Strategy Creation week 10 - Staffordshire University

advertisement

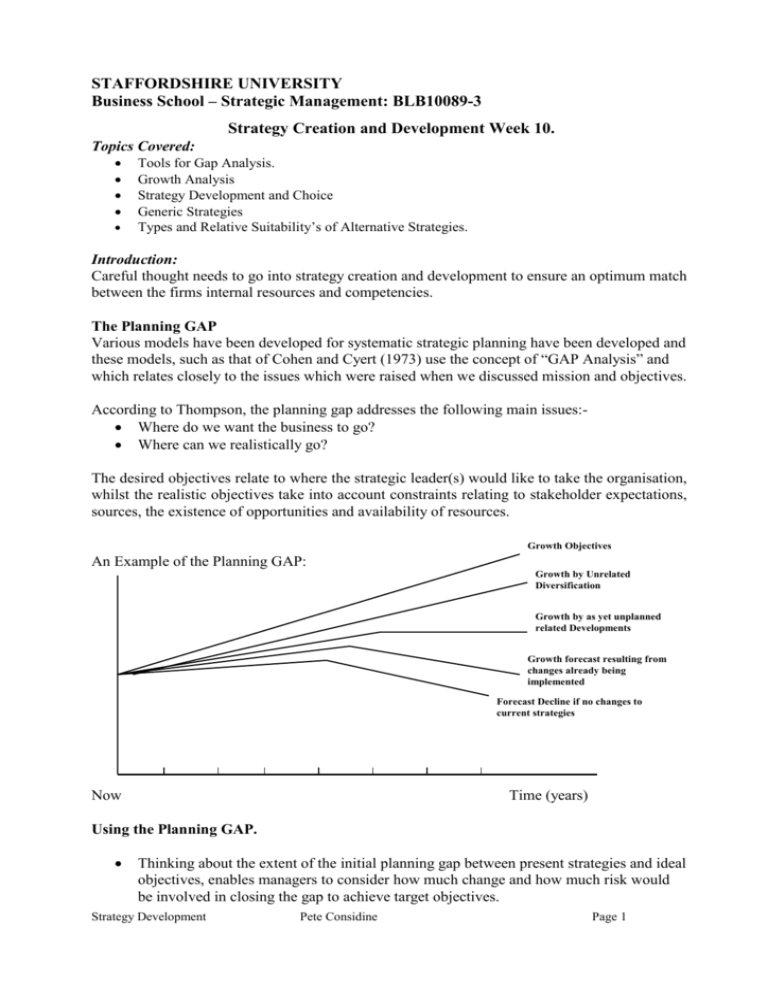

STAFFORDSHIRE UNIVERSITY Business School – Strategic Management: BLB10089-3 Strategy Creation and Development Week 10. Topics Covered: Tools for Gap Analysis. Growth Analysis Strategy Development and Choice Generic Strategies Types and Relative Suitability’s of Alternative Strategies. Introduction: Careful thought needs to go into strategy creation and development to ensure an optimum match between the firms internal resources and competencies. The Planning GAP Various models have been developed for systematic strategic planning have been developed and these models, such as that of Cohen and Cyert (1973) use the concept of “GAP Analysis” and which relates closely to the issues which were raised when we discussed mission and objectives. According to Thompson, the planning gap addresses the following main issues: Where do we want the business to go? Where can we realistically go? The desired objectives relate to where the strategic leader(s) would like to take the organisation, whilst the realistic objectives take into account constraints relating to stakeholder expectations, sources, the existence of opportunities and availability of resources. Growth Objectives An Example of the Planning GAP: Growth by Unrelated Diversification Growth by as yet unplanned related Developments Growth forecast resulting from changes already being implemented Forecast Decline if no changes to current strategies Now Time (years) Using the Planning GAP. Thinking about the extent of the initial planning gap between present strategies and ideal objectives, enables managers to consider how much change and how much risk would be involved in closing the gap to achieve target objectives. Strategy Development Pete Considine Page 1 Some of the strategies considered might be neither feasible nor desirable, and consequently the gap might be too wide to close. The Degree of risk might be greater than the strategic leader is prepared to accept. In the above two cases it may therefore be necessary to revise the objectives downwards so that they finally represent realistic targets – ie ones which are acceptable and achievable. Whilst this type of thinking is related to growth it should not be forgotten that some firms will not seek growth or profit maximisation (eg Charities) The organisations culture and the expectations of the strategic leader together with the key stakeholders will influence the process of strategy analysis and decision making. Ansoff’s Growth Vector Analysis. Market Product Present New Present Market Penetration Product Development New Market Development Diversification The figure above shows the market based options for development as proposed by Ansoff. Market Penetration. The lowest risk is to manage existing products or services more effectively, in order to sell more at perhaps also lower cost Product Development. Ideally using related technologies and skills for sale into existing markets. Market Development. New customers or segments within existing markets for existing products (perhaps with some modifications to increase differentiation. Diversification. This option presents the highest risk, since it involves new products in new markets. However it may be possible to still diversify into related markets at lower risk. Strategy Development Pete Considine Page 2 Strategic Development & Choice: Johnson and Scholes (2005,2008/9) “Exploring Corporate Strategy” Development Strategies What Basis Which Direction Bases of Choice * Corporate purpose * SBU generic competitive advantages * The role of the corporate parent Alternative Directions * Withdrawal * Consolidation * Market penetration * Market Development *Related Diversification *Unrelated Diversification How? Alternative Methods * Internal Development * Acquisition * Alliances /Joint Development’s The SBU “generic strategies” referenced in the above framework were first proposed by M.E. Porter in 1980 in his text Competitive Strategy and give the bases upon which to develop competitive strategy or according to Porter to “cope with the five competitive forces” which we covered in lecture three. The three generic strategies being: Overall Cost Leadership Differentiation Focus An example of an overall cost leader is Toyota Cars, yet whilst achieving this position they still have a differentiated product range. (ie according to Porter it is possible to pursue combinations strategies.) Strategy Development Pete Considine Page 3 Resource Competences required for Generic Strategies Success. Generic Strategy Commonly Required Skills Common Organisational and Resources Requirements Overall Cost Leadership * Sustained capital investment and access to capital. * Process engineering skills * Intense supervision of labour * Ease of build product designs *Low-cost distribution systems *Strong Marketing abilities *Product engineering *Creative flair *Strong capability I basic research * Corporate Reputation for quality or technological leadership *Long tradition in the industry * Strong co-operation from suppliers/distributors * Tight cost control * Frequent detailed reports * High levels of structure * Productivity Incentives Combination of the above polices directed at the particular strategic target Combination of the above polices directed at the particular strategic target. Differentiation Focus * Strong Co-ordination among functions in R&D, product development * Subjective measurement and incentives rather than detailed quantitative measures. *Amenities to attract highly skilled labour Types and Relative Suitability’s of Alternative Strategies. According to Thompson the alternatives associated with market penetration, market development and product development are associated with more limited growth whilst more substantial growth can be achieved through: Horizontal integration. Related diversification. Vertical integration. Unrelated diversification. Retrenchment strategies requiring either a Turnaround or Divestment. Strategy Development Pete Considine Page 4 Guidelines for Pursuing Particular Strategies. J.L. Thompson in Strategic Management cites 13 different strategic alternatives and David in Strategic Management Concepts and Cases (7th edition 1999) offers the following guidelines for each. Forward Integration This involves gaining ownership or at least achieving increased control over distributors or retailers. E.g. Packard Bell selling PC’s directly to customers on a build to order basis. This strategy is most useful when o An organisation’s present channels of distribution are expensive o When the quality of existing distributors is limited o When distributors are adding significant margin to the items being sold. o The advantages of stable high volume production are high ie by increasing the stability and level of demand. Backward Integration This is a strategy for seeking ownership or increased control of the suppliers to the firm. This can help secure supplies of materials or services and to reduce the cost of procurement. In the car industry, as it has globalised, the trend has been away from this strategy. Instead car producers negotiate for the best deals. This strategy is most useful when When an organisation’s present suppliers are expensive, unreliable or otherwise incapable of meeting the firms demands When the number of suppliers is small and the number of competitors is large When rapid growth is occurring in the industry in which the firms competes. When an organisation needs to acquire materials or services quickly When suppliers are making high profit margins Horizontal Integration This refers to a strategy of seeking ownership of or increased control over a firm’s competitors. One of the most significant trends in strategic management today is the increased use of Horizontal integrations as a growth strategy. Mergers, acquisitions and takeovers among competitors allow for increased economies of scale and enhanced transfer of resources and competencies. Kenneth Davidson makes the following observation about horizontal integration: The trend towards horizontal integration seems to reflect strategists’ misgivings about their ability to operate many unrelated businesses. Mergers between direct competitors are more likely to create efficiencies than mergers between unrelated businesses, both because there is a greater potential for eliminating duplicate facilities and because the management of the acquiring firm is more likely to understand the business of the target. Use When:- Strategy Development Pete Considine Page 5 When an organisation can gain monopolistic characteristics in a particular area or region without being challenged by the federal government for ‘tending substantially’ to reduce competition. When an organization competes in a growing industry. When increased economies of scale provide major competitive advantages. When an organization has both the capital and human talent needed to successfully manage an expanded organization. When competitors are faltering due to a lack of managerial expertise or a need for particular resources that an organization possess. Market Penetration A Market penetration strategy seeks to increase market share for present products or services in present markets through greater marketing efforts. This strategy is widely used alone and in combination with other strategies. Market penetration includes increasing the number of salespersons, increasing advertising expenditures, offering extensive sales promotion items, or increasing publicity efforts. Procter & Gamble is an example of this, spending heavily on advertising to increase market share of Venezia, its upscale perfume. Its advertising campaign includes full page ads with scent strips in glossy magazines. This strategy is most useful when: When current markets are not saturated with a particular product or service. When the usage rate of present customers could be increased significantly. When the market shares of major competitors have been declining while total industry sales have been increasing when the correlation between dollar sales and dollar marketing expenditures historically has been high. When increased economies of scale provide major competitive advantages. Market Development Involves introducing present products or services into new geographic areas. The climate for international market development is becoming more favourable in many industries, such as airlines, it is going to be hard to maintain a competitive edge by staying close to home. This strategy is most useful when: When new channels of distribution are available that are reliable, inexpensive, and of good quality. When an organization is very successful at what it does. When new untapped or unsaturated markets exist. When an organization has the needed capital and human resources to manage expanded operations. When an organization has excess production capacity. When an organization’s basic industry rapidly is becoming global in scope. Strategy Development Pete Considine Page 6 Product Development Is a strategy that seeks increased sales by improving or modifying present products or services. Product development usually entails large research and development expenditures. This strategy is most effective when: When a firm has successful products that are in the maturity stage of the product life cycle, the idea here is attract satisfied customers to try new and improved products as a result of their positive experience with the firms present products or services. When a firm competes in an industry that is characterised by rapid technological developments. When major competitors offer better-quality products at comparable prices. When an organisation competes in a high-growth industry. When an organisation has especially strong research and development capabilities. Diversification Strategies 7.aConcentric (or related) Diversification This strategy involves adding new, but related, products or services E.g. Banks moving into insurance products etc. This strategy is most effective when When an organisation competes in a no growth or slow growth industry When adding new, but related, products significantly would enhance a sale of current products. When new, but related, products could be offered at highly competitive prices when new, but related, products have seasonal sales levels that counter balance a firms existing peaks and troughs. When an organisations products are in the decline stage of t he product life cycle. When a firm has a strong management team. 8.aHorizontal Diversification Adding new unrelated products or services for present customers is called horizontal diversification. This strategy is less risky than conglomerate diversification, since the corporation should already be familiar with its present customer base. E.g. Pepsi & CocaCola both recently entered the bottled water market. Strategy Development When revenues derived from the firms existing products or services would increase significantly by adding the new unrelated products When an organisation competes in a highly competitive and/ or no growth industry When the firms current channels of distribution can be used to market the new products to current customers. Pete Considine Page 7 When the new products have counter cyclical sales patterns compared to the existing product ranges. 9. Conglomerate Diversification Adding new, unrelated products or services is called conglomerate diversification. According to David some corporation pursue this option in an expectation of profits from breaking up acquired firms and selling division’s piecemeal. General Electric (USA) is highly diversified with train manufacture, light bulbs, white goods etc. When a firms basic industry in experiencing declining sales and profits When the firm has the capital and managerial talents required to compete successfully in a new industry When a firm has the opportunity to purchase an unrelated business that is an attractive business opportunity. When there exists financial synergy between the acquired and acquiring firm When existing markets for the firms current products are saturated. Defensive Strategies 10.vJoint Venture Joint ventures are popular strategies and occur when two or more firms form a temporary venture partnership or consortium for the purpose of capitalising on a specific opportunity. The only reason for classifying this as a defensive strategy is because the firm is not entering into this venture on its own. Joint ventures and co-operatives are becoming increasingly popular since they allow firms to improve communications and networking, to globalise operations and to reduce risk. When there exists a need to introduce a new technology quickly. When two or more smaller firms have trouble competing with a large firm When some project is potentially very profitable, but requires overwhelming resources and risks e.g. the Alaskan pipeline When the distinctive competencies of two or more firms complement each other especially well. 11. Retrenchment This occurs when a corporation regroups to cut costs and assets in order to survive in difficult circumstances. This is sometimes called a turnaround or re-organisation strategy. In these situations strategists work with limited resources and face considerable pressure from stakeholders such as shareholders, unions, banks etc. This often entails selling off land or other assets to raise capital. (Wal –Mart implemented a retrenchment strategy in 1998 when it closed 48 of its 61 Bud’s discount stores) In some case bankruptcy can be an effective type of retrenchment strategy, since it can enable firms to avoid major debt obligations and to void union contacts. When a firm has a clearly distinctive competence but has consistently failed to meet its goals and objectives. When a firm is one of the weaker competitors in a given industry. Strategy Development Pete Considine Page 8 When an organisation has grown so large, so quickly, that major internal reorganisation is needed. 12. Divestiture Selling off a division or SBU is often done to raise capital to fund further strategic developments or acquisitions. This has also become a popular strategy as firms focus upon core strengths, sometimes lessening their level of diversification. When a firm has pursued a retrenchment strategy, but has failed to accomplish the needed improvements. When a SBU needs more resources to be competitive than the company can provide. When a SBU is responsible for a firms overall poor performance. When a large amount of cash is need quickly and cannot be obtained from other sources. When a SBU is a misfit with the other SBU’s in an organisation. 13. Liquidation Selling off all of a companies assets for their tangible value is called Liquidation and is recognition of defeat (as a consequence difficult for strategic leader to come to terms with). In the UK many small firms fail every year. When the shareholders of a firm can minimise their losses by selling their organisations assets When an organisation has pursued both a retrenchment strategy and a divestiture strategy and neither has been successful. When an organisations only alternative is bankruptcy, liquidation represents an orderly and planned means of obtaining a greatest possible cash value of its assets. Strategy Development Pete Considine Page 9 The Grand Strategy Matrix (GSM) (adapted from F. David (2003). p193) – (later edition in print) Depending upon the firms competitive position and the rate of market growth we can position the above alternative strategies on the Grand Strategy Matrix as shown below and use this as a tool to help screen and then select the most viable option(s) for a particular corporation. Rapid Market Growth Quadrant 1 1. Market Development 2. Market Penetration 3. Product Development 4. Forward Integration 5. Backward Integration 6. Horizontal Integration 7. Concentric Diversification Quadrant 2 1. Market Development 2. Market Penetration 3. Product Development 4. Horizontal Integration 5. Divestiture 6. Liquidation Strong Competitive Position Weak Competitive Position Quadrant 3 1. Retrenchment 2. Concentric Diversification 3. Horizontal Diversification 4. Conglomerate Diversification 5. Divestiture 6. Liquidation Quadrant 4 1. Concentric Diversification 2. Horizontal Diversification 3. Conglomerate Diversification 4. Joint Venture Slow Market Growth Interpretation and Application of the GSM Quadrant One Firms located in quadrant one of the GSM are in a good position to develop without needing to shift too much from their established competitive position. If such firms have excess resources then they can consider backward and/or forward integration or even horizontal integration may be an effective strategy. Should a quadrant one firm be too committed to a single product then concentric diversification may be the appropriate strategy to pursue. Such firms are able to take advantage of external opportunities and can take on risks aggressively when required. Strategy Development Pete Considine Page 10 Quadrant Two Firms located in quadrant one of the GSM need to evaluate their present position very seriously, since although their industry is growing the are unable to compete effectively against their rivals. Since they are in a rapidly growing industry then they need to pursue more intensive rather than integration or diversification strategies. However if the firm is lacking in distinctive competences then it could consider horizontal integration. As a last resort then divestment or even liquidation should be considered. Quadrant Three Firms in this quadrant are in slow growth industries and also in a weak competitive position. Such firms need to make drastic changes in the shorter term if they are to survive (i.e. avoid liquidation) and develop. Extensive cost and asset reductions are required (i.e. retrenchment), should be pursued as a first choice. An alternative to this may be to divert resources into new business areas. Should this fail then divestment of the SBU(s) or liquidation will likely be required. Quadrant Four Firms in this quadrant are strong competitors in slow growth industries or sectors. Such firms will typically have the financial strength and other resources necessary to pursue diversification strategies or even joint ventures. Conclusions. The Grand Strategy Matrix helps strategic decision makers select the best strategies for a given competitive situation. The choice of strategies as described above are not mutually exclusive in and some larger already diversified firms may be pursuing more than one strategy simultaneously. The culture of the organisation and the risk taking propensity or aversion of the strategic leaders will often impact on this selection process, but which itself is dependent upon having identified suitable opportunities as well as having the appropriate resources available (eg financial, human and capital). It is worth remembering that some firms may decide to adopt the “do nothing strategy” although in the longer term this strategy has led to many firms going out of business all together! References : David F (2003). Strategic Management- Concepts & Cases. Prentice Hall Thompson and Martin (2008) Strategic Management ‘. Tompson. Johnson & Scholes (2010) Exploring Corporate Strategy. 6th Edition Strategy Development Pete Considine Page 11