Techno-mathematical Literacies in financial

advertisement

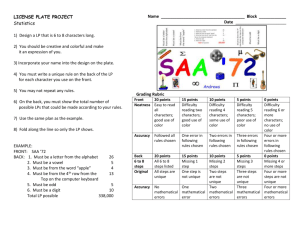

Designing Learning Opportunities for Techno-mathematical Literacies in Financial Workplaces: A status report Arthur Bakker, Celia Hoyles, Phillip Kent and Richard Noss Institute of Education, University of London technomaths@ioe.ac.uk www.ioe.ac.uk/tlrp/technomaths Paper presented at the 6th Annual Conference of the Teaching and Learning Research Programme, Warwick, 28-30 November 2005 DRAFT – NOT TO BE QUOTED ABSTRACT. The “Techno-mathematical Literacies in the Workplace” project is investigating the needs of employees in a range of industrial and commercial workplaces to have functional mathematical knowledge that is grounded in their workplace situations and in the technological artefacts that surround them. We describe this kind of knowledge in terms of “Techno-mathematical Literacies” (TmL), and we report in this paper on our developing ideas for training in TmL, which we call “learning opportunities”: flexible resources for mathematical learning that can be incorporated within workplace technical training materials, and are situated within the contexts and artefacts of the workplace. Where mathematical skills are required in workplaces, the training of de-contextualised mathematical ideas has long been recognised as a problematic approach to effective skills development. We will explain how our situated approach may contribute to more effective training practices. We will describe the development process, and present an example of a learning opportunity in the mortgage sales area of the financial services industry, in which we are addressing the needs of sales agents to develop a better understanding of the mathematical models which underpin the complex mortgage product that they deal with. On the basis of this example, we will discuss several key ideas for our development work: (1) “situated modelling”, that is, the need for employees to develop models of processes that allow them to make data-informed decisions and to communicate with colleagues, managers and customers about the systems and processes that they work with; (2) the role of “boundary objects” that mediate workplace practices and hence can be used to develop workplace learning. KEYWORDS: Knowledge at work, Learning contexts and settings, Learning trajectories, Mathematics, Computers/IT, Boundary objects -1- Introduction The “Techno-mathematical Literacies (TmL) in the Workplace Project” is investigating the combinations of mathematical, statistical and technological skills that people need in workplaces. We are investigating three contrasting industry sectors (Pharmaceuticals Manufacturing, Packaging, Retail Financial Services 1) and we focus on employees at “intermediate” skill level, typically non-graduates with Alevel (or equivalent) qualifications who may be working in service industry (such as banking) as sales agents or customer enquiry agents, or in manufacturing industry as skilled operators or supervisory managers. In a previous project (Hoyles et al, 2002) we promoted the idea of “mathematical literacy” as a growing necessity for successful performance in the workplace. In the current project, we are using the term “Techno-mathematical Literacies” (TmL) as a way of thinking about mathematics as it exists in current IT-based workplace practices. The idea of literacy is crucial: individuals need to be able to understand and use mathematics as a language that will increasingly pervade the workplace through IT-based control and administration systems as much as conventional literacy (reading and writing) has pervaded working life for the last century. As workplaces become increasingly organised around IT systems, the tendency is for mathematical processes to become less visible when the mathematics becomes performed by IT. In such cases, the nature of the mathematical skills required changes: there is a shift in requirement from fluency in doing explicit “pen and paper” mathematical procedures to a fluency with using and interpreting output from IT systems and software, and the mathematical models deployed within them, to carry out mathematical procedures in order to inform workplace judgements and decisionmaking. Significantly, the mathematical skills shift to a broader form: whereas penand-paper techniques may have been for most employees a matter of narrowly following through a calculation without having to worry about the context or meaning of that calculation, the new emphasis is around using calculations appropriately in contexts. It is this kind of broader thinking that we intend with the notion of “technomathematical literacies” (TmL), with the “techno-mathematics” part emphasising that the visible mathematics of workplaces, the mathematics recognised in formal training procedures, is only part of a more broadly-defined and technologically-shaped mathematics, which remains largely invisible and embedded within the routines of working practice. The project’s research consists of two phases. The first (described in our paper for the previous TLRP Conference: Bakker et al, 2004) was concerned with identifying the mathematical practices which are present in the three industry sectors. This phase involved case studies in three or four companies per sector. Based on workshadow observations and interviews, we aimed to understand the work process and to describe what was techno-mathematical about the practices that we observed. 1 We have recently begun developing learning opportunities in a fourth sector, automotive manufacturing, which shares many characteristics with pharmaceuticals manufacturing. -2- One of the results is a set of real contexts and situations in which we think employees’ TmL can be improved. The current phase of the research is thus concerned with the question of how we can support employees in developing the TmL that are useful in their work. We carry out design experiments (Cobb et al, 2003) in collaboration with companies and industry sector experts, which are characterised by design cycles of preparing, designing, testing and revision of materials that we call learning opportunities. These are flexible resources for mathematical learning that will eventually be incorporated within, or be presented alongside, workplace technical training materials. During the process of development, we continue to learn from the learners, trainers and managers within companies. We propose “learning” over “training” to emphasise that rather than thinking of training as transmitting our mathematical knowledge to employees and managers in companies we think of learning opportunities as potentially “boundary crossing” activities (see below) involving the participants and ourselves, essentially connecting mathematical knowledge and work process knowledge. This implies we take employees’ perspectives seriously and thus we use learning opportunities as “windows” onto their thinking. The learning opportunities are carefully designed to weave mathematical ideas into real situations using appropriate technology in a constructionist way and are based around problems that we have observed in workplaces, so as to facilitate rich discussion. We devise activities where employees are given space to voice the meanings they bring to mathematical artefacts such as graphs and mathematical concepts, even if these are seen formally as incorrect. Unpacking why they attribute possibly “incorrect” meanings to artefacts is an important element of the learning opportunity, both to them and to us. We see negotiation around boundary objects as an important step in employees’ articulation of TmL, so that they may develop “situated abstractions” where mathematical tools both frame their understanding and are the means by which they are communicated (cf. Noss & Hoyles, 1996). In this paper we will describe an example of a “skills gap” that we have observed in a financial workplace concerning TmL for the financial mathematics involved in mortgage products, and we will present some emerging ideas (as yet, very early prototypes) for learning opportunities intended to address this situation. A methodological note Like most researchers in education who adopt ethnographic methods, we are not able to attempt the kind of engagement which is typical of ethnography amongst professional anthropologists (immersion of the researcher in the community under investigation). We can spend only short periods of time in workplaces, and so to guard against the problem of biased observation we place significant effort on triangulation. In collecting data, we continuously seek to triangulate different views of the same workplace activity, through the perspectives of employees at all levels. In analysing data, we triangulate interpretations of the raw data (audio transcripts, photographs of workplaces, artefacts in the form of paper documentation) amongst the project team. We further triangulate our findings by appealing to experts from the particular industrial sector, by means of direct consultation and through validation -3- meetings in which sector experts are invited to learn about project findings, comment on their validity and generality, and suggests ways forward for the research. The triangulation of research findings effectively continues through the cycles of the design experiments as we gain feedback from the prototyping of materials which serves to refine and extend the original findings. Analytical framework: Workplaces as activity systems We will briefly outline our theoretical framework for analysing mathematical practices in workplaces. We seek to understand how different companies deploy IT-based systems, the forms of (mathematical) knowledge required by employees to operate effectively and how these relate to the managerial strategies adopted by a company. The basic premise of activity theory is helpful in understanding the role of TmL in workplaces: that people work to realise an object of activity (i.e. the purpose of work) through actions that are mediated by artefacts, for example computers and the information that they provide. We interpret each workplace as a complex arrangement of interacting activity systems each characterised by its own object, mediated by artefacts and located in a context characterised by a specific division of labour, sets of rules and inter-related workplace communities (see, for example, Kuutti, 1996; Engeström, 2001). Our thinking about how to conceptualise the relations between the objects of activity and the actions carried out by individuals, both within and between activity systems, is influenced by the debate in the activity theory literature about “boundary-crossing” and “boundary objects” (Tuomi-Gröhn and Engeström, 2003). Boundary crossing builds on Star and Griesemer’s (1989) notion of a boundary object, an object which serves to coordinate different perspectives of several communities of practice. Boundary objects are flexible enough that different social worlds can use them effectively and robust enough to maintain a common identity among those worlds. Boundary crossing happens if boundary objects are used across the boundaries of different activity systems, or between different communities within an activity system, in ways that facilitate communication between and within systems. Then, tacit knowledge and assumptions can be made more explicit and individuals from different communities can learn something new. This idea is the basis for our approach to the learning of TmL in workplaces, seeking to develop boundary objects and boundary crossing situations based on authentic workplace artefacts and situations, in order to create new knowledge across the boundaries. Techno-mathematical Literacies in financial workplaces A significant feature of TmL as we have seen it in financial services companies is that the mathematics involved seems not much different from what appears in the secondary school mathematics curriculum (for example, calculating compound interest). Yet the effect of workplace context is to introduce a significant degree of complexity to even the simplest mathematics, since any mathematical procedure is not an isolated mathematical exercise but is part of a set of decisions and judgements that have to be made about what is generally a complex process. Moreover, this complexity is, for the most part, hidden in the IT models, only -4- unexpectedly surfacing when customers ask difficult questions or different communities need to communicate across knowledge boundaries. Through our dialogues with financial services companies, we have become convinced that our suppositions about TmL and their importance for workplaces are broadly correct. We have further noted a general pattern of “maths avoidance” that runs through training and working practices. Companies are reorganising to deal with changed circumstances, and the new skills requirements are being recognised, but it seems these are often not responded to in a positive way. For example, in the company we are about to describe we were told that mathematical issues are deliberately avoided in initial training for sales employees because it would frighten and alienate many of the trainees. The situation is, however, that employees do become generally functional through this training, and indeed the company, because of its niche product market, enjoys good profitability. Yet a narrowly-trained workforce is less effective against the uncertainties of the future and will lack flexibility to change. Increasingly, the competitive environment and an increasingly knowledgeable customer base (thanks to the internet) are restricting the effectiveness of functional product knowledge. It is for breadth of understanding about “where the numbers come from” and flexibility for changing practice that we advocate the importance of TmL, including individual needs for personal and career development. An example of TmL: Selling current account mortgages Important examples of TmL that we have found ubiquitous in financial services are: appreciating models of financial products and their inter-related outputs; reading graphs and being able to communicate the meanings of graphs in context. An example which combines these 2 comes up in the selling of current account mortgages, which we have investigated in a specialist mortgage provider. The key to selling here is to establish how the current account mortgage, which is extremely flexible but cannot offer a low interest rate, is different to the majority of mortgages which require fixed regular repayments in return for a discounted interest rate. Prospective customers typically seek out information by making a phone call to a sales agent (customers can do essentially the same for themselves by using the company website). The agent inputs personal and financial details, as well as the property for which the customer is seeking a mortgage, into the computer system. If the basic lending criteria are satisfied, the agent then goes into a typically rather long computer-assisted dialogue (20 minutes or more) which leads to the generation of a printed illustration document based on how the customer might use the current account mortgage: how much would he pay in each month as salary, how much savings can be left in the account, any regular bonuses from his employment, any 2 The financial services work that we have seen features surprisingly little use of graphical representations, with numbers, often in tabular form, being very much dominant. This contrasts with science and engineering practice (including school mathematics and science) which is extremely rich in the use of graphical representations. Although IT is ubiquitous in financial services, it seems that it has not yet changed the rather a-graphical culture of working practices. -5- outstanding credit card debts or loans that can be combined with the mortgage, and so on. Each of these inputs leads to possible savings on the cost of the mortgage since the mortgage debt is “offset” against income and savings – that is, interest is paid only on the difference between the outstanding mortgage and the positive balance held in the account. A standard “persuasive graphic” that is used shows the outstanding balance of the mortgage over time, and the effects on the graph of offsetting – see Figure 1 below which shows the standard repayment of £100,000 borrowed over 20 years (grey line), compared with offsetting £20,000 of savings for the life of the mortgage (black line). By saving on interest (more than £28,000 over the whole term), capital can be repaid more quickly, saving in the case shown several years on the “standard” mortgage term, assuming that the same monthly payment is made regularly. (This is an overly simplistic case, but illustrates the effect of offsetting; in fact, most users of a current account mortgage make quite variable repayments, overpaying and underpaying with respect to the “standard” amount as their financial circumstances change.) 100000 90000 Outstanding balance £ 80000 70000 60000 50000 40000 30000 20000 10000 0 0 5 10 15 20 Years Figure 1: Outstanding balance graphs and “savings” information for a current account mortgage Graphs and data like this (generated by “black box” software) are a key tool used in selling current account mortgages, where a central point to be made to the customer is that discounted interest rates are not the only things that matter about a mortgage, contrary to the way that most mortgages are sold. Common difficulties with this information are: the customer is quoted a saving in money and years of repayment which often sounds “too good to be true”; in the absence of any visible calculation there are few grounds on which the customer or the sales agent has a basis with which to quantify the reported savings – the sales agent cannot make a “common sense” judgement as to whether the figures are realistic or how to bring them to life and make them meaningful to the person on the phone; sales agents are trained to follow a standard script that is tuned to the behaviour of the majority of customers. The minority who ask unusual questions, or who do not wish to follow through the standard long script for illustrations, are likely to find the sales agent “floundering” (the expression of -6- one of the training managers) and unable to answer the customer’s question beyond vague generalities. Given the importance of the repayment graphs, we investigated how sales agents understand them. We found that none had more than a superficial idea of how the graphs are calculated by the software. In itself this is not surprising. It raises the question of whether it matters that the user of the tool does not know what the creator of the tool has done? One reason why it might, is that there are key parameters for the mortgage that are not directly visible in the graph, and hence not connected to the displayed numerical information – among these are the interest rate, the monthly payment, and the possible tax benefits for a higher-rate taxpayer. Moreover, there would be a benefit in knowing something about how the parameters inter-relate to determine the repayment characteristics, since a significant problem reported to us by managers is that sales agents could have a better appreciation of how the different aspects of the current account mortgage fit together. Communicating attractive features of the mortgage involves a network of reasoning steps by which agents are able to link a customer concern or characteristic to a feature or benefit of the product. In suggesting an improved reasoning ability with the graphs and other numerical information, we are definitely not advocating mini “algebra refresher courses” for sales agents as a basis for improved understanding. Rather, there is a need for employees to explore the relationships that are embedded in the model of the mortgage that is encoded in the software – to reason about these relationships, and their effects on “outputs” (mortgage repayments), and having a language to communicate these to customers. Learning opportunities We are currently developing learning opportunities that will address the situation of current account mortgages described above. Key aspects to our work on learning opportunities are use of realistic mathematical artefacts, as a basis for the creation of boundary objects; learning needs to happen in the context of the work with the aim to develop a situated appreciation of the analytical models in use, as expressed through the IT systems; use of realistic “scenarios” (actual customer interactions and how they were dealt with): especially “surprise” situations which motivate a need for explanation in quantitative, techno-mathematical terms; “open” software, such as spreadsheets, which allow learners to construct formal mathematical ideas for themselves (in line with the constructionist approach to learning – cf. Noss & Hoyles, 1996), so that learners can build models of financial products and situations, opening up the closed calculations of the IT system. These offer a dynamic picture of a situation, where “input” quantities can be changed and the effects on outputs can be observed; collaborative activities where learners communicate their results to others; -7- have to work together and interventions which integrate with existing training/employee development modes, and involve managers at different levels so that there is “buy-in”. Working within the design experiment paradigm, we work on design cycles of preparing, designing, testing and revising materials in collaboration with companies and (where accessible) industry sector experts. The aim is that learning opportunities will eventually be incorporated within workplace technical training materials, and so it is essential that the company has ownership of them. An important aspect of the boundary crossing activity involving the participants and ourselves is therefore to develop this sense of ownership. We are developing learning opportunities by starting from the actual products and systems in use in a company, and trying to open up some of the calculations and decisions which are carried out as black boxes behind computer screens. A number of such calculations occur for current account mortgage illustration, particularly concerning the results of offsetting savings against debts. Our general aim here is to take mathematical artefacts that learners know as everyday objects in the workplace – such at the repayment graph illustrated above – and make them the focus of a discussion between learners, and between learners and ourselves – that is, to become boundary objects for shared communication and understanding. As we have suggested above, training and practice in this company tends to “steer around” the mathematics of such artefacts. Thus the idea of discussing how these artefacts work mathematically may be a very novel experience with such familiar objects. The power of discussion is twofold: it prompts learners to ask their own questions about the objects, and therefore to seek mathematical answers using the software; secondly, it helps us to find out how learners think. Repeatedly, we find ourselves making assumptions about what people will think of the objects and tasks that we present – assumptions which reflect our own biased viewpoint as mathematicians. The point is that meanings are strongly rooted in contexts, and as outsiders to the workplace context we continually have to reevaluate our interpretations as we learn more about the context. We are using open software (Excel spreadsheets) in the learning opportunities which seek to open up “black box” calculations for investigation, and which allow for exploration and manipulation of variables in calculations. Figure 2 shows a sample screenshot, illustrating a spreadsheet model for mortgage repayments, resulting in repayment graphs equivalent to those shown in Figure 1; all the input variables and calculations are made explicit here and the inputs may be varied to see the effect on the repayment graphs. Note here that the whole structure is potentially modifiable by simple changes that lead to models of more complex situations; this is an important aspect of what we mean by “open-ness” of the software. Where possible, we invite learners to build their own spreadsheets, and then modify them bit-by-bit to model more realistic situations. Spreadsheets like the one shown in Figure 2 are supplemented by specially-written macros and applications to provide special financial functions (that would otherwise require complex formulae to appear in the spreadsheet), and to provide interfaces for doing calculations where we want learners to focus on specific relationships (by varying one or more quantities – e.g. by slider controls – and looking for the effect on outputs) and not worry about calculation details. -8- Figure 2: Screenshot from a learning opportunity using Excel to model mortgage repayments; the input variables to the model (mortgage term, interest rate, offset savings) are made explicit and modifiable, and the results of changes can be seen directly in the repayment graphs (equivalent to those shown in Figure 1). Calculations on the right (no offsetting) generate the grey line, and calculations on the left (with offsetting against savings) generate the black line. We do not attempt to bring into the foreground all the “essential” mathematical details. Rather, we let the software tool mediate the mathematics, and the spreadsheet in many situations can allow for an approach that keeps algebraic formalism “encoded” within the spreadsheet structure in such a way that the learner can see rather clearly what the formalism is doing. This is in line with our overall emphasis on guiding learners to use mathematical ideas appropriately, rather than guiding them to do the explicit mathematical calculations involved. To develop this point further, we have proposed a set of techno-mathematical literacies which make up a collective literacy that we term situated modelling (Bakker -9- et al, in preparation). We seek to contrast “mathematical modelling” as it is conventionally understood with a description of modelling that fits with how Technomathematical Literacies may operate in the workplace. Situated modelling involves the activities of “making the invisible visible” in the form of “situated models” and using those models as the basis for decision-making. We characterise these models as situated because their understanding depends on a combination of contextual and mathematical issues. This kind of modelling is rather different from the standard idea of mathematical modelling in which a real-world situation is “translated” into a mathematical model so that it can be used to solve a mathematised problem or make a prediction that is translated back to the real world, while neglecting any “noise” from the context 3 . The situated approach takes the noise (from a mathematical perspective) as providing much of the meaning to the model. Conclusions We have presented in this paper the current status of our research on analysing mathematical practices in financial workplaces, and developing learning opportunities for Techno-mathematical Literacies that seek to respond to employees’ needs to reason more effectively with mathematics, in response to business needs. We illustrated this with an example of a mortgage provider which despite current good profitability is aware that its sales employees are rather narrowly-trained for future needs. However the route towards a broader training requires an engagement with the mathematical ideas underlying financial products, which this company presently avoids so as not to alienate most of its sales employees. In our response to this kind of situation, we have emphasised the changing nature of mathematical practices in workplaces, arising from the introduction of IT. This is a point which we feel is not sufficiently recognised (at least in the UK) in education and workplace-related research and in policy discussion around mathematics and numeracy. It is interesting to reflect on the learning opportunities that we have created at the current early stage of our design experiment. They are quite “mathematical” in flavour, despite our continual attempt to engage with realistic contexts. Actually, we think this transition is inevitable, in the process of boundary crossing between ourselves and the company involved. We have adopted this methodology, on the basis of previous research experience, as a way of dealing with the perennial “problem of transfer” of de-contextualised mathematical knowledge into everyday workplace practice (cf. Tuomi-Grohn & Engestrom, 2003). Our approach also gives recognition to the fact that employees develop through experience very rich and generally tacit understandings and ways to cope with the complexities of their workplace situations and these understandings are to some extent mathematised. Mathematical practices at work are inseparably tied up with everyday activity at work, the tools used and how they are used to solve business problems and communicate relevant mathematical ideas. The challenge for the development of learning materials is to develop connections and an enhanced discourse across the boundary between workplace and mathematical communities. “Mathematicians are like Frenchmen: whatever you say to them they translate into their own language and forthwith it is something entirely different.” (Goethe, 1829) 3 - 10 - Acknowledgement Funding of this research project October 2003 – March 2007 by the ESRC Teaching and Learning Research Programme [www.tlrp.org] is gratefully acknowledged (Award Number L139-25-0119). References Bakker, A., Hoyles, C., Kent, P. and Noss, R. (2004, November). Technomathematical Literacies in the workplace: Improving workplace processes by making the invisible visible. Paper for the TLRP Annual Conference 2004 [Online: www.tlrp.org/dspace/handle/123456789/199 ] Bakker, A., Hoyles, C., Kent, P. and Noss, R. (in preparation). “Improving work processes by making the invisible visible and coming to data-informed decisions”. Cobb, P., Confrey, J., diSessa, A. A., Lehrer, R., & Schauble, L. (2003). “Design experiments in educational research”. Educational Researcher 32, 9-13. Engeström, Y. (2001). “Expansive learning at work: toward an activity theoretical reconceptualization”. Journal of Education and Work, 14, 1, 133 – 156. Hoyles, C., Wolf, A., Molyneux-Hodgson, S. and Kent, P. (2002), Mathematical Skills in the Workplace. London: Science, Technology and Mathematics Council. [Online: www.ioe.ac.uk/tlrp/technomaths/skills2002 ] Kuutti, K. (1996). “Activity theory as a potential framework for human-computer interaction research”. In Nardi, B. (ed.), Context and Consciousness: Activity Theory and Human-computer Interaction, pp. 17-44. MIT Press. Noss, R. & Hoyles, C. (1996) Windows on Mathematical Meanings: Learning cultures and computers. Dordrecht: Kluwer Academic. Star, S. L. (1989). “The structure of ill-structured solutions: Boundary objects and heterogeneous distributed problem-solving”. In L. Gasser & M. N. Huhns (Eds.), Distributed Artificial Intelligence, volume 2. London: Pitman / San Mateo, CA: Morgan Kaufmann. Star, S. L. and Griesemer, J. (1989). “Institutional Ecology, ‘Translations,’ and Boundary Objects: Amateurs and professionals in Berkeley’s Museum of Vertebrate Zoology, 1907-1939,” Social Studies of Science, 19: 387-420. Tuomi-Gröhn, T. and Engeström, Y. (Eds.) (2003). Between School and Work: New Perspectives on transfer and boundary crossing. Oxford: Pergamon. - 11 -