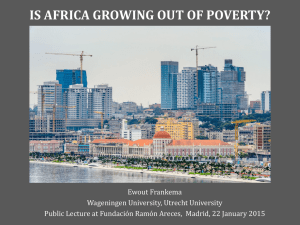

Continental drift: globalization, liberalization and

advertisement