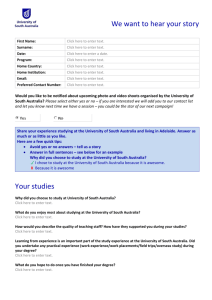

Southern Adelaide industry structure

advertisement

SOUTHERN FUTURES Local Community Partnership - Environmental Scan – 2007 1. Environmental scan for the region Background on Current Workforce status in Southern Adelaide (January 2007) The Southern Region Economic Development Board (SREDB) Blueprint will be launched in April 2007, and focuses on the Onkaparinga and Marion Council areas. Southern Futures LCP supports school across the Onkaparinga Council area only. Schools in the Marion Council area and supported by our neighbouring Quality LinCS LCP. The Blueprint will be a living document that sets the vision of a prosperous region delivering a quality life and environment for everyone into the future. The region has developed a local Workforce Development Strategy with skills formation planning that will facilitate the implementation of the Blueprint, supporting social and economic objectives. Sustained economic growth in South Australia over the past two years has generated strong employment growth. For growth to continue though we must ensure that there is an adequate supply of appropriately skilled people by delivering training and a learning culture that matches the need. The key issue for Southern Adelaide (Onkaparinga and Marion Councils) is we have a low proportion of formal qualifications (32% compared to 54% Nationally), and this is a key statistic we must turn around to align with the SA Strategic Plan target of having a skilled workforce. A particularly welcome feature of this growth has been a significant increase in full-time jobs. In mid to late 2006 the official unemployment rate fell to a record low of 4.7%. Labour underutilisation remains evident however with around 27% of part-time workers indicating that they would prefer to work more hours. At the same time skill shortages have emerged with some employers finding it more difficult to recruit and retain workers in a tighter labour market. The proposed expansion of major mining operations in SA will provide a significant boost to mining industry employment over the next five years. Similarly defence industry manufacturing employment is set to expand with the awarding of the Air Warfare destroyer contract to SA. On the other hand the wider manufacturing sector is under pressure from competition from overseas, with job losses and the future of car manufacturing (Mitsubishi) in SA as symptoms of this. All of these events lead to both threats and opportunities for Southern Adelaide. Overall SA economic growth is expected to be more subdued over the next few years. The State Budget forecasts slower economic and employment growth before a return to more buoyant conditions. The Southern Adelaide region needs business growth strategies to cope with the strong residential population and commercial developments that will demand local jobs are available for them in the region. The traditional problem of lack of employment in the South has been continuing for some time, resulting in people having to reluctantly travel beyond the boundaries of their region for suitable work. Southern Adelaide industry structure To put Southern Adelaide in perspective, South Australia’s economic growth has under-performed Australia for a number of years. In terms of industry structure, this lower growth can largely be attributed to relative industry performance. While the comparatively larger sectors of Manufacturing, Retail Trade and Health & Community Services performed well in terms of growth compared with the Australian average, many other smaller local sectors have been growing too slowly when compared to the rest of Australia, so we lack diversity. Also, lower employment growth in the South can be attributable to a negative contribution related to faster productivity growth. Southern Adelaide has an above average concentration of industries where more rapid productivity improvements have been achieved. The fact is that our top four key sectors – Manufacturing, Retail Trade, Health & Community Services and Property & Business Services have achieved relative rapid productivity improvements both locally and Australia wide. All of these sectors represent a greater proportion of the Southern Adelaide gross product than they do Statewide. Hence the higher aggregate productivity growth and lower employment growth in the Southern Adelaide, which has led to job redundancies and workforce contraction. These top four sectors alone represent the key cross-section of Southern Adelaide industry and employ over half (55%) of the workforce. Of these four key sectors, manufacturing is the main sector with above average productivity due to automation, while the others are relatively labour intensive. However because of its size, manufacturing employs 17.7% of the Southern Adelaide workforce against 14.7% State and 13.5% Nationally. The machinery and equipment manufacturing sub-sector (about 42% of this sector), is dominated by vehicle component manufacturing, which has experienced considerable global restructuring and industry change in the last decade, and will continue to do so in future years making the Southern Adelaide quite vulnerable. The other strong manufacturing sub-sector is secondary processing of food and beverage (about 12% of the sector which incorporates the wine industry). With the current oversupply of wine grapes and the corporatisation of the wine industry, this again leaves the South vulnerable to cycles in this sector too. The manufacturing industry plays such a vital role in the local Southern Adelaide economy and its performance has a significant impact on the regional input to the State GDP. But in an arena of globalisation, the ‘old-world blue collar manufacturing sector will only see decline. So in terms of ‘new-world white collar’ thinking, the sophisticated skilled economy of the future can only survive with a dynamic agile manufacturing sector. Technical innovation and R&D propensity in manufacturing is three times the non-manufacturing sectors. A high wage, high growth, knowledge intensive economy has its roots deep within a sophisticated and diversified manufacturing sector which will influence the type of jobs and businesses we have in the South in the future, and the level of prosperity we enjoy. The SREDB Blueprint has developed as a key to the prosperous future of the region, promoting the development of a dynamic Southern Adelaide economy, advocating innovation and the growth of knowledge based industries. Identified target sectors include opportunities in environmental industries, advanced manufacturing, food/wine/tourism, health and education. Current high growth segments of Retailing employs 16.1% of the Southern Adelaide workforce, while Health & Community Services employs 12.3%. These though are important sectors for local workforce development as these industries can cater for lower entry skill levels and flexible delivery of working hours that particularly suit disabled job seekers, parents returning to work and young people studying. One saving grace for Southern Adelaide is that most of the private housing growth for Adelaide in the next two decades will be in the far South (Seaford). This significant population growth will lead to increased local consumer demand. The Construction Industry is the next biggest sector in Southern Adelaide behind the key four sectors listed above, and will continue to grow due to this housing and commercial growth in the area. Future Workforce Development needs – the ‘big picture’ Australia is currently enjoying a period of sustained economic growth. Unemployment is at a 30-year low and labour force participation is at an all time high (although lagging behind other OECD nations). The growing economy means that demand for skilled labour is strong, especially in the trades area. At the same time the population is ageing and there will not be a ready supply of young people to take up the vast array of employment opportunities that will be available. By 2010 retirees and growth will create a projected shortfall of 10,000 to 15,000 workers per annum in South Australia. Business acumen will be critical as 5 years of 6% wage inflation (as predicted in 2 to 3 years time) will wipe out profits in an inelastic pricing environment, and only the adaptable will survive. The workforce of the future will be more diverse and will include more older workers, more single parents, more people with disabilities and more people wanting to work part-time to fit in with work-life balance. Employers must consider flexible workforce options, innovative recruitment, talent retention, job share and staff training strategies to attract and retain skilled workers. Department of Employment and Workplace Relations (DEWR) data indicates that currently around 180,000 new participants join the Australian workforce every year, but between 2020–2030 it is predicted only 180,000 new participants will join the workforce in the whole decade! Phased retirement options and succession planning will be vital in this environment. Many employers are unaware that the recent SA Unemployment rate of 4.7% is a record low level with the impact being that those left in the job seeker pool need more intensive assistance to prepare them to be job ready. Some retrenched and redundant workers do have skills, but are not recognised, meaning more RPL (Recognition of Prior Learning) and RCC (Recognition Current Competencies) programs need to be conducted. Some also have social, personal and attitude issues that need to be addressed prior to being deemed job ready by employers. To compound the recruitment problem many businesses do not understand young people who are ‘living for of today, not tomorrow’, so Generation Y forums need to be developed to inform them and find some middle ground between employer expectations and youth attitudes. Many old industries will collapse, as the younger generation have no interest in engaging with them, as employer perceptions and conditions do not match the reality of youth seeking respect and dynamics in their work choice. Many employers are not investing into staff training, which is an element young people crave. The supportive culture of training development in the workplace keeps them motivated and loyal. The supply of workers in the near future will be insufficient to service labour demand. We must start grappling with the looming demographic change, which will soon impact on our economic growth, and local businesses and industry sectors should be planning now for the change. The increasing skills required for the new world of work will see the need for a lifelong learning fast and flexible training culture to keep in touch with ever changing technologies. More research and development, commercialising innovation, applying knowledge and developing niche opportunities will be the way forward for the future. Workforce succession planning policies in retaining mature age talent through phased retirement, flexible work hours and job sharing practices to transfer knowledge to younger staff will be needed. Creative restructuring of the workplace will be required by many to attract and nurture the young Generation Y cohort into their business or industry sectors. There will need to be a new skill shift focus, where investing in people will be an infrastructure priority. Around 10% of young people want to start their own business rather than working for a boss, so will need to be encouraged to do so more than any other generation beforehand. In summary, the following local growth industries will align with the priority growth sectors for the State: - Information communication and technology, environmental industries, advanced manufacturing, food/wine/tourism, health and education. Current high growth industries include Retail, Health and Community Services, transport and Construction. Southern Adelaide Economic Development Blueprint, SAWorks in the Regions, DEWR. Existing Career and Transition Support services being delivered by other organisations in the region; - Futures Connect Youth Engagement Strategy; funded by the State Government for public sector schools. - Australian Technical College; funded the Federal Dept. of Education Science and Training (based just outside the border of the Fleurieu Peninsula) to provide opportunities school-based Australian Apprenticeships in identified industries. - Youth Employment Alliance; funded by DFEEST this program funds business associations for every Australian Apprenticeship signed to a contract of training, with an employer that is a member of the business association. - Flexible Learning Option (FLO) funded by DECS and Southern ICAN supports students that are not engaged or at risk of disengaging from school in developing an individual learning plan and accessing education and/or training in their area of interest. The LCP program of short courses is increasingly becoming accessed by this particular student cohort. - SA Works in the Regions; Employment Skill Formation Networks focus on supporting programs for young people who are not within education or training. - Trade Schools; The State Government will fund Trade schools to be established in 10 areas across the State. One has been identified for the “south” although information on the actual location, industry areas and catchment area is not yet available. - Youth Pathways; funded by DEST to support young people at risk of leaving school before the end of Year 12, and students with mental health issues via case management. - Mission Australia; a suite of programs and services for young people with a range of social, health, educational and other issues. - Alternative schooling programs; FAME, SCAEP and WAVES – these programs support students with an education alternative to school. - POEMS SA Choices; funded by DEST is an education alternative for young people to gain their SACE with intensive support at an off school site. - ACE programs; funded by DFEEST, three local youth support agencies support young people to reengage in education, training or employment.