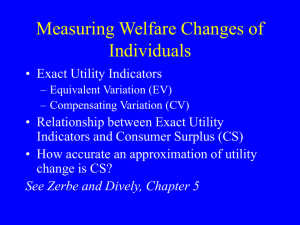

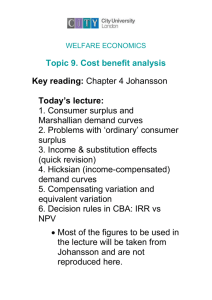

Consumer Welfare

advertisement

Consumer Welfare

1. Review of consumer theory and duality

We have represented consumer theory by the maximization problem

V(p, r) = Maxx {u(x) : p x r, x n },

which has for solution the Marshallian demand functions x*(p, r), where V(p, r) =

u(x*(p, r)) is the indirect utility function.

(1)

Consider the expenditure minimization problem

E(p, U) = Minx {p x: u(x) U, x n },

(2)

which has for solution the Hicksian demands xc(p, U), where E(p, U) is the expenditure

function which satisfies Shephard's lemma E/pi = xic, i = 1, …, n. The expenditure

function measures the smallest amount of money the household is willing to pay facing

price p to reach the household utility level U. As such, it is a willingness-to-pay measure.

Note: The expenditure minimization problem (2) is very similar to the cost minimization

problem we analyzed earlier. In the single output case, the main difference is that

f(x) q replaces u(x) U in (2), where f(x) is the production function and q is

output. Otherwise, all analytical results obtained in the context of cost

minimization apply to the expenditure minimization problem (2).

Duality between V and E: Under non-satiation, and given r > 0, we have

xc(p, U) = x*(p, E(p, U)),

and

x*(p, r) = xc(p, V(p, r)),

implying that

E(p, V(p, r)) = r,

and

V(p, E(p, U)) = U.

(3a)

(3b)

(4a)

(4b)

Expressions (4a)-(4b) show the indirect utility and expenditure functions are inverse

functions of each other.

Consider a reference commodity bundle g = (g1, …, gn)T Rn satisfying g 0, g 0.

Define the benefit function

b(x, U, g) = Max {: u(x - g) U, (x - g) 0},

(5)

where b(x, U, g) is the benefit function. It measures the quantity of the bundle g that the

household must give up to obtain x starting with the utility level U. In the case where the

bundle g is worth one unit of money (i.e. where p g = 1), then the benefit function has a

simple and intuitive interpretation: it measures the household willingness-to-pay to reach

x starting with utility level U.

1

Recall that b(x, U, g) is concave in x if u(x) is a quasi-concave function. The

concavity of the benefit function is noteworthy. It means that the benefit function b(x, U,

g) exhibits diminishing marginal values with respect to x.

Duality between E and b: Assume that p g = 1. Then

E(p, U) = -Maxx {b(x, U, g) - p x: x 0}.

(6)

Equation (6) involves the maximization of the net benefit function [b(x, U, g) - p

x]. This has two attractive characteristics. It is intuitive: it states that consumers should

try to choose consumption goods x so as to maximize the benefit b, net of the cost of

purchasing the goods, p x. And it is a "nice" unconstrained maximization problem, with

an objective function that is concave in x, and linear in prices p.

Under differentiability, the FOC for an interior solution to (6) are

b/x = p.

This simply states that, at the optimum, marginal benefit, b/x, must equal

marginal cost, p. And the benefit function being concave, this is a necessary and

sufficient condition to identify a global solution to the maximization problem in (6).

If x > 0, then

u(x) = Minp {V(p/1): p x 1, p 0},

(7)

which has for solution the price dependent Marshallian demand functions p*(x,

1).

If x > 0, then

b(x, U) = Minp {p x - E(p, U): p g = 1, p 0},

(8)

which has for solution the price dependent Hicksian demand functions pc(x, U),

with b/x = pc(x, U) from the envelope theorem.

If u(x) is non-satiated in g and x > 0, then

b(x, U) = 0 is equivalent to u(x) = U.

(9)

The duality relationships are summarized in Figure 2.

Figure 2: Duality when u(x) is quasi-concave

(5)

Direct utility

function

u(x)

(1)

(9)

(7)

(2)

Indirect utility

function

V(p, r)

(4b)

(4a)

Benefit

function

b(x, U, g)

(6)

(8)

Expenditure

function

E(p, U)

2

Figure 2 shows that that each of the function u(x), V(p, r), b(x, U, g) and E(p, U) can be

recovered from any of the others. These are mathematical relationships. However, they

provide some flexibility in conducting economic analysis (depending on the data

available and the questions being investigated…).

2. Implications for Welfare analysis

We have seen that the direct and indirect utility functions characterize

Marshallian household behavior. This is relevant in empirical analysis of household

behavior since Marshallian behavior x*(p, r) is observable.

Alternatively, the expenditure and benefit functions are relevant in the

characterization of Hicksian household behavior. They hold household utility at some

given level U. Since utility is typically not observable, these functions cannot be used

directly in the empirical analysis of household behavior (although they can be used

indirectly through duality; see the AIDS specification). However, the expenditure and

benefit functions provide the foundation for welfare analysis.

2.1. Measuring the welfare effects of price changes

Consider a situation where a household faces a change in consumer prices from

(pa, ra) to (pb, rb). We would like to evaluate the effects of this change on the welfare of

the household. A natural choice is to rely on the expenditure function E(p, U) defined in

(2). We have seen that the expenditure E(p, U) measures the household willingness-topay to reach a utility level U when facing p. This suggests measuring the welfare effects

of a change from (pa, ra) to (pb, rb) by the function

W(pa, pb, U) = rb - E(pb, U) - ra + E(pa, U),

(10)

which reflects the change in household income net of expenditures, holding U constant.

The household is made better off (worse off) by the change from (pa, ra) to (pb, rb)

if W(pa, pb, U) > 0 (< 0). Intuitively, the household is better off (worse off) when its

income net of expenditure increases (decreases) while holding its utility constant at U.

Note from (10) that W/pa = E/pa. Also, from calculus, if E(p, U) is differentiable,

W(pa, pb, U) = rb - ra + E(pa, U) - E(pb, U)

n

= rb - ra - i

1

p ib

(E/pi) dpi,

p ia

n

= rb - ra - i

1

p ib

xic(p, U) dpi,

(11)

p ia

from Shephard's lemma. Equation (11) is an important result. It states that welfare change

can be measured exactly from the integral of Hicksian demand functions xc(p, U).

To make use of (11) in welfare analysis, two issues must be settled: 1/ how to choose U

in (11)?; and 2/ how to measure xic(p, U)?

3

Two options have been commonly used in the choice of U.

We can choose U = V(pa, ra). Then, the welfare measurement given in (11) is

called compensating variation (CV), where CV ≡ W(pa, pb, V(pa, ra)) = rb - ra

+ E(pa, V(pa, ra)) - E(pb, V(pa, ra)). This amounts to choosing the situation

before the change as the reference situation in welfare analysis. As such, the

compensating variation (CV) is the maximum amount of money the household

would be willing to pay to face a change from (pa, ra) to (pb, rb) while

remaining at the initial utility level U = V(pa, ra).

Or we can choose U = V(pb, rb). Then, the welfare measurement given in (11)

is called the equivalent variation (EV), where EV ≡ W(pa, pb, V(pb, rb)) = rb ra + E(pa, V(pb, rb)) - E(pb, V(pb, rb)). This amounts to choosing the situation

after the change as the reference situation in welfare analysis. As such, the

equivalent variation (EV) is the amount of money the household would be

willing to receive to avoid facing a change from (pa, ra) to (pb, rb) while

remaining at the subsequent utility level U = V(pb, rb).

In general, CV EV. In addition, xc(p, U) being typically unobservable, we need to find

some simple way of measuring the right-hand side in (11). One possibility is to replace

xc(p, U) in (11) by the Marshallian demand x*(p, r). If we do this, we obtain

p ib

n

CS = rb - ra - i

1

xi*(p, r) dpi,

(12)

p ia

which is called consumer surplus (CS).

In the case a single price decrease in p1 from p1a to p1b, this illustrated in figure 3.

Figure 3: Case of a single price decrease

p1

Marshallian demand

x1*(p, y)

p1a D

p1b C

A

B

x1

Figure 3 shows that the consumer surplus CS is measured as the area ABCD: it is the area

to the left of the Marshallian demand curve and between the two prices pa and pb.

In general, CV CS EV. However, there is one situation where they all become

identical. This is the situation where price changes occur for commodities that exhibit

zero income effects (i.e., where xi*/r = 0). In this case, from the Slutsky equation

(xi*/p = xic/pj – (xi*/r) xj*), we know that xi*/r = 0 implies that Marshallian

price effects are equal to Hicksian price effects: xi*/p = xic/p. Then, (11) and (12)

become identical for any choice of U. This gives the following important result:

4

If price changes take place for commodities exhibiting zero income effects

(xi*/r = 0), then

CS = CV = EV.

In such a situation, equation (12) provides a convenient way to conduct empirical welfare

analysis.

However, in the presence of income effects (xi*/r 0), consumer surplus CS no longer

provides an exact welfare measure for (11). This is illustrated in figure 4 in the context of

positive income effects under a single price decrease: p1 decreases from p1a to p1b.

Figure 4: Case of a single price decrease

Hicksian demand xc(p, Ua)

p1

Hicksian demand xc(p, Ub)

p1a F

A

p1b E

C

D

x1b*

B

x1a*

Marshallian

demand x*(p, y)

x1

Figure 4 shows that CV = area ADEF, EV = area CBEF, and CS = area ABEF. It also

shows that EV > CS > CV. This gives the following result.

In the context of positive income effects and price decreases,

EV > CS > CV.

In addition, from the Slutsky equation, we have ln(xi*)/ln(pi) - ln(xic/ln(pi) = ln(xi*)/ln(r) (pi xi*/r). Thus, ln(xi*)/ln(pi) - ln(xic/ln(pi) 0 whenever

ln(xi*)/ln(r) (pi xi*/r) 0. This means that we expect the own price slope of the

Marshallian demand xi*(p, r) to be "close" to the own price slope of the Hicksian demand

xic(p, U) when the income elasticity ln(xi*)/ln(r) is small and/or the budget share (pi

xi*/r) is small. Under such circumstances, from figure 4, we expect CS to provide a good

approximation to either CV or EV. This gives the following result.

If price changes occur for commodities with low income elasticity,

(ln(xi*)/ln(r) = small) and/or small budget shares (pi xj*/r = small), then

CV CS EV.

5

This establishes conditions under which consumer surplus CS can provide a good

approximation to either CV or EV.

Linking Marshallian and Hicksian demands: An Example

Consider the case where the expenditure function E(p, U) takes the form

ln(E(p, U)) = a(p) + b(p)/[U-1 - c(p)],

where

a(p) = 0 + nj1 j ln(pj) + 0.5 in 1 nj1 ij ln(pi) ln(pj), with ij = ji for j i,

ln(b(p)) = ln(0) + nj1 j ln(pj),

c(p) = nj1 cj ln(pj),

and the parameters satisfy

ij = ji for all i ≠ j,

in 1 i = 1,

in 1 ij (= in 1 ji) = 0, for all j = 1, …, n,

in 1 i = 0,

nj1 cj = 0.

Using Shephard’s lemma, the corresponding Hicksian expenditure shares are

Sic(p, U) pi xic/E = ln(E)/ln(pi),

= a(p)/ln(pi) + b(p)/ln(pi)/[U-1 - c(p)] + [c(p)/ln(pi)] b(p)/[U-1 - c(p)]2,

= i + nj1 ij ln(pj) + i b(p)/[U-1 – c(p)] + ci b(p) /[U-1 - c(p)]2,

i = 1, …, n. From duality, solving ln[E(p, V)] = ln(r) for V under the above specification

yields

V-1 = c(p) + b(p)/[ln(r) – a(p)],

Using the duality relationship x*(p, r) = xc(p, V(p, r)), this gives the Marshallian budget

shares

Si*(p, r) pi xi*/r

= i + nj1 ij ln(pj) + i [ln(r) – a(p)] + ci [1/b(p)] [ln(r) – a(p)]2,

i = 1, …, n. This shows that the above specification (called the "quadratic almost ideal

demand system" or QAIDS) exhibits income effects through ln(r) as well as [ln(r)]2. The

above Marshallian budget shares can be estimated, yielding parameter estimates that can

be used to recover the expenditure function E(p, U) and to conduct welfare analysis…

2.2. Measuring the welfare effects of quantity changes

Consider a situation where a household faces a change in consumption x

n

from xa to xb. We would like to evaluate the effects of this change on the welfare of

the household. A natural choice is to rely on the benefit function b(x, U, g) defined in (5).

We have seen that the benefit function b(x, U) measures the quantity of the bundle g that

the household must give up to obtain x starting from the utility level U. In the case where

the bundle g is worth one unit of money (i.e. where p g = 1), the benefit function

measures the household willingness-to-pay to reach x starting from utility level U. This

suggests measuring the welfare effects of a change from xa to xb by the function

W'(xa, xb, U) = b(xb, U, g) - b(xa, U, g),

(13)

6

which reflects the change in household benefit, holding U constant.

The household is made better off (worse off) by the change from xa to xb if W'(xa,

xb, U) > 0 (< 0). Intuitively, the household is said to be better off (worse off) when its

benefit increases (decreases) while holding utility constant at U.

Note from (13) that W'/xb = b/xb = marginal benefit. Also, when p g = 1 and if b(x,

U, g) is differentiable in x,

W'(xa, xb, U) = b(xb, U, g) - b(xa, U, g)

n

= i

1

xb

(b/xi) dxi

xa

n

= i

1

xb

pic(x, U) dxi,

(14)

xa

since b/x = pc(x, U) from the envelope theorem applied to (8). The functions pc(x, U)

are Hicksian price-dependent demands. They can be interpreted as the shadow prices of

the bundles x. Equation (14) is an important result. It states that welfare change can be

assessed from the integral of Hicksian price-dependent demands. This is illustrated in

figure 5 in the case a single quantity change in x1 from x1a to x1b.

Figure 5: Case of a single quantity change

p1

Price dependent Hicksian

demand p1c(x, U)

A

B

D

x1a

C

x1b

x1

Figure 5 shows that household welfare changes can be measured by the area

ABCD: it is the area below the price-dependent demand curve and between the two

quantities xa and xb.

As above, this raises two issues in welfare analysis: 1/ how to choose U?; and 2/

how to measure empirically the right-hand side in (14) (e.g., by using the Marshallian

price-dependent demand p*(x) instead of pc(x, U))?

Two convenient options can be used in the choice of U.

We can choose U = u(xa). Then, the welfare measurement given in (14) is

called compensating variation (CV'), where CV' ≡ W'(xa, xb, u(xa)) = b(xb,

u(xa), g) - b(xa, u(xa), g). This amounts to choosing the situation before the

change as the reference situation in welfare analysis. As such, when p g =1,

7

the compensating variation (CV') is the maximum amount of money the

household would be willing to pay to face a change from xa to xb while

remaining at the initial utility level U = u(xa).

Or we can choose U = u(xb). Then, the welfare measurement given in (11) is

called the equivalent variation (EV'), where EV' ≡ W'(xa, xb, u(xb)) = b(xb,

u(xb)) - b(xa, u(xb)). This amounts to choosing the situation after the change as

the reference situation in welfare analysis. As such, when p g = 1, the

equivalent variation (EV') is the amount of money the household would be

willing to receive to avoid facing a change from xa to xb while remaining at

the subsequent utility level U = u(xb).

In general, CV' EV'. In addition, pc(x, U) being typically unobservable, we need to find

some simple way of measuring the right-hand side in (14). One possibility is to replace

pc(x, U) in (14) by the Marshallian price-dependent demand p*(x). If we do this, we

obtain the consumer surplus measure

n

CS' = i

1

xb

pi*(x) dxi.

(15)

xa

In the case a single quantity change (where x1 increases from x1a to x1b), this illustrated in

figure 6.

Figure 6: Case of a single quantity increase

p1

p1a

A

p1b

Price-dependent

Marshallian demand

p1*(x)

B

D

x1a

C

x1b

x1

Figure 6 shows that the consumer surplus CS' is measured as the area ABCD: it is the

area below the price-dependent Marshallian demand curve and between the two

quantities x1a and x1b.

In general, CV' CS' EV'. To investigate the relationships between these expressions,

note from duality that p*(x) = pc(x, u(x)). Under differentiability, this gives

∂p*/∂x = ∂pc/∂x + (∂pc/∂U)(∂u/∂x).

This shows that ∂pi*/∂xj = ∂pic/∂xj when ∂pic/∂U = 0. It means that when ∂pic/∂U = 0,

Marshallian quantity effects become identical to Hicksian quantity effects: ∂pi*/∂xj =

∂pic/∂xj. In this situation, (14) and (15) become identical for any choice of U. This implies

8

that CS' = CV' = EV' when quantity changes take place for commodities that exhibit

∂pic/∂U = 0. However, when ∂pic/∂U ≠ 0, then ∂pi*/∂xj ≠ ∂pic/∂xj, and CS' no longer

provides an exact welfare measure for (14).

Linking Marshallian and Hicksian price-dependent demands: An Example

Consider the following specification for the benefit function b(x, U, g)

b(x, U, g) = (x) - (x)/[U-1 - (x)],

where (x) > 0. The benefit function satisfies (∂b/∂x) g = 1 for all x and U. This implies

(/x) g = 1, (/x) g = 0, and (/x) g = 0. In addition, when the reference bundle

g is chosen such that p g = 1, using the envelope theorem in (8) implies that the

marginal benefit equals the price-dependent Hicksian demands: b/x = pc(x, U). This

yields

pic(x, U) = /xi - /xi [U/(1 - U (x))] - (/xi) (x) U2/[1 - U (x)]2,

i = 1, …, n.

Solving b(x, U) = 0 yields U = u(x). Thus, U/[1 - U (x)] = (x)/(x). From

duality, the price-dependent Marshallian demands are pi*(x) = pic(x, u(x)). Given p g =

1, it follows that

pi*(x) = /xi - /xi [(x)/(x)] - (/xi) [(x)2/(x)]].

Let

N

(x) = 0 + Nj1 j xj + Nj1 k

1 ½ jk xj xk,

(x) = exp(0 + Nj1 j xj),

(x) = Nj1 j xj,

with

jk = kj for all j k,

as symmetry restrictions. Then, with (/x) g = 1, (/x) g = 0, and (/x) g = 0

holding for all x imply the following restrictions

Nj1 j gj = 1,

Nj1 jk gj = 0, k = 1, ..., N, (using the symmetry restrictions),

Nj1 j gj = 0,

and

Nj1 j gj = 0.

Given p g = 1, it follows that the price-dependent Marshallian demands for the i-th good

is

N

2

pi*(x) = i + k

1 ik xk - i [(x)] - i [(x) /(x)],

i = 1, …, n. These price-dependent Marshallian demands can be estimated, yielding parameter

estimates that can be used to recover the benefit function b(p, U, g) and to conduct welfare

analysis…

3. Index numbers

Index numbers are commonly used for two reasons:

9

1/ as relative welfare measures (e.g., cost of living index reflecting the welfare

effects of price changes, or standard of living index reflecting the welfare effects of

quantity chnages); and

2/ as means of generating price and quantity indexes for a commodity group (e.g.,

food, capital, etc.).

Although these two motivations are quite different, they are unified by their common

objective of “summarizing economic information about a group of commodities.” For

relative welfare measures, the group of commodities includes all commodities relevant to

an economic agent. For price and quantity index, the group of commodities involves only

a subset of all the commodities relevant to a decision-maker (e.g., food, capital, etc.).

Note: In the case of a subset of commodities, the theoretical justification for using a

price index requires imposing weak separability restrictions on the cost function,

profit function, or expenditure function. For example, a weakly separable

expenditure function (or cost function) implies the existence of a “price

aggregator function” that summarizes all the information related to the prices of

commodities within the given subset. Then, a price index is simply an empirical

measurement of the corresponding price aggregator function over the subset of

commodities in the expenditure-cost function.

Similarly, in the case of a subset of commodities, the theoretical justification for

using a quantity index requires imposing weak separability restrictions on the

utility function, shortage function, distance function, or production function.

Indeed, a weakly separable utility function (or shortage function, or distance

function, or production function) implies the existence of a “quantity aggregator

function” that summarizes all the information related to the quantities of

commodities within the given subset. Then, a quantity index is simply an

empirical measurement of the corresponding quantity aggregator function over

the subset of commodities in the relevant utility-distance-production function.

Note that justifying the existence of both a price aggregator function and a

quantity aggregator function for a subset of commodities requires the weak

separability of both the expenditure-cost function, and the utility-distanceproduction function. This implies stronger restrictions than just the weak

separability of the utility-distance-production function. Indeed, it requires the

homothetic separability of the utility-distance-production function. Note that this

may appear rather restrictive…

3.1. Price index

For simplicity, we discuss the price index in the context of household consumption (with

the understanding that all the arguments could be presented similarly in the context of

firm production). The analysis is based on the expenditure function E(p, U) = minx{p x:

u(x) U, x 0}. We consider a situation where the prices p change from pa to pb.

3.1.1. The true price index

Definition: The true price index (P) is

P(pa, pb, U) = E(pb, U)/E(pa, U).

10

This shows that a price index is a unit-free measure of relative cost-expenditure change,

reflecting the effects of changing prices that keep household utility U constant. It

satisfies P > (=, or <) 1 whenever the price change tends to increase (maintain, or

decrease) cost or expenditure. It means that (P-1)100 is the percentage change in cost or

expenditure due to changing prices, keeping utility U constant.

Definition: The Divisia price index (DP) is

n

DP(pa, pb, U) = exp[ i

1

ln(pib )

ln(pia )

wic(p, U) dln(pi)],

or

n

ln(DP) = i

1

ln(pib )

ln(pia )

wic(p, U) dln(pi),

where wic(p, U) = pi xic(p, U)/E(p, U) = the i-th Hicksian expenditure share.

Proposition 1: The true price index P and the Divisia price index DP are equivalent:

DP(pa, pb, U) = P(pa, pb, U).

Proof: The definition of P gives

ln(P) = ln E(pb, U) – ln E(pa, U).

But, under differentiability,

n

ln E(pb, U) – ln E(pa, U) = i

1

n

= i

1

ln(pib )

ln(pia )

ln(pib )

ln(pia )

(ln E(p, U)/pi) dpi,

(ln E(p, U)/ln(pi)) dln(pi).

Shephard’s lemma gives

ln E/ln(pi) = wic(p, U) = pi xic(p, U)/E(p, U) = the i-th Hicksian cost

share.

It follows that

n

ln(P) = ln E(pb, U) – ln E(pa, U) = i

1

ln(pib )

ln(pia )

wic(p, U) dln(pi) = ln(DP).

3.1.2. The Laspeyres price index

Definition: The Laspeyres price index (LP) is

LP(pa, pb, xa) = (pb xa)/(pa xa).

Note: The Laspeyres price index can be alternatively written as

n

n

b a

a a

LP(pa, pb, xa) = ( i

1 pi xi )/( i1 pi xi )

n

n

a a

a a

b a

= i

1 {[pi xi )/( j1 pj xj )] (pi /pi )}

n

a a

b a

= i

1 [wi(p , x ) (pi /pi )]

where wi(p, x) = pi xi/( nj1 pj xj) is the “i-th commodity share”.

The consumer price index (CPI) is a Laspeyres price index over all commodities

consumed by households. Note that it does not require information about the quantities

xb observed after the price change.

11

Note: For general price increases (pb pa) the Laspeyres price index LP gives an upward

biased estimate of the true price index P. Indeed, we have

P – 1 = [E(pb, U) – E(pa, U)]/E(pa, U)

n

= [ i

1

n

= [ i

1

pib

pib

pia

pia

(E(p, U)/pi) dpi]/E(pa, U)

xic(p, U) dpi]/E(pa, U), (from Shephard’s lemma)

n

c a

b

a

a

[ i

1 xi (p , U) (pi – pi )]/E(p , U), (since Hicksian demands slope

downward)

= [pb xa – pa xa]/[pa xa] if U = u(xa)

= LP – 1.

However, there are two situations where this upward bias vanishes:

1/ when all prices increase proportionally, in which case they have no effect on

demand since the Hicksian demands xc(p, U) are homogenous of degree zero in

prices p;

2/ when all goods are consumed in fixed proportions with zero Allen elasticities

of substitution, implying the absence of price effects on the Hicksian demands

xc(p, U).

3.1.3. The Paasche price index

Definition: The Paasche price index (PP) is

PP(pa, pb, xb) = (pb xb)/(pa xb).

Note: The Paasche price index can be alternatively written as

n

n

b b

a b

PP(pa, pb, xb) = ( i

1 pi xi )/( i1 pi xi )

n

n

a b

a b

b a

= i

1 {[pi xi )/( j1 pj xj )] (pi /pi )}

n

a b

b a

= i

1 [wi(p , x ) (pi /pi )]

where wi(p, x) = pi xi/( nj1 pj xj) is the “i-th commodity share”.

Note that the Paasche price index requires information about the quantities xb observed

after the price change. To the extent that price information is easier to obtain than

quantity information, the Paasche price index is typically more difficult to implement

empirically than the Laspeyres price index.

3.1.4. The Fisher price index

Definition: The Fisher price index (FP) is

FP(pa, pb, xa, xb) = [LP(pa, pb, xa) PP(pa, pb, xb)]1/2

= {[(pb xa)(pb xb)]/[(pa xa)(pa xb)]}1/2.

Note that the Fisher price index requires information about both quantities xa and xb (i.e.,

both before and after the price change).

12

3.1.5. The Tornquist-Theil price index

Definition: The Tornquist-Theil price index (TP) is

n

c a

c b

b

a

TP(pa, pb, U) = exp{ i

1 (1/2)[wi (p , U) + wi (p , U)][ln(pi ) – ln(pi )]},

or

n

c a

c b

b

a

ln(TP) = i

1 (1/2)[wi (p , U) + wi (p , U)][ln(pi ) – ln(pi )],

where wic(p, U) = pi xic(p, U)/E(p, U) = the i-th Hicksian expenditure share.

Note that the Tornquist-Theil price index TP can be interpreted as an approximation to

the Divisia price index DP. Also, calculating TP requires information about expenditures

both before and after the price change.

3.2. Quantity index

For simplicity, we discuss the quantity index in the context of household consumption

(with the understanding that all the arguments could be presented similarly in the context

of firm production). Consider the distance function D(x, U) that is dual to the household

utility function u(x), where D(x, U) = 1 is the implicit solution to u(x/D) = U. The

distance function D(x, U) is linear homogenous and increasing in x. This distance

function plays the same role for quantity index as the expenditure function for price index

(as discussed above). In a way similar to Shephard’s lemma, it satisfies

D(x, U)/xi = pic(x, U),

where pic(x, U) is the “Hicksian shadow price” of the i-th commodity.

From the linear homogeneity of D(x, U) in x, Euler equation gives

n

i

1 (D/xi) xi = D(x, U) = 1,

or

n

c

i

1 pi (x, U) xi = 1.

Let x = (x1, …, xn) is a vector of commodities, and p = (p1, …, pn) is a vector of

corresponding prices.

If we want to evaluate a standard of living index, then U = u(x) is the household utility

function. Alternatively, if we want to obtain a quantity index for a subset of

commodities, then U = u(x) is an aggregator function for the subset of commodities,

aggregator function that is an argument of the household utility function under weak

separability.

We consider a situation where the quantities x change from xa to xb.

3.2.1. The true quantity index (sometimes called the Malmquist index)

Definition: The true quantity index (Q) is

Q(xa, xb, U) = D(xb, U)/D(xa, U).

This shows that a quantity index is a unit-free measure of relative distance, reflecting the

effects of changing quantities that keep household utility U constant. It satisfies Q > (=,

or <) 1 whenever the quantity change tends to increase (maintain, or decrease) distance. It

means that (1 – Q)100 is the percentage change in distance due to changing quantities,

keeping utility U constant.

13

Definition: The Divisia quantity index (DQ) is

n

DQ(xa, xb, U) = exp[ i

1

ln(xib )

ln(xia )

wic(x, U) dln(xi)],

or

n

ln(DQ) = i

1

ln(xib )

ln(xia )

wic(x, U) dln(xi),

n

c

where wic(x, U) = pic(x, U) xi/D(x, U) = the i-th Hicksian share (since i

1 pi (x, U) xi =

D = 1).

Proposition 1: The true quantity index Q and the Divisia quantity index DQ are

equivalent:

DQ(xa, xb, U) = Q(xa, xb, U).

Proof: The definition of TQ gives

ln(Q) = ln D(xb, U) – ln D(xa, U).

But

n

ln D(xb, U) – ln D(xa, U) = i

1

ln(xib )

ln(xia )

ln D(x, U)/ln(xi) dln(xi).

Given D(x, U)/xi = pic(x, U), we have

ln D/ln(xi) = wic(x, U) = pic(x, U) xi/D(x, U) = the i-th Hicksian share.

It follows that

n

ln(TQ) = ln D(xb, U) – ln D(xa, U) = i

1

ln(xib )

ln(xia )

wic(x, U) dln(xi) =

ln(DQ).

3.2.2. The Laspeyres quantity index

Definition: The Laspeyres quantity index (LQ) is

LQ(xa, xb, pa) = (pa xb)/(pa xa).

Note: The Laspeyres quantity index can be alternatively written as

n

n

a b

a a

LQ(xa, xb, pa) = ( i

1 pi xi )/( i1 pi xi )

n

n

a a

a a

b a

= i

1 {[pi xi )/( j1 pj xj )] (xi /xi )}

n

a a

b a

= i

1 [wi(p , x ) (xi /xi )]

where wi(p, x) = pi xi/( nj1 pj xj) is the “i-th commodity share”.

3.2.3. The Paasche quantity index

Definition: The Paasche quantity index (PQ) is

PQ(xa, xb, pb) = (pb xb)/(pb xa).

Note: The Paasche quantity index can be alternatively written as

n

n

b b

b a

PQ(xa, xb, pb) = ( i

1 pi xi )/( i1 pi xi )

n

n

b a

b a

b a

= i

1 {[pi xi )/( j1 pj xj )] (xi /xi )}

n

b

a

b a

= i

1 [wi(p , x ) (xi /xi )]

14

where wi(p, x) = pi xi/( nj1 pj xj) is the “i-th commodity share”.

3.2.4. The Fisher quantity index

Definition: The Fisher quantity index (FQ) is

FQ(xa, xb, pa, pb) = [LQ(xa, xb, pa) PQ(xa, xb, pb)]1/2

= {[(pa xb)(pb xb)]/[(pa xa)(pb xa)]}1/2.

3.2.5. The Tornquist-Theil quantity index

Definition: The Tornquist-Theil quantity index (TQ) is

n

c a

c b

b

a

TQ(xa, xb, U) = exp{ i

1 (1/2)[wi (x , U) + wi (x , U)][ln(xi ) – ln(xi )]},

or

n

c a

c b

b

a

ln(TQ) = i

1 (1/2)[wi (x , U) + wi (x , U)][ln(xi ) – ln(xi )],

where wic(x, U) = pic(x, U) xi /D(x, U) = the i-th Hicksian expenditure share.

Note that the Tornquist-Theil quantity index TQ can be interpreted as an approximation

to the Divisia quantity index DQ.

3.3. Superlative index numbers

Definition: A superlative price (quantity) index is a true index associated with a flexible

expenditure (distance) function (i.e. a function that does not impose a priori

restrictions on the Allen elasticities of substitution).

Examples of expenditure (or distance) functions that are “flexible” are the quadratic, the

“generalized Leontief”, and the translog. It also includes the class of functions that are

“geometric mean of order k”.

Definition: A “geometric mean function of order k” is f(z) = [(zk/2)T A (zk/2)]1/k, for some

k 0, where z is a (n1) vector, and A is a (nn) symmetric matrix.

Note: Under homothetic preferences, the expenditure function is E(p, U) = h(u) c(p).

Then, if c(p) is “geometric mean of order k”, it gives

c(p) = [(pk/2)T A (pk/2)]1/k = a “flexible form” for any k 0,

= a translog cost function as k 0

= (p1/2)T A (p1/2) = a “generalized Leontief” cost function if k = 1,

= [(p)T A (p)]1/2 if k = 2.

Proposition: The Tornquist-Theil price (quantity) index is a superlative price (quantity)

index because it is a true price (quantity) index associated with a translog

expenditure (distance) function.

Proof: We present the proof only for a price index associated with the translog

expenditure function

n

n

n

ln[E(p, U)] = a0 + i

1 ai ln(pi) + au ln(U) + (1/2) j1 i1 aij ln(pi) ln(pj)

(B1)

n

2

+ i

1 aiu ln(pi) ln(U) + auu [ln(U)] .

15

For a change in prices from pa to pb, the associated true price index P satisfies

ln(P) = ln[E(pb, U)] – ln[E(pa, U)]

n

n

n

b

a

b

b

= i

1 ai [ln(pi ) – ln(pi )] + (1/2) i1 j1 aij ln(pi ) ln(pj )

n

n

n

a

a

b

a

– (1/2) i

1 j1 aij ln(pi ) ln(pj ) + i1 aiu ln(U) [ln(pi ) - ln(pi )].

(B2)

Shephard’s lemma gives

ln(E)/ln(pi) = pi xic(p, U)/E(p, U) = wic(p, U) = the i-th Hicksian cost

share.

(B3)

In the context of the translog expenditure function (B1), we have

ln(E)/ln(pi) = ai + nj1 aij ln(pj) + aiu ln(U).

(B4)

k

k

k

Let E = E(p , U ), where k = a, b. Using the above results, the log of the

Tornquist-Theil price index TP is

n

c b

b

c a

a

b

a

ln(TP) = i

1 (1/2)[wi (p , U ) + wi (p , U )][ln(pi ) – ln(pi )]

n

b

b

a

a

b

a

= (1/2) i

1 [ln(E )/ln(pi ) + ln(E )/ln(pi )][ln(pi ) – ln(pi )], (from

(B3))

n

n

n

b

b

a

= (1/2) i

1 [ai + j1 aij ln(pj ) + aiu ln(U ) + ai + j1 aij ln(pj )

+ aiu ln(Ua)][ln(pib) – ln(pia)], (from (B4))

n

n

n

b

a

b

b

= i

1 ai [ln(pi ) – ln(pi )] + (1/2) i1 j1 aij ln(pj ) ln(pi )

n

n

a

a

- (1/2) i

1 j1 aij ln(pj ) ln(pi )

n

b

a

b

a

+ (1/2) i

1 aiu [ln(U ) + ln(U )][ln(pi ) – ln(pi )]

n

n

n

b

a

b

b

= i

1 ai [ln(pi ) – ln(pi )] + (1/2) i1 j1 aij ln(pi ) ln(pj )

n

n

a

a

– (1/2) i

1 j1 aij ln(pi ) ln(pj )

n

*

b

a

*

a b 1/2

+ i

1 aiu ln(U ) [ln(pi ) - ln(pi )], where U = (U U ) ,

= ln(P) (from (B2) evaluated at U* = (Ua Ub)1/2).

Proposition: The Fisher price (quantity) index is a superlative index because it is a true

index associated with an expenditure (distance) function that is a “quadratic mean

of order two”.

Proof: Again, we present a proof only for the price index. Consider the case of

homothetic preferences where the expenditure function is E(p, U) = h(U) c(p),

and c(p) = (pT A p)1/2 is a quadratic mean of order two (k = 2). Then, Shephard’s

lemma gives

/p = xc = (pT A p)-1/2 A p,

(C1)

or

A p = xc (pT A p)1/2,

(C2)

where xc = xc(p, U) is the Hicksian demand function.

For a change in price from pa to pb, we have

P = E(pb, U)/E(pa, U)

= c(pb)/c(pa) (under homothetic preferences)

= {[(pb)T A (pb)]/[(pa)T A (pa)]}1/2, (where c(p) = (pT A p)1/2)

16

= {[(pb)T xcb ((pb)T A pb)1/2]/ [(pa)T xca ((pa)T A pa)1/2]}1/2, (from

(C2)

= {[(pb)T xcb (pb)T xca]/ [(pa)T xca (pa)T xcb)]}1/2, (from (C1)

= [(LP) (PP)]1/2

= FP.

3.4. Implicit index

In general, an index (either price or quantity) can be interpreted as a ratio of expenditures.

If so, when applied to the same group of commodities, we expect the following

relationship to hold

(price index)(quantity index) = [pb xb]/[pa xa].

Note that this relationship always holds for the Fisher index since

(FP)(FQ) = [(LP) (PP)]1/2 [(LQ) (PQ)]1/2 = [pb xb]/[pa xa].

However, it does not always hold for the other indexes. In this case, the above

relationship can be treated as an identity. Then, if only one of the two indexes (either

price or quantity) is known, the other one can always be obtained from this identity.

Obtaining an index in this manner generates an implicit index. A useful rule of thumb is

to calculate a “direct index” for the variables (either prices or quantities) that tend to vary

“more proportionally”, and calculate an “implicit index” for the variables that tend to

vary “less proportionally”.

17