GENERAL INDIAN ECONOMIC SCENARIO

advertisement

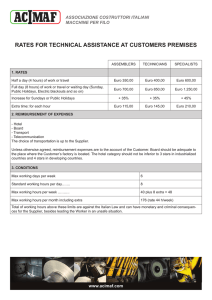

BRIEF STUDY ON THE INDIAN CERAMIC PRODUCTS (POTTERY/TABLEWARE) INDUSTRY (FEBRUARY 2006) GENERAL INDIAN ECONOMIC SCENARIO 1. India is among the fastest growing economies in the world with a consuming middle class of 300 million people 2. Its GDP in terms of purchasing power parity is USD 3.3 trillion 3. It continues to be among the top 10 global destinations for Foreign Direct Investment (FDI) 4. Approximately 600,000 households have an annual income of over Euro 17895 while approximately 150,000 households have an annual income of above 89477 POTTERYWARE/TABLEWARE INDUSTRY OVERVIEW The ceramic industry in India is estimated to be approximately Euro 3.44.5 billion and is over 100 years old in India. It comprises ceramic tiles, sanitaryware and crockery items. Potteryware signifying crockery and tableware are produced both in the large scale and small scale sectors. There are 16 units in the organized sector with a total installed capacity of 43000 tonnes per annum. In the small scale sector, there are about 1200 plants with a capacity of 300,000 tonnes per annum. Majority of the production of ceramic tableware is of bone china and stoneware. This industry in India is highly labour intensive while in USA, UK, Japan and other countries there is full automation. The unorganized sector accounts for over 50% of the production which makes it difficult to maintain or report production data to the government. The predicted growth rate is 10% due to increasing, disposable incomes, changing lifestyles and tastes among the urban consumers. Indian tableware industry makes bone china and stoneware crockery, although porcelain and dolomite crockery are more popular worldwide. India has in fact emerged as the second largest producer of bone china crockery in the world after UK. The main reason for the popularity of bone china crockery in India is that it was first to be introduced in India (through UK) and it is more light and white. Porcelain crockery, which has higher mechanical strength, is not manufactured in India due to non availability of raw material-talc which has to be imported from Japan. Further, kilns for porcelain tableware are not available in India. PRODUCTION AREAS As per industry estimates, almost 50-60% of all bone china crockery is manufactured in Jaipur, in the state of Rajastan, in North and India. The other major center for ceramic tableware production is also in North India, located in Khurja. While the large companies are equipped to manufacture the entire range of flatware and hollowware, in a variety of designs and decorations, the unorganized sector units have limited product range, mainly restricted to mugs, cups and saucers. EXPORT & IMPORT OF TABLEWARE EXPORT In the last 3 years, the export figures are: 2002-03: Euro 12.66 million 2003-04: Euro 13.73 million 2004-05: Euro 10.16 million IMPORT 2002-03: Euro 2.11 million 2003-04: Euro 2.83 million 2004-05: Euro 3.57 million Currently, more than 45% imports are from China. DOMESTIC RETAILING OF CERAMIC PRODUCTS/POTTERY/TABLEWARE The evolution of Indian ceramics began with the Harappan age and has endured through the ages. Ceramic ware is made of hard brittle material produced from non-metallic minerals by firing at high temperature. Its popularity is evident from the numerous categories and types, one finds all over India. Today, Khurja pottery has become quite famous and it dates back to about 600 years when some of the potters moved from Delhi to Khurja during the reign of Mohammed bin Tughlaq. The Jaipur blue pottery is equally famous and unique. It is impervious and more hygienic. Some of it is semi-transparent and mostly decorated with animal and bird motifs. The potter items, unlike that of Delhi are mostly made out of Egyptian paste and fired at very low temperature. Pondicherry is famous for the Golden Bride pottery which is molded out of china clay. Hand crafted ceramic paintings and figurines of deities are very much in vogue in India. RETAIL STORES AND BRANDED VS UNBRANDED PRODUCTS Most of the products are sold in small giftware shops or tableware shops. More than 80% products are not branded. Amongst the imported few varieties found in retail are the following brands: Horselane, (Japan), Swan (Thailand), Coral (American), Peach (China), Oakwood, Stafford, Shrew, Queeneannie (U.K.), Crown (Thailand), Hervit, Florence, Linea Argenti, Baldi (Italy). Amongst the stores, D’MART is the only store which was successfully selling Italian products. The above mentioned Italian brands were only present in D’Mart. Florence is also available in 2 Archies outlets. A list of some stores contacted is enclosed. PRODUCT MIX The ceramic products which sell more popularly are giftware, vases, jewellery boxes, etc. PRICE RANGE Unbranded products range anywhere between Rs. 100-900. (Euro 1.9-17) Branded products range between Rs. 1000-40,000 (Euro 18.9-755) Amongst the branded products, the Italian products (brand-FLORENCE) which are selling in D’Mart are in the range of Rs. 4250-7000 (app. Euro 80-135). The Italian statues and figurines which are above Rs. 40,000 (Euro 755 approximately) have so far not found much favorable response. CONCLUSION The Indian market is not ready yet for Italian ceramic products unless the brand is very strong and has the backing to do strong promotions. The primary reason being the price sensitivity. On the contrary, the market is ready to take in super luxury brands in other product categories -like Louis Vuitton, GUCCI, etc. since the Indian elite is well travelled and these brands are already well known. ENCLOSURES List of some shops contacted