Homework 4, Due in class Wednesday August 28 at 12

advertisement

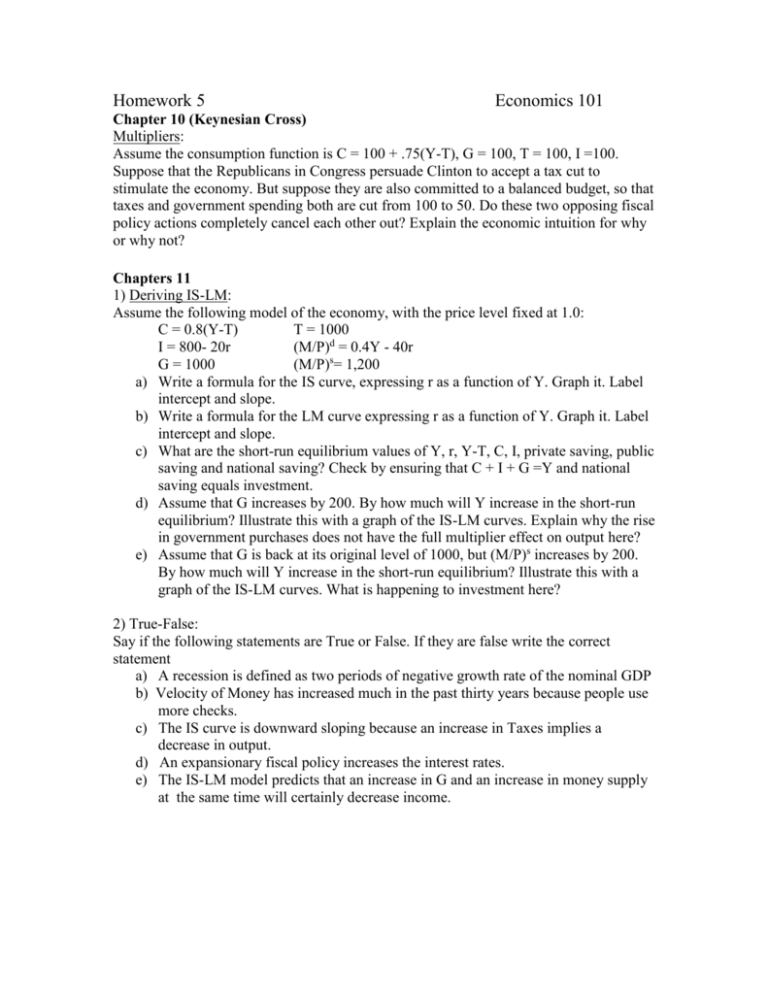

Homework 5 Economics 101 Chapter 10 (Keynesian Cross) Multipliers: Assume the consumption function is C = 100 + .75(Y-T), G = 100, T = 100, I =100. Suppose that the Republicans in Congress persuade Clinton to accept a tax cut to stimulate the economy. But suppose they are also committed to a balanced budget, so that taxes and government spending both are cut from 100 to 50. Do these two opposing fiscal policy actions completely cancel each other out? Explain the economic intuition for why or why not? Chapters 11 1) Deriving IS-LM: Assume the following model of the economy, with the price level fixed at 1.0: C = 0.8(Y-T) T = 1000 I = 800- 20r (M/P)d = 0.4Y - 40r G = 1000 (M/P)s= 1,200 a) Write a formula for the IS curve, expressing r as a function of Y. Graph it. Label intercept and slope. b) Write a formula for the LM curve expressing r as a function of Y. Graph it. Label intercept and slope. c) What are the short-run equilibrium values of Y, r, Y-T, C, I, private saving, public saving and national saving? Check by ensuring that C + I + G =Y and national saving equals investment. d) Assume that G increases by 200. By how much will Y increase in the short-run equilibrium? Illustrate this with a graph of the IS-LM curves. Explain why the rise in government purchases does not have the full multiplier effect on output here? e) Assume that G is back at its original level of 1000, but (M/P)s increases by 200. By how much will Y increase in the short-run equilibrium? Illustrate this with a graph of the IS-LM curves. What is happening to investment here? 2) True-False: Say if the following statements are True or False. If they are false write the correct statement a) A recession is defined as two periods of negative growth rate of the nominal GDP b) Velocity of Money has increased much in the past thirty years because people use more checks. c) The IS curve is downward sloping because an increase in Taxes implies a decrease in output. d) An expansionary fiscal policy increases the interest rates. e) The IS-LM model predicts that an increase in G and an increase in money supply at the same time will certainly decrease income. 3) On Slopes of IS and LM curves a) Explain in words why the IS-LM theory says the aggregate demand curve slopes downward. b) What will happen to the slopes of the IS and AD curves if investment is less responsive to the interest rate? c) What will happen to the slopes of the LM and AD curves if money demand is less responsive to the interest rate? 4) IS-LM Policy Analysis: Japan is considering how it might stimulate its currently sluggish economy, but it is not sure whether it should use expansionary monetary policy or expansionary fiscal policy. Consider two policy alternatives: (1) a rise in money supply and (2) a cut in taxes -which are scaled so that they raise equilibrium output the same amount. Using the IS-LM curves, contrast these two alternative policies in terms of their implications for the equilibrium interest rate and their likely effects on consumption and investment. 5) More on Short-run/Long run: Suppose that Congress is going to cut government purchases on a permanent basis. Use the IS-LM/AS-AD tools to analyze the implications in the short run and in the long run. (Assume the following. Prices are completely fixed in the short run and completely flexible in the long run. Taxes remain constant. Consumption is a function of disposable income, with a constant marginal propensity to consume. Investment is a function only of interest rate. Our starting point is full equilibrium output. a) Use the IS-LM and AS-AD graphs to show the short run and long run equilibria following this policy. Be sure to label the axes, curves, use arrows to show shifts in curves, and mark the equilibrium points: 1 for equilibrium, 2 for the short run equilibrium, and 3 for the long run equilibrium. b) What happens to the following variables in the short run (rise, fall, no change, can’t tell): output, interest rate, investment, consumption, and real money demand. c) What happens in the long run? For each of the variables listed in (b) above, state if it returns in the long run to its initial equilibrium value, if it is higher in the long run than its initial level, or if it is lower.