Downloads - University of Southern California

advertisement

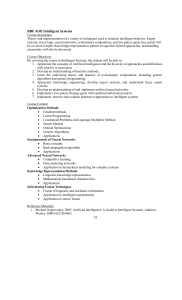

Downloads and Citations in Intelligent Systems in Accounting, Finance and Management Daniel E. O’Leary University of Southern California Oleary@usc.edu Words = ~ 5850 Abstract This paper summarizes the most downloaded papers from the years 2000 – 2002 and traces the number of citations from Google Scholar (beta) for those papers at the beginning of 2008. It is found that the number of downloads and citations are highly correlated, suggesting that downloads is a leading indicator of citations, even years into the future. In addition, this paper assesses which of the papers from the journal have been the most cited papers over the history of the journal, using both ISI/Social Science Citation Index and Google Scholar. It is found that the numbers of citations using both approaches are highly correlated. Keywords: Downloads, Citations, H-index 1. Introduction In 2007, the John Wiley journal, Intelligent Systems in Accounting, Finance and Management (ISAFM) published its 15th volume. At such points in a journal’s history it is time to provide an historical analysis as to where the journal has been. One approach is to determine those papers that have garnered more attention, either by being frequently cited by other research papers or frequently downloaded for potential future use. Citations Diamond (1986) and others have noted that citations have economic benefit for those being cited. Accordingly, citation studies can be important to those identified as among the most cited. In addition, citation studies are important to those who are being considered for tenure, promotion or chaired positions. As noted by Smith (2004), ultimately, an individual’s citation list may be more important than their publication list. Perhaps the two leading sources for citation research are ISI’s World of Knowledge (Social Science Citation Network - SSCI) and Google Scholar (beta). Historically, citation analyses most frequently have employed data generated from Thompson’s “ISI World of Knowledge” (e.g., Howitt 1998), also known as the “Social Science Citation Index” – a source of ISI’s World of Knowledge. ISI limits its search for citations to a set of journals from which it indexes each of the reference citations, even if the journal being cited is not “indexed.” However, ISI is not the only source of citation information. In 1 addition, this paper also analyzed the most cited papers using Google Scholar (Beta). Although Google is still only in beta form, it increasingly is being used to assess citations of scholarly papers. Unlike ISI, Google Scholar indexes virtually all papers on the Internet. Further, unlike ISI, Google Scholar is provided as a free service. As a result, we have two citation sources, one that does not index ISAFM (ISI) and one that does index ISAFM (Google Scholar). Given such different sources of citations, it is not clear, a priori, how the number of citations from each would be related Downloads of Research Papers Digital downloads are a relatively new occurrence, deriving from the evolution toward an increasingly digital world. In some cases download information is now available as journals increasingly move on-line. For example, download information about their 25 most downloaded papers for various journals is provided by Elsevier. In other settings, the download information is kept as proprietary information. Download information may be viewed as proprietary, since publishers’ digital economic models are increasingly predicated based on downloads. To disclose too much about paper downloads is to disclose a journal’s economic model, potentially to competition. However, there is interest in downloads, since there are a number of reasons to expect that downloads of a paper might ultimately manifest themselves as citations. First, in order to know what a paper says, typically, it needs to be downloaded and read. Second, if a paper is downloaded, generally it is downloaded for a reason, such as citation. Third, if a user downloads a paper, then the user has direct local access to the paper and can cite it if they need it. Fourth, a researcher may have downloaded a paper because they were requested to examine and cite the paper. For example, a referee may have recommended that the paper be cited. Publicly Available vs. Proprietary Download Information If the download list is public, then the fact that a paper is among the more frequently downloaded, may cast additional attention to it, ultimately, resulting in additional citations. However, with a proprietary list, the extent to which a paper was downloaded is not known to others. As a result, if a paper is downloaded or ultimately is cited then it is not because of any “publicity” or issues relating to the paper being a frequently downloaded paper. Thus, in the case of proprietary download information there is no possibility of feedback from a download list that can result in additional downloads or citations. Purpose of this Paper The purpose of this paper is three-fold. First, this paper investigates the relationship between paper downloads and citations in Intelligent Systems in Accounting, Finance and Management. Proprietary download information is found to be statistically significantly correlated with citations for the 50 most downloaded papers from 2000-2002. Second, this paper investigates the most cited papers in IJAFM, finding the H-Index of the most 2 cited papers for the journal. Third, this paper also compares the number of citations found using two different sources, and finds the number of citations in those two sources to be highly correlated, in spite of the fact that only one of the citation sources indexes ISAFM. Outline of This Paper This paper proceeds in the following manner. Section 2 summarizes the approach used to study the paper downloads and citations. Section 3 and 4 discuss the findings. Section 5 briefly summarizes the paper and discusses some contributions and extensions. 2. Approach This paper uses proprietary download data available to the author when he was editor of the International Journal of Intelligent Systems in Accounting, Finance and Management that was not, in general, publicly available. Information was gathered regarding the fifty most downloaded papers across the time frame January 2000 to December 2002. At that time, and to this day, only papers from 1996 were available in a digital format. As a result, only those papers published from 1996 through 2002 could have been in that sample. In addition, citation information was then gathered for each of the individual items in March 2008. In order to generate a list of the most cited papers, Google Scholar was used, in March 2008, where all of the papers and their citations listed under the following names were gathered: “Intelligent Systems in Accounting, Finance and Management” “International Journal of Intelligent Systems in Accounting, Finance and Management” “Int. J. Intell. Sys. Acc. Fin.” The results were then examined and duplicate entries were removed. This resulted in a substantial list of papers that was later pruned to consider only those with 10 or more citations. For each of these most cited Google papers, ISI – SSCI citations were also found in March 2008. Unfortunately, ISAFM is not indexed by ISI – SSCI, and the journal name that is used appears to overlap with the Wiley Journal “International Journal of Intelligent Systems.” As a result, the search for the number of ISAFM citations in ISI was based on a search of specific authors and papers, and their individual citations. 3. Findings – Most Downloaded Papers A list of the 50 most downloaded papers between January 2000 and December 2002 is summarized in Table 1. In addition, the number of Google citations for those papers as of March 2008, five years after the data was compiled, is also provided. As a result, there was five to eight years between when the papers were downloaded and when the papers were cited and that citation information was gathered by Google Scholar. This is a 3 substantial lag and there is question as to whether the number of downloads is related to the number of citations over such a long time period. Relationship Between Downloads and Citations Only two of the 50 have a number of citations that is greater than two standard deviations from the mean: Herst and Karagiannis (2000) and Fanning and Cogger (1998). If those two (relatively anomalous) observations are removed, then the correlation of the number of downloads and the number of Google citations is 0.437, which is statistically significantly different than 0 at better than the .05 level. Further, the correlation is 0.331, which also is statistically significantly different than 0 at better than the .05 level, when only the only entry more than five standard deviations from the mean is removed. 4. Findings – Most Cited Papers A list of the 40 most cited papers is summarized in table 2. The data is sorted based on Google citations, and then by ISI citations. Relationship Between Citation Sources As noted earlier ISI does not index ISAFM, however, Google Scholar indexes virtually all materials available on the web. As a result, a priori, it is not clear if the number of citations to ISAFM between those two sources would be related. For the 40 most cited papers, the correlation between the number of citations for those two sources was 0.792, which is statistically significantly different than 0 at better than .01. Relationship to Citations and Publication Year Given that the number of citations should only increase over time, we generally would expect the number of citations to be negatively related to publication years. For the 40 most cited papers, we find that both Google Citations (- 0.169) and ISI Citations (- 0.294) are negatively correlated with publication year. However, only the second is statistically significantly different than 0 at the .05 level or better. H – Index Using Google Citations An emerging issue in citation analysis is the use of the so-called “H – Index” (Hirsch 2005). Let C(m,n) = k, be the number of citations of publications of source m, with n or more citations. When n=k, the index is referred to as the “H-index.” Informally, the HIndex for an individual or journal etc., would be computed using the following approach. First, the number of citations would be gathered for each document. Second, the appropriate set of documents would be ranked starting with the most citations being ranked first, the second most being ranked second, etc. Third, the highest rank, at which that rank is greater than or equal to the number of citations, is determined. Then, that rank is called the H-Index. Using Google citations, ISAFM has an H-Index of 20. Using ISI citations, the H-Index would be 9, based on the data in table 2. 4 Why 40 Most Cited? I focused on the 40 most cited papers for two reasons. First, 40 is simply double the HIndex for the Google citations. This illustrates a generalization of the H-Index, where rather than just use the H-Index we use some general version of k*H for k an arbitrary parameter. Second, the 40 most cited each have 10 or more citations at the time that the data was gathered. As a result, by focusing on those papers with citations in so-called “double digits” we focus on the more cited papers. In many settings the movement from single to double digits is an important psychological barrier. Digital vs. Non-Digital If a paper is in digital format, compared to paper only, is it more likely to result in citations? One approach is to analyze the 40 most cited papers for whether or not the paper was digitally available. Out of the 40 most cited papers, which resulted in 47 different papers because of ties, 12 were from the four year time period 1992 -1995 and were not digitally available from Wiley. The average number of papers among those 47 papers, per year, for 1992-1995 was 3, and the average number of papers, per year, from 1996 – 2003 was 3.889. Unfortunately, this is not convincing evidence that that digitally available papers garner more citations, particularly since two of the four years from 1992 -1995 had 4 papers among those 47. 5. Summary, Contributions and Extensions This final section of the paper briefly summarizes the paper and its contributions, and discusses some extensions. Summary This research has investigated both downloads and citations for Intelligent Systems in Accounting, Finance and Management. The 50 most downloaded papers from 20002002 were investigated and the number of downloads were found to be highly correlated with the number of citations to those papers, up to eight years after the original downloads may have occurred. In addition, for the most cited papers over the first 15 volumes it was found that the number of citations in ISI and Google Scholar are highly correlated. Limitations Perhaps the primary limitation to this study is that Google Scholar is in beta format. As a result, citations may not be as stable as with alternative more established sources, such as ISI. On the other hand, as of October 12, 2008, Google Scholar had 24,000,000 page references, suggesting quite a strong presence. In addition, Google Scholar has been compared favorably to ISI (http://www.harzing.com/resources.htm#/pop_gs.htm). 5 Contributions First, this paper found that even after five to eight years, the number of downloads is highly correlated with the number of citations. Second, this set of downloads information is unique in that it was proprietary. As a result, there was no possibility of feedback from the download list to the citations generated by a paper, yet citations were still statistically significantly correlated with number of downloads. Third, this is one of the first papers to compute an “H-Index” for a journal, and used both ISI and Google Scholar to compute the index. Fourth, this paper found that the number of citations from an emerging source, Google Scholar, and an established source, ISI/SSCI, are highly correlated for the most cited papers from ISAFM, in spite of the fact that one indexes ISAFM and the other does not. Extensions Future work could investigate the relationship between number of downloads and citations over even longer time periods than 5 years, or analyze more recent download lists. Further, future work could examine alternative citation sources, such as Scopus. In addition, future work could identify the sources of publication of the citing literature, focusing on some subset of the most cited papers, such as the top 40 or the H-Index set. Further, this paper provides a benchmark so that future research could track the extent of change of the number of citations or H-Index over time. Finally, perhaps the most important issue to explore is to what extent does the posting most downloaded lists for public consumption ultimately influence the number of citations. Does posting provide additional incentive, opportunity, etc. for papers to be cited? 6 Table 1 50 Most Downloaded Papers 2000-2002 and Google Citations Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 19 21 22 23 23 23 26 27 28 29 30 31 31 33 34 35 Authors Coakley and Brown (2000) Nissen (2000) Anandarajan et al. (2001) Jung (1999) Yu et al. (2000) Ramamoorti et al. (1999) Kauffman et al. (2000) McKee (2000) Stefanowski and Wilk (2001) Baestaens (1999) Feelders (2000) Abdolmohammadi and Usof (2001) Kim et al. (2000) Lenard et al. (2001) Fritz and Hosemann (2000) Bruno (2002) Yu et al. (2001) Herbst and Karagiannis (2000) Lee et al. (2000) Yeo et al. (2001) Yager (1999) Kim (1999) Chen et al. (1999) Nanda and Pendharkar (2001) O'Leary (1998) Singh and Huhns (1999) Huh and Bae (1999) Lanquillon (1998) Feroz et. (2000) Swicegood and Clark (2001) Spangler and Peters (2000) Davis et al. (2001) O'Leary (2000) Yan et al. (2001) Vojinovic et al. (2001) 7 Downloads 854 497 375 369 360 349 333 286 282 279 267 262 257 243 236 233 223 222 218 218 214 206 201 201 201 196 192 191 180 178 176 176 172 169 168 Google Citations 31 8 6 16 4 11 10 14 10 4 28 9 3 10 8 3 0 78 2 3 5 0 10 5 31 28 1 3 9 3 0 4 3 18 8 36 37 38 39 40 41 42 42 44 45 46 47 48 49 50 163 160 158 154 151 147 145 145 144 142 141 129 128 126 125 Poh et al. 1998 Wu (2000) Hellström and Holmström (2000) Zacharia et al. (2000) Ong et al. (2002) Milani and Marcugini (1999) Collier et al. (1999) Bons et al. (1999) Fanning and Cogger (1998) Deshmukh and Talluru (1998) Wang (2001) Heatley and Otto (1998) Binbasioglu and Zychowicz (1998) Taudes et al. (1998) Haefke et al. (1998) 8 16 3 10 4 2 5 9 10 44 6 4 1 6 4 0 Table 2 - 40 Most Cited Papers (Ranked by Google Citations, Then ISI Citations) Rank 1 2 3 4 5 6 7 8 9 9 11 12 12 14 14 16 17 17 19 19 19 22 22 22 22 26 27 27 27 27 31 31 33 33 35 35 35 35 35 40 40 40 40 40 40 40 40 Author Decker (1994) Slowinski and Zopounidis (1995) Herbst and Karagiannis (2000) Fanning and Cogger (1998) Fanning and Cogger (1994) Kohara et al. (1997) Lee and Kim (2000) Bryant (1997) O'Leary (1998) Coakley and Brown (2000) Boritz et al.(1995) Singh and Huhns (1999) Feelders (2000) Barniv et al. (1997) Foster (1995) Maher and Sen (1997) Chung and Tam (1993) Coakley and Brown (1993) Kwon et al. (1997) Scacchi and Mi (1997) Fortin and Kuzmics (2002) Jhee and Lee (1993) Fu et al. 2002) Antoniou and Arief (2001) Yan et al. (2001) Etheridge and Sriram (1997) Brown and Gupta (1994) Srivastava et al. (1996) Poh et al. (1998) Jung et al.(1999) McKee (2000) Wuthrich (1997) Bell (1997) Lee and Lee (1998) Lin and Carley (1993) Morris (1994) Rockwell and McCarthy (1999) Ramamoorti et al. (1999) Kloptchenko et al. (2004) Stefanowski and Wilk (2001) Kauffman et al. (2000) O'Leary and Watkins (1992) Chen et al. (1999) Bons et al. (1999) Charitou et al. (1996) Hellstrom and Holmstrom (2000) Lenard et al. (2001) 9 Google Citations 93 88 78 44 35 34 33 32 31 31 29 28 28 26 26 25 21 21 20 20 20 18 18 18 18 17 16 16 16 16 14 14 13 13 11 11 11 11 11 10 10 10 10 10 10 10 10 ISI Citations 20 47 19 9 2 16 0 9 12 6 11 6 5 6 0 8 8 5 8 3 1 6 2 1 0 6 8 6 4 4 8 1 4 4 9 4 1 1 0 6 4 3 2 2 2 1 1 References 1. Mohammad Abdolmohammadi, Catherine Usoff, A longitudinal study of applicable decision aids for detailed tasks in a financial audit, International Journal of Intelligent Systems in Accounting, Finance and Management, Volume 10, Number 3, pp. 139-154, 2001. 2. Murugan Anandarajan, Picheng Lee, Asokan Anandarajan, Bankruptcy prediction of financially stressed firms: an examination of the predictive accuracy of artificial neural networks, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, number 2, pp. 69-81, 2001. 3. G. Antoniou and M. Arief, Executable Declarative Business Rules and Their Use in Electronic Commerce, International Journal of Intelligent Systems in Accounting, Finance and Management, 2001, Volume 10, number 4, pp. 211-223. 4. Dirk-Emma Baestaens, Credit risk modeling strategies: the road to serfdom?, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 4, pp. 225-235, 1999. 5. R Barniv, A Agarwal, R Leach, "Predicting the outcome following bankruptcy filing: A three-state classification using neural nets,” International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 3, pp. 177-194. 6. Timothy B. Bell Neural nets or the logit model? A comparison of each model’s ability to predict commercial bank failures, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 6, Number 3, pp. 249264, 1997 7. Meral Binbasioglu, Edward J. Zychowicz, Knowledge-based management support: an application of diagnostic reasoning to corporate financing decisions, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 4, pp. 199-211, 1998. 8. R.W.H. Bons, R.M. Lee and R.W Wagenaar Computer-aided auditing of interorganizational trade procedures, International Journal of Intelligent Systems in Accounting, Finance and Management. Volume 8, Number 1, pp. 25-44, 1999. 9. JE Boritz, DB Kennedy, A Albuquerque, Predicting corporate failure using a neural network approach. International Journal of Intelligent Systems in Accounting, Finance and Management 1995, Volume 4, Number 2, pp. 95-109. 10. CE Brown, UG Gupta, Applying case-based reasoning to the accounting domain, International Journal of Intelligent Systems in Accounting, Finance and Management, 1994, Volume 3, Number 3, pp. 205-117. 10 11. Jeanette Bruno, Facilitating knowledge flow through the enterprise, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 11, Number 1, pp. 1-8, 2002. 12. S. M. Bryant, “A Case-based Reasoning Approach to Bankruptcy Prediction,” International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 3, pp. 195-214. 13. A Charitou and C Charalambous, The Prediction of Earnings Using Financial Statement Information: Empirical Evidence With Logit, International Journal of Intelligent Systems in Accounting, Finance and Management ,1996, Volume 5, Number 2, pp. 199-215. 14. Shu-Heng Chen, Wo-Chiang Lee, Chia-Hsuan Yeh, Hedging derivative securities with genetic programming, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, number 4, pp. 237-251, 1999. (23) 15. HMM Chung, KY Tam, A comparative analysis of inductive-learning algorithms, International Journal of Intelligent Systems in Accounting, Finance and Management 1993, Volume 2, Number 1, p. 3-19. 16. JR Coakley, CE Brown, Artificial neural networks applied to ratio analysis in the analytical review process, International Journal of Intelligent Systems in Accounting, Finance and Management 1993, Volume 2, Number 1, pp. 19-39. 17. James R. Coakley, Carol E. Brown, Artificial neural networks in accounting and finance: modeling issues, International Journal of Intelligent Systems in Accounting, Finance and Management volume 9, number 2, pp. 119 – 144, 2000. (1) 18. Philip A Collier, Stewart A Leech, Nicole Clark, A validated expert system for decision making in corporate recovery, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 2, pp. 7588, 1999. (44) 19. Jefferson T. Davis, Athanasios Episcopos 2, Sannaka Wettimuny, Predicting direction shifts on Canadian-US exchange rates with artificial neural networks, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 2, pp. 83-96, 2001. (32) 20. Keith Decker, “Quantitative Modeling of Complex Environments,” International Journal of Intelligent Systems in Accounting, Finance and Management International of Intelligent Systems in Accounting, Finance and Management, 1994, Volume 2, number 4, pp. 215-235. 11 21. Ashutosh Deshmukh and Lakshminarayana Talluru 2 A rule-based fuzzy reasoning system for assessing the risk of management fraud, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, number 4, pp. 223-241, 1998. 22. Diamond, A., “What is a Citation Worth?” Journal of Human Resources, Volume 21, pp. 200-215, 1986. 23. HL Etheridge and RS Sriram, A comparison of the relative costs of financial distress models: artificial neural networks, logit, and Multivariate discriminant Analysis, International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 3, pp. 235-248. 24. Kurt M. Fanning and K. O. Cogger, “A Comparative Analysis of Artificial neural Networks using Financial Distress Prediction,” International Journal of Intelligent Systems in Accounting, Finance and Management, 1994, Volume 3, Number 4, pp. 241-252. 25. Kurt M. Fanning and Kenneth O. Cogger, Neural network detection of management fraud using published financial data, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 1, pp. 21-41, 1998. 26. A.J. Feelders, Credit scoring and reject inference with mixture models, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 1, pp. 1-8, 2000. 27. Ehsan Habib Feroz, Taek Mu Kwon, Victor S. Pastena, Kyungjoo Park, The efficacy of red flags in predicting the SEC's targets: an artificial neural networks approach, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 3, pp. 145 – 157, 2000. 28. I Fortin and C Kuzmics, Tail-Dependence in Stock-Return Pairs International Journal of Intelligent Systems in Accounting, Finance and Management , 2002, Volume 11, Number 2, pp. 89-107. 29. DA Foster, FRA: Teaching Financial Accounting with a Goal-Based Scenario International Journal of Intelligent Systems in Accounting, Finance and Management 1995. Volume 4, Number 3, pp. 173-195. 30. Sebastian Fritz and Detlef Hosemann, Restructuring the credit process: behaviour scoring for german corporates, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 1, pp. 9 – 21, 2000. 12 31. Y Fu, MY Shih, M Creado,"Reorganizing Web Sites Based on User Access Patterns,” International Journal of Intelligent Systems in Accounting, Finance and Management 2002, Volume 11, Number 1, pp. 39-53. 32. CHRISTIAN HAEFKE, MARTIN NATTER, TARUN SONI, HEINRICH OTRUBA, Adaptive Methods in Macroeconomic Forecasting, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 6, Number 1, pp. 1-10, 1998. 33. Sharon Kay Heatley, James R. Otto, Data mining computer audit logs to detect computer misuse, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 3, pp. 125-134, 1998. 34. Thomas Hellström and Kenneth Holmström, The relevance of trends for predictions of stock returns, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, number 1, 2000, pp. 23-34. 35. Joachim Herbst and Dimitris Karagiannis, Integrating machine learning and workflow management to support acquisition and adaptation of workflow models International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 2, pp. 67-92, 2000. 36. Hirsch, J.E., “An Index to quantify an Individual’s Scientific Research Output,” available at http://www.cs.ucla.edu/~palsberg/hirsch05.pdf, 29 September 2005. 37. Howitt, M., “ISI Spins a Web of Science,” Database, April/May, 1998, pp. 37-40. 38. Soon-Young Huh and Kyoung-Ll Bae, Dynamic web server construction on the intranet using a change management framework, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 1, pp. 45-60, 1999. 39. Changduk Jung, Ingoo Han, Bomil Suh, Risk analysis for electronic commerce using case-based reasoning, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 1, pp. 61-73, 1999. 40. C Jung, I Han, and B Suh, Risk Analysis for Electronic Commerce Using CaseBased Reasoning, International Journal of Intelligent Systems in Accounting, Finance and Management 1999, Volume 8, Number 1, pp. 61-73. 41. WC Jhee and JK Lee, Performance of neural networks in managerial forecasting International Journal of Intelligent Systems in Accounting, Finance and Management (1993), Volume 2, number 1, pp. 55-70. 42. Robert J. Kauffman, Salvatore T. March, Charles A. Wood, Design principles for long-lived Internet agents, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, number 4, pp. 217-236, 2000. 13 43. Sang-Ii Kim, Jae Kyeong Kim 2, Soung Hie Kim 1Development of a case-based decision support system for process modeling in BPR, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 2, pp. 93-105, 2000. 44. Steven Kim, Learning agent architecture for design and manufacturing knowledge on the Web: an extension of enterprise resource planning capabilities, Volume 8, Number 1, pp. 15 – 24, International Journal of Intelligent Systems in Accounting, Finance and Management 1999. 45. K Kohara, T Ishikawa, Y Fukuhara, Y Nakamura, Stock price prediction using prior knowledge and neural networks, International Journal of Intelligent Systems in Accounting, Finance and Management 1998, Volume 6, Number 1, pp. 11-22. 46. A Kloptchenko, T Eklund, J Karlsson and B Back, Combining data and text mining techniques for analysing financial reports International Journal of Intelligent Systems in Accounting, Finance and Management (2004), Volume 12, Number 1, pp. 29-45. 47. YS Kwon, IG Han, KC Lee, Ordinal pairwise partitioning (OPP) approach to neural networks training in bond rating International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 1, pp. 23-40. 48. Carsten Lanquillon, Dynamic aspects in neural classification, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 4, pp. 281-296, 1998. 49. Jae Kwang Lee, Jae Kyeong Kim and Soung Hie Kim, A methodology for modeling influence diagrams: a case-based reasoning approach, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 1, pp. 55-63, 2000. 50. Jae Kyu Lee and Woongkyu Lee, An intelligent agent-based competitive contract process: UNIK-AGENT, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 2, pp. 91-105. 51. Mary Jane Lenard, Pervaiz Alam, David Booth and Gregory Madey, Decisionmaking capabilities of a hybrid system applied to the auditor's going-concern assessment, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, number 1, pp. 1-23, 2001. 52. Z Lin and K Carley, Proactive or reactive: An analysis of the effect of agent style on organizational decision making International Journal of Intelligent Systems in Accounting, Finance and Management 1993, Volume 2, number 4, pp. 271-287. 14 53. J. J. Maher and T.K. Sen, Predicting Bond Rating Using Neural Netowrks: A Comparison with Logistic Regression,” International Journal of Intelligent Systems in Accounting, Finance and Management, 1997, Volume 6, Number 1, pp. 59-72. 54. Thomas E. Mckee, Developing a bankruptcy prediction model via rough sets theory, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 3, pp. 159-173, 2000. 55. Alfredo Milani and Stefano Marcugini Stockbot: a monitoring and acting software agent for stock markets, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 1, pp. 3-14, 1999. 56. BW Morris, SCAN: a case-based reasoning model for generating information system control recommendations International Journal of Intelligent Systems in Accounting, Finance and Management 1994, Volume 3, Number 1, pp. 47-65. 57. Mark Nissen, Agent-based supply chain disintermediation versus reintermediation: economic and technological perspectives, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 4, pp. 237-256, 2000. 58. Sudhir Nanda and Parag Pendharkar, Linear models for minimizing misclassification costs in bankruptcy prediction, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 3, pp. 155-168, 2001. 59. Daniel E. O’Leary, Using neural networks to predict corporate failure, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 3, pp. 187-197, 1998. 60. Daniel E. O’Leary, Management of reengineering knowledge: AI-based approaches, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 2, pp. 107-118, 2000. 61. Daniel E. O’Leary and Paul Watkins, Integration of Intelligent Systems and Conventional Systems, International Journal of Intelligent Systems in Accounting, Finance and Management 1992, Volume 1, Number 2, pp. 135-145. 62. Hwee-Leng Ong, Ah-Hwee Tan, Jamie Ng, Hong Pan, Qiu-Xiang Li Organizing and personalizing intelligence gathering from the web, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 11, Number 1, pp. 9-21, 2002 15 63. Hean-Lee Poh, Jingtao Yao, Teo Ja ic Neural networks for the analysis and forecasting of advertising and promotion impact, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 4, 1998, pp. 253-268. 64. Sridhar Ramamoorti, Andrew D. Bailey Jr., Richard O. Traver, Risk assessment in internal auditing: a neural network approach, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 3, pp. 159-180, 1999. 65. Stephen R. Rockwell and William E. McCarthy, REACH: automated database design integrating first-order theories, reconstructive expertise, and implementation heuristics for accounting information systems, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 3, pp. 181-197, 1999. 66. Schacchi, W., and Mi, P. “Process Life Cycle Engineering: A Knowledge-based Approach and Environment,” International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 2, pp. 83-107. 67. Munindar P. Singh , Michael N. Huhns, Multiagent systems for workflow, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 2, pp. 105-117, 1999. 68. R. Slowinski and C. Zopounidis, “Application of the Rough Set approach to evaluation of bankruptcy risk,” International Journal of Intelligent Systems in Accounting, Finance and Management, 1995, Volume 4, Number 1, pp. 27-47. 69. Smith, S., “IS an Article in a Top Journal a Top Article,” Financial Management, Winter 2004, pp. 133-149. 70. William E. Spangler and James M. Peters, Management control of complex, mission-critical processes, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, number 3, 175-193, 2000. 71. R. P. Srivastava, S.K. Dutta, R. W. Johns, “An Expert System Approach to Audit Planning and Evaluation in the Belief Function Framework,” International Journal of Intelligent Systems in Accounting, Finance and Management 1996, Volume 5, pp. 165. 72. Jerzy Stefanowski and Szymon Wilk, Evaluating business credit risk by means of approach-integrating decision rules and case-based learning, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, number 2, pp. 97-114, 2001. 16 73. Philip Swicegood and Jeffrey A. Clark, Off-site monitoring systems for predicting bank underperformance: a comparison of neural networks, discriminant analysis, and professional human judgment, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, number 3, pp. 169-186, 2001. 74. Alfred Taudes, Martin Natter, Michael Trcka, Real option valuation with neural networks, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 7, Number 1, pp. 43-52, 1998. 75. Zoran Vojinovic, Vojislav Kecman, Rainer Seidel A data mining approach to financial time series modelling and forecasting, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 4, pp. 225-239, 2001. 76. Shouhong Wang, Cluster a International Journal of Intelligent Systems in Accounting, Finance and Management nalysis using a validated self-organizing method: cases of problem identification, Volume 10, number 2, 2001, pp. 127138. 77. D. J. Wu, Agent-based stochastic production lines design, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 4, 2000, pp. 257-270. 78. B Wuthrich, Discovering Probabilistic Decision Rules International Journal of Intelligent Systems in Accounting, Finance and Management 1997, Volume 6, Number 4, pp. 269-277. 79. R. Yager, A game-theoretic approach to decision making under uncertainty, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 8, Number 1, pp. 131-143, 1999. 80. Yonghe Yan, Jerome Yen, Tung Bui, A multi-agent-based negotiation support system for distributed transmission cost allocation, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 3, 2001, pp. 187-200. 81. Ai Cheo Yeo, Kate A. Smith 1, Robert J. Willis 1, Malcolm Brooks 2 Clustering technique for risk classification and prediction of claim costs in the automobile insurance industry, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 1, pp. 39-50, 2001. 82. Chien-Chih Yu, Hung-Chao Yu, Chi-Chun Chou, The impacts of electronic commerce on auditing practices: an auditing process model for evidence collection and validation, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 3, pp. 195-216, 2000. 17 83. Song Jin Yu, Sang Chan Park, Jyun-Cheng Wang, Decision making using timedependent knowledge: knowledge augmentation using qualitative reasoning, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 10, Number 1, pp. 51-66. 84. Giorgos Zacharia, Theodoros Evgeniou, Pattie Maes, Dynamic pricing in a reputation-brokered agent-mediated marketplace, International Journal of Intelligent Systems in Accounting, Finance and Management Volume 9, Number 4, pp. 271-286, 2000. 18