VEHICLE - ANNUAL CIRCULATION TAX

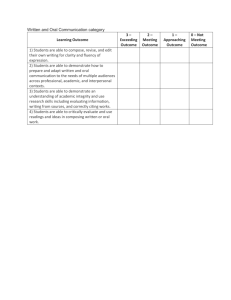

advertisement

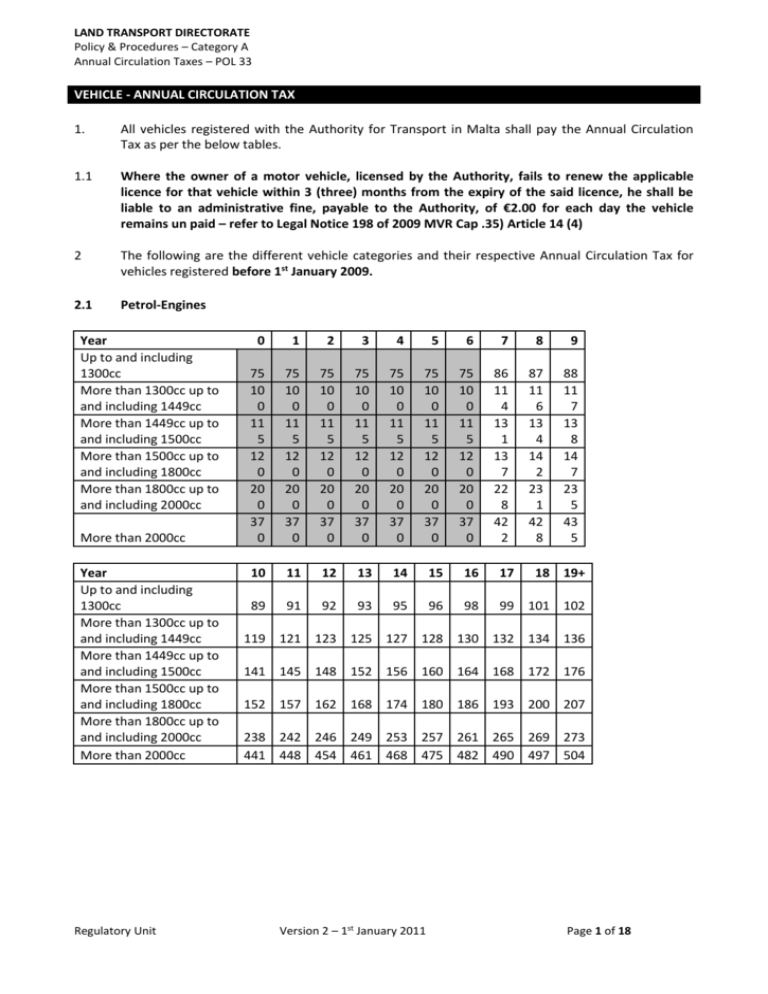

LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 VEHICLE - ANNUAL CIRCULATION TAX 1. All vehicles registered with the Authority for Transport in Malta shall pay the Annual Circulation Tax as per the below tables. 1.1 Where the owner of a motor vehicle, licensed by the Authority, fails to renew the applicable licence for that vehicle within 3 (three) months from the expiry of the said licence, he shall be liable to an administrative fine, payable to the Authority, of €2.00 for each day the vehicle remains un paid – refer to Legal Notice 198 of 2009 MVR Cap .35) Article 14 (4) 2 The following are the different vehicle categories and their respective Annual Circulation Tax for vehicles registered before 1st January 2009. 2.1 Petrol-Engines Year Up to and including 1300cc More than 1300cc up to and including 1449cc More than 1449cc up to and including 1500cc More than 1500cc up to and including 1800cc More than 1800cc up to and including 2000cc More than 2000cc Year Up to and including 1300cc More than 1300cc up to and including 1449cc More than 1449cc up to and including 1500cc More than 1500cc up to and including 1800cc More than 1800cc up to and including 2000cc More than 2000cc Regulatory Unit 0 1 2 3 4 5 6 7 8 9 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 75 10 0 11 5 12 0 20 0 37 0 86 11 4 13 1 13 7 22 8 42 2 87 11 6 13 4 14 2 23 1 42 8 88 11 7 13 8 14 7 23 5 43 5 10 11 12 13 14 15 16 17 89 91 92 93 95 96 98 99 101 102 18 19+ 119 121 123 125 127 128 130 132 134 136 141 145 148 152 156 160 164 168 172 176 152 157 162 168 174 180 186 193 200 207 238 242 246 249 253 257 261 265 269 273 441 448 454 461 468 475 482 490 497 504 Version 2 – 1st January 2011 Page 1 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 2.2 Diesel Engines Year Up to and including 1300cc More than 1300cc up to and including 1449cc More than 1449cc up to and including 1500cc More than 1500cc up to and including 1800cc More than 1800cc up to and including 2000cc More than 2000cc 0 83 2 83 3 83 4 83 5 83 6 83 7 94 8 95 9 97 110 110 110 110 110 110 110 125 127 129 127 127 127 127 127 127 127 144 148 152 132 132 132 132 132 132 132 150 156 161 220 220 220 220 220 220 220 251 255 258 407 407 407 407 407 407 407 464 471 478 Year Up to and including 1300cc More than 1300cc up to and including 1449cc More than 1449cc up to and including 1500cc More than 1500cc up to and including 1800cc More than 1800cc up to and including 2000cc More than 2000cc 2.3 1 83 10 11 12 13 14 15 16 17 18 19+ 98 100 101 103 104 106 108 109 111 112 131 133 135 137 139 141 143 146 148 150 155 159 163 167 171 176 180 185 189 194 167 173 179 185 191 198 205 212 220 227 262 266 270 274 278 283 287 291 295 300 485 492 500 507 515 523 531 538 547 555 Motorcycles Year Not exceeding 50cc Exceeding 50cc but not exceeding 125cc Exceeding 125cc but not exceeding 250cc Exceeding 250cc but not exceeding 500cc Exceeding 500cc but not exceeding 800cc Exceeding 800cc Battery/electric motorcycle Regulatory Unit 0 1 2 3 4 5 6 7 8 9 10 11 12 50 50 50 50 50 50 50 55 56 57 58 58 59 52 52 52 52 52 52 52 57 58 59 60 61 62 56 56 56 56 56 56 56 62 63 63 64 65 66 58 58 58 58 58 58 58 64 65 66 67 68 69 60 60 60 60 60 60 60 66 67 68 69 70 71 62 62 62 62 62 62 62 68 69 70 71 72 73 10 10 10 10 10 10 10 11 11 11 12 12 12 Version 2 – 1st January 2011 Page 2 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 Year Not exceeding 50cc Exceeding 50cc but not exceeding 125cc Exceeding 125cc but not exceeding 250cc Exceeding 250cc but not exceeding 500cc Exceeding 500cc but not exceeding 800cc 13 14 15 16 17 18 19+ 60 61 62 63 64 65 66 63 63 64 65 66 67 68 67 68 69 70 71 73 74 70 71 72 73 74 75 76 72 73 74 75 77 78 79 Exceeding 800cc Battery/electric motorcycle 75 76 77 78 79 80 82 12 12 12 13 13 13 13 2.4 Quad bikes Year ATV (to be used on the road) 0 1 2 3 4 5 6 7 8 9 10 75 75 75 75 75 75 75 83 84 85 86 Year ATV (to be used on the road) 11 12 88 89 Regulatory Unit 13 90 14 92 15 93 Version 2 – 1st January 2011 16 94 17 96 18 19+ 97 99 Page 3 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3 Annual Circulation Tax for M1 motor vehicles registered on the 1st January, 2009 and thereafter (including electric and hybrid electric motor vehicles): 3.1 Petrol-Engines Year 0g/km up to and including 100g/km More than 100g/km up to and including 130g/km More than 130g/km up to and including 140g/km More than 140g/km up to and including 150g/km More than 150g/km up to and including 180g/km More than 180g/km up to and including 220g/km More than 220g/km up to and including 250g/km More than 250g/km Regulatory Unit 0 1 2 3 4 5 6 7 8 9 10 11 12 100 100 100 100 100 125 138 151 166 183 201 221 244 268 295 110 110 110 110 110 138 151 166 183 201 221 244 268 295 324 120 120 120 120 120 150 165 182 200 220 242 266 292 322 354 140 140 140 140 140 175 193 212 233 256 282 310 341 375 413 180 180 180 180 180 225 248 272 299 329 362 399 438 482 531 250 250 250 250 250 313 344 378 416 458 503 554 609 670 737 350 350 350 350 350 438 481 529 582 641 705 775 853 938 1032 500 500 500 500 500 625 688 756 832 915 1007 1107 1218 1340 1474 Version 2 – 1st January 2011 13 14+ Page 4 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3.2 Diesel-Engines (PM 0-0.005g/km) Year 0g/km up to and including 100g/km More than 100g/km up to and including 130g/km More than 130g/km up to and including 140g/km More than 140g/km up to and including 150g/km More than 150g/km up to and including 180g/km More than 180g/km up to and including 220g/km More than 220g/km up to and including 250g/km More than 250g/km Regulatory Unit 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14+ 100 100 100 100 100 125 138 151 166 183 201 221 244 268 295 110 110 110 110 110 138 151 166 183 201 221 244 268 295 324 120 120 120 120 120 150 165 182 200 220 242 266 292 322 354 140 140 140 140 140 175 193 212 233 256 282 310 341 375 413 180 180 180 180 180 225 248 272 299 329 362 399 438 482 531 250 250 250 250 250 313 344 378 416 458 503 554 609 670 737 350 350 350 350 350 438 481 529 582 641 705 775 853 938 1032 500 500 500 500 500 625 688 756 832 915 1007 1107 1218 1340 1474 Version 2 – 1st January 2011 Page 5 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3.3 Diesel-Engines (PM 0.006-0.025g/km) Year 0g/km up to and including 100g/km More than 100g/km up to and including 130g/km More than 130g/km up to and including 140g/km More than 140g/km up to and including 150g/km More than 150g/km up to and including 180g/km More than 180g/km up to and including 220g/km More than 220g/km up to and including 250g/km More than 250g/km 0 1 2 3 4 5 6 7 8 9 10 11 12 13 105 105 105 105 105 131 144 159 175 192 211 233 256 281 309 116 116 116 116 116 144 159 175 192 211 233 256 281 309 340 126 126 126 126 126 158 173 191 210 231 254 279 307 338 371 147 147 147 147 147 184 202 222 245 269 296 326 358 394 433 189 189 189 189 189 236 260 286 314 346 380 419 460 506 557 263 263 263 263 263 328 361 397 437 480 528 581 639 703 774 368 368 368 368 368 459 505 556 611 673 740 814 895 985 1083 525 525 525 525 525 656 722 794 873 961 1057 1163 1279 1407 1547 Regulatory Unit Version 2 – 1st January 2011 Page 6 of 18 14+ LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3.4 Diesel-Engines (PM 0.026-0.035g/km) Year 0g/km up to and including 100g/km More than 100g/km up to and including 130g/km More than 130g/km up to and including 140g/km More than 140g/km up to and including 150g/km More than 150g/km up to and including 180g/km More than 180g/km up to and including 220g/km More than 220g/km up to and including 250g/km More than 250g/km 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14+ 110 110 110 110 110 138 152 167 183 202 222 244 269 295 325 121 121 121 121 121 152 167 183 202 222 244 269 295 325 357 132 132 132 132 132 165 182 200 220 242 266 293 322 354 390 154 154 154 154 154 193 212 233 257 282 311 342 376 414 455 198 198 198 198 198 248 273 300 330 363 400 439 483 532 585 276 276 276 276 276 345 379 417 459 504 555 610 671 739 812 386 386 386 386 386 482 531 584 642 706 777 855 940 1034 1137 551 551 551 551 551 689 758 834 917 1009 1110 1221 1343 1477 1625 Regulatory Unit Version 2 – 1st January 2011 Page 7 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3.5 Diesel-Engines (PM 0.036+g/km) Year 0g/km up to and including 100g/km More than 100g/km up to and including 130g/km More than 130g/km up to and including 140g/km More than 140g/km up to and including 150g/km More than 150g/km up to and including 180g/km More than 180g/km up to and including 220g/km More than 220g/km up to and including 250g/km More than 250g/km Regulatory Unit 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14+ 116 116 116 116 116 145 159 175 193 212 233 256 282 310 341 127 127 127 127 127 159 175 193 212 233 256 282 310 341 375 139 139 139 139 139 174 191 210 231 254 280 308 338 372 409 162 162 162 162 162 203 223 245 270 297 326 359 395 434 478 208 208 208 208 208 260 287 315 347 381 419 461 508 558 614 289 289 289 289 289 362 398 438 481 530 583 641 705 775 853 405 405 405 405 405 506 558 613 674 741 816 898 987 1086 1194 579 579 579 579 579 723 796 876 963 1059 1166 1282 1410 1551 1706 Version 2 – 1st January 2011 Page 8 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 3.6 Motorcycles Year Not exceeding 50cc Exceeding 50cc but not exceeding 125cc Exceeding 125cc but not exceeding 250cc Exceeding 250cc but not exceeding 500cc Exceeding 500cc but not exceeding 800cc Exceeding 800cc Battery/electric motorcycle 3.7 1 2 3 4 5 6 7 8 9 10 11 12 13 14+ 55 55 55 55 55 61 67 73 81 89 60 60 60 60 60 66 73 80 88 97 106 117 129 141 156 65 65 65 65 65 72 79 87 95 105 115 127 139 153 169 70 70 70 70 70 77 85 93 102 113 124 136 150 165 182 97 107 118 130 143 75 75 75 75 75 83 91 100 110 121 133 146 161 177 195 80 80 80 80 80 88 97 106 117 129 142 156 171 189 207 10 10 10 10 10 11 12 13 15 16 18 19 21 24 26 Quad bikes Year ATV (to be used on the road) 4 0 0 1 2 3 4 5 6 7 8 9 10 11 12 14 13 + 10 0 10 0 10 0 10 0 10 0 11 0 12 1 13 3 14 6 16 1 17 7 19 5 21 4 23 6 25 9 Annual Circulation Tax for N1, N2, N3 motor vehicles, Special Purpose and Tractor Units Vehicles which have been registered up to the 31 st December 2009 will continue to be charged the existing fees; hence there will be no change in the license fee paid. The following annual licence fees shall be paid for a period of four years until the 31st December, 2013, for the use of goods carrying motor vehicles which have been registered with Transport Malta before the 1st January, 2010. Regulatory Unit Version 2 – 1st January 2011 Page 9 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 4.1 For the use of N1, N2 and N3 motor vehicles, excluding tractors/tractor trailer combinations and special purpose vehicles, per annum: No. of axles 2 3 4 5 Regulatory Unit Maximum authorized mass Kgs Driving axle(s) with air suspension or recognized equivalent € Up to 3,500 from 3,501 to 5,000 from 5,001 to 11,999 from 12,000 to 12,999 from 13,000 to 13,999 from 14,000 to 14,999 15,000 and over from 15,000 to 16,999 from 17,000 to 18,999 from 19,000 to 20,999 from 21,000 to 22,999 from 23,000 to 24,999 25,000 and over from 23,000 to 24,999 from 25,000 to 26,999 from 27,000 to 28,999 from 29,000 to 30,999 31,000 and over 32,000 and over Version 2 – 1st January 2011 185 185 185 185 185 185 230 185 185 210 210 295 295 205 205 320 510 510 510 Other driving axle(s) suspension systems € 185 185 185 185 185 185 370 185 185 210 300 460 460 210 320 510 740 740 740 Page 10 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 4.2 For the use of a tractor/tractor-trailer combination, per annum: No. of axles 2+1 2+2 2+3 3+2 3+3 3+4 4+3 Regulatory Unit Maximum authorized mass Kgs Driving axle(s) with air suspension or recognized systems € up to11,999 from 12,000 to 13,999 from 14,000 to 15,999 from 16,000 to 17,999 from 18,000 to 19,999 from 20,000 to 21,999 from 22,000 to 22,999 from 23,000 to 24,999 25,000 and over from 23,000 to 24,999 from 25,000 to 25,999 from 26,000 to 27,999 from 28,000 to 28,999 from 29,000 to 30,999 from 31,000 to 32,999 from 33,000 to 35,999 36,000 and over from 36,000 to 37,999 38,000 and over from 36,000 to 37,999 from 38,000 to 39,999 40,000 and over from 36,000 to 37,999 from 38,000 to 39,999 40,000 and over 40,000 and over 40,000 and over Version 2 – 1st January 2011 93 93 93 93 93 93 93 97 177 93 93 116 170 205 335 466 466 370 517 328 454 623 186 226 338 338 338 Other driving axle(s) suspension systems € 93 93 93 93 93 93 98 177 307 93 116 170 205 335 466 708 708 517 701 454 629 929 226 338 536 536 536 Page 11 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 5 The following annual licence fees shall be paid for the use of goods carrying motor vehicles registered with the Authority after the 31st December, 2009. As from the 1st January, 2014,these licence fees shall also be paid for the use of goods carrying motor vehicles registered prior to the 1st January, 2010, in which case the licence fee shall be that which corresponds to the vehicle’s year of manufacture; provided that the said fee shall not be lower than the current fee. 5.1 Goods carrying vehicles (excluding vehicle combinations - articulated vehicles and road trains) Driving axle(s) with air suspension or recognized equivalent Year No of axles 2 3 4 5 Maximum authorized mass (Kgs) up to 3,500 over 3,500 up to 5,000 over 5,000 up to 11,999 over 11,999 up to 12,999 over 12,999 up to 13,999 over 13,999 up to 14,999 over 14,999 from 15,000 up to 16,999 over 16,999 up to 18,999 over 18,999 up to 20,999 over 20,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 26,999 over 26,999 up to 28,999 over 28,999 up to 30,999 over 30,999 32,000 and over 0 € 101 101 101 101 101 101 126 101 101 115 144 222 222 144 146 228 362 362 362 1 € 101 101 101 101 101 101 126 101 101 115 144 222 222 144 146 228 362 362 362 2 € 101 101 101 101 101 101 126 101 101 115 144 222 222 144 146 228 362 362 362 3 € 101 101 101 101 101 101 126 101 101 115 144 222 222 144 146 228 362 362 362 4 € 101 101 101 101 101 101 126 101 101 115 144 222 222 144 146 228 362 362 362 5 € 126 126 126 126 126 126 157 126 126 143 157 237 237 156 158 246 392 392 392 6 € 139 139 139 139 139 139 173 139 139 158 170 251 251 168 170 265 421 421 421 13 € 271 271 271 271 271 271 337 271 271 307 307 432 432 300 14+ € 298 298 298 298 298 298 370 298 298 338 338 475 475 330 7 € 153 153 153 153 153 153 190 153 153 174 184 266 266 181 181 283 451 451 451 Year No of axles 2 3 Maximum authorized mass (Kgs) up to 3,500 over 3,500 up to 5,000 over 5,000 up to 11,999 over 11,999 up to 12,999 over 12,999 up to 13,999 over 13,999 up to 14,999 over 14,999 from 15,000 up to 16,999 over 16,999 up to 18,999 over 18,999 up to 20,999 over 20,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 Regulatory Unit 8 € 168 168 168 168 168 168 209 168 168 191 197 280 280 193 9 € 185 185 185 185 185 185 230 185 185 210 210 295 295 205 10 € 204 204 204 204 204 204 253 204 204 231 231 325 325 226 Version 2 – 1st January 2011 11 € 224 224 224 224 224 224 278 224 224 254 254 357 357 248 12 € 246 246 246 246 246 246 306 246 246 280 280 393 393 273 Page 12 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 4 5 over 24,999 up to 26,999 over 26,999 up to 28,999 over 28,999 up to 30,999 over 30,999 32,000 and over Regulatory Unit 193 302 480 480 480 205 320 510 510 510 226 352 561 561 561 Version 2 – 1st January 2011 248 387 617 617 617 273 426 679 679 679 300 469 747 747 747 330 515 821 821 821 Page 13 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 5.2 Other driving axle(s) suspension systems Year No of axles 2 3 4 5 No of axles 2 3 4 5 Maximum authorized mass (Kgs) up to 3,500 over 3,500 up to 5,000 over 5,000 up to 11,999 over 11,999 up to 12,999 over 12,999 up to 13,999 over 13,999 up to 14,999 over 14,999 from 15,000 up to 16,999 over 16,999 up to 18,999 over 18,999 up to 20,999 over 20,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 26,999 over 26,999 up to 28,999 over 28,999 up to 30,999 over 30,999 32,000 and over Maximum authorized mass (Kgs) up to 3,500 over 3,500 up to 5,000 over 5,000 up to 11,999 over 11,999 up to 12,999 over 12,999 up to 13,999 over 13,999 up to 14,999 over 14,999 from 15,000 up to 16,999 over 16,999 up to 18,999 over 18,999 up to 20,999 over 20,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 26,999 over 26,999 up to 28,999 over 28,999 up to 30,999 over 30,999 32,000 and over Regulatory Unit 0 € 1 € 2 € 3 € 4 € 5 € 6 € 7 € 101 101 101 101 101 121 274 101 101 144 222 345 345 146 228 362 537 537 537 101 101 101 101 101 121 274 101 101 144 222 345 345 146 228 362 537 537 537 101 101 101 101 101 121 274 101 101 144 222 345 345 146 228 362 537 537 537 101 101 101 101 101 121 274 101 101 144 222 345 345 146 228 362 537 537 537 101 101 101 101 101 121 274 101 101 144 222 345 345 146 228 362 537 537 537 126 126 126 126 126 134 293 126 126 157 238 368 368 159 246 392 578 578 578 139 139 139 139 139 147 312 139 141 170 253 391 391 172 265 421 618 618 618 153 153 153 153 153 159 332 153 155 184 269 414 414 184 283 451 659 659 659 10 € 204 204 204 204 204 204 407 204 204 231 330 506 506 231 352 561 814 814 814 Year 11 12 € € 224 246 224 246 224 246 224 246 224 246 224 246 448 492 224 246 224 246 254 280 363 399 557 612 557 612 254 280 387 426 617 679 895 985 895 985 895 985 13 € 271 271 271 271 271 271 542 271 271 307 439 673 673 307 469 747 1,083 1,083 1,083 14+ € 298 298 298 298 298 298 596 298 298 338 483 741 741 338 515 821 1,192 1,192 1,192 8 € 168 168 168 168 168 172 351 168 170 197 284 437 437 197 302 480 699 699 699 9 € 185 185 185 185 185 185 370 185 185 210 300 460 460 210 320 510 740 740 740 Version 2 – 1st January 2011 Page 14 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 5.3 Vehicle articulated vehicles Driving axle(s) with air suspension Year No of axles 2+1 2+2 2+3 3+2 3+3 3+4 4+3 Maximum authorized mass (Kgs) up to 11,999 over 11,999 up to 13,999 over 13,999 up to 15,999 over 15,999 up to 17,999 over 17,999 up to 19,999 over 19,999 up to 21,999 over 21,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 25,999 over 25,999 up to 27,999 over 27,999 up to 28,999 over 28,999 up to 30,999 over 30,999 up to 32,999 over 32,999 up to 35,999 over 35,999 from 36,000 up to 37,999 over 37,999 from 36,000 up to 37,999 over 37,999 up to 39,999 over 30,999 from 36,000 up to 37,999 over 37,999 to 39,999 over 39,999 40,000 and over 40,000 and over 0 € 51 51 51 51 51 51 75 97 175 51 70 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 1 € 51 51 51 51 51 51 75 97 175 51 70 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 2 € 51 51 51 51 51 51 75 97 175 51 70 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 3 € 51 51 51 51 51 51 75 97 175 51 70 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 Maximum authorized mass (Kgs) up to 11,999 over 11,999 up to 13,999 over 13,999 up to 15,999 over 15,999 up to 17,999 over 17,999 up to 19,999 over 19,999 up to 21,999 over 21,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 25,999 over 25,999 up to 27,999 over 27,999 up to 28,999 over 28,999 up to 30,999 8 € 85 85 85 85 85 85 90 97 177 85 89 116 170 205 9 € 93 93 93 93 93 93 93 97 177 93 93 116 170 205 10 € 102 102 102 102 102 102 102 107 195 102 102 128 187 225 11 € 113 113 113 113 113 113 113 117 214 113 113 141 206 248 4 € 51 51 51 51 51 51 75 97 175 51 70 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 5 € 64 64 64 64 64 64 79 97 175 64 75 115 169 204 335 465 465 370 515 327 454 628 186 225 336 336 336 6 € 70 70 70 70 70 70 82 97 176 70 79 116 169 204 335 465 465 370 516 328 454 628 186 225 337 337 337 7 € 77 77 77 77 77 77 86 97 176 77 84 116 170 205 335 466 466 370 516 328 454 629 186 226 337 337 337 Year No of axles 2+1 2+2 Regulatory Unit Version 2 – 1st January 2011 12 € 124 124 124 124 124 124 124 129 236 124 124 155 226 273 13 € 136 136 136 136 136 136 136 142 259 136 136 170 249 300 14+ € 150 150 150 150 150 150 150 156 285 150 150 188 274 330 Page 15 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 2+3 3+2 3+3 3+4 4+3 5.4 over 30,999 up to 32,999 over 32,999 up to 35,999 over 35,999 from 36,000 up to 37,999 over 37,999 from 36,000 up to 37,999 over 37,999 up to 39,999 over 30,999 from 36,000 up to 37,999 over 37,999 to 39,999 over 39,999 40,000 and over 40,000 and over 335 466 466 370 517 328 454 629 186 226 337 337 337 335 466 466 370 517 328 454 629 186 226 338 338 338 369 512 512 407 569 361 500 692 205 249 372 372 372 406 564 564 448 626 397 550 761 225 273 409 409 409 446 620 620 493 688 437 605 837 248 301 450 450 450 491 682 682 542 757 481 665 921 273 331 494 494 494 540 750 750 596 833 529 731 1,013 300 364 544 544 544 Other driving axle(s) suspension systems Year No of axles 3+4 4+3 Maximum authorized mass (Kgs) up to 11,999 over 11,999 up to 13,999 over 13,999 up to 15,999 over 15,999 up to 17,999 over 17,999 up to 19,999 over 19,999 up to 21,999 over 21,999 up to 22,999 over 22,999 up to 24,999 over 24,999 from 23,000 up to 24,999 over 24,999 up to 25,999 over 25,999 up to 27,999 over 27,999 up to 28,999 over 28,999 up to 30,999 over 30,999 up to 32,999 over 32,999 up to 35,999 over 35,999 from 36,000 up to 37,999 over 37,999 from 36,000 up to 37,999 over 37,999 up to 39,999 over 30,999 from 36,000 up to 37,999 over 37,999 to 39,999 over 39,999 40,000 and over 40,000 and over 0 € 51 51 51 51 51 51 75 97 175 70 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 1 € 51 51 51 51 51 51 75 97 175 70 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 2 € 51 51 51 51 51 51 75 97 175 70 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 3 € 51 51 51 51 51 51 75 97 175 70 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 4 € 51 51 51 51 51 51 75 97 175 70 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 5 € 64 64 64 64 64 64 79 97 175 75 115 169 204 335 465 706 706 515 700 454 628 929 225 336 535 535 535 6 € 70 70 70 70 70 70 82 97 175 79 116 169 204 335 465 707 707 516 700 454 628 929 225 337 535 535 535 No of axles Maximum authorized mass (Kgs) 8 € 9 € 10 € 11 € Year 12 € 13 € 14+ € 2+1 2+2 2+3 3+2 3+3 Regulatory Unit Version 2 – 1st January 2011 7 € 77 77 77 77 77 77 86 97 176 84 116 170 205 335 466 707 707 516 701 454 629 929 226 337 535 535 535 Page 16 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 2+1 2+1 2+2 2+3 3+2 3+3 3+4 4+3 5 up to 11,999 over 11,999 up to 13,999 over 13,999 up to 15,999 over 15,999 up to 17,999 over 17,999 up to 19,999 over 19,999 up to 21,999 over 21,999 up to 22,999 over 22,999 up to 24,999 over 24,999 85 85 85 85 85 90 98 177 307 93 93 93 93 93 93 98 177 307 102 102 102 102 102 102 108 195 338 113 113 113 113 113 113 118 214 372 124 124 124 124 124 124 130 236 409 from 23,000 up to 24,999 over 24,999 up to 25,999 over 25,999 up to 27,999 over 27,999 up to 28,999 over 28,999 up to 30,999 over 30,999 up to 32,999 over 32,999 up to 35,999 over 35,999 from 36,000 up to 37,999 over 37,999 from 36,000 up to 37,999 over 37,999 up to 39,999 over 30,999 from 36,000 up to 37,999 over 37,999 to 39,999 over 39,999 40,000 and over 40,000 and over 89 116 170 205 335 466 708 708 517 701 454 629 929 226 337 536 536 536 93 102 113 124 116 128 141 155 170 187 206 226 205 225 248 273 335 369 406 446 466 512 564 620 708 779 857 942 708 779 857 942 517 569 626 688 701 771 848 933 454 500 550 605 629 692 761 837 929 1,022 1,125 1,237 226 249 273 301 338 372 409 450 536 589 648 713 536 589 648 713 536 589 648 713 136 136 136 136 136 136 143 259 450 150 150 150 150 150 150 158 285 495 136 170 249 300 491 682 1,037 1,037 757 1,026 665 921 1,361 331 494 784 784 784 150 188 274 330 540 750 1,140 1,140 833 1,129 731 1,013 1,497 364 544 863 863 863 Annual Circulation Tax for M2 an M3 vehicles For the use of Route buses, and M2 and M3 vehicles (including trackless trains and amphibious motor vehicles): M2 M3 Route buses 1 €80 €150 €23 2 €80 €150 €23 3 €80 €150 €23 M2 M3 Route buses 9 €100 €350 €23 10 €105 €400 €23 11 €110 €450 €23 5.1 Year 4 €80 €150 €23 Year 12 €120 €450 €23 5 €80 €150 €23 6 €85 €200 €23 7 €90 €250 €23 13 €130 €450 €23 14 €140 €450 €23 15+ €150 €450 €23 8 €95 €300 €23 As from the 1st January, 2015, the annual circulation licence fee for the use of M2 and M3 vehicles (including trackless trains and amphibious motor vehicles) manufactured on or before a date falling twenty years preceding the date of renewal of their licence shall be €300 and €750 respectively. Regulatory Unit Version 2 – 1st January 2011 Page 17 of 18 LAND TRANSPORT DIRECTORATE Policy & Procedures – Category A Annual Circulation Taxes – POL 33 6 Annual Circulation Licence Fee for All Other Vehicles (€ per annum) Ambulance Prison Van Hearse Classic, Vintage and Veteran Vehicles (manufactured on or before a date falling 35 years preceding the date of issue or renewal of their licence and certified by a board approved by the ADT) Classic, Vintage and Veteran Motorcycles Classification Petrol (€) Diesel (€) All Engines 95 95 up to and including 1300cc 38 42 more than 1300cc up to and including 1449cc 50 55 more than 1449cc up to and including 1500cc 58 64 more than 1500cc up to and including 1800cc 60 66 more than 1800cc up to and including 2000cc 100 110 more than 2000 c.c. 185 204 N1, N2, N3 (Goods Carrying Vehicles) 93 93 up to and including 50cc 25 N/A more than 50cc up to and including 125cc 26 N/A more than 125cc up to and including 250cc 28 N/A more than 250cc up to and including 500cc 29 N/A more than 500cc up to and including 800cc 30 N/A more than 800 cc 31 N/A Electric motor vehicle (excluding motor cycles) Regulatory Unit €0 Version 2 – 1st January 2011 Page 18 of 18