PERFORMING COMPILATION AND REVIEW

advertisement

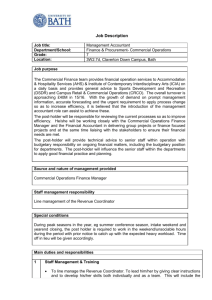

CPA Practice Aids, LLC PERFORMING COMPILATION AND REVIEW ENGAGEMENTS, RECENT UPDATES AND PROPOSALS Learning Objectives After completing this section of the course, you will be able to: 1. Understand the fundamental concepts of compilation services and the effects of recent updates and proposals 2. Apply effective and efficient compilation engagement performance, reporting and documentation methods 3. Understand the fundamental concepts of review services, recent updates and proposals and other related professional standards 4. Apply effective and efficient review engagement performance, reporting and documentation methods Part 1—Compilation Engagements AR Section 80, Compilation of Financial Statements AR Section 80 establishes standards and provides guidance on compilations of financial statements. The accountant is reminded that he or she should comply with the provisions of this section whenever he or she: 1. Is engaged to report on compiled financial statements, 2. Submits (prepares and presents) financial statements to a client that are or reasonably might be expected to be used by a third party, or 3. Submits (prepares and presents) financial statements to a client that are not expected to be used by a third party. Requirements of SSARS No. 19 SSARS No. 19 requires that the accountant establish an understanding with management regarding the services to be performed for each engagement through a written communication (that is, an engagement letter). The letter should include: 1. The objective of a compilation—to assist management in preparing financial statements; 2. That the accountant utilizes management’s representation without providing any assurance; 3. That management is responsible for a fair presentation of financial statements, internal controls, preventing and detecting fraud, complying with all laws and regulations, and making all records available to the accountant; 4. That the accountant is responsible for complying with SSARS; 5. A description of how a compilation differs from a review or audit; 6. That the engagement can’t be relied upon to disclose errors, fraud or illegal acts, but the accountant will notify management when any errors, fraud, or illegal acts (unless clearly inconsequential) are discovered. 7. The effect of any independence impairments on the accountant’s report; and 1 CPA Practice Aids, LLC 8. Other matters’ such as fees and billings, limitations of accountant’s liability, additional services, material departures, omitting substantially all disclosures or statement of cash flows, and reference to supplementary information. SSARS No. 19 also: 1. Establishes enhanced documentation requirements for a compilation engagement (for significant unusual matters and fraud). 2. Allows the accountant to include a general description in the accountant’s compilation report regarding the reason(s) for an independence impairment, and Non-Attest Services An accountant may also be engaged to perform a non-attest service such as bookkeeping, payroll, or other accounting services, and in addition, certain non-attest services may also be considered to be internal control services. SSARS does not cover the performance and reporting requirements of a non-attest service, even if performed in conjunction with a compilation. These are discussed in ET 101-3, Non-Attest Services. Reporting When the Accountant Is Not Independent The accountant may indicate his or her lack of independence by including the following as the final paragraph of the accountant’s compilation report: “I am (we are) not independent with respect to XYZ Company.” The accountant is not required to provide any additional details regarding the reasons for the independence impairment. The accountant is allowed, however, to provide a general description regarding all the general reasons that his or her independence is impaired. If the accountant elects to disclose a general description about the reasons his or her independence is impaired, the accountant should ensure that all reasons are included in the general description. Caveat: The accountant may provide a general description regarding the reason that his or her independence is impaired. He or she is precluded from disclosing a detailed description about the reason that his or her independence is impaired, including disclosing the specific internal control services performed. The standard explains that to do so increases the possibility that a user of the accountant’s compilation report may misunderstand and misinterpret the independence impairment. Accountant’s Communications With the Client When the Compiled Financial Statements Are Not Expected to Be Used by a Third Party SSARS No. 19 retains requirements in the previous SSARs regarding cases when the accountant submits compiled financial statements to his or her client that are not expected to be used by a third party. Preparation of management-use-only financial statements by a CPA requires an engagement letter detailing the performance requirements for a compilation engagement and the restrictions on the use of financial statements. 2 CPA Practice Aids, LLC Emphasis of a Matter This section is in the previous requirements and SSARS No. 19 does not change them. The accountant may emphasize, in any report on financial statements, a matter disclosed in the financial statements or footnotes. Departures from the Applicable Financial Reporting Framework The language has been changed from “Departures from Generally Accepted Accounting Principles” to “Departures from the Applicable Financial Reporting Framework.” An accountant who is engaged to compile financial statements may become aware of a departure from the applicable financial reporting framework (including inadequate disclosure) that is material to the financial statements. Restricting the Use of an Accountant’s Compilation Report This section discusses restricting the use of an accountant’s compilation report and retains the previous requirements. It describes general use and restricted use reports and says that nothing in this section precludes the accountant from restricting the use of any report. An Entity’s Ability to Continue as a Going Concern This SSARS contains a discussion as to what the accountant should do if he or she encounters a going-concern issue. The previous SSARS contains the same information as is contained in the SSARS No. 19 standard describing what the accountant should do if, during the performance of compilation procedures, evidence or information comes to his or her attention indicates that an uncertainty may exist about the entity's ability to continue as a going concern for a reasonable period of time, not to exceed one year beyond the date of the financial statements being compiled. In such cases, the accountant should request management to consider the possible effects of the going concern uncertainty on the financial statements and possible need for related disclosure. The accountant should consider the reasonableness of management's conclusions including the adequacy of the related disclosures, if applicable. If the accountant determines that management's conclusions are unreasonable or the disclosure of the uncertainty regarding the entity's ability to continue as a going concern is not adequate, he or she should follow the guidance contained in the section of SSARS No. 19, “Departures from the Applicable Financial Reporting Framework.” Subsequent Events Events or transactions that sometimes occur subsequent to the balance sheet date but prior to management's issuance of financial statements, which have a material effect on the financial statements and require adjustment to or disclosure in the statements. Adjustments are necessary when the entity, having knowledge of subsequent events prior to the close of the reporting period, would have recorded those events. Footnote disclosures are necessary for other material subsequent events. Selected footnote disclosures may be necessary for other material subsequent events even when management elects to omit substantially all disclosures. This section is also contained in the previous standards. The requirements remain the same in SSARS No. 19. SFAS No. 165, Subsequent Events, (ASC Topic 855-10) retains the old rules from the auditing literature but distinguishes between the dates financial statements are issued or are available for 3 CPA Practice Aids, LLC issue. Management’s responsibility for adjusting or disclosing subsequent events for non-public entities normally ends when statements are available for issue. Accountants and auditors responsibility for subsequent events also normally ends on that date. Supplementary Information This section remains the same as that in the previous standards. When the basic financial statements are accompanied by information presented for supplementary analysis purposes, the accountant should clearly indicate the degree of responsibility, if any, he or she is taking with respect to such information. Communicating to Management and Others This section is the same as that in the previous standards and concerns when evidence or information comes to the accountant's attention during the performance of compilation procedures that fraud or an illegal act may have occurred, communicating that matter to the attention of the appropriate level of management. The accountant need not report matters regarding illegal acts that are clearly inconsequential and may reach agreement in advance with the entity on the nature of such items to be communicated. 4 CPA Practice Aids, LLC Approach to Performing Compilation Engagements Start OBTAIN ENGAGEMENT LETTER ACQUIRE INDUSTRY/GAA P KNOWLEDGE UNDERSTAND CLIENT’S BUSINESS AND ENVIRONMENT READ FINANCIAL STATEMENTS ANY UNUSUAL MATTERS? CAN WE OR CLIENT REVISE? ` REPORT FRAMEWORK OK? 5 NO? DISCLOSE DEPARTURE REPORT DISCLOSURES OK? CPA Practice Aids, LLC PREPARE STANDARD REPORT MODIFIED REPORT INDEPENDENT? ISSUE REPORT DISCLOSE LACK OF INDEPENDENCE Obtain an Engagement Letter SSARS No. 19 requires a written communication with management. An illustration of a standard engagement letter is provided in SSARS No. 19. When management doesn’t intend to distribute the financial statements to a third party and the accountant doesn’t plan to issue a compilation report, the engagement letter should contain an acknowledgment of management’s representation and an agreement that the statements will not be distributed to a third party. This, of course, assumes the accountant has no knowledge or expectation of planned third party use. Other matters that should be considered for inclusion in the engagement letter include: 1. Material departures from GAAP (or the applicable reporting framework) may exist and the possible effects of such departures may not be disclosed; 2. A statement of cash flows and substantially all disclosures may not be included; and 3. The nature of any supplementary information that will be included in the financial statements, as well as the degree of responsibility the accountant is taking for such information. The compilation engagement letter will normally include an understanding of non-attest and other services performed by the accountant and it can cover services performed throughout a 6 CPA Practice Aids, LLC year. ET 101-3 on non-attest services previously required such an understanding, which was either communicated in a compilation engagement letter or a separate letter. To minimize misunderstandings, descriptions of the non-attest and other services should be as specific as possible. Obtain Industry/Reporting Framework Knowledge The accountant is required to have a sufficient knowledge of the accounting and reporting principles of the industry in which the client operates. This knowledge is necessary to determine if the financial statements are prepared in appropriate form. This knowledge is also necessary to enable the accountant to identify and follow up on unusual matters (incorrect, incomplete, or unsatisfactory information) common to the industry. Scrap and waste in manufacturing, common uses of byproducts, or cost allocation methods may be unique to an industry and affect the form and content of financial statements. Understand Client’s Business The accountant should obtain a general understanding of the client’s business, its organization and operating characteristics, and the nature of its accounts. The accountant’s experience with the client and/or its industry, reading or scanning general ledger account activity, making inquiries of entity personnel, and completion of a practice aid, like the Small Entity Information Form illustrated in Part 2 of this series, can provide this understanding. An understanding of the client’s accounting principles and practices, along with the nature and content of its accounts, is also required. Unusual matters coming to the accountant’s attention may require additional inquiries and possible proposed journal entries to eliminate obvious material errors from the financial statements. Financial statements should be revised to reflect the resolution of the unusual matters. If the accountant believes the financial statements are materially misstated and the client refuses to revise the statements, the accountant should withdraw from the engagement. Read Financial Statements The purpose of the accountant’s reading of financial statements is to use the understanding of the client’s business and industry to determine that the statements are free of “obvious material errors.” This term is defined as clerical or mathematical mistakes in the preparation of the financial statements and mistakes in application of accounting principles and related disclosures. While SSARS No. 19 doesn’t use the term risk in connection with compilation engagements, practically speaking, the accountant reads financial statements to determine any potential risks of material misstatement. Below is the process of “reading” financial statements used by most accountants: 1. Obtain a trial balance of general ledger accounts and trace balances to the general ledger (or determine balances came from the entity’s accounting software); 2. Scan (read) general ledger account activity for unusual matters; 3. Perform accounting services by comparing account balances to applicable supporting documents, records, subsidiary records, and/or account analysis as considered necessary based on the understanding of the client’s business and industry; 7 CPA Practice Aids, LLC 4. 5. 6. 7. 8. Propose necessary adjusting journal entries; Perform compilation procedures if financial statements are being submitted to the client; Draft, or assist client personnel in drafting, financial statement and footnotes; Complete an abbreviated disclosure checklist; Read the statements and footnotes to determine if they are presented in accordance with the applicable reporting framework; and 9. If the statements and footnotes contain any incorrect, incomplete, or unsatisfactory information (unusual matters), request the client to make revisions and/or make inquiries of management personnel to facilitate additional procedures or to propose adjustments to correct the unusual matters. For most small annual or interim compilation engagements, the accountant will assist in the preparation of the financial statements. Reading those statements is the culmination of the process outlined above and the final quality control procedure performed by the accountant. Other Compilation Procedures In addition to reading the financial statements, other compilation procedures may be performed. Such procedures may include: 1. 2. 3. 4. Performing client acceptance and continuance procedures; Evaluating independence of CPA firm personnel; Documenting unusual matters discovered and their disposition; Documenting communication of any fraud or illegal acts coming to the accountant’s attention; 5. Drafting the financial statements and reading as outlined above; 6. Drafting the accountant’s report; 7. Documenting any consultations made; and a. Making a final review of the financial statement and footnotes. Compilation Engagement Documentation The extent and nature of documentation will depend on firm policies and the risk of misstatement associated with an engagement. SSARS No. 19 requires an engagement letter, documentation of unusual matters and their resolution and documentation of the communication of any fraud or illegal acts. A list of common documentation for compilation engagements from Part 2 of this series follows. Compilations (full disclosure): Engagement letter Client Acceptance and Continuance Form (Part 2) Planning Document (optional) Small Entity Information Form (Part 2) General Ledger Analysis Worksheet Compilation Procedures Checklist Adjusted working trial balance 8 CPA Practice Aids, LLC Working papers or memos documenting significant and/or unusual matters and their disposition Checklist and schedules supporting financial statement disclosures or the reasons why disclosures are omitted Schedules and account analyses for footnotes and tax return preparation. Engagement Review Checklist (Part 2) Compilations (disclosures omitted): Engagement letter Client Acceptance and Continuance Form Small Entity Information Form General Ledger Analysis Worksheet Compilation Procedures Checklist (abbreviated) Adjusted working trial balance Working papers or memos documenting significant and/or unusual matters and their disposition Schedules and account analysis for tax return preparation Engagement Review Checklist, memo or routing document For interim compilations performed in connection with accounting services, some documentation can be prepared annually (Engagement Letter, Client Acceptance and Continuance Form, Small Entity Information Form) or other documentation may be combined on a spreadsheet with multiple-period sign offs (Compilation Procedures Checklist). Common Deficiencies in Compilation Engagements The AICPA has compiled findings from peer reviews and issued various reports and alerts on deficiencies noted in compilation and review engagements. Here are some of those deficiencies: 1. Management’s election to omit substantially all disclosures not mentioned in the accountant’s compilation report, 2. Wording of compilation report not current, 3. Failure to disclose lack of independence in compilation report, 4. Failure to describe the degree of responsibility for supplementary information, 5. Statements prepared without disclosures on a basis of accounting other than GAAP that was not readily determinable, 6. Failure to disclose omission of statement of cash flows in GAAP statements, 7. Statement of cash flows that didn’t conform to SFAS No. 95 (ASC 230-10), 8. Failure to disclose a departure from the applicable reporting framework in the accountant’s report, 9. No disclosures of accounting policies and/or other required disclosures, 10. Improper accounting and/or classification of a material transactions, 11. Titles of financial statements and terminology not meeting industry standards or basis of accounting, 12. Failure to refer to the accountant’s report on each page of financials, 13. Failure to include all periods presented in accountant’s report descriptions, 9 CPA Practice Aids, LLC 14. Failure to use practice aids required by firm policy, 15. Incomplete engagement letter for management-use-only engagements, and 16. Failure to disclose the effects of changes in accounting principles. Illustrative Documentation from SSARS No. 19 (SSARS No. 19 should be consulted for detailed instructions on the use of these documents) Compilation of Financial Statements—Illustrative Engagement Letter (Addressed to the individual or board that engaged the CPA firm) This letter is to confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. We will perform the following services: We will compile, from information you provide, the annual balance sheet and related statements of income, retained earnings, and cash flows of ABC Company for the year 20__. We will compile the financial statements and issue an accountant’s report thereon in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a compilation is to present in the form of financial statements, information that is the representation of management (owners) without undertaking to express any assurance on the financial statements. A compilation differs significantly from a review or an audit of financial statements. A compilation does not contemplate performing inquiry, analytical procedures, or other procedures performed in a review. Additionally, a compilation does not contemplate obtaining an understanding of the entity’s internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, the examination of source documents (for example, cancelled checks or bank images of checks); or other procedures ordinarily performed in an audit. Therefore, a compilation does not provide a basis for expressing any level of assurance on the financial statements being compiled. Our engagement cannot be relied upon to disclose errors, fraud, or illegal acts that may exist. However, we will inform the appropriate level of management of any material errors, and of any evidence or information that comes to our attention during the performance of our compilation procedures that fraud may have occurred. In addition, we will report to you any evidence or information that comes to our attention during the performance of our compilation procedures regarding illegal acts that may have occurred, unless they are clearly inconsequential. As part of our engagement, we will also [list any non-attest services to be performed, if applicable, such as income tax preparation and bookkeeping services]. You are responsible for: a. Making all management decisions and performing all management functions; b. Designating an individual who possesses suitable skill, knowledge, and/or experience, preferably within senior management, to oversee the services; 10 CPA Practice Aids, LLC c. Evaluating the adequacy and results of the services performed; d. Accepting responsibility for the results of the services; and e. Establishing and maintaining internal control, including monitoring ongoing activities. If, for any reason, we are unable to complete the compilation of your financial statements, we will not issue a report on such statements as a result of this engagement. Our fees for these services . . . . We will be pleased to discuss this letter with you at any time. If the foregoing is in accordance with your understanding, please sign the copy of this letter in the space provided and return it to us. Sincerely yours, ________________________ [Signature of accountant] Acknowledged: ABC Company _______________________ President _______________________ Date 11 CPA Practice Aids, LLC Compilation of Financial Statements Not Intended for Third Party Use—Illustrative Engagement Letter (Addressed to the individual or board that engaged the CPA firm) This letter is to confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. We will perform the following services: We will compile, from information you provide, the [monthly, quarterly, or annual] financial statements of ABC Company for the year 20__. We will compile the financial statements in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a compilation engagement is to present in the form of financial statements, information that is the representation of management (owners) without undertaking to express any assurance on the financial statements. A compilation differs significantly from a review or an audit of financial statements. A compilation does not contemplate performing inquiry, analytical procedures, or other procedures performed in a review. Additionally, a compilation does not contemplate obtaining an understanding of the entity’s internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, the examination of source documents (for example, cancelled checks or bank images of checks); or other procedures ordinarily performed in an audit. Therefore, a compilation does not provide a basis for expressing any level of assurance on the financial statements being compiled. The financial statements will not be accompanied by a report. Based upon our discussions with you, these statements are for management's use only and are not intended for third-party use. Material departures from generally accepted accounting principles (GAAP) may exist and the effects of those departures, if any, on the financial statements may not be disclosed. In addition substantially all disclosures required by GAAP may be omitted. (The accountant may wish to identify known departures.) Notwithstanding these limitations, you represent that you have knowledge about the nature of the procedures applied and the basis of accounting and assumptions used in the preparation of the financial statements that allows you to place the financial information in the proper context. Further, you represent and agree that the use of the financial statements will be limited to members of management with similar knowledge. The financial statements are intended solely for the information and use of _____________________ and are not intended to be and should not be used by any other party. Our engagement cannot be relied upon to disclose errors, fraud, or illegal acts that may exist. However, we will inform the appropriate level of management of any material errors and of any evidence or information that comes to our attention during the performance of our compilation 12 CPA Practice Aids, LLC procedures that fraud may have occurred. In addition, we will report to you any evidence or information that comes to our attention during the performance of our compilation procedures, regarding illegal acts that may have occurred unless they are clearly inconsequential. We are not independent with respect to ABC Company [if applicable]. As part of our engagement, we will also (list any non-attest services to be provided, if applicable, such as income tax preparation and bookkeeping services). You are responsible for: a. Making all management decisions and performing all management functions; b. Designating an individual who possesses suitable skill, knowledge, and/or experience, preferably within senior management, to oversee the services; c. Evaluating the adequacy and results of the services performed; d. Accepting responsibility for the results of the services; and e. Establishing and maintaining internal control, including monitoring ongoing activities. The other data accompanying the financial statements are presented only for supplementary analysis purposes and will be compiled from information that is the representation of management, without audit or review, and we do not express an opinion or any other form of assurance on such data—[if applicable]. Our fees for these services … Should you require financial statements for third-party use, we would be pleased to discuss with you the requested level of service. Such engagement would be considered separate and not deemed to be part of the services described in this engagement letter. We will be pleased to discuss this letter with you at any time. If the foregoing is in accordance with your understanding, please sign the copy of this letter in the space provided and return it to us. Sincerely yours, _______________________ [Signature of accountant] Accepted and agreed to: ABC Company _______________________ Title _______________________ Date 13 CPA Practice Aids, LLC Illustrative Compilation Report Detailed reporting requirements and illustrations in SSARS No. 19 should be consulted when reporting on compilation engagements. The following illustrative compilation report is from SSARS No. 19: Accountant’s Compilation Report [Appropriate Salutation] I (we) have compiled the accompanying balance sheet of XYZ Company as of December 31, 20XX, and the related statements of income, retained earnings, and cash flows for the year then ended. I (we) have not audited or reviewed the accompanying financial statements and, accordingly, do not express an opinion or provide any assurance about whether the financial statements are in accordance with accounting principles generally accepted in the United States of America. Management (owners) is (are) responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America and for designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of the financial statements. My (our) responsibility is to conduct the compilation in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a compilation is to assist management in presenting financial information in the form of financial statements without undertaking to obtain or provide any assurance that there are no material modifications that should be made to the financial statements. [Signature of accounting firm or accountant, as appropriate] [Date] Part 2—Review Engagements AR Section 90, Review Of Financial Statements Establishes standards and provides guidance on reviews of financial statements. The accountant should comply with the provisions of this section whenever he or she has been engaged to review financial statements, except for reviews of certaub interim financial information. The entity’s latest annual financial statements have been audited by the accountant or a predecessor (SSARS No. 20 eliminated the requirement for the accountant, or any accountant to have been engaged to audit the entity’s current year financial statements), 14 CPA Practice Aids, LLC The client prepares its interim financial information in accordance with the same financial reporting framework as that used to prepare the annual financial statements, Accountants engaged to perform reviews of interim financial information when the conditions above are met should perform such reviews in accordance with AU section 722, Interim Financial Information (AICPA, Professional Standards, vol. 1), or The accountant is precluded from performing a review engagement if the accountant’s independence is impaired.1 Changes from Existing Standards as a Result of SSARS No. 19 Engagement Letter — SSARS No. 19 requires that the accountant establish an understanding with management regarding the services to be performed for each engagement through a written communication (an engagement letter). The previous AR section 100 paragraph .05 stated that the understanding should preferably be in writing but did not require a written engagement letter. Expanded Guidance — provides expanded guidance on the performance of analytical procedures in a review engagement. Documentation of Management’s Responses To Accountant Inquiries—establishes a requirement that the accountant document: Management’s responses to the accountant’s inquiries regarding fluctuations or relationships that are inconsistent with other relevant information or that differ from expected values by a significant amount and Management’s responses to the significant matters covered in the accountant’s inquiry procedures. The previous AR section 100 paragraph .45 did not require that the accountant document management’s responses. Significant Changes from Existing Standards Establishing an Understanding (Engagement Letter) The accountant should: Establish an understanding with management regarding the services to be performed for each engagement and Document the understanding through a written communication (emphasis added) with management. Review Performance Requirements The accountant should apply professional judgment in determining the specific nature, timing, and extent of review procedures (based on risks of material misstatements). 1 The original exposure draft contained a section that permitted the accountant to perform a review engagement when he or she was not independent. This “non-independent review” is not part of SSARS No. 19. As a result of the comments the ARSC received on this proposal, for and against, they decided to defer this issue in order to hold additional meetings with key stakeholders. 15 CPA Practice Aids, LLC Procedures should be tailored based on the accountant’s understanding of the industry in which the client operates. The understanding includes accounting principles and practices of the industry. Procedures will also be designed based the accountant’s knowledge of the entity. This includes the client’s organization, its operating characteristics, the nature of its accounts and its accounting principles and practices. While there is no requirement to understand a client’s internal control system, evidence of internal controls obtained from reading the general ledger, performing analytical procedures and making inquiries may reduce review risk. Review evidence necessary to restrict review risk to a moderate level can ordinarily be obtained primarily through analytical procedures and inquiries. Designing and Performing Review Procedures Analytical Procedures SSARS No. 19 provides expanded guidance with respect to the performance of analytical procedures, which includes the following: Understanding financial and nonfinancial relationships is essential in planning and evaluating the results of analytical procedures; Knowledge of the client and the industry in which the client operates is generally required; An understanding of the purposes of analytical procedures and the limitations of those procedures is also important; Analytical procedures involve comparisons of recorded amounts, or ratios developed from recorded amounts, to expectations developed by the accountant; and Expectations are developed by identifying and using plausible relationships that are reasonably expected to exist based on the accountant's understanding of the industry in which the client operates and knowledge of the client. Examples of sources of information for developing expectations include: Financial information for comparable prior period(s) giving consideration to known changes; Anticipated results, for example, budgets or forecasts including extrapolations from interim or annual data; Relationships among elements of financial information within the period; Information regarding the industry in which the client operates, for example, gross margin information; and Relationships of financial information with relevant nonfinancial information, for example, payroll costs to number of employees. Analytical procedures may be performed at the financial statement level or at the detailed account level. The nature, timing, and extent of the analytical procedures are a matter of professional judgment basic on the subjective level of review risk. 16 CPA Practice Aids, LLC Practical Note: For small and medium-size review engagements, comparison of absolute dollar balances of accounts after adjustment, among a number of years, may be the most meaningful analytical procedure. Coupled with reading the general ledger account activity for the current year, this procedure also is the most pervasive and most efficient analytical procedure. Inconsistent Information If analytical procedures performed identify fluctuations or relationships that are inconsistent with other relevant information or that differ from expected values by a significant amount, the accountant should investigate these differences by inquiring of management and performing other procedures as necessary in the circumstances. (Emphasis added) Review evidence relevant to management’s responses may be obtained by evaluating those responses, taking into account the accountant’s understanding of the entity and its environment, along with other review evidence obtained during the course of the review. The accountant is not required to corroborate management’s responses with other evidence, however, the accountant may need to perform other procedures when, for example, management is unable to provide an explanation or the explanation, together with review evidence obtained relevant to management’s response, is not considered adequate. Inquiries and Other Review Procedures Inquiries to members of management who have responsibility for financial and accounting matters include the following: Whether the financial statements have been prepared in conformity with the applicable financial reporting framework; The entity's accounting principles and practices and the methods followed in applying them; procedures for recording, classifying, and summarizing transactions; and accumulating information for disclosure in the financial statements; Unusual or complex situations that may have an effect on the financial statements; Significant transactions occurring or recognized near the end of the reporting period; The status of uncorrected misstatements identified during the previous engagement; Questions that have arisen in the course of applying the review procedures; Events subsequent to the date of the financial statements that could have a material effect on the financial statements; Their knowledge of any fraud or suspected fraud affecting the entity involving management or others, where the fraud could have a material effect on the financial statements (for example, communications received from employees, former employees, or others); Significant journal entries and other adjustments; 17 CPA Practice Aids, LLC Communications from regulatory agencies; Inquiries concerning actions taken at meetings of stockholders, the board of directors, committees of the board of directors, or comparable meetings that may affect the financial statements; and Reading the financial statements to consider, on the basis of information coming to the accountant's attention, whether the financial statements appear to conform with the applicable financial reporting framework. Obtaining reports from other accountants, if any, who have been engaged to audit or review the financial statements of significant components of the reporting entity, its subsidiaries, and other investees Corroboration of Management’s responses—The accountant ordinarily is not required to corroborate management's responses with other evidence; however, the accountant should consider the reasonableness and consistency of management's responses in light of the results of other review procedures and the accountant's knowledge of the client’s business and the industry in which it operates. The higher the risk of material misstatement, the more likely management’s responses should be corroborated! Incorrect, Incomplete, or Otherwise Unsatisfactory Information (AR Section 90 paragraph .21) This concerns situations in which the accountant may become aware that information is incorrect, incomplete, or otherwise unsatisfactory. In this case, he or she should: Request that management consider the effect of these matters on the financial statements and communicate the results of its consideration to the accountant and Consider the results communicated to the accountant by management and the effect, if any, on the accountant’s review report. If the accountant believes the financial statements may be materially misstated, the accountant should perform additional procedures deemed necessary to obtain limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with the applicable financial reporting framework. If the accountant concludes that the financial statements are materially misstated, the accountant should follow the guidance in the section of SSARS No. 19 entitled “Departures from the Applicable Financial Reporting Framework.” Management Representations Written representations are required from management for all financial statements and periods covered by the accountant's review report. The specific written representations obtained by the accountant will depend on the circumstances of the engagement and the nature and basis of presentation of the financial statements. Written representations from management ordinarily confirm representations explicitly or implicitly given to the accountant, indicate and document the continuing appropriateness of such 18 CPA Practice Aids, LLC representations, and reduce the possibility of misunderstanding concerning the matters that are the subject of the representations. The accountant should request that management provide a written representation related to the following: Management's acknowledgment of its responsibility for the fair presentation of the financial statements in conformity with the applicable financial reporting framework; Management's belief that the financial statements are fairly presented in conformity with the applicable financial reporting framework; Management's acknowledgement of its responsibility to prevent and detect fraud; Knowledge of any fraud or suspected fraud affecting the entity involving management or others where the fraud could have a material effect on the financial statements (including any communications received from employees, former employees, or others); Management's full and truthful response to all inquiries; Completeness of information; Information concerning subsequent events; and Any additional information tailored to appropriate representations from management relating to matters specific to the entity's business or industry. Updating Representation Letter Circumstances exist in which the accountant should consider obtaining an updating representation letter from management, for example: The accountant obtains a management representation letter after completion of inquiry and analytical review procedures but does not issue the review report for a significant period of time thereafter; A material subsequent event occurs after the completion of inquiry and analytical review procedures, including obtaining the original management representation letter, but before the issuance of the report on the reviewed financial statements; and If a predecessor accountant is requested to reissue the report on the financial statements of a prior period, and those financial statements are to be presented on a comparative basis with reviewed financial statements of a subsequent period, the predecessor accountant should obtain an updating representation letter from the management of the former client. The updating management representation letter should state: Whether any information has come to management's attention that would cause management to believe that any of the previous representations should be modified and 19 CPA Practice Aids, LLC Whether any events have occurred subsequent to the balance-sheet date of the latest financial statements reported on by the accountant that would require adjustment to or disclosure in those financial statements. Date of Management’s Representation Letter Management's representations set forth in the management representation letter should be made as of the date of the accountant's review report, which should be the date the financial statements are available for issue. Documentation in a Review Engagement SSARS No. 19 does not change previous SSARS requirements for the accountant to prepare documentation in connection with each review engagement in sufficient detail to provide a clear understanding of the work performed (including the nature, timing, extent, and results of review procedures performed), the review evidence obtained and its source, and the conclusions reached. The accountant may also support the review report by other means in addition to the review documentation, including: Written documentation contained in other engagement files (for example compilation or non-attest services) or quality control files (for example consultation files) and Oral explanations, in limited situations. Oral explanations on their own do not represent sufficient support for the work the accountant performed or conclusions the accountant reached, but may be used by the accountant to clarify or explain information contained in the documentation. The form, content, and extent of documentation depend on the circumstances of the engagement, the methodology and tools used, and the accountant’s professional judgment. Documentation is discussed further in other parts of this series. SSARS No. 19 contains a list of documentation that should be included, in addition to the customary documentation with which accountants are familiar: Under the analytical procedures performed, management’s responses to the accountant’s inquiries regarding fluctuations or relationships that are inconsistent with other relevant information or that differ from expected values by a significant amount and Evidence from the performance of internal control services, if applicable. The following items that should be included in the accountant’s documentation are in the current documentation requirements (Some of the language has been modified from the previous standard): The signed engagement letter documenting the understanding with the client; The analytical procedures performed including the following: 20 CPA Practice Aids, LLC The expectations, where the expectations are not otherwise readily determinable from the documentation of the work performed, and factors considered in the development of the expectations; Results of the comparison of the expectations to the recorded amounts or ratios developed from recorded amounts; and Any additional review procedures performed in response to significant unexpected differences arising from analytical procedures and the results of such additional procedures. The significant matters covered in the accountant’s inquiry procedures and the responses thereto. The accountant may document the matters covered by the accountant’s inquiry procedures and the responses thereto through a spreadsheet, memorandum, checklist, or other means; Any findings or issues that, in the accountant's judgment, are significant, for example, the results of review procedures that indicate the financial statements could be materially misstated, including actions taken to address such findings, and the basis for the final conclusions reached; Significant unusual matters that the accountant considered during the performance of the review procedures, including their disposition. Evidence from the performance of internal control services, if applicable; Communications, whether oral or written, to the appropriate level of management regarding fraud or illegal acts that come to the accountant's attention; and The representation letter. Reporting on the Financial Statements Financial statements reviewed by an accountant should be accompanied by a report. The financial statements reviewed by the accountant should include on each page a reference, such as "See Independent Accountant's Review Report." Incomplete Review —When the accountant is unable to perform the inquiry and analytical procedures he or she considers necessary to obtain limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with the applicable financial reporting framework, or the client does not provide the accountant with a representation letter, the review will be incomplete. A review that is incomplete does not provide an adequate basis for issuing a review report. The accountant should consider the matters discussed in the AR 90 section, “Change in Engagement from Audit to Review” in deciding whether it is appropriate to issue a compilation report on the financial statements. Supplementary Information When information presented for supplementary analysis purposes, the accountant should clearly indicate the degree of responsibility, if any, he or she is taking with respect to such information. When the accountant has reviewed the basic financial statements, an 21 CPA Practice Aids, LLC explanation of the accountant’s responsibility for the supplementary information should be included in the review report, or in a separate report on the other data. The report should state that the review has been made for the purpose of expressing a conclusion that there are no material modifications that should be made to the financial statements in order for them to be in conformity with the applicable financial reporting framework, and either: The other data accompanying the financial statements are presented only for purposes of additional analysis and have been subjected to the inquiry and analytical procedures applied in the review of the basic financial statements, and the accountant did not become aware of any material modifications that should be made to such data or The other data accompanying the financial statements are presented only for purposes of additional analysis and have not been subjected to the inquiry and analytical procedures applied in the review of the basic financial statements but were compiled from information that is the representation of management, without audit or review, and the accountant does not express an opinion or any other form of assurance on such data. Approach to Performing Review Engagements In the order of performance, here are the review engagement procedures required by the SSARS. A discussion of each of these procedures follows. 1. Determine if the accountant lacks independence for any reason; 2. If the accountant’s independence is impaired, consider a step-down to a compilation with disclosure of independence impairment; 3. Obtain an engagement letter; 4. Acquire industry/GAAP knowledge; 5. Understand the entity’s organization, operations and accounting; 6. Read (scan) the general ledger, make inquiries and perform other appropriate analytical procedures; 7. Make additional inquiries or perform additional procedures to resolve “unusual matters.” 8. Propose adjustments as necessary; 9. Prepare, or assist client personnel in preparing, financial statements and footnotes; 10. Read financial statements and footnotes to determine they are presented in accordance with GAAP (or the applicable reporting framework); 11. Prepare a standard or modified report (disclosing omissions or departures) on review; and 12. Obtain a representation letter. Evaluate Independence Because reviews are attest and assurance engagements, an accountant must be independent to perform the services. A CPA firm’s system of quality control must have 22 CPA Practice Aids, LLC policies in place to evaluate and document the independence of its members that are covered by the AICPA Code of Professional Conduct. In addition to the prohibition of certain familial relationships and financial interests in the client, the accountant cannot perform unsupervised non-attest services without impairing independence. Management must assign a person with suitable skill, knowledge, and experience to oversee and approve any non-attest services performed by the accountant to avoid impairment of the accountant’s independence. Obtain an Engagement Letter SSARS No. 19 requires a written communication with management. An illustration of a standard engagement letter is provided in Appendix E of the standard. In addition to the matters described in the illustrative letter, an understanding of the following matters may be included: Fees and billings; Any limitations on the liability of the accountant, such as indemnification for management’s misrepresentations (unless restricted or prohibited by regulators); Conditions when others may be granted access to review documentation; and Additional services to be provided due to regulatory requirements. These other matters, if applicable, should be addressed in the engagement letter: Material departures from the applicable reporting framework and Reference to supplementary information and the degree of responsibility the accountant is assuming for it. The review engagement letter will normally include an understanding of the non-attest and other services to be performed by the accountant. The client’s responsibility for oversight and approval of those services should also be included in the letter. Obtain Industry/Reporting Framework Knowledge The accountant is required to have a sufficient knowledge of the accounting and reporting principles of the industry in which the client operates. This knowledge is necessary to determine if the financial statements are prepared in appropriate form. This knowledge is also necessary to enable the accountant to identify and follow up on unusual matters (incorrect, incomplete or unsatisfactory information) common to the industry. Scrap and waste in manufacturing, common uses of byproducts or cost allocation methods may be unique to an industry and affect the form and content of financial statements. Understand Client’s Business The accountant should obtain a general understanding of the client’s business, its organization and operating characteristics, and the nature of its accounts. The accountant’s experience with the client and/or its industry, reading the general ledger, 23 CPA Practice Aids, LLC inquiries of its personnel, and completion of a practice aids can provide documentation of this understanding. For review engagements, the extent of the documentation of the accountant’s knowledge of a client should be more extensive than for compilations. The accounting principles and practices used by the client in measuring, recognizing, recording, and disclosing all significant accounts and disclosures in the financial statements should be documented. Unusual matters coming to the accountant’s attention may require additional inquiries and possible proposed journal entries to eliminate obvious material errors from the financial statements. Financial statements should be revised to reflect the resolution of the unusual matters. If the accountant believes the financial statements are materially misstated and the client refuses to revise the statements, the accountant should withdraw from the engagement. Performing Review Procedures Review procedures should be designed to accumulate review evidence sufficient to reduce review risk to provide a reasonable basis for expressing limited assurance that no material modifications are necessary for the financial statements to be in conformity with the applicable reporting framework. SSARS No. 19 continues by stating: “The accountant should apply professional judgment in determining the specific nature, timing, and extent of review procedures. Such procedures should be tailored based on the accountant’s understanding of the industry in which the client operates and the accountant’s knowledge of the entity. Review evidence obtained through the performance of analytical procedures and inquiry will ordinarily provide the accountant with a reasonable basis for obtaining limited assurance.” Using Professional Judgment in Selecting Analytical Procedures and Inquiries for Review Engagements A major change in SSARS No. 19 is the emphasis on using professional judgment to select and perform appropriate analytical procedures and inquiries depending on each engagement’s unique risk circumstances. Review services are attest services and require an accountant’s professional judgment to gather sufficient review evidence to provide limited assurance that no material modifications are necessary for the financial statements to be presented in accordance with the applicable reporting framework. While review engagements have always been risk-driven services and the accountant’s judgment has been necessary to determine the amount of evidence necessary to express limited assurance, some CPA firms have defaulted to a canned set of procedures applied to all review engagements. While such procedures enable the accountant to satisfy the SSARS requirements in most cases, it is possible not all risks are identified or properly evaluated, i.e., that appropriate professional judgment is not being applied. It is almost certain that more than the necessary review procedures are being performed! 24 CPA Practice Aids, LLC Using professional judgment to determine appropriate analytical procedures and inquiries requires identification of unusual matters and risks of material misstatements during planning. Reading the general ledger, tracing account balances to subsidiary records and supporting documents, account analysis, and making inquiries of key client personnel can reveal most unusual matters, particularly on smaller review engagements. In such cases, a simple comparison of account balances with the prior year or with budgeted amounts may be the only additional analytical procedures that are necessary. SSARS 19 does require the documentation of the accountant’s expectations for analytical procedures (if not evident from the documentation of the procedures) and of management’s responses to inquiries about variances in analytical procedures and other significant matters. Preparing the documentation in spreadsheet or memo form will often be more effective and efficient than reading and using lengthy detailed checklists that contain unnecessary procedures. Designing and Performing Review Procedures If we haven’t figured it out yet, review procedures are risk driven. The accountant should focus analytical procedures and inquiries where there is indication of increased risk of misstatements. The starting place should be scanning, or reading, the client’s general ledger. Reading the general ledger and the documentation on a spreadsheet or memo is a risk identification procedure that provides review evidence which, when combined with evidence from other analytical procedures, inquiries and additional procedures, is necessary for an accountant to provide limited assurance on the financial statements. Here is an approach to determining which analytical procedures and inquiries should be performed. The SSARS literature states that analytical procedures involve comparisons of expectations developed by the accountant to recorded amounts or ratios. The first step would be to develop a list of what is expected of a client. Here goes: 1. The client has an accounting system sufficient to prepare reliable financial data. 2. Management has designed a system of internal control, which it operates with diligence to properly measure, record, classify and report all transactions in the financial statements; 3. Absent unusual circumstances, the operations of the entity and the financial reporting of results, will be consistent from year to year, or period to period; and 4. Management’s daily involvement in operations of the entity provides the control environment that sets the standard for employees and minimizes the risk of error or fraud. We could make a long detailed list from the four expectations above, but this is sufficient to identify the accountant’s expectations in performing analytical procedures. The expectation should be that there won’t be unusual matters, errors or fraud that have occurred and gone undetected! The beginning expectation should be that risk is low! Once the accountant has prepared documentation for understanding the client’s business and industry, read the detailed account activity in the general ledger, and at least 25 CPA Practice Aids, LLC compared the current year account balances with the prior year, the areas of higher risk should be apparent. Read this carefully. SSARS No. 19 says that the only analytical procedures and inquiries we need are those that are necessary to determine if risks of misstatement have a misleading affect on financial statements. While a few standard inquiries may be appropriate, reading the general ledger and comparing the current year’s account balances to the prior year usually represent the only analytical procedures that should be routinely performed. Using professional judgment to design review procedures is not a routine business. Similar to risk assessment for audits, the analytical procedures, inquiries and additional procedures required for reviews depends on the review risk coming to the accountant’s attention while obtaining and documenting an understanding of the client’s business and its operations. Here it is simply: When review risk is low, few procedures are required; the greater the risk that comes to our attention, the more work that is required. Inquiries and Other Review Procedures In addition to gathering information about the client discussed above, here are some standard inquiries the accountant may consider making: Are there any unusual or complex situations that may affect the financial statements? Are there any significant transactions occurring around yearend? What is the status of uncorrected misstatements identified during the prior period? Are there any subsequent events that could have a material effect on the financial statements? Does management have knowledge of any fraud or suspected fraud? Are there any significant journal entries during the period? Are there any communications from regulatory agencies? Are there any actions taken at directors’ meetings that have accounting significance? Preparing Financial Statements and Footnotes For many review engagements, the accountant will assist the client in preparing the financial statements and footnotes. Because preparing statements is the client’s responsibility, such assistance is considered a non-attest service. The client’s oversight of the process and approval of the finalized statements and notes is necessary to prevent the accountant’s independence from being impaired. Obtain a Representation Letter Written representations are required from management for all statements and periods reviewed. An illustrative representation letter is included in Appendix F of SSARS No. 19. Review Engagement Documentation Documentation is required to provide a clear understanding of the reasons for performing procedures and their results, the source of all review evidence obtained and the 26 CPA Practice Aids, LLC conclusions reached. A list of common documentation for review engagements from Part 2 of this series follows: Engagement letter Client Acceptance and Continuance Form Planning Document Small Entity Information Form Inquiries and Analytical Procedures Memoranda General Ledger Analysis Worksheet Review Procedures Checklist Adjusted working trial balance and analytical comparisons to prior years Working papers documenting unusual matters and their disposition Representation letter Checklist and schedules supporting financial statement disclosures Schedules and account analyses for footnote and tax return preparation Engagement Review Checklist Other Review Reporting Issues Emphasis of a Matter The accountant may wish to emphasize certain matters in an explanatory paragraph. Such matters may include: 1. Going concern and other uncertainties, 2. Related party transactions, and 3. Significant subsequent events Restricting the Use of a Review Report The use of any report may be restricted to the use of one or more parties when the information may be misunderstood or taken out of the context in which it was presented. It may be appropriate to restrict the use of certain reports to limit the liability of the accountant. Going Concern Issues When uncertainties exist about and entity’s ability to continue in existence for a year from the date of the financial statements, management should be requested to consider the possible impact of the uncertainties on the financial statements. If the accountant believes management’s decisions are unreasonable or disclosures are inadequate, it may be necessary to disclose a departure from the applicable reporting framework in the accountant’s report. The uncertainty may be emphasized in the accountant’s report if it is disclosed in the financial statements. Subsequent Events A subsequent even that has a material effect on financial statements should be considered by management for either adjustment or disclosure. If the accountant believes such events 27 CPA Practice Aids, LLC are not accounted for properly, a paragraph in the accountant’s report may be necessary to disclose a departure from the applicable reporting framework. Supplementary Information When supplementary information has been included with the financial statements, the review report should clearly indicate the degree of responsibility the accountant is taking. The report should state the purpose of a review and that: The supplementary information is presented only for additional analysis and has been subjected to the inquiry and analytical procedures applied in the review of the basic financial statements, and the accountant did not become aware of any material modifications that should be made or The supplementary information is presented only for additional analysis and has not been subjected to the inquiry and analytical procedures applied in the review of the basic financial statements but were compiled from information that is the representation of management, without audit or review, and the accountant does not express an opinion or provide any assurance on the information. Common Deficiencies in Review Engagements The AICPA has compiled findings from peer reviews and issued various reports and alerts on deficiencies noted in compilation and review engagements. Here are some of those deficiencies for reviews: Reports dated incorrectly, without a date or with no reference to the dates of financial statements; Reports with financial statement titles and terminology not in accordance with applicable financial reporting framework; Issuance of a review report when the accountant is not independent; Failure to disclose departures such as no income tax provision or inventory adjustments on interim statements; Failure to explain the accountant’s responsibility on supplementary information; Use of inappropriate method of revenue recognition; Failure to make required disclosures; Failure to refer to accountant’s review report on each page of the financial statements; Inappropriate format for non-profit organization or other industry financial statements; Failure to disclose omission of statement of cash flows or misclassifications on the statement; Inappropriate or insufficient procedures for the level of service; Documentation not sufficient to allow an experienced reviewer to assess compliance with professional standards; Failure to use a work program and disclosure checklist as required by firm policy; Failure to perform and document inquiry and analytical procedures; 28 CPA Practice Aids, LLC Failure to perform and document consultations and other research; Failure to use engagement letters for accounting engagements; and Failure to obtain representation letter for review engagements. Illustrative Documentation from SSARS No. 19 (SSARS No. 19 should be consulted for detailed instructions on the use of these documents) Review of Financial Statements—Illustrative Engagement Letter (Addressed to the individual or board that engaged the CPA firm) This letter is to confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. We will perform the following services: We will review the financial statements of ABC Company as of December 31, 20__ and issue an accountant’s report thereon in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a review engagement is to express limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in accordance with generally accepted accounting principles. A review differs significantly from an audit of financial statements, in which the auditor provides reasonable assurance that the financial statements, taken as a whole, are free of material misstatement. A review does not contemplate obtaining an understanding of the entity’s internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images of checks); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles. Our engagement cannot be relied upon to disclose errors, fraud, or illegal acts that may exist. However, we will inform the appropriate level of management of any material errors, and of any evidence or information that comes to our attention during the performance of our review procedures that fraud may have occurred. In addition, we will report to you any evidence or information that comes to our attention during the performance of our review procedures regarding illegal acts that may have occurred, unless they are clearly inconsequential. 29 CPA Practice Aids, LLC As part of our engagement, we will also (list any non-attest services to be provided, if applicable, such as income tax preparation and bookkeeping services). You are responsible for: a. Making all management decisions and performing all management functions; b. Designating an individual who possesses suitable skill, knowledge, and/or experience, preferably within senior management, to oversee the services; c. Evaluating the adequacy and results of the services performed; d. Accepting responsibility for the results of the services; and e. Establishing and maintaining internal control, including monitoring ongoing activities. As part of our review procedures, we will require certain written representations from management about the financial statements and matters related thereto. If, for any reason, we are unable to complete our review of your financial statements, we will not issue a report on such statements as a result of this engagement. Our fees for these services. . . . We would be pleased to discuss this letter with you at any time. If the foregoing is in accordance with your understanding, please sign the copy of this letter in the space provided and return it to us. Sincerely yours, _______________________ [Signature of accountant] Acknowledged: ABC Company _______________________ President _______________________ Date _______________________ Chairman of the Board of Directors _______________________ Date 30 CPA Practice Aids, LLC Review of Financial Statements—Illustrative Representation Letter (Date) (To the Accountant) We are providing this letter in connection with your review of the [identification of financial statements] of [name of entity] as of [dates] and for the [periods of review] for the purpose of expressing limited assurance that there are no material modifications that should be made to the statements in order for them to be in conformity with generally accepted accounting principles. We confirm that we are responsible for the fair presentation in the financial statements of financial position, results of operations, and cash flows in conformity with generally accepted accounting principles. Certain representations in this letter are described as being limited to matters that are material. Items are considered material, regardless of size, if they involve an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person using the information would be changed or influenced by the omission or misstatement. We confirm, to the best of our knowledge and belief, as of [the date of the accountant's review report], the following representations made to you during your review. 1. The financial statements referred to previously are fairly presented in conformity with generally accepted accounting principles. 2. We have made available to you all: a. Financial records and related data. b. Minutes of the meetings of stockholders, directors, and committees of directors, or summaries of actions of recent meetings for which minutes have not yet been prepared. 3. There are no material transactions that have not been properly recorded in the accounting records underlying the financial statements. 4. We acknowledge our responsibility to prevent and detect fraud. 5. We have no knowledge of any fraud or suspected fraud affecting the entity involving management or others where the fraud could have a material effect on the financial statements, including any communications received from employees, former employees or others. 6. We have no plans or intentions that may materially affect the carrying amounts or classification of assets and liabilities. 7. There are no material losses (such as from obsolete inventory or purchase or sales commitments) that have not been properly accrued or disclosed in the financial statements. 8. There are no: a. Violations or possible violations of laws or regulations, whose effects should be considered for disclosure in the financial statements or as a basis for recording a loss contingency; 31 CPA Practice Aids, LLC b. Unasserted claims or assessments that our lawyer has advised us are probable of assertion that must be disclosed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 450, Contingencies; or c. Other material liabilities or gain or loss contingencies that are required to be accrued or disclosed by FASB ASC 450. 9. The company has satisfactory title to all owned assets and there are no liens or encumbrances on such assets, nor has any asset been pledged as collateral, except as disclosed to you and reported in the financial statements. 10. We have complied with all aspects of contractual agreements that would have a material effect on the financial statements in the event of noncompliance. 11. The following have been properly recorded or disclosed in the financial statements: a. Related party transactions, including sales, purchases, loans, transfers, leasing arrangements, and guarantees, and amounts receivable from or payable to related parties. b. Guarantees, whether written or oral, under which the company is contingently liable. c. Significant estimates and material concentrations known to management that are required to be disclosed in accordance with FASB ASC 275, Risks and Uncertainties. 12. We are in agreement with the adjusting journal entries you have recommended, and they have been posted to the company’s accounts. [if applicable] 13. To the best of our knowledge and belief, no events have occurred subsequent to the balance-sheet date and through the date of this letter that would require adjustment to or disclosure in the aforementioned financial statements. 14. We have responded fully and truthfully to all inquiries made to us by you during your review. ________________________________ (Name of Owner or Chief Executive Officer and Title) ________________________________ (Name of Chief Financial Officer and Title, where applicable) ________________________________ (Name of Member of Board of Governance, preferably the Chairperson) Representation letters ordinarily should be tailored to include additional appropriate representations from management relating to matters specific to the entity’s business or industry. Detailed guidance is included in the Appendices to SSARS No. 19. 32 CPA Practice Aids, LLC Review of Financial Statements—Illustrative Updating Management Representation Letter (Date) (To Accountant) In connection with your review(s) of the [identification of financial statements] of [name of entity] as of [dates] and for the [periods of review] for the purpose of expressing limited assurance that there are no material modifications that should be made to the statements for them to be in conformity with generally accepted accounting principles, you were previously provided with a representation letter under date of [date of previous representation letter]. No information has come to our attention that would cause us to believe that any of those previous representations should be modified. To the best of our knowledge and belief, no events have occurred subsequent to [date of latest balance sheet reported on by the accountant or date of previous representation letter] and through the date of this letter that would require adjustment to or disclosure in the aforementioned financial statements. ________________________________ [Name of Owner or Chief Executive Officer and Title] ________________________________ [Name of Chief Financial Officer and Title, where applicable] ________________________________ (Name of Member of Board of Governance, preferably the Chairperson) 33 CPA Practice Aids, LLC Illustrative Review Report Detailed reporting requirements and illustrations in SSARS No. 19 should be consulted when reporting on review engagements. The following illustrative review report is from Appendix D of SSARS No. 19. Independent Accountant’s Review Report [Appropriate Salutation] I (We) have reviewed the accompanying balance sheet of XYZ Company as of December 31, 20XX, and the related statements of income, retained earnings, and cash flows for the year then ended. A review includes primarily applying analytical procedures to management’s (owners’) financial data and making inquiries of company management (owners). A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Accordingly, I (we) do not express such an opinion. Management (owners) is (are) responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America and for designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of the financial statements. My (our) responsibility is to conduct the review in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. Those standards require me (us) to perform procedures to obtain limited assurance that there are no material modifications that should be made to the financial statements. I (We) believe that the results of my (our) procedures provide a reasonable basis for our report. Based on my (our) review, I am (we are) not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in conformity with accounting principles generally accepted in the United States of America. [Signature of accounting firm or accountant, as appropriate] [Date] 34