Saudis Promise More Oil To Curb World-Wide Fears

advertisement

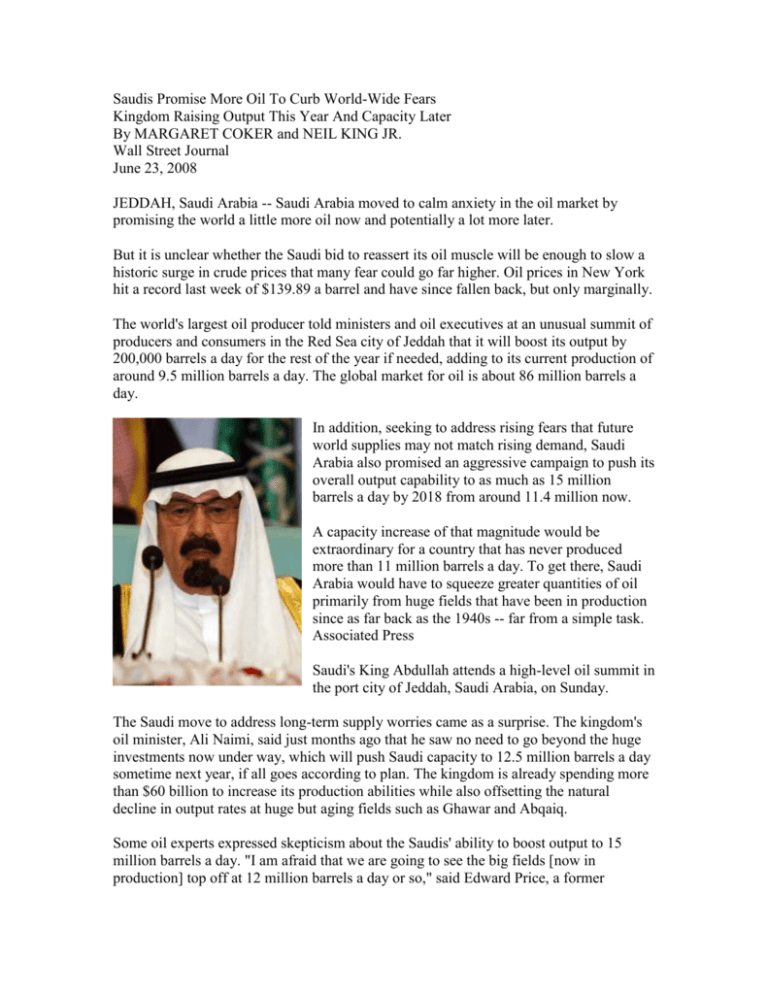

Saudis Promise More Oil To Curb World-Wide Fears Kingdom Raising Output This Year And Capacity Later By MARGARET COKER and NEIL KING JR. Wall Street Journal June 23, 2008 JEDDAH, Saudi Arabia -- Saudi Arabia moved to calm anxiety in the oil market by promising the world a little more oil now and potentially a lot more later. But it is unclear whether the Saudi bid to reassert its oil muscle will be enough to slow a historic surge in crude prices that many fear could go far higher. Oil prices in New York hit a record last week of $139.89 a barrel and have since fallen back, but only marginally. The world's largest oil producer told ministers and oil executives at an unusual summit of producers and consumers in the Red Sea city of Jeddah that it will boost its output by 200,000 barrels a day for the rest of the year if needed, adding to its current production of around 9.5 million barrels a day. The global market for oil is about 86 million barrels a day. In addition, seeking to address rising fears that future world supplies may not match rising demand, Saudi Arabia also promised an aggressive campaign to push its overall output capability to as much as 15 million barrels a day by 2018 from around 11.4 million now. A capacity increase of that magnitude would be extraordinary for a country that has never produced more than 11 million barrels a day. To get there, Saudi Arabia would have to squeeze greater quantities of oil primarily from huge fields that have been in production since as far back as the 1940s -- far from a simple task. Associated Press Saudi's King Abdullah attends a high-level oil summit in the port city of Jeddah, Saudi Arabia, on Sunday. The Saudi move to address long-term supply worries came as a surprise. The kingdom's oil minister, Ali Naimi, said just months ago that he saw no need to go beyond the huge investments now under way, which will push Saudi capacity to 12.5 million barrels a day sometime next year, if all goes according to plan. The kingdom is already spending more than $60 billion to increase its production abilities while also offsetting the natural decline in output rates at huge but aging fields such as Ghawar and Abqaiq. Some oil experts expressed skepticism about the Saudis' ability to boost output to 15 million barrels a day. "I am afraid that we are going to see the big fields [now in production] top off at 12 million barrels a day or so," said Edward Price, a former president of Saudi Arabian Oil Co., or Aramco, who keeps up with developments there. "Even in Saudi Arabia, there are resource limits." The promised added barrels from Saudi Arabia come as output has fallen sharply in other big producing countries. Nigeria said Sunday that because of continuing militant attacks against its oil facilities, production is down nearly one million barrels a day from its normal output. Oil exports from Mexico, Britain and Norway -- all of which have played major roles in slaking the world's oil thirst -- also are falling. The Saudi-hosted summit was a somber affair as delegates from 36 countries -- including British Prime Minister Gordon Brown, the heads of nearly 10 international oil companies and top officials from the Organization of Petroleum Exporting Countries -debated how to address nosebleed oil prices, a situation that Saudi King Abdullah called a major threat to global security. Oil prices have doubled in the past year, causing fuel costs to soar and straining industries from airlines and cargo shipping to U.S. auto manufacturers. The price rise has also stirred violent protests in Europe and economic unrest in much of the developing world. The one-day Jeddah gathering unleashed a spate of promises as big producers such as Saudi Arabia vowed to do more to calm supply fears and big consumers like the U.S. talked of heightened investments in renewable energies. Yet the conclave is likely to do little to change perceptions about the precariousness of world oil markets. Behind the handshakes and the talk of cooperation rumbled a deep disagreement over what has caused the oil-price surge. Saudi officials worked the halls, delivering the message that price volatility wasn't related to oil supplies. King Abdullah, in his speech, decried the "selfishness" of those involved in the oil-futures market, speculators whom he derided as "despicable." The king said that many in the West continue to "point the finger of blame at OPEC alone," despite efforts within OPEC to keep pace with demand in recent months. While a political backlash against speculators is gaining momentum in the U.S., representatives at the Jeddah meeting from consuming nations put most of the blame on the fundamentals of supply and demand. More oil is needed, they said, at a time when global demand since 2003 has jumped by 1.8% a year on average -- thanks largely to surging demand from China and India. OPEC supplies nearly 40% of the world's crude oil. "I believe that most of us agree on one thing: Prices are too high at present," said U.S. Energy Secretary Samuel Bodman. "And unless we act, the situation will remain unsustainable." The gathering made no clear headway on whether the U.S. should take steps to tighten regulations on the oil-futures trading market, as many oil producers think it should. Nor was there any public discussion of how to get big producers such as Saudi Arabia, Iran or Russia to publish more reliable data on their reserves or on the depletion rates of individual fields. Such data would offer more clarity to a market that most often operates in a fog. The International Energy Agency, a watchdog for consuming nations, is doing its own study of the world's biggest fields in a bid to bridge the information gap. Many officials came to Jeddah under heavy political fire either at home or abroad. British Prime Minister Brown, who has faced a rash of protests at home over high fuel costs, pitched a number of ways that producing and consuming nations could better cooperate to ease the crisis. He called for the end of restrictions to Western investment in Arab countries' energy sectors while also announcing his willingness to increase access for sovereign wealth funds, many from Middle Eastern nations, to the British market. China's Vice President Xi Jinping defended his country's energy policies, saying China is committed to alternative energy developments and to increased energy efficiency. China's booming energy demand has helped propel world oil prices. To counter that rise, China announced last week that it plans to raise its subsidized fuel costs to consumers. (Please see related article on page A12.) Still, Mr. Xi noted that, until recently, 90% of China's domestic energy needs came from domestic supplies. Leading up to the Jeddah meeting, the Saudis first hoped to nudge prices down by promising a big boost in output. When that left markets unfazed, the country's oil officials appeared to turn their attention to long-range plans instead. Mr. Naimi said the country is looking to invest $129 billion in oil projects over the next five years. If needed, he said, the country could add more than two million barrels a day in extra capacity through more drilling in five huge fields. But that is certain to be a challenge. Saudi Arabia has been hit by soaring costs and project delays, as have oil producers elsewhere. And with some projects, Mr. Naimi is making output predictions that could be hard to hit. Aramco is spending nearly $20 billion, for example, to develop the huge Khurais field, with an aim of pushing its output to 1.2 million barrels a day -- a target that many within the company think is overambitious. But to push the country's abilities still higher, Mr. Naimi said Sunday that Khurais would over time be made to deliver 250,000 barrels a day more. Write to Margaret Coker at margaret.coker@wsj.com and Neil King Jr. at neil.king@wsj.com