designated donations Years enforced Within a year after applying to donate a national treasure or important cultural property to national museum, national art value of the donation is museum, or national science museum, if a corporation makes a calculated as a loss donation (of money or other assets) to meet expenses required for the collection or conservation of the national treasure or important cultural property concerned, the entire value of the latter donation may be calculated as a loss due to an individual designation by the Minister of Finance. Reduction of inheritance tax Exemption from land tax (for the time being, no levy of land tax since fiscal 1998) Designated donations In case a private house and its grounds are designated as an important cultural property, the inheritance valuation for the inheritance tax shall be reduced for the portion of the house and grounds used by the owner for habitation. 60% deduction of the inheritance valuation No land tax is levied on important cultural properties, important tangible folk cultural properties, historical sites, places of scenic beauty, or natural monuments; on certain plots of land associated with cultural properties designated by local governments; or on certain plots of land within a preservation district for a group of historic buildings. Land tax: exempt Among cultural properties in the non-taxable category, the amount of taxable value shall be reduced for land and other property associated with certain types of cultural properties that merit preservation and utilization. The taxable value is reduced to half the value of the land and other property. For land and other property associated with a building registered as a registered tangible cultural property, the amount of taxable value shall be reduced. The taxable value is reduced to half the value of the land or other property. A house and/or its premises that are designated as an important cultural property, important tangible folk cultural property, historical site, place of scenic beauty, natural monument or that are authorized as an important art work shall be exempt from fixed assets taxes, special property tax, and city planning tax. Fixed assets taxes, special property tax, and city planning tax: exempt Apr 1950~ Fixed assets taxes and city planning tax: exempt Apr 1998~ A suitable tax reduction up to 50%, depending on the circumstances of the municipality concerned Apr 1998~ A suitable tax reduction up to 50%, depending on the circumstances of the municipality concerned Jan 1997 A historic building (excluding those used for "businesses that may affect public morals") that is in a preservation district for a group of important historic buildings and is so proclaimed by the Exemption/Reduction Minister of Education shall be exempt from fixed assets taxes and of city planning tax. fixed Assets taxes, Special Property tax, For the premises of a historic building (excluding those used for "businesses that may affect public morals") that is in a and City Planning preservation district for a group of important historic buildings tax and is so proclaimed by the Minister of Education, the fixed assets taxes and city planning tax shall be appropriately reduced by up to 50%. (Notification of the Ministry of Home Affairs) For a house that is a registered tangible cultural property, taxes shall be appropriately reduced by up to 50%. (Notification of the Ministry of Home Affairs) Jan 1985~ Jan 1992~