Lecture 3 The dynamics of human capital

advertisement

modifeid November 14, 2002

Lecture 3 The democratic dynamics of human capital

A. PUNE dynamics

We have observed that, if there are constant returns to scale (b+c=1) then , under

laissez-faire the distribution of human capital remains constant over time, except for a

multiplicative growth factor. On the other hand, if at every period educational finance is

determined by a political equilibrium (PUNE), then, regardless which party wins the

election, the coefficient of variation of the distribution of human capital is strictly

monotone decreasing. Our task, now, is to study whether that coefficient of variation

tends to some positive number, or to zero. In the latter case, we say that wages approach

equality in the long-run.

It is convenient to normalize the distributions of human capital that occur over

time to have constant mean. Thus, if Ft is the probability distribution of human capital at

date t, t=0,1,…., and its mean is t define the normalized distributions

t

t

Fˆ (h) F ( t h) ,

0

(3.1)

which all have mean 0. This transformation does not affect the coefficients of variation

of the distributions, so we will now study the dynamics of the coefficients of variation of

t

the sequence {Fˆ } . Denote the coefficient of variation of Fˆ t by t.

Our first observation is:

Proposition 3.1 Let b c 1. Then

(a) the distribution function Fˆ t 1cuts the distribution function Fˆ t once from below.

That is,

t 1

t

t 1

t

(h )(0 h h Fˆ (h) Fˆ (h) and h h Fˆ (h) Fˆ (h)).

Graz-Schumpeter Lec 3

2

(b) Fˆ t 1second-order stochastic dominates Fˆ t

t

(c) The sequence { } is monotone decreasing, and hence converges.

Proof. See appendix.

We have already observed part (c). Part (b) follows from part (a). Part (a) is

proved by again exploiting the fact that both educational investment functions give a

positive investment to families at the lowest level of human capital. See the Appendix

for the proof.

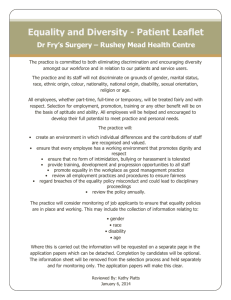

Part (a) of the proposition is illustrated in figure 3.1. What is not clear is whether

these CDFs converge to the one with all its mass at the mean, indicated by the heavy line

in the figure, or if the convergence stops before that.

Consider the manifold of quasi-PUNEs, illustrated again in Figure 3.2. Fix a

pivot type h* at which the probability of victory is positive for both parties. At any

PUNE with h* as the pivot, those who vote Left are predicted to be the interval [0,h*);

1

1 F(h*) 2

hence the probability of Left victory is

, where is the error term.

2

2

Because the educational investment function is weakly monotone increasing, whichever

party wins, it follows that the mapping of parent’s human capital to child’s human capital

is strictly increasing, and so descendents occupy exactly the same rank in their

distribution of human capital as their ancestors.

It follows that

t

0

Fˆ (St (h*)) F (h*) .

Let St (h*) be the tth descendent of h*.

Graz-Schumpeter Lec 3

3

Let us therefore fix a sequence of quasi-PUNEs in which, at every date, the pivot

type is the descendent of our given h* from date 0. Then the probabilities of Left victory

will be constant in the sequence.

Our dynamic analysis will investigate two such sequences. One sequence is

denoted A(h*) , where the pivot is St(h*)at date t and the quasi-PUNE lies on the lower

boundary of the manifold. The other sequence, denoted B(h*), again has the pivot as the

tth descendent of h*, but it lies on the upper boundary of the manifold. Recall from

Lecture 2 that the A sequence is one where politics are ideological, in the sense that the

militants are as powerful as they can be in the intra-party bargaining game, and the B

sequence is one in which politics are opportunist.

Our main theorem is:

Theorem 3.1 . Let b+c=1. For any h*>0, the limit CV of the distribution of human

capital for the sequence A(h*) is zero, and the limit CV of distribution of human capital

for the sequence B(h*) is positive.

Thus our claim is that ideological politics produce equality of wages in the longrun, while opportunist politics do not.

The proof is a bit involved, and so I will not attempt to present it here; it is

relegated to the Appendix. Let me, however, attempt to motivate the result.

In the sequence B(h*), both parties play the ideal policy of the pivot voter, which

I graph in Figure 3.3. Because investment is constant for h>h*, it follows that, over

time, the ratio of the human capitals of any two dynasties h1>h2 that are greater than h*

bt

h

approaches one. This is because their ratio at date t is simply 1 , which approaches

h2

Graz-Schumpeter Lec 3

one, because b<1.

4

The question is, what happens to the ratios of human capital in

dynasties that are smaller than h*?

Suppose that the educational investment function illustrated in figure 3.3 passed

through the origin, instead of above it. Then, on the interval [0,h*), the investment

function would be exactly the laissez-faire investment function, and hence the

distribution of human capital in that interval would stay the same over time. Thus,

intuitively, the issue is: How rapidly does the vertical intercept of the investment function

approach the origin? (It does approach the origin.) The proof shows that the intercept

approaches the origin ‘fast,’ and so the coefficient of variation of the distribution stays

bounded away from zero.

Indeed, it converges to a positive number.

Of course the distributions of human capital need not converge to a distribution:

there could be constant growth. But the mean-normalized distribution functions do

indeed weakly converge to a distribution function.

Now for the first claim of the theorem, where we study ideological politics. I

have noted that in both the A and B sequences, the probabilities of victory are constant

over time, and they are positive for both parties. It follows that each party wins the

election an infinite number of times in these sequences.

Consider the sequence of total resource bundles that is realized in the stochastic

process that unfolds in A(h*), which we denote

L

R

R

L

X 0 ,X1 ,X 2 ,X 3 ,...

(3.2)

where the sub-script denotes the date and the super-script the victorious party. We have

noted that, whichever party wins, the coefficient of variation strictly decreases at each

Graz-Schumpeter Lec 3

5

date. Consider a sequence where we replace the Right policies with the laissez-faire

policy; thus:

L

LF

LF

L

X 0 ,X1 ,X 2 ,X 3 ,...

(3.3)

Recall that we are studying the normalized distributions, and if the laissez-faire policy is

enacated at date t then the normalized distribution of human capital is identical at dates t

and t+1. Therefore, the limit coefficient of variation of the sequence (3.3) is at least as

large as the limit CV of the sequence (3.2). But we may now drop the laissez-faire

policies from (3.3), since they leave the distribution of human capital unchanged, and

conclude that the limit CV of (3.3) is the same as the limit CV of the sequence consisting

of all Left policies.

We therefore need only show that, if Left wins every election, the CV approaches

zero. That will prove the result.

Let us recall what the Left policy looks like, from figure 2.2. At each date, there

t

will be a critical type hL : below this type, investments in education are the same for all,

and above h*, investments in education are the same for all. The proof proceeds by

t

*t

showing that the gap between hL and h becomes an arbitrarily small fraction of the

population. Thus, for large t, investment in virtually all children becomes the same, and

this produces convergence to equality of wages. The fraction of the population where

investment is strictly increasing becomes vanishingly small, and the amounts invested in

all types approach the same value.

I do not think the fact that ideological politics engenders equality of human

capital in the long-run is intuitively obvious. It is perhaps not surprising that if Left

ideological politics dominate, we get equality: but equality will occur even if Right wins

Graz-Schumpeter Lec 3

6

an infinite number of elections -- even if Right wins the election 99% of the time! The

reason is, as I have explained, that even when Right wins, the coefficient of variation of

human capital decreases, and when Left wins, it decreases ‘a lot’. And so, even if Left

only wins 1% of the time, the CV approaches zero.

Let me present the results of a simulation. I begin with F0 being the lognormal

distribution with mean 40 and median 30, an approximation to the US distribution of

income, in units of thousands of dollars, in 1990. I take b=c==0.5. I examine the

sequence of quasi-PUNEs defined, at each date, by taking h* to be the median wage, and

which is located half-way between the upper and lower boundaries of the manifold.

Each party wins with probability one-half at each date. Our theorem does not tell us what

will happen to the CV in this sequence, because it does not lie on one of the boundaries

of .

In Table 3.1, I present the sequence of CV’s for nine iterations of six generations

each. The reason these iterations differ is that there is a different realization of the

random variable that determines which party wins the election at each date. We notice

that CV’s appear to converge rapidly to zero. This is a conjecture. I was not able to

extend these simulations beyond six generations, because of limits of precision in the

computation.

Figure 3.4 shows what the CDF of the normalized distribution of human capital

looks like after five consecutive Left victories.

It is getting very close to an equal

distribution, with all the mass at one point.

I do not know what happens to the coefficient of variation if we take PUNEs

which lie in the interior of the quasi-PUNE manifold. My conjecture is that if we are

Graz-Schumpeter Lec 3

7

near the lower boundary, we converge to equality, and if we are near the upper boundary

we do not.

I also do not know exactly where the true PUNEs lie in the manifold. I know the

set of PUNEs is non-empty. It is even conceivable that there are no PUNEs on the upper

boundary of . It is therefore conceivable that in all true PUNEs, the CV converges to

equality. This would be an important result, but it remains an open question.

Theorem 3.1 assumes the case of constant returns to scale. We are not proposing

that returns to scale are indeed constant. If, in reality, they are decreasing, then we

conjecture that convergence to equality will occur much more rapidly with ideological

politics than with opportunist politics or with laissez-faire: that is what our theorem

suggests.

Recall that we studied the constant-returns case because of its sharp attribute

that, under laissez-faire, the distribution of human capital remains unchanged.

It is

easier to study whether or not a sequence of coefficients of variation converges to zero

than to compare the speeds of convergence of different processes.

The final contribution to this section will be a short report on what happens if

returns to scale are increasing -- that is, if b+c>1. I report on a simulation where

b=c=.75, =.5, and the initial distribution is again the lognormal with mean 40 and

median 30. I examine, again, the sequence of quasi-PUNEs which is defined by the point

midway between the top and bottom boundaries of the manifold, at each date, where the

pivot is always the median of the distribution. For two six generation simulations, see

Table 3.2. The coefficient of variation falls, but it is not monotone decreasing: Right

victories sometimes increase inequality. The interesting comparison is with laissez-faire:

at date 3, the CV of human capital is already 3 x 1011. So democracy appears to have a

Graz-Schumpeter Lec 3

8

radical equalizing effect, in comparison to laissez-faire, when returns to scale are

increasing.

B. Hotelling-Downs dynamics

I now proceed to a comparison of this model of ruthless political competition with

the model of Hotelling-Downs applied to our problem. As you know, the HotellingDowns model only (roughly speaking) has an equilibrium when policies are

unidimensional. So let us suppose that the policy space is the space of affine total

resource functions, that is

X(h) ah (1 a), 0 a 1.

Here, 1 a is a constant marginal tax rate, and (1 a) is a lumpsum transfer to all

citizens. As always, consumption and educational investment are divided in proportions

1:c.

The constraint on a assures us that X is non-decreasing and has derivative no

larger than one.

Denote the median of the distribution of human capital by m. The indirect utility

function of types on policies a now becomes

v(a;h) Log(ah (1 a)),

which is single-peaked in a. Consequently, since both parties are unremittingly

opportunist, the unique political equilibrium has them both proposing the ideal policy of

the median type, which is

1, if m

.

a

0, if m

Graz-Schumpeter Lec 3

9

That is, if the median is less than the mean, X(h)=, while if the median is greater than

the mean, then X(h)=h, the laissez-faire policy.

Let us suppose we begin with a distribution in which the median wage is less than

the mean wage. Then the policy X(h)= wins. This generates a distribution of human

t

t

capital at date 1. As long as m , there will be constant investment in all children,

and if this continues forever, then we converge to equality of wages.

On the other hand, if there is some date at which the median is greater than the

mean, then the laissez-faire distribution is implemented, and the distribution of human

capital remains unchanged. Therefore the median is greater than the mean at the next

date, and so on forever. Thus, if the median is ever greater than the mean, then the

coefficient of variation is constant and positive forever after.

Our problem thus becomes: When is it the case that the median is less than the

mean forever? We have a nice result:

Theorem 3.2 . Let b+c=1. Let F be the date 0 distribution of h, with median m and

mean . Under Hotelling-Downs politics, on the unidimensional policy space, the CV of

the distribution of human capital converges to zero if and only if

log m log h dF (h).

The proof uses some well-known inequalities. In fact, the arguments are very

similar to those that show the CES production function approaches the Cobb-Douglas

production function as the elasticity of substitution approaches one.

Graz-Schumpeter Lec 3

10

The condition "log m log h dF (h)" is stronger than the condition "m " . (Just

note that log m log h dF (h) m exp( log h dF(h)) m h dF (h) , where the

last implication follows from Jensen’s inequality [for convex functions].) But the

converse direction is generally false. So the critical inequality for the theorem is one that

can be interpreted as strong positive skewness of the distribution F (because ‘m<’ is

commonly called positive skewness).

It so happens that the lognormal distribution with mean 40 and median 30

satisfies precisely the equation

log m log h dF (h).

So, with that distribution, wages will converge to equality under Hotelling-Downs.

However, if the median were any larger, the limit CV would be positive.

There are two notable differences between Hotelling-Downs politics and what I

will modestly call democratic politics, à la PUNE. The first is that convergence to

equality never occurs with democratic opportunist politics, but it sometimes occurs with

the unidimensional opportunist politics of Hotelling-Downs.

The second is that,

whether or not convergence to equality occurs with Hotelling-Downs depends on the

initial distribution; but with democratic politics, if political competition is sufficiently

ideological, there is convergence to equality independent of the initial distribution.

Let me comment on the first difference. Why do we get convergence to equality

with opportunist politics, in some cases, but never with democratic politics? The reason

is that, on the unidimensional policy space, doing well by the median voter means doing

well by the poor. That is, the median voter’s ideal policy, in the case m<, is the best

policy for the poor as well: radical redistribution to the mean. However, with democratic

Graz-Schumpeter Lec 3

11

opportunist politics, as we saw in figure 3.1, doing well by the pivotal voter does not

mean doing well by the poor. With an infinite dimensional policy space, the pivotal voter

does best for himself by depriving the poor.

Thus, I claim, the Hotelling-Downs model gives us a false picture of the dynamics

of democracy.

Although the PUNE model is not so easy to handle, the analysis shows

that the Hotelling-Downs model is a poor approximation to reality -- if we think of real

politics as being, more or less, no-holds-barred, as our infinite-dimensional policy space

captures. Until a simpler model than PUNE comes along, I think that serious political

analysis requires that we use it.

We can now summarize what we have learned about convergence to equality ,

according to the three possibilities of decreasing, constant, or increasing returns to scale,

and Downsian versus democratic politics:

(Table 3.3 here)

C. Stochastic talent

Until now, we have assumed that the wage formation process is deterministic.

We now relax this assumption, and allow for a random talent element in children. Thus

we assume that the wage of child is given by

h h r ,

b c

where is a positive random variable with mean one. Let us assume that is i.i.d for all

families.

If the parent knows the realization of for her child before she engages in politics,

then nothing about political equilibrium changes from our earlier analysis: the talent

Graz-Schumpeter Lec 3

12

term just appears as an additive constant in parental utility. Equilibrium policies are the

same as before. However, the distribution of human capital will not be the same as in

the earlier model.

Suppose we are in the sequence of equilibria B(h*). Then, in the earlier model,

the human capital of distant descendents of the first ancestor, Eve, depends on the Eve’s

rank in the initial distribution, whereas in the sequence of equilibria A(h*), the long-run

descendent of Eve has human capital that is independent of Eve’s rank. We could say

that in the A distribution, equality of opportunity is achieved in the limit, while in the B

distribution it is not. That property is inherited by the model with random talent.

Distributions of human capital will not tend to equality of wages, because of stochastic

talent: but in the ideological political equilibrium, equality of opportunity is approached,

in the sense that the distant descendant’s human capital becomes independent of his

Eve’s human capital, while equality of opportunity is not approached, if politics are

opportunist.

Of course, we could interpret the random variable as defining effort, as well as

talent, in which case the equal-opportunity language is more appropriate. For according

to equality of opportunity, it is appropriate for a person’s income to depend on her effort,

but not on her ancestor’s social class.

D. Endogenous Growth

In the proof of theorem 3.1, exogenous growth was permitted, in the sense that we

could assume that the educational technology at date t is defined by

h h r ,

t

b c

Graz-Schumpeter Lec 3

13

where t is a time superscript, and the sequence {t} is exogenously given. Exogenous

technical change means that the value of t is independent of political decisions.

Because we have not included capital in the wage function, we must assume that the

influence of capital on marginal productivity, and hence on the wage, is captured in t.

Thus, investment must be uninfluenced by political decisions. This is unrealistic, but

perhaps no more unrealistic than the assumption that labor is inelastically supplied in our

model: investment is also inelastically supplied.

Because we are concentrating on the role of education, however, it is

inappropriate to ignore the effects of education on the technology, and so we should

recognize the possibility of growth that is endogenous in our model, in the sense of the

production function’s being influenced by decisions on educational policy. Thus, we

now consider a modified educational technology given by

h h r r ,

t

b c

d

(3.4)

where r is the average educational investment in generation t’s children. We may think

of r as influencing the quality of the technology, either in the sense that a higher level of

education produces better R & D, or because a more educated work force is capable of

using a more sophisticated technology, which is therefore built, or both.

I noted earlier, that in our first model, the social and private returns to education

were identical. This is no longer the case with (3.4). Thus, society may have an interest

in investing more in your child than you wish to invest, because of the external effects

your child, among many others, will have on aggregate productivity.

Thus, we can no longer expect that parties will propose to disaggregate the total

resource bundle into consumption and investment just as each family would like. One

Graz-Schumpeter Lec 3

14

consequence is that we will no longer be able to simplify the analysis by looking at the

reduced policy space T*: we shall have to work on the policy space T, which preserves

the distinction between the consumption and investment policies.

Let us first note that, under a laissez-faire policy, as before, the distribution of

human capital is unchanged from one generation to the next, except for a multiplicative

constant. For if parents decide privately on educational investment, then each

appropriately assumes aggregate investment is fixed and unchangeable by her action, and

so an h parent invests

c

h in her child’s education, and so

1 c

c

c c d

h h

h r ,

1 c

b

whence the ratio of human capitals of the sons of h1 and h2 is:

h h b c

1

1

,

h

2

h2

just as in the first model. So under laissez-faire the CV of distribution of human

converges to zero, stays constant, or explodes, as returns are decreasing, constant, or

increasing, respectively. It is therefore again appropriate for us to study the constantreturns case in this model, because of the clean benchmark it provides.

Suppose c were close to zero, but d were significantly positive. Then there are

small private returns to education, but significant social returns. Political parties, which

represent large coalitions, will be interested in making educational investments.

Individual parents would also want society to invest in education, but they would want

almost all of their family’s total resource bundle devoted to consumption. Indeed, in this

case, we might conjecture that society would invest approximately equally in all children.

Graz-Schumpeter Lec 3

15

In this case, if b 1 then wages would tend to equality, because the ratio of the human

capitals in any two dynasties would approach one. Such policies, we conjecture, would

be Pareto efficient, in the policy space, and hence both parties would advocate policies of

this form.

So we can surmise that, in the case c>0 and d>0, there will be more of a tendency

to equality of wages than in the case where returns to investment are only private. We

will therefore concentrate on the case of equilibria in sequence B(h*), where politics are

dominated by opportunism. Will we achieve equality of wages in the long-run, even

with opportunistic politics, if d>0 ? If so, then our previous work strongly implies that

any sequence of equilibria with ‘invariant pivot’ will bring about equality of wages.

As I remarked, this problem is more difficult than the first one we studied,

because we no longer can work on the reduced policy space where parties are choosing

only the total-resource-bundle function. We must return to policy space with elements

(,r) . Our trade-off will be to work on subspace of T, namely the set of policies

Tˆ {(,r) T | 0 1, 0 r1} .

Thus, we now require the consumption and investment functions each to have bounded

derivatives in the interval [0,1], which is not a constraint on T. Of course, all of the

policies in PUNEs in the earlier problem were in fact in Tˆ as well, so this might not

appear to be a serious restriction. Nevertheless, it does simplify the optimizations that we

will have to perform.

Let F be the probability measure of human capital at a given date. It is

convenient to define the function

Graz-Schumpeter Lec 3

16

h

Q(h) xdF(x) h(1 F(h)) .

0

Note that Q() and Q is increasing.

We have two theorems that characterize what the PUNEs in the sequence B(h*)

look like, depending on the size of Q(h*) .

Theorem 3.3 Suppose that:

(A1) (c d)h* Q(h*) , and

(A2)

d 1 F(h*)

.

c

F(h*)

Then the investment in all types is a constant given by:

r* (h) r (c d)y,

where y

h *Q(h*)

. Consumption is given by:

1 (c d)

h h * y, if h h *

.

* (h)

y, if h h *

If we begin , in the sequence B(h*), with an economy in which (A2) and (A1)

hold, then (A2) holds forever. If (A1) held forever, we would surely converge to

equality of wages, because the same amount is being invested in all children.

Unfortunately, the r.h.s. of (A1) approaches zero over time, and the l.h.s. does not. So

eventually we leave the regime of Theorem 3.1.

We therefore require an analysis of what occurs in the sequence B(h*) when (A1)

no longer holds. We have:

Graz-Schumpeter Lec 3

17

Theorem 3.4 Suppose that:

(B1) (c d)h* Q(h*) , and

(B2)

d r0 Q(h1 ) 1 F (h*)

,

c

r0 h1 F (h*) F(h1 )

where (r0,h1) is the solution of the system of equations:

(a) r0 Q(h*),

(b)

1

c

d

(1 F (h1 )).

h *h1 r0 h1 r0 Q(h1 )

Then the PUNE at B(h*) has both parties proposing the policy (r*, *) given by:

r0 h, for 0 h h1

r * (h)

r0 h1 , for h h1

and

0, for h h1

* (h) h h1 , for h1 h h *

h * h , for h h *.

1

The policy is illustrated in Figure 3.5.

t

*t

We see that investment is constant for h>h1, and since at every date, h1 h , it

follows that the ratio of wages of any two dynasties with initial human capital larger than

t

h* tends to one. The question is, what happens to the value h1 ? We are able to show:

Theorem 3.5 Let b+c=1. Suppose that for all t=0,1,2,… the time-dated versions of

conditions (B1) and (B2) of theorem 3.4 hold. Then :

t

t

(1) lim F (h1 ) 0,

(2) the CV of human capital approaches zero in the dynamic process,

Graz-Schumpeter Lec 3

t

(2) lim h1

18

(c d)

*t

lim h and

1 (c d)

(3) condition (B2) approaches condition (A2) [of Theorem 3.3].

Because of conclusion (1), it follows that, for large t, the same is invested in

virtually all children, and hence wages tend to equality. To be precise, given any two

original Eves with non-zero human capital, there exists a date T, such that, for all t >T,

the same amount is invested in the education of the descendents in these dynasties, and

hence the ratio of their human capitals tends to one. Thus conclusion (2) follows

immediately from (1).

We may therefore conclude that if the ratio

d

is sufficiently large, then wages

c

converge to equality, even with opportunist politics. ‘Sufficiently large’ means, in the

case where (A1) holds, that (A2) is true, and in the case where (B1) holds, that (B2) is

true.

Because of (3), it follows that condition (A2) is essentially what is needed

concerning the ratio d/c.

I next provide a simulation. I begin with the lognormal distribution with mean 40

and median 30, and choose h* to be the median. It is convenient to re-normalize, and set

the median equal to unity, at all dates: this does not affect the coefficients of variation. I

choose 0.75, b c 0.5, d 0.6. The critical ratio

d

1.2. At date 0, we are in the

c

regime of Theorem 3.2: both (B1) and (B2) hold. Table 3.1 presents the results of a three

generation simulation:

Graz-Schumpeter Lec 3

19

Table 3.3

The last column presents the ratio at the r.h.s. of condition (B2) at each date; we require

that this ratio be less than or equal to 1.2. We see that the convergence claimed in

conclusion (1) of Theorem 3.3 appears to be occurring rapidly: by date 2, the same

amount is being invested in virtually all children. From condition (2) of that theorem,

t

we know that h1 is converging to approximately 0.452.

Another glimpse of the speed of convergence is provided by looking at the CDFs

of human capital in dates 0 and 2 of the above simulation. They are provided in Figure

3.6. The medians have been normalized to one in these graphs.

(figure 3.6 here)

We see the convergence to equality is rapid. And recall, this is in the PUNE

where politics are most opportunistic, which is when the convergence to equality is least

rapid, in the manifold of quasi-PUNEs.

It is interesting to observe what the ratio

easy to verify that

r(h)

looks like in these solutions. It is

(h)

r(h)

c for all h. This means that every type would like to

(h)

redistribute the total resource bundle assigned to its family towards consumption and

away from educational investment. This desire will be strongest among the poorest

types. We thus see, in this model, an important role for the publicness of education:

Graz-Schumpeter Lec 3

20

assuming the usual free-rider psychology, it would not be possible to realize these

solutions with private financing of education. Political parties here overcome the freerider problem because they represent large coalitions of citizens. Parties in PUNEs

always propose constrained Pareto efficient solutions.

Indeed, we note that , in this opportunist solution, after-tax income is zero for a

poor section of the population. This is to be interpreted as consumption’s being driven

down to subsistence level.

One might hastily conclude that it is empirically incorrect that every type – even

the rich-- would like to shift the resources dedicated to its family away from education

towards consumption. But it is not clear that this is indeed incorrect. The wealthy send

their children to universities, but pay only a fraction of university tuitions. In the United

States, if a wealthy child attends a public university, then a very large fraction of her

tuition is paid for by taxpayers, and, indeed, by non-wealthy taxpayers. If the child

attends a private university, a fraction of the tuition, sometimes substantial, is paid for by

endowment funds. At many private universities in the United States today, students are

admitted independently of their parents’ ability to pay; when such a student is admitted,

the university finances the short-fall out of endowment income. University attendance

would doubtless fall by a great deal if all expenses had to be privately financed, which is

the same as saying that families would not invest in their children what society invests in

them. This conjecture is consistent with our analysis. And why are relatively poor

families willing to pay taxes to support public universities? Because of the positive

externality the education thus provided bestows on their children, who may not attend the

Graz-Schumpeter Lec 3

21

university, but whose wages will benefit from the education of more privileged. This

too, then, is consistent with our model.

Thus, to repeat this important point, it is perfectly consistent to say that, given the

total resources devoted to her family (after-tax income plus educational investment), each

parent would rather redistribute towards consumption and away from investment, and

that the members of political parties are content, on average, with what their parties

recommend to invest publicly in education.

What happens if the ratio d/c is not as large as the conditions in theorems 3.3 and

3.4 require? We know that if d=0, we definitely do not get convergence to wage

equality—that was our first model in the equilibria B(h*). I have not analyzed the

PUNEs in the intermediate situation, when d is positive but not large relative to c.

Doubtless, when d /c becomes sufficiently small, convergence to equality no longer

occurs with opportunist politics.

E. Conclusion

Let me sum up. We began by analyzing the model where returns to education are

completely private. We showed that, if politics are ideological, then in a sequence of

PUNEs where the probability of each party’s victory remains constant over time,

convergence to equality of human capital occurs, where by that convergence we mean

that the ratio of the levels of human capital in any two dynasties approaches unity. If

politics is very opportunistic, then convergence to equality of human capital never occurs.

These statements are independent of the initial distribution of human capital. In contrast,

we showed that in a unidimensional model, with opportunist politics, convergence to

Graz-Schumpeter Lec 3

22

equality of wages does occur, if and only if the initial distribution of human capital is

strongly positively skewed. That result was given to argue for the value of working on a

large policy space. Large policy spaces exist in reality, and it makes a difference to

model politics thusly.

We then considered an educational technology with endogenous growth, one in

which the general level of education has a positive effect on all wages. One

interpretation is that the sophistication of machines and technique is positively related to

the level of education, and hence, so is labor productivity and hence wages. We showed

that if the ratio d/c is sufficiently large, then, over time, even in the PUNEs with

opportunist politics, we tend to a state in which the same amount is invested in all

children, which induces equality of wages.

All these statements are true for the constant-returns case, when b+c=1. If

decreasing returns are the reality, then we presume that our theorems transform into

statements about the relative speed of convergence to equality of wages. And if there is a

stochastic talent or effort element in children, then we argued that statements about

convergence to equality transform into statements about convergence to a state in which

the tth descendant’s human capital is independent of the human capital of his distant

ancestors.

Graz-Schumpeter Lec 3

23

Ft(h)

t=1

t=0

t=2

0

Figure 3.1

The normalized CDF of human capital at various dates

h

Graz-Schumpeter Lec 3

24

total resource

X(h*)

boundary

where

opportunists

dominate

B(h*)

ˆ

boundary

where

militants

dominate

A(h*)

h*

Figure 3.2 The manifold of quasi-PUNEs

h*

Graz-Schumpeter Lec 3

25

Figure 3.3 The policy played by both parties on the upper boundary of manifold

r(h)

c

1 c

h

h*

Graz-Schumpeter Lec 3

Table 3.1 Coefficients of variation in six-generation simulations when b=c= 0.5=

26

Graz-Schumpeter Lec 3

27

gen

0

1

2

3

4

5

6

mean

40.

31.4903

25.5745

20.6967

16.9311

13.854

11.3373

median

30.

29.4005

25.8911

21.9691

18.2861

15.1532

12.5166

cvar

0.777778

0.238905

0.133496

0.0552047

0.045739

0.040081

0.0363719

winner

Right

Right

Left

Right

Right

Right

none

gen

0

1

2

3

4

5

6

mean

40.

31.4903

24.4413

19.9764

16.026

13.1141

10.8325

median

30.

29.4005

25.8911

21.7406

18.1286

14.9711

12.3349

cvar

0.777778

0.238905

0.111755

0.0876068

0.0647746

0.0598669

0.0400345

winner

Right

Left

Right

Left

Right

Left

none

gen

0

1

2

3

4

5

6

mean

40.

31.4903

24.4413

19.401

15.6823

12.8274

10.4978

median

30.

29.4005

25.8911

21.7406

18.0099

14.8266

12.1695

cvar

0.777778

0.238905

0.111755

0.0756528

0.0605814

0.0492044

0.0478734

winner

Right

Left

Left

Left

Left

Right

none

gen

0

1

2

3

4

5

6

mean

40.

31.4903

25.5745

20.0601

16.4099

13.3159

10.9721

median

30.

29.4005

25.8911

21.9691

18.2861

15.1532

12.4772

cvar

0.777778

0.238905

0.133496

0.0825377

0.0712898

0.0535628

0.0378218

winner

Right

Right

Left

Right

Left

Left

none

gen

0

1

2

3

4

5

6

mean

40.

30.1078

23.3832

18.6632

15.2701

12.5011

10.3844

median

30.

29.4005

25.3509

21.1867

17.5126

14.4383

11.8592

cvar

0.777778

0.209562

0.104315

0.0740434

0.0672418

0.051507

0.0346534

winner

Left

Left

Left

Right

Left

Left

none

gen

0

1

2

3

4

5

6

mean

40.

30.1078

23.3832

19.1164

15.4042

12.6056

10.4662

median

30.

29.4005

25.3509

21.1867

17.6068

14.5167

11.9462

cvar

0.777778

0.209562

0.104315

0.0841093

0.0640802

0.0599651

0.038533

winner

Left

Left

Right

Left

Right

Left

none

gen

0

1

2

3

4

5

6

mean

40.

30.1078

24.5092

20.0248

16.3769

13.2326

10.8889

median

30.

29.4005

25.3509

21.4133

17.9313

14.9242

12.3143

cvar

0.777778

0.209562

0.127354

0.0967003

0.0802714

0.0565481

0.0382226

winner

Left

Right

Right

Right

Left

Left

none

gen

0

1

2

3

4

5

6

mean

40.

31.4903

24.4413

19.401

15.6823

12.8334

10.5026

median

30.

29.4005

25.8911

21.7406

18.0099

14.8266

12.1876

cvar

0.777778

0.238905

0.111755

0.0756528

0.0605814

0.0574073

0.0552878

winner

Right

Left

Left

Left

Right

Right

none

gen

0

1

2

3

4

5

6

mean

40.

31.4903

24.4413

19.401

15.8728

12.9463

10.5949

median

30.

29.4005

25.8911

21.7406

18.0099

14.8723

12.2253

cvar

0.777778

0.238905

0.111755

0.0756528

0.0675324

0.0520871

0.0500408

winner

Right

Left

Left

Right

Left

Right

none

Graz-Schumpeter Lec 3

28

Table 3.2 Coefficients of variation when b=c= 0.75, =0.5

gen

0

1

2

3

4

5

gen

0

1

2

3

4

5

mean

40.

46.3957

62.1499

92.1395

178.626

497.265

mean

40.

46.3957

62.1499

92.1395

168.301

439.997

median

30.

40.6303

57.4749

94.2662

186.659

525.59

median

30.

40.6303

57.4749

94.2662

186.659

508.532

cvar

0.777778

0.431824

0.397763

0.293562

0.389374

0.50656

cvar

0.777778

0.431824

0.397763

0.293562

0.245359

0.358216

winner

Left

Right

Left

Right

Right

none

winner

Left

Right

Left

Left

Right

none

Graz-Schumpeter Lec 3

b+c < 1

Laissez-faire (LF)

CV 0

29

Democracy

CV 0,

Downsian politics

CV 0

faster than LF

b+c =1

b+c >1

constant CV

CV explodes

Theorem 1

CV decreases to 0.4

(simulation)

Theorem 2

if b<1:

strong skew CV 0;

otherwise, CV explodes

Table 3.3: Dynamic behavior of coefficient of variation of human capital by regime type

Graz-Schumpeter Lec 3

30

Figure 3.5 The solution of Theorem 3.3

r

1

1

h

h1

Graz-Schumpeter Lec 3

Figure 3.6 CDFs in a dynamic simulation with endogenous growth

31

Graz-Schumpeter Lec 3

32

This is generation 5 afterfiveLeftvictories

CDF

1

0.8

0.6

0.4

0.2

10

20

30

40

50

Figure 3.4 The CDF of human capital after five Left victories