Environmental Safety and Toxic Materials

advertisement

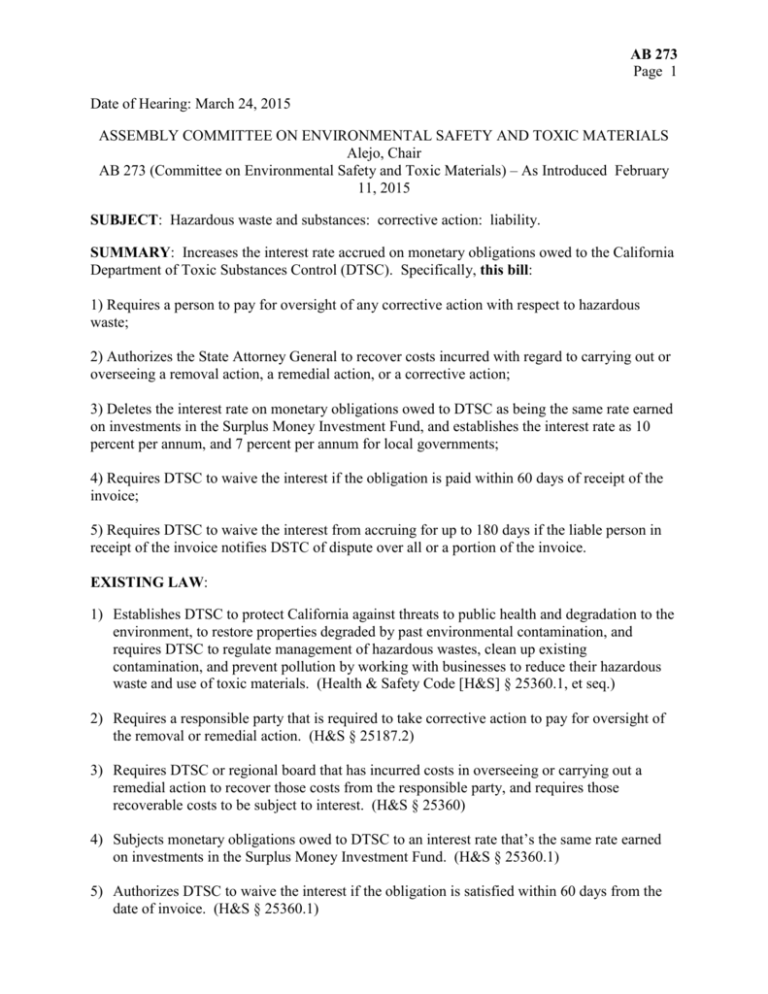

AB 273 Page 1 Date of Hearing: March 24, 2015 ASSEMBLY COMMITTEE ON ENVIRONMENTAL SAFETY AND TOXIC MATERIALS Alejo, Chair AB 273 (Committee on Environmental Safety and Toxic Materials) – As Introduced February 11, 2015 SUBJECT: Hazardous waste and substances: corrective action: liability. SUMMARY: Increases the interest rate accrued on monetary obligations owed to the California Department of Toxic Substances Control (DTSC). Specifically, this bill: 1) Requires a person to pay for oversight of any corrective action with respect to hazardous waste; 2) Authorizes the State Attorney General to recover costs incurred with regard to carrying out or overseeing a removal action, a remedial action, or a corrective action; 3) Deletes the interest rate on monetary obligations owed to DTSC as being the same rate earned on investments in the Surplus Money Investment Fund, and establishes the interest rate as 10 percent per annum, and 7 percent per annum for local governments; 4) Requires DTSC to waive the interest if the obligation is paid within 60 days of receipt of the invoice; 5) Requires DTSC to waive the interest from accruing for up to 180 days if the liable person in receipt of the invoice notifies DSTC of dispute over all or a portion of the invoice. EXISTING LAW: 1) Establishes DTSC to protect California against threats to public health and degradation to the environment, to restore properties degraded by past environmental contamination, and requires DTSC to regulate management of hazardous wastes, clean up existing contamination, and prevent pollution by working with businesses to reduce their hazardous waste and use of toxic materials. (Health & Safety Code [H&S] § 25360.1, et seq.) 2) Requires a responsible party that is required to take corrective action to pay for oversight of the removal or remedial action. (H&S § 25187.2) 3) Requires DTSC or regional board that has incurred costs in overseeing or carrying out a remedial action to recover those costs from the responsible party, and requires those recoverable costs to be subject to interest. (H&S § 25360) 4) Subjects monetary obligations owed to DTSC to an interest rate that’s the same rate earned on investments in the Surplus Money Investment Fund. (H&S § 25360.1) 5) Authorizes DTSC to waive the interest if the obligation is satisfied within 60 days from the date of invoice. (H&S § 25360.1) AB 273 Page 2 6) Establishes an interest rate at 10 percent per annum on the principal amount of a money judgment remaining unsatisfied, and establishes the right of the Legislature to change the rate of interest at any time to a rate of less than 10 percent per annum, regardless of the date of entry of the judgment or the date any obligation upon which the judgment is based was incurred. (Code of Civil Procedure § 685.010) 7) Establishes that interest on a tax or fee judgment against a local public entity shall accrue at a rate equal to the weekly average one year constant maturity United States Treasury yield at the time of the judgment plus 2 percent, but shall not exceed 7 percent per annum. (Government Code § 970.1) FISCAL EFFECT: Unknown. COMMENTS: State Audit Report: On August 7, 2014, the Bureau of State Audits (BSA) released a report on DTSC's cost recovery. The BSA found that long-standing shortcomings with DTSC's recovery of costs have resulted in millions of dollars in unbilled and billed but uncollected cleanup costs dating back to 1987. According to the report, "increasing the interest rate charged on billed but delinquent unpaid amounts may improve the timeliness of collections from responsible parties. State law requires the department to charge interest for invoices not paid within 60 days at a rate equal to the rate of return earned on investments in the State’s Surplus Money Investment Fund (SMIF). However, the SMIF interest rate is substantially lower than the interest rate charged for late payments by other state entities, such as the California State Board of Equalization (BOE). For example, for the quarter ending June 30, 2013, the SMIF interest rate was 0.246 percent, while the BOE interest rate was 6 percent for the same period. As long as the SMIF interest rate remains low, there is less incentive for responsible parties to make payments on time." The BSA recommended that in order to improve DTSC's efforts to promptly recover its costs, the legislature should revise state law to allow DTSC to use a higher interest rate assessed on late payments. Special treatment for local governments: State law establishes different interest rates for local governments. California Government Code § 970.1 sets an interest rate for local governments only for interest on tax or fee judgments. Article XV of the California Constitution provides that "[t]he rate of interest upon a judgment rendered in any court of this State shall be set by the Legislature at not more than 10 percent per annum. Such rate may be variable and based upon interest rates charged by federal agencies, or economic indicators, or both. In the absence of setting of such rate by the Legislature, the rate of interest on any judgment rendered in any court of the State shall be 7 percent per annum." The California Supreme Court determined in California Federal Savings and Loan Association v. City of Los Angeles (1995) 11 Cal.4th 342 that in the absence of the Legislature establishing a different rate, the "applicable rate of post-judgment interest to be paid by local public entities is 7 percent." The interest rate imposed on local governments (aside from judgments involving taxes or fees) is unspecified and is the 7% specified in the Constitution. AB 273 Page 3 Previous legislation: SB 812 (De León 2014), among other provisions, proposed to require any monetary obligation owed to DTSC to accrue interest at the same rate as the modified adjusted rate per annum imposed for underpayments of sales and use taxes to the state. That bill was vetoed on September 29, 2014, for reasons stated unrelated to the provision modifying the interest rate. REGISTERED SUPPORT / OPPOSITION: Support Natural Resources Defense Council Opposition None on file Analysis Prepared by: Paige Brokaw / E.S. & T.M. / (916) 319-3965