Circular Letter MT /2010 - Department of Environment and Local

advertisement

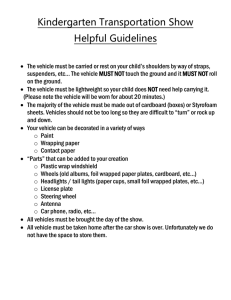

Circular Letter MT 4/2010 10th August 2010 Taxation of Goods Vehicles and Adapted Goods Vehicles Dear Authorised Officer, It has come to our attention that an increasing number of vehicles have changed their tax class from private to adapted goods. Your attention is drawn to circular MT 10/2005, copy attached, which deals with this issue. It is essential that all motor tax offices follow all the guidelines laid out in this circular, in particular in relation to inspection of the vehicle and the “used for the conveyance of goods or burden in the course of trade or business” condition. Having regard to Article 3 of the Road Vehicles (Registration and Licensing) (Amendment) Regulations 1992, which provides that a licensing authority must be satisfied that a vehicle is correctly taxed, the applicant, in particular in relation to small vans and adapted goods vehicles, should be asked for supporting documentation which can include but is not limited to: evidence of registration for VAT; a Tax Clearance Certificate; a commercial insurance certificate; a copy of their “Notice of Tax Registration Form”. Form RF 111A Goods Declaration Form has been revised and is attached. This supersedes the previous version issued. It now requires an applicant who is applying for a vehicle to be taxed at the goods rate to provide a Revenue registration identity number to confirm that he or she has a business registered for tax purposes. All applicants should be asked to complete this form and be made aware that if the vehicle is used in any private capacity it must be taxed at the private rate. Please note the wording must not be changed on this form. It is, of course, open to a motor tax office to seek additional documentation from the applicant if required. Your co-operation in this matter is appreciated. Yours sincerely, ____________________ Deirdre Fanning Assistant Principal Officer Local Government Finance and Motor Tax Policy Goods Only Declaration RF111A Please read the following note before completing this declaration. Article 3 of the Road Vehicles (Registration & Licensing) (Amendment) Regulations 1992 provides that a licensing authority must be satisfied that a vehicle is correctly taxed. In this regard, in order to tax a vehicle at the goods rate all applicants must confirm that they are registered for tax purposes as a business with the Revenue Commissioners by providing their Revenue Registration identity number. Please note these details are strictly confidential and are for the sole purpose of ascertaining entitlement to tax a vehicle as a goods vehicle. RF111A Goods Only Declaration - You must complete this Declaration at a Garda Station if you are taxing the vehicle at the goods rate and the design gross vehicle weight of the vehicle does not exceed 3,500 kg. I declare that vehicle registration number will be used only as a goods carrying vehicle in the course of my business/trade and will not be used at any time for social, domestic or pleasure purposes. I confirm that my business is registered with the Revenue Commissioners for tax purposes. My Income Tax Registration number is The nature of my business/trade is Signature Date The foregoing declaration was completed in my presence by the applicant. Garda Signature Garda Station Stamp Date Dearbhú Earraí Amháin RF111A Léigh le do thoil an nóta a leanas roimh an dearbhú seo a chomhlánú. De réir Alt 3 de na Rialacháin um Fheithiclí Bóthair (Clárú agus Ceadúnú) (Leasú) 1992, ní mór don údarás ceadúnaithe a bheith sásta gur gearradh an chain cheart ar fheithicil. I dtaca leis seo, d’fhonn cáin a ghearradh ag an ráta a bhaineann le feithicil earraí, ní mór do ghach iarratasóir a dhearbhú go bhfuil said cláraithe mar ghnó do chúrsaí cánacha leis na Coimisinéirí Ioncaim trí an Chláruimhir aitheantais a bhfuair said ó na Coimisinéirí a chur ar fail.. Tabhair faoi ndeara le do thoil go bhfuil na sonraí seo faoi rún daingean agus go n-úsáidfear iad amháin chun teidlíocht cáin a ghearradh ar fheithicil mar fheithicil earraí a dhearbhú. RF111A Dearbhú Earraí Amháin - Ní mór duit an Dearbhú seo a líonadh ag Stáisiún na nGardaí má tá tú ag ioc cánach i dtaobh na feithicle ag an ráta cánach d’fheithiclí earraí agus nach dtéann an fheithicil thar ollmheáchan ceaptha na feithicle thar 3,500kg. Dearbhaím gur mar fheithicil iompair earraí amháin I dtaca le mo ghnó/le mo cheird a úsáidfear and fheithicil darb uimhir chlárúcháin agus nach mbainfear úsáid shóisialta, tís ná phléisiúir aisti am ar bith. Dearbhaím go bhfuil mo ghnó cláraithe leis na Coimisinéirí Ioncaim do chúrsaí cánacha. Is é mo úimhir Chláraithe Cánach Ioncaim Is é cineál mo ghnó/mo cheirde Síniú Dáta Líon an t-iarrthóir an dearbhú lastuas I mo láthair. Síniú an Gharda Dáta Stampa Stáisiún an Gharda Circular MT 10/2005 14 September 2005. Taxation of Goods Vehicles and Adapted Goods Vehicles Dear Authorised Officer, I am directed by the Minister for the Environment, Heritage and Local Government to say that the above question, in particular the taxation of adapted goods vehicles, has been the subject of discussion between vehicle testing authorised officers, motor tax officers and this Department. The purpose of the discussion was to get technical advice as to the requirements for adapted goods vehicles and to achieve a uniform practice at both testing and motor tax office levels in relation to goods vehicles. The legal basis for taxing goods vehicles is provided in paragraph 5 of Part 1 of the Schedule to the Finance (Excise Duties)(Vehicles) Act 1952 as inserted by section 3 of the Motor Vehicle (Duties and Licences) Act 2004. Every time there is a change in motor tax rates there is a new Act which inserts a new Schedule of rates into the 1952 Act. Paragraph 5 provides: “5. Vehicles (including tricycles weighing more than 500 kilograms unladen) constructed or adapted for use and used for the conveyance of goods or burden of any other description in the course of trade or business (including agriculture and the performance by a local or public authority of its functions) and vehicles constructed or adapted for use and used for the conveyance of a machine, workshop, contrivance or implement by or in which goods being conveyed by such vehicles are processed or manufactured while the vehicles are in motion. The purpose of the wording in italics/underlined is to include cement mixers in this tax class. Most vehicles can in some fashion convey goods or burden but to be taxed as a goods vehicle the vehicle must be constructed or adapted for that purpose. This construction requirement to carry goods applies equally to a constructed or adapted vehicle and, accordingly, an adapted vehicle must have the same characteristics of a goods vehicle in relation to space and accommodation for carrying goods and limited seating capacity. This means that applications to tax an adapted vehicle at the goods rate must satisfy the following conditions: (A) The goods carrying area to be greater than the seating area, and (B) All seats to the rear of the driver’s seat to be removed and seat bolt holes welded over, and (C) All rear seat belts removed and seat belt anchor points welded over. It is not necessary to blacken side windows. It is essential that all motor tax offices follow these guidelines. In regard to the involvement of the authorised officers for vehicle testing, from September 2005, test centres will refuse to test adapted goods vehicles which do not comply with all of the above conditions. Information on the refusal to test will be passed on to motor tax officers by the authorised officers for vehicle testing by way of a written notification which will state that the vehicle was inspected and is not constructed or adapted for use and used for the conveyance of goods or burden. This input by vehicle testers will be of assistance in discussions on adapted vehicles particularly as there is a visual inspection of the vehicle by testers and the view expressed is by a qualified person in the motor trade. In relation to the condition to remove all seats behind the driver’s seat, applicants may comment that such seats are required for the carriage of employees. The following information will be of assistance in response to such a comment: the provision (section 8(2) of the Roads Act 1920) before referring to employees, firstly states that the vehicle must be a goods vehicle and accordingly, the first decision to be made is whether or not the vehicle satisfies the conditions to be taxed as a goods vehicle, the provision on allowing a goods vehicle to carry employees in the course of their employment dates back to the 1920s and its likely purpose is to cover the carriage of a helper as a front seat passenger as otherwise the vehicle would fall into the private tax class. The provision was never intended primarily to provide a mode of transport for employees, the acceptance of insurance companies to the manner in which employees are conveyed behind the driver is a matter between the applicant and the insurance company. Applications may also enquire as to the change and the fact that their vehicle was/is already accepted as an adapted goods vehicle. The position is that a vehicle can only be taxed for 3/6/12 months and each application is a new application although the term “tax renewal” is used. The over-riding reason for the change is that people are putting the seats back in their vehicles. If the applicant responds that they would not do such a thing, then they should have no problem meeting the required conditions to adopt their vehicle. On a general note, to be taxed as a goods vehicle, the goods must be conveyed in the course of trade or business, including agriculture. Having regard to article 3 of the 1992 Regulations, which provides that a licensing authority must be satisfied that a vehicle is correctly taxed, the applicant, particularly in the case of small vans, crew cabs and adapted vehicles, may be asked to supply a copy of their “Notice of Tax Registration Form” issued by the Revenue Commissioners. This notice, copy enclosed, is a confirmation of registration for tax purposes. The format of the notice may vary but will be on Revenue headed paper and will cover the question of tax registration. Applicants should be informed that the sole purpose of requesting this tax notice is to satisfy the trade or business requirement to tax a goods vehicle and has nothing to do with tax compliance. In addition applicants should complete the “Goods Declaration Form RF 111A” and be made aware that if the vehicle is used in any private capacity it must be taxed at the private rate. Your co-operation in this matter is appreciated. Yours sincerely, John Keenan