Intel Corporation

advertisement

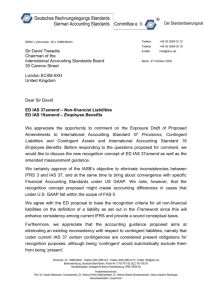

Intel Corporation 2200 Mission College Blvd. Santa Clara, CA 95052-8119 Tel: 408-765-8080 Fax: 408-765-8871 May 18, 2010 Sir David Tweedie Chairman International Accounting Standards Board 30 Cannon Street London EC4M 6XH United Kingdom Re: Exposure Draft ED/2010/1 Measurement of Liabilities in IAS 37 Dear Sir David: Intel is pleased to respond to your request for comment on the Exposure Draft, Measurement of Liabilities in IAS 37. We support the IASB’s objectives to improve and align the recording of liabilities across IFRSs and to support global convergence of financial reporting standards. We believe that these objectives are achievable through the IASB’s convergence efforts with the FASB. A separate project outside of these convergence efforts will result in disparity within IFRS and increase divergence with US GAAP, as discussed below. We also provide more detailed responses to the questions posed in the Exposure Draft in the Appendix. We support the Board’s effort to improve and align the recording of liabilities across IFRS’s. While we respect that the Board does not want to receive comments on the recognition of a liability under the proposed new IFRS, the issuance of a new IFRS based upon the current working draft of the standard will create divergence within IFRSs. The proposed IFRS removes the criterion that an outflow of resources be probable. This revised criteria for recognizing a liability is not consistent with the IASB Framework’s definition of a liability. The Framework defines a liability as a present obligation which is expected to result in an outflow of economic resources. We believe that to align the recording of liabilities across IFRSs, the recognition of a liability should be based on the IASB Framework. The Framework sets forth the objectives and conceptual foundation of financial accounting that is the basis for the development of financial accounting and reporting standards. Any fundamental change in the recognition of a liability should be addressed as part of the IASB Conceptual Framework project, which is a joint project with the FASB, rather than though an amendment to IAS 37 Provision, Contingent Liabilities and Contingent Assets. We also support the Board’s objective of global convergence of financial reporting standards. The guidance in the proposed standard is aimed at eliminating timing differences between IAS 37 and US GAAP on when entities recognize restructuring costs. While the proposed standard does align the recognition of restructuring costs between IFRS and US GAAP, it will create new differences. For example, the recognition of a liability or contingent liability under US GAAP occurs when it is deemed probable or expected and one or more future events will confirm the fact of a loss and the amount of loss can be measured reliably. The consequence of removing the assessment of whether it is probable that an outflow of resources will result is a loss of symmetry between recognition under IFRS and US GAAP. The proposed guidance will also create significant divergence in how liabilities are measured. The Exposure Draft proposes that measurement should be the amount that the entity would rationally pay to be relieved of the liability. Under this guidance, this amount would normally be an estimate of the present value of the resources required to fulfill the liability. Under US GAAP, settlement price or even fair value are not objectives of the measurement of liabilities. Recognition under US GAAP is based on management’s estimate. This divergence in measuring liabilities between IFRS and US GAAP could create significant differences in how companies measure liabilities under IFRS and US GAAP. To ensure that the Board meets its objective of global convergence, we recommend that the Board make changes to the accounting for liabilities through convergence projects as part of the IASB and FASB Memorandum of Understanding rather than within individual improvement projects. In summary, we encourage the Board’s objective to improve and align the recording of liabilities across IFRSs and to support global convergence of financial reporting standards. We believe that these objectives are best accomplished through convergence projects between the IASB and FASB, including the current Conceptual Framework project that aims to create a sound foundation for future accounting standards that are internally consistent and internationally converged. Thank you for your consideration of the points outlined in this letter. If you have any questions regarding our responses, please contact me at (408) 765-5545, or Liesl Nebel, Accounting Policy Controller, at (971) 215-1214. Sincerely, Leslie Culbertson Vice President, Director of Corporate Finance Appendix Response to Questions Question 1 – Overall requirements The proposed measurement requirements are set out in paragraphs 36A – 36F. Paragraphs BC2-BC11 of the Basis for Conclusions explain the Board’s reasons for these proposals. Do you support the requirements proposed in paragraphs 36A-36F? If not, with which paragraphs do you disagree, and why? We believe shifting measurement from an entity’s best estimate of the amount required to settle the obligation to the amount that that the entity would rationally pay at the end of the reporting period to be relieved of the present obligation may result in financial statements that are neither representationally faithful nor relevant. In making investment and credit decisions, information must be a faithful representation of the actual event. To faithfully represent an economic event, an estimate must be based on the appropriate inputs, and each input must reflect the best available information. We believe the proposed measurement principal does not meet the objective of faithful representation because measuring a liability at the amount an entity would pay to be relieved of the liability may not reflect the substance of the economic event. Considering all possible outcomes, the expected outflows or resources, and the risk that the actual outflows may differ from expected will result in the measurement of a liability that is different from management’s best estimate of the expected outcome. Management’s best estimate represents the actual resources an entity expects to pay, which we believe reflects a more reliable measure of the expected future outflow of resources. Measurement of liabilities, as proposed by the Board, also raises concerns over the disclosure of uncertain liabilities. We are concerned about disclosing an amount associated with a lawsuit that is not based on our best estimate of the expected outcome. The Board believes an entity’s estimate of the expected value of a litigation liability is less revealing than the entity’s estimate of the most likely outcome. However, if the expected value of a litigation liability exceeds the entity’s best estimate and this amount is required to be disclosed, we think this would provide an unnecessary benefit to the other party in the litigation. As mentioned in the main body of the letter, we recommend that the Board not make any changes to how liabilities are recognized, measured or disclosed through this stand-alone project. Rather, the accounting for liabilities should be addressed through convergence projects as part of the IASB and FASB Memorandum of Understanding rather than by eliminating differences within individual improvement projects. Question 2 –Obligations fulfilled by undertaking a service Some obligations within the scope of IAS 37 will be fulfilled by undertaking a service at a future date. Paragraph B8 of Appendix B specifies how entities should measure the future outflows required to fulfill such obligations. It proposes that the relevant outflows are the amounts that the entity would rationally pay a contractor at the future date to undertake the service on its behalf. Paragraphs BC19-BC22 of the Basis for Conclusions explain the Board’s rationale for this proposal. Do you support the proposal in paragraph B8? If not, why not? When fulfilling an obligation by undertaking a service, we do not support the Board’s proposal that measurement of the outflows of resources be based solely on the amounts that an entity would rationally pay a contractor at a future date to undertake the service on its behalf. If management engages a third-party to settle the service; it would be appropriate to calculate the liability based on the contractor costs expected to be incurred. However, if management elects to settle the obligation internally; we believe that the only costs that should be included in the calculation of the liability are the internal costs expected to be incurred. We do not support recognizing the profit margin that would result if the entity intended to settle the obligation internally. We understand that the Board’s objective is to ensure comparability of the measurement of liabilities amongst entities regardless of how the obligation will be fulfilled, but we believe that the proposed measurement principal for obligations that will be fulfilled by undertaking a service may not faithfully represent the actual substance of the economic event. The objective of financial reporting is to provide information to investors and creditors that assist in assessing the amounts, timing, and uncertainty of an entity’s future cash flows. If the Board were to require an entity to include a profit margin even when services would be provided internally, the financial statements would not provide decision-useful information to the readers of the financial statements since the recorded liability would not represent expected cash outflows. Question 3 – Exception for onerous sales and insurance contracts Paragraph B9 of Appendix B proposes a limited exception for onerous contracts arising from transactions within the scope of IAS 18 Revenue or IFRS 4 Insurance Contracts. The relevant future outflows would be the costs the entity expects to incur to fulfill its contractual obligations, rather than the amounts the entity would pay a contractor to fulfill them on its behalf. Paragraphs BC23-BC27 of the Basis for Conclusions explain the reason for this exception. Do you support the exception? If not, what would you propose instead and why? We agree that an onerous contract arises based on a comparison of the costs the entity expects to incur to fulfill its contractual obligation with the expected economic benefits. We believe this view is consistent with the cost approach proposed in the Revenue Recognition Discussion Paper. Under the cost approach, a performance obligation is considered onerous when the expected costs to satisfy a performance obligation exceeds its carrying amount. The cost approach rejects the notion of applying a reasonable margin to determine an entity’s expected costs. We support the Board exception as it is consistent with the preliminary views expressed on changes to the Revenue Recognition project.